Summary:

- Amazon’s 2Q FY2023 results show promising signs of growth rebound in its online stores segment, contributing to improved total revenue.

- The company’s focus on operational efficiency and cost management has led to an impressive expansion of the operating margin.

- While concerns persist about the significant deceleration in AWS growth compared to its competitors like Azure and Google Cloud, the management believes AWS has stabilized.

- Considering AMZN’s non-GAAP P/E Fwd of 26x, the valuation multiple can expand further as the current multiple is not overly stretched.

Noah Berger

Investment Thesis

Despite facing a 67% drop in adjusted net income in FY2022 due to the prolonged impact of higher labor costs from the pandemic disruption, Amazon (NASDAQ:AMZN) is showing growth rebound on its online stores sales, which composed 40% of the company’s total revenue in 2Q FY2023. While I’m still concerned about the growing competition in the e-commerce industry, it’s reassuring to see a strong rebound in product sales in 2Q and a better-than expected growth outlook in 3Q FY2023.

However, AWS is experiencing a growth deceleration, with growth heading towards single digits, significantly below Azure’s 26% and Google Cloud’s 28%. The management believes AWS has stabilized in 2Q, which implies a growth rebound in the near term.

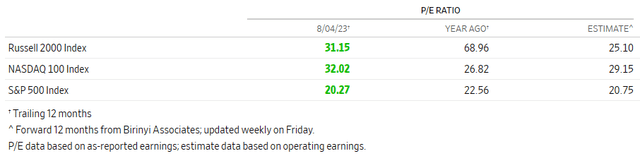

In terms of the post-earnings valuation, AMZN is currently trading at 26x non-GAAP P/E Fwd, excluding stock-based compensation (SBC), which is below the Nasdaq index’s valuation of 29x. Therefore, I am upgrading the stock to a buy from hold, as we have observed several inflecting metrics in this quarter.

2Q23 Takeaway

AMZN delivered a strong quarter, suppressing all metrics. From the price action, we can see investors are expressing optimism in response to an early sign of reacceleration in total revenue, which rebounded by 11% YoY in 2Q FY2023, surpassing the 9% growth seen in the previous quarter (1Q FY2023). The market consensus had anticipated a lower YoY growth of 8.3%. This encouraging trend can be largely attributed to a significant rebound in total product revenue growth, showing a 4.3% YoY increase. These positive indicators suggest that the online e-commerce industry may be starting to recover, which can be supported by better-than-expected online advertising revenue reported for Google (GOOGL) and Meta (META) last month.

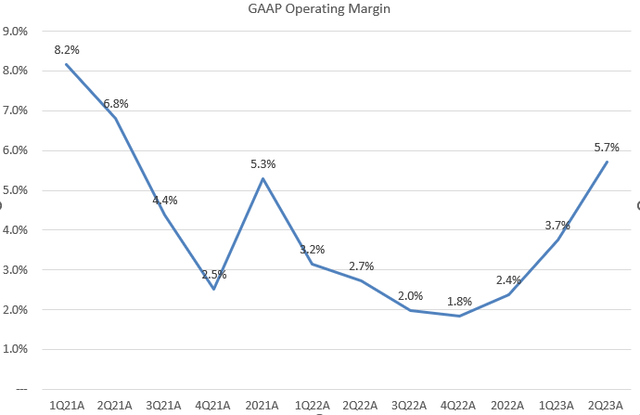

In addition, we saw a significant expansion in AMZN’s operating margin to 5.7%, which is very impressive compared to an expected contraction of 3.5% on quarter over quarter basis. This highlights the company’s successful dedication to operational efficiency and cost management efforts.

Before delving into the company’s profitability, I want to address a pre-tax valuation change in Rivian (RIVN) last quarter. According to the 2Q23 press release,

“Second quarter 2023 net income includes a pre-tax valuation gain of $0.2 billion included in non-operating expense from the common stock investment in Rivian Automotive, Inc., compared to a pre-tax valuation loss of $3.9 billion from the investment in second quarter 2022.”

The significant rebound in RIVN’s valuation this year is expected to have a positive impact on AMZN’s bottom-line growth. While comparing earnings growth on a year-over-year basis may be less meaningful in this context, it is evident that AMZN’s top-line growth and margin expansion have played a crucial role in contributing to a strong rebound in profitability.

Regarding the forward guidance for 3Q FY2023, despite a wide range of outlooks on revenue and operating income, both metrics have come in above the market consensus. Moreover, the outlook implies a 5% operating margin, indicating that the margin expansion is still intact. I’ll discuss AWS in a later section.

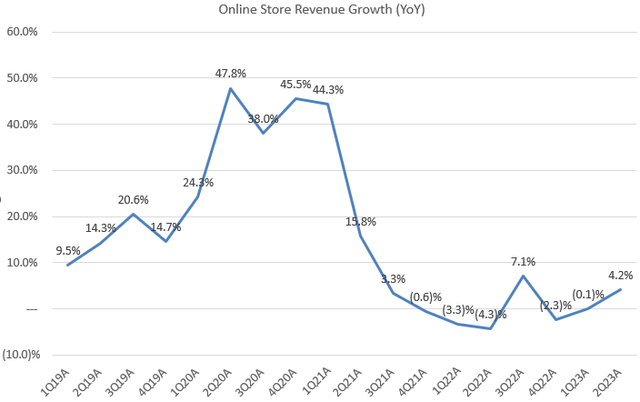

Rebound in Online Retail

Looking at the chart, AMZN’s online store revenue started to decline in 4Q FY2021. However, we saw this decline has largely reversed in the last quarter. This may imply that the company’s core business has reached an inflection. As a result, it could be a positive catalyst to push the stock higher from here.

Let’s take a step back. One possible explanation for the decline in FY2022 could be the currency headwind. The company suggested that there would be a positive YoY growth in FY2022 if the currency impact were excluded. This implies that fluctuations in exchange rates may have contributed to the growth slowdown last year.

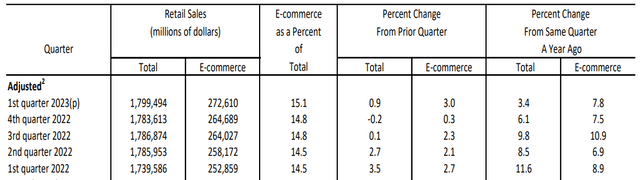

According to the Census Bureau of the Department of Commerce, we observe that e-commerce experienced a significant acceleration of 3% QoQ growth in 1Q 2023, marking the highest growth rate in the last four quarters. This suggests that both U.S retail sales and e-commerce are currently displaying resilience.

From a macro perspective, if the Fed becomes a less hawkish and halts interest rate hikes, it is likely that we may see a peak in the U.S dollar. A weaker dollar could potentially benefit AMZN’s international sales as it makes their products more competitive in foreign markets.

In 2Q, we have seen a rebound in AMZN’s online store revenue. I believe it could be an early sign of growth rebound in Amazon’s core business segment, which is a key signal for investors becoming more bullish on the company’s growth outlook.

AWS Stabilization

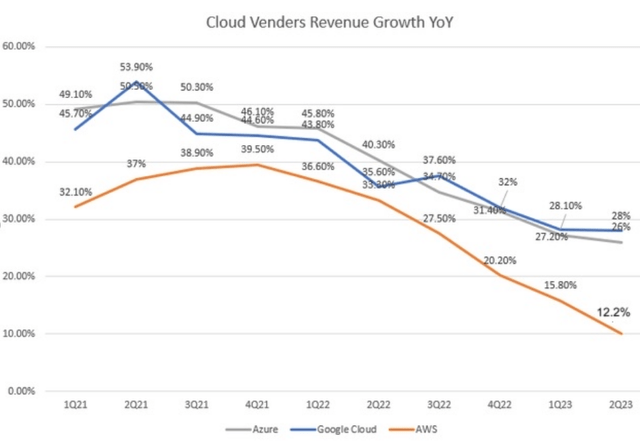

Despite an impressive 2Q results, we saw a continued decline in AWS’s revenue growth compared to its competitors, Azure and Google Cloud. Just to be clear, the chart above shows the year-on-year growth for the top three cloud vendors in each calendar quarter, not the fiscal quarter.

The slowdown in revenue growth for these cloud vendors is not surprising, considering the high competition and potential macro challenges. The pandemic led to a surge in cloud demand as workplaces shifted from physical offices to remote setups, resulting in increased reliance on cloud services. During this period, the yellow line exhibited a positive slope in CY2021, indicating that AWS was the primary beneficiary and experienced significant revenue growth due to higher demand compared to Azure and Google Cloud.

This growth acceleration was particularly impressive considering AWS’s already substantial revenue exposure. However, AWS’s growth has slowed down significantly since then. In 2Q CY2023, AWS’s YoY growth dropped to 12.2%, significantly lower than Azure’s 26% and Google Cloud’s 28%. Therefore, we can see the growth trend of AWS is deteriorating faster compared to its peers.

Despite all these, during the earnings call, the management expects to see a final 12% growth for AWS and believes that the business has stabilized for the upcoming quarters, which I believe could boost investor sentiment in the near term.

Valuation

I believe using P/E GAAP TTM to evaluate AMZN’s valuation is not appropriate for two reasons. Firstly, AMZN’s GAAP numbers include a significant amount of stock-based compensation, which can distort the true earnings outlook. Secondly, the company’s adjusted EPS experienced a significant decline of 67% YoY in FY2022, making its P/E TTM of 40x less comparable.

On the other hand, when considering AMZN’s adjusted EPS consensus over the next 12 months, the stock is currently trading at 26x P/E. While the valuation is not cheap compared to Google’s 23x and META’s 23x, the potential rebound in AMZN’s online retail business can justify an expansion in its valuation multiple. However, I would like to see AWS stabilization and a potential rebound in 3Q FY2023 before making any further conclusions.

Given these factors, I believe the stock should be trading at a slightly higher multiple to better reflect these improvements and expectations.

Conclusion

In sum, AMZN’s 2Q FY2023 results indicate a promising growth rebound in its online stores segment, contributing to overall improved total revenue growth. Moreover, the company’s focus on operational efficiency and cost management has led to an impressive margin expansion. However, we saw a continued deceleration in AWS compared to its competitors like Azure and Google Cloud, which is a major concern to me. After the management’s reassurance of AWS stabilization, it is crucial for investors to closely monitor if AWS has indeed stabilized in 3Q FY2023. In terms of the valuation, AMZN’s non-GAAP P/E Fwd is still lower than the Nasdaq index despite a 63% rally YTD, suggesting potential for further multiple expansion if AWS rebounds in 3Q. Therefore, I have upgraded the stock to a buy from hold to reflect this optimism.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.