Summary:

- Texas Instruments is the market leader in the analog and embedded chip segment, serving various end markets, particularly industrial and automotive.

- The company has different competitive advantages, disciplined capital allocation, and a healthy balance sheet.

- Based on the dividend discount model, the fair value of TXN stock is $176.66, which is 4.8% undervalued.

- Despite the short-term headwinds, TXN is in a great position to stay a solid long-term dividend growth investment.

kynny

Investment Thesis

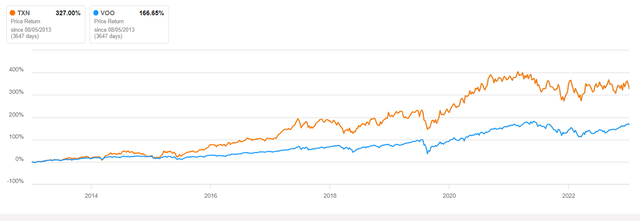

At the moment a lot of technology stocks are on fire, because of AI driven expectations. Sometimes companies are trying to use the word AI as much as possible in their reports to further boost the hype. There are also some technology companies that don’t want to surf on the hype and even said that they have an allergy for words like AI, IoT and 5G, so they usually don´t speak about it. One of these companies is Texas Instruments Incorporated (NASDAQ:TXN).This company is letting the cash flow doing the talk and TXN has a proven track record of market beating results over the long term.

TXN 10 year performance (Seeking Alpha)

With disciplined capital allocation TXN has managed to become a market leader in its industry. The company is also loved in the dividend growth community, because of their relatively attractive starting yield and impressive dividend growth and consistency. In this article, I am going to show you why TXN is a company that you need to consider putting on your buying list.

Company overview

TXN is a company that produce, designs and sells semiconductors internationally. It was founded in 1930 and is headquartered in Dallas. They operate semiconductor facilities in North America, Asia, Japan and Europe. The company has grown into a huge business with a market cap of $155.99 billion and approximately 33000 employees.

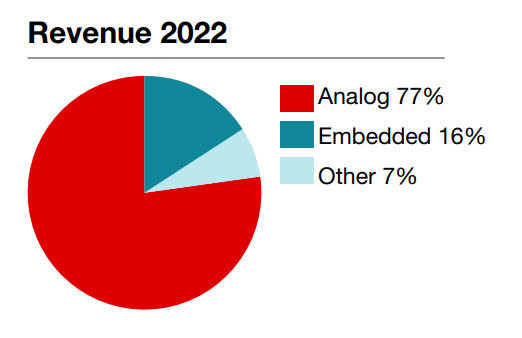

TXN is the market leader in the analog and embedded chip segment. The analog part is by far the largest segment and represents 77% of total revenue. TXN has a total of 17.2% of the total analog market share and is looking to increase that over time. Every electric device needs analog chips in order to function. This includes power and signal chain types of products. Think about managing voltage in electronic systems or the ability to detect or measure the signals of the environment to allow information to be transferred of converted for further processing and control. The embedded processors are designed to handle the specific electrical or mechanical tasks depending on the application where it’s used for. This segment accounts for 16% of their total revenue and TXN has a total market share of 11.6%.

Revenue distributions (TXN investment overview 2023)

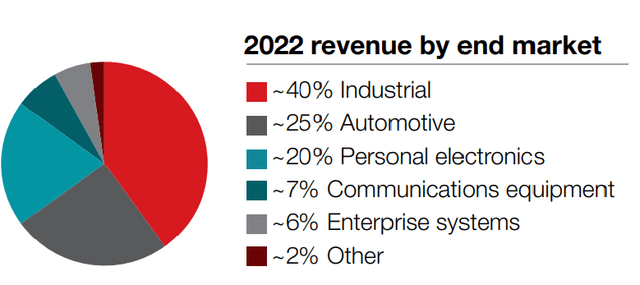

TXN serves a lot of different end markets and I think their product portfolio is well distributed. The company itself is leaning the most towards the industrial and automotive markets as their main growth drivers for the future. In these end markets there is really a trend to make products more smart, safe and efficient. This leads to more chips per application, even more compared to the other segments where they operate. Industrials need more analog chips for more complex applications, such as:

- Smart thermostats.

- Humidity, temperature and motion detection.

- Transmitters of diagnostic information.

- Sensing technology to work more autonomously and precise.

In the automotive segment the amount of chips will increase due to electrification and more electronic parts in the car itself.

revenue by end market (TXN investment overview 2023)

Competitive advantages

TXN has some important competitive advantages compared to its peers.

The most important one is the 300-mm wafer production, which is 40% less expensive compared to the 200-mm wafer, which is used by the most of its peers. This leads to higher margins. They also do the majority of assembling and testing internally, which reduces the costs compared to their pears even more.

As a huge company they have a product portfolio of approximately 80000 products, which create a lot of opportunities to sell more chips to its customers. They also invest a lot in research and development so they can expand their product portfolio even further. I like the fact that they’re also critical if their products lead to long term return on investment. TXN has a great reach in the international market via their online platform, which has more than tens of millions of visits each year. Because of their large product portfolio and revenue size they’re able to invest more money into their marketing team to further strengthen their market position.

Philosophy and capital allocation

TXN believes that the growth of free cash flow per share is the most important metric of measuring long-term value creation. The company really wants to attract investors with a long-term mindset.

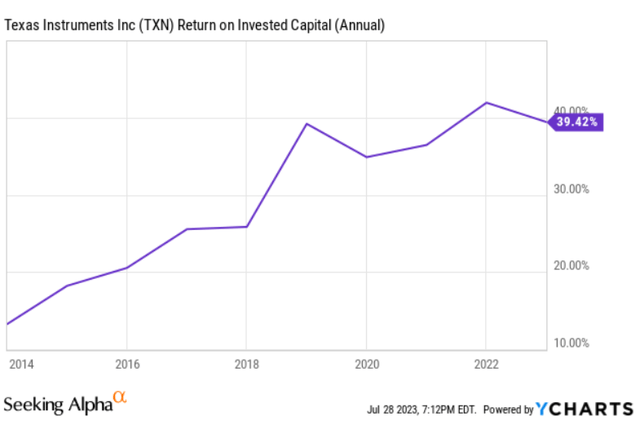

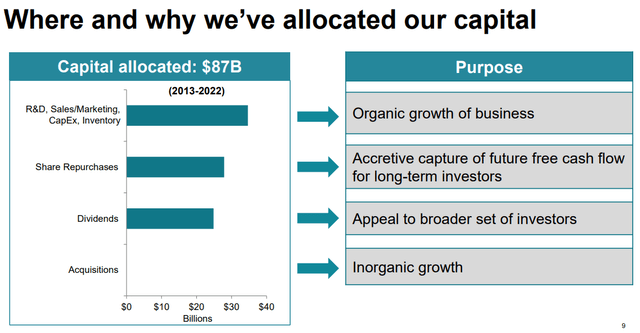

What I really like about TXN is there transparency in their capital allocation. In my opinion the company is allocating it’s capital really well, because they have managed to further increase their ROIC the last 10 years, which means that they have a high capital efficiency.

Return on investment capital (Ycharts)

Going forward, there will be an increase in CapEx to be the largest driver of organic business growth. Dividends were introduced to attract a broader set of investors, and share repurchases are made with the goal of the accretive capture of future free cash flow for long-term investors. Lastly, for inorganic growth, they only do acquisitions that meet their financial and strategic objectives.

Capital management presentation 2023 (TXN investor relations)

Increased CapEx for further organic growth

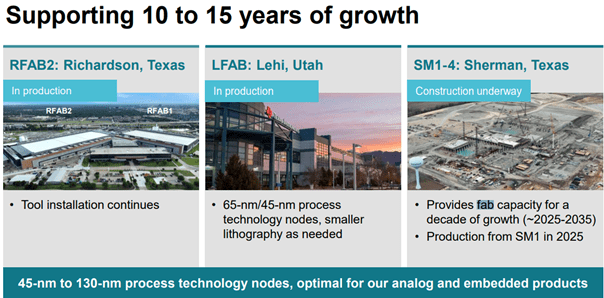

TXN states that their main driver for long term shareholder value is investing in organic growth. In their Q2 2023 earnings call they said they will invest about $5 billion in CapEx per year for the next four years. Investing money in new fabs should trigger growth for at least the next decade.

Manifacturing plans (TXN capital management 2023)

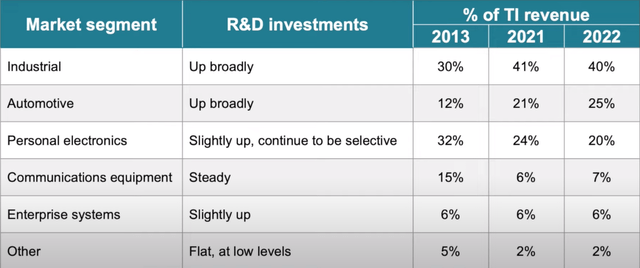

In addition to increasing their production TXN is also focused on higher valued growth opportunities in order to strengthen the product portfolio.

Market segments (TXN capital management presentation 2023)

As previously discussed, TXN is shifting more towards Industrial and Automotive. At the end of 2022 the industrial and automotive segment accounts for 65% of the total revenue and they even think that this percentage will be higher in 2023, because of the robustness of this market segments.

The company expects a further growing demand in the industrial and automotive markets, so they will anticipate that demand. At the Bernstein’s 39th Annual Strategic Decisions Conference TXN said they prefer to be two years ahead of supply rather than two quarters later, because they experienced this during the COVID-19 cycle, when there wasn’t enough supply to support customer needs.

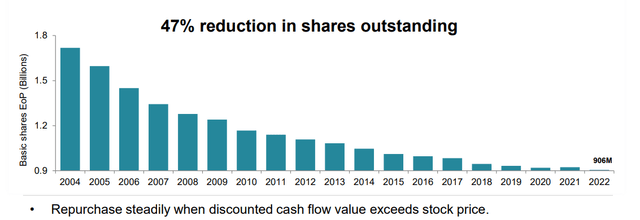

Share Repurchases

TXN states that they are focused on share buybacks when the share price is below the intrinsic value of the company based on reasonable growth assumptions. In the last 10 years they bought back around 189.5 million shares, which is 17.3% of their total shares outstanding. I really like their approach of repurchasing shares with a value investors mindset. However, this is really hard to see in the numbers. From a numbers point of view it looks like TXN is buying back shares at a more consistent rate.

Share repurchases (TXN capital management presentation 2023)

Dividends

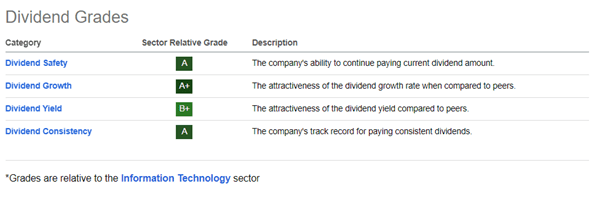

The main goal TXN of paying dividends is to attract a broader set of investors, with a focus on dividend growth and sustainability. This is exactly what you want to hear as a dividend growth investor. The dividend metrics that are used on the Seeking Alpha website looks great as well.

Dividend grades (Seeking Alpha)

Yield and growth

At the moment TXN pays a dividend of $4.96 per share, with a current share price of $168.46 this comes down to a dividend yield of 2.89%. This is higher than its own 5 year average of 2.68%.From a yield perspective this could be an attractive entry point.

10Y dividend yield history (Seeking Alpha)

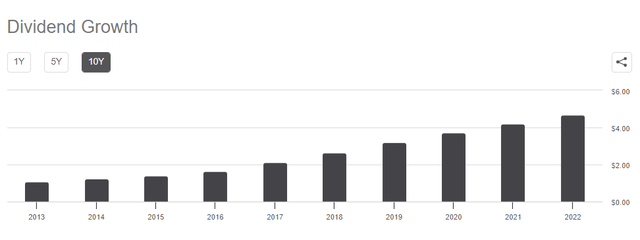

Where TXN actually shines is the dividend growth. In the last 10 years TXN has managed to achieve a 10 year dividend growth CAGR of 18.8% and the dividend itself quadrupled in this time frame. Since 2004 the dividend growth streak has started and if we do the math until 2023 we have a CAGR of around 21%. That’s what I call compounding at its finest. The latest dividend increase was 8% due to weakness in the semiconductor cycle. In my opinion it is not realistic to think that the dividend will grow further at 18% on a 10 year basis. I wouldn’t be surprised that the future dividend growth of TXN will be around the high single-digit CAGR range.

With the current yield and dividend growth TXN has the potential to be a nice dividend growth compounder in the future. If we apply the Chowder-rule the score would be 17.67% (2.89% yield + 14.78% 5 year dividend CAGR). This would surpass the 15% threshold and could be an indication that the stock could be an interesting investment. Unfortunately the Chowder-rule is only a quick screener and a reflection of the past. In my opinion it doesn’t look like their future 5 year dividend growth rate is also going to be 14.78%, especially with the short-term headwinds TXN is facing.

TXN 10Y dividend growth (Seeking Alpha)

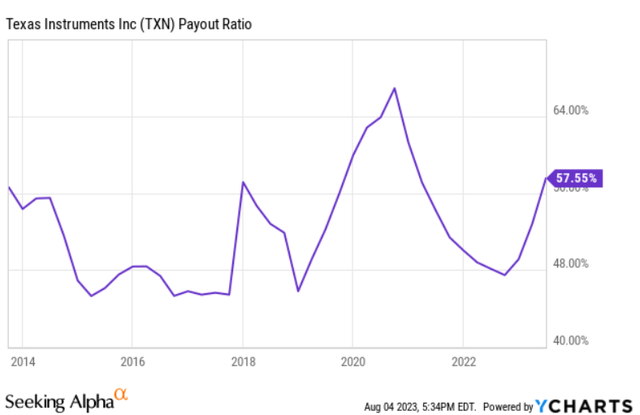

Safety and consistency

The dividend is relatively safe at the moment with a payout ratio of 57.55%, based on annual dividend per share divided by non-GAAP earnings per share. On a 10-year basis, TXN has been able to keep it in the 45-60% range most of the time, which I consider healthy.

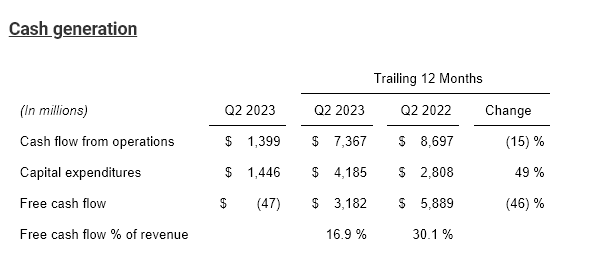

If we divide the annual dividend by the free cash flow per share the percentage would be negative. The main reason for that is the lower cash from operations and higher capital expenditures. In Q2 2023, they were even free cash flow negative (-$47 million).

Free cash flow Q2 (Q2 2023 quarterly report TXN)

From a free cash flow point of view the dividend doesn’t look that safe, but things will getting better in the long term. It’s possible that the company will leverage up their balance sheet a bit to pay the dividend without really hurting their financial position.

TXN has a dividend growth streak of 19 years and is well on its way to become a future dividend aristocrat.

Acquisitions

I like their focus on organic growth and their critic stance when it comes to acquisitions. TXN hasn’t done any acquisitions in the last ten years. This isn’t essentially a bad thing, because M&A often leads to value destruction. The company also has some strict criteria when it comes to acquisitions. Firstly, it must be analog focused with high exposure to the industrial and automotive sector, so it must be a bolt on acquisition. Secondly, it must meet certain financial metrics. The investment must be generating a greater return than the weighted average cost of capital in 4 years.

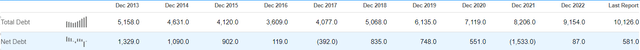

Balance sheet

The balance sheet of TXN looks healthy as well. Based on their latest report the company has a total of $4.477 billion cash on hand and $5.068 billion cash in short term investments. The total long-term debt is $10.126 billion, which is increasing over time. However, if we adding up all the cash and liquid assets their net debt isn’t high at all. The company also has an A+ S&P global credit rating, which means they have a strong capacity to meet their financial commitments. In my opinion there is sufficient financial flexibility to finance further growth or pay the dividend if needed. Based on historical data the company has proven that they can keep their debt at a healthy level over long periods of time.

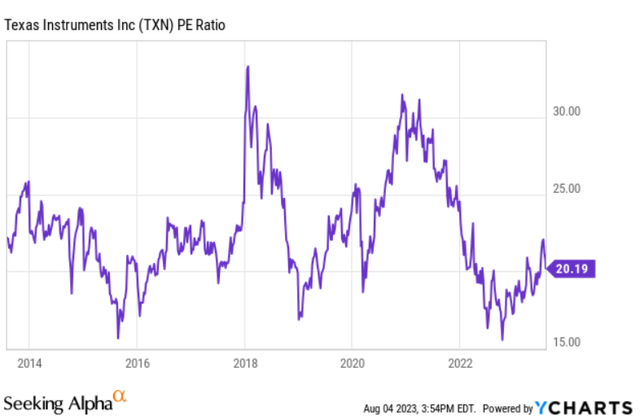

Valuation

At the moment TXN has a PE ratio of 20.19, this is below its 5Y average of 21.85. Looking at the 10 year chart this could be a solid entry point.

To determine the fair value of TXN, the dividend discount model has been used. At the moment I prefer using this model over discounted cash flow analysis, because I think it’s difficult to make accurate assumptions of expected future cash flows of TXN in the short-term. I also think it is unfair to take the free cash flow as the main metric for valuation, especially when the CapEx for the next years is really high. In my opinion this model fits TXN quite well, because it has promising long term growth rates with an already existing dividend growth policy combined with a stable leverage. This will make the future estimates much more accurate. The dividend discount model requires the following inputs:

- The expected annual dividend per share for the next year.

- The required rate of return.

- The dividend growth rate.

I used an expected FY 2024 annual dividend per share of $5.30. This is based on the Seeking alpha consensus rate of $5.02 per share at the end of FY 2023 and adding a relatively conservative growth rate of 5.5% for the year thereafter. From my personal investment perspective I want a minimal rate of return of 12.5% annually. Based on my own dividend grade analysis and the prediction that the dividend growth on the short-term will be far lower than its own 10 year CAGR of more than 18%, I think an average dividend growth rate of around 9-10% per year is reasonable , so I took 9.5% for my calculations. If we do the math this results in a share price of $176,66 , which is higher compared to the current share price of $168.41.

Company risks

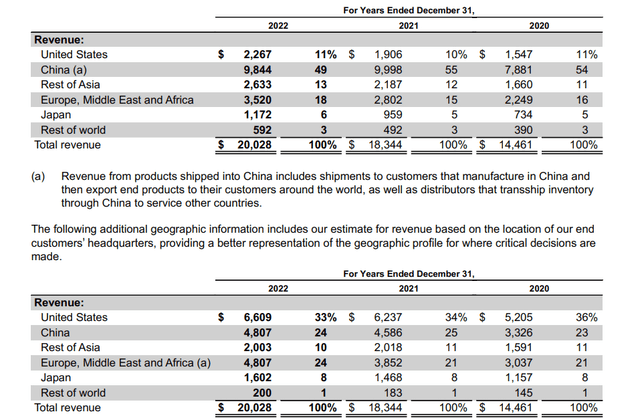

There are also some investment risks to consider when investing in TXN. When it comes to investing in semiconductor stocks, geopolitical risks is something to keep in mind. As the friction increases between the USA and China , this could impact the profitability of TXN.

TXN revenue distribution (TXN 2022 annual report)

Looking at the numbers, 24-25% of the total revenue from their end products comes from China. Of course this is significant , but in my opinion this risk is manageable. The company still sees China as an opportunity, but the level of competition is going to be higher than ever. The company is running a list of more than 50 competitors in China, which are mostly local/smaller companies. TXN is aware of them and they really putting effort in tracking them and collecting data. In my opinion it is clear that TXN doesn’t want to lose its competitive edge and they don’t underestimate their competitors. This is also the case for their other international competitors. Despite the positive thinking of TXN, there is always a chance that there will be future restrictions participating in the China semiconductor market.

TXN also has a cyclical nature and a further economic downturn could result in a decline in revenue and profitability. However, as a semiconductor company, TXN isn’t highly cyclical because of their broad portfolio. On the other hand the automotive segment is holding up quite nicely. This creates a safety cushion for TXN, because it seems like the different market cycles where they operate aren’t synchronous to each other.

The industrial and automotive segments are holding better comparing to the other end markets. This was also the case in the Q2 2023 earnings. The company is experiencing weakness in all of its business segments except for automotive and personal electronics (after several quarters of declines), which grew low-single digits. The customers of TXN are still work down inventories to get that in line with their own demand. As usual, it is really hard to predict when market conditions should turn around, but if they do TXN is a company that is profiting from it immediately.

Conclusion

TXN is a high-quality company. They have a market leading position and are operating in different end markets that can drive a lot of growth in the future, they have a disciplined capital allocation and a healthy balance sheet. TXN is also a no-nonsense business in its communication and I like this a lot. They are really good in explaining what they’re doing and why they’re doing it. At the moment the company is facing some short-term headwinds and due to continuing economic weakness in several business segments. There are also heavily investing in CapEx, which further impacts their free cash flow negatively. I believe the company really needs to make this kind of investments to further achieve organic business growth and staying ahead of competition for the coming years. At the moment I think TXN is decently valued. Despite the short-term headwinds, the long term investment case is still intact. With the current share price you get a starting yield of 2.89%, combine this with a high single digit or even more dividend growth in the future and it should compound nicely. I don’t have TXN in my own dividend growth portfolio at the moment, but I am considering initiating a position. I do not worry about the possibility of a further drop in share price, because dollar cost averaging on the way down can be a good strategy in these situations. If you’re a dividend growth investor with a long term mind-set, TXN can be a solid player in your team. With this in mind I give TXN a “BUY” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TXN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.