Summary:

- Following its earnings release, PayPal stock has fallen dramatically on speculations regarding the near-term future.

- The market is now pricing-in significant deterioration of the company’s top or bottom line which, in my view, is a very low probability scenario.

- In the meantime, the management is making the right moves to secure long-term competitive advantages while also rewarding shareholders.

chameleonseye

Buying a stock when it has fallen in price nearly 80% could be seen as either a risky move of trying to catch a falling knife or a prudent investment decision for anyone looking for attractive future returns at relatively low risk. Which case applies largely depends on the underlying reasons for the large drop in share price and also requires an objective assessment of the business model itself.

After the market’s negative reaction to PayPal’s (NASDAQ:PYPL) Q2 2023 earnings, I have even more reasons to believe that the company falls in the latter category.

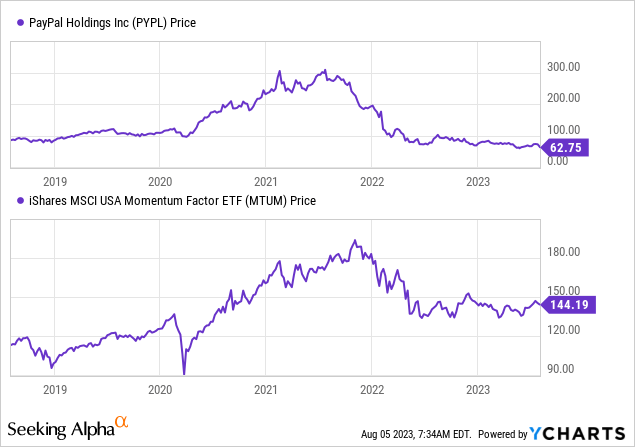

Taking a step back from the quarterly results, PYPL’s recent highs from the 2020-21 period were largely driven by momentum trade and excessive liquidity in the markets, which brought many other momentum stocks to unsustainably high levels.

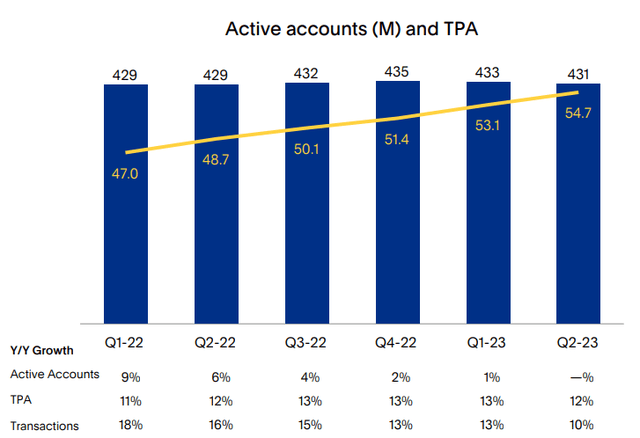

As a result, most of the attention is now focused on PayPal’s ability to sustain high quarterly revenue growth and continue growing key KPI’s, such as total payment volume and active accounts.

Although this is important for short-term results, it could easily make investors miss the forest for the trees by ignoring company’s positioning, its strategy and existing competitive advantages – an issue I talked about in further detail roughly 3 months ago.

Overreaction To Fears Of A Slowdown

Although the recent quarter was largely in-line with the consensus estimates and the company reiterated its guidance, the growth-oriented market participants reacted negatively to the company’s 0.6% decline in active accounts.

Our results are tracking with the guidance we gave for the full year and reflect steady progress against our long-term growth aspirations.

Source: PayPal Q2 2023 Earnings Transcript

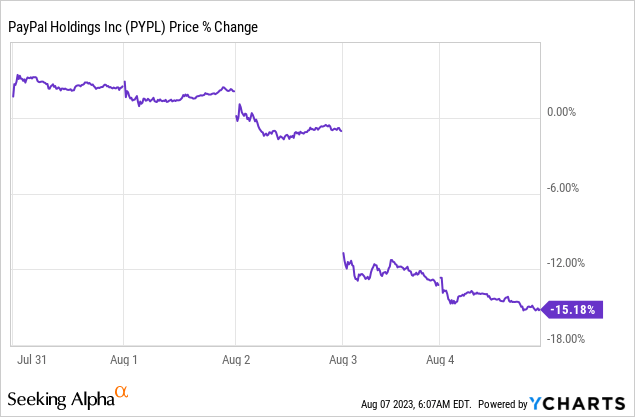

Consequently, PYPL share price fell more than 15% in a matter of just 5 trading days and is now trading at levels from 6 years ago.

In addition to the slight drop in active accounts, one could also justify the sharp movement in the share price by the stiff competition in the space and transaction margin compression.

There are other nuances that could be added to create a proper narrative, but the fact to the matter is that short-term topline growth has become the only game in town.

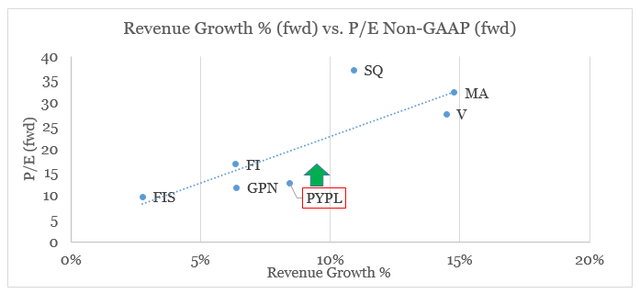

As we see down below, expected revenue growth rate is still a major factor that could explain differences in Price-to-Earnings multiples in the sector. Even a company like Block (SQ), which struggles to achieve operating profitability is rewarded with exceptionally high earnings multiple on a forward basis due to its strong revenue growth.

prepared by the author, using data from Seeking Alpha

More importantly, however, PayPal is now priced well-below the implied earnings multiple by its expected revenue growth rate of 8.4%.

What that clearly illustrates is that PYPL is on the other end of the spectrum of Block as far as investors’ sentiment is concerned. Meaning that the market is now pricing a very high probability that revenue growth will be significantly below the 8.4% mark.

On the surface, the recent quarter seemed to confirm that with the less meaningful KPI of total active accounts noting a marginal decline.

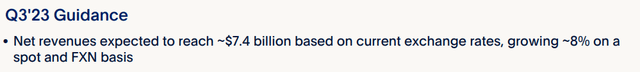

However, the Q3 revenue guidance remains strong and the management is still confident that growth should accelerate by the end of the fiscal year.

As I mentioned, we expect our top line to accelerate to low double-digit growth by Q4.

Source: PayPal Q2 2023 Earnings Transcript

Profitability And Valuation Multiples

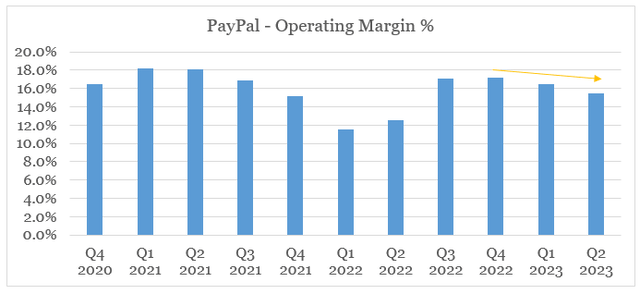

Another area of concern for PayPal is the risk for profitability as competition in the space intensifies and the share of unbranded processing volumes increases.

prepared by the author, using data from Seeking Alpha

I covered this topic in further detail a few months ago, but overall I see this as a transitional headwind for PayPal. At the same time, the brand is among the strongest within the sector and offers a major competitive advantage for the company over the long run.

Even in the short-term, if we look beyond the third quarter of this year the headwinds for PayPal’s margins would most likely begin to dissipate as the share of branded volume recovers.

While our transaction margin declined in the quarter, the rate of decline slowed considerably from both Q1 and the second quarter of last year, and we’re executing on our strategy to grow transaction margin dollars.

(…)When we think about the back half in Q3, we’ll still see some pressure on transaction margin performance. In Q4, we expect to see an improvement. And then over the longer term, our TM profile in the future will certainly be benefited by the acceleration in branded checkout by e-commerce acceleration by the improved cross-border trends

Source: PayPal Q2 2023 Earnings Transcript

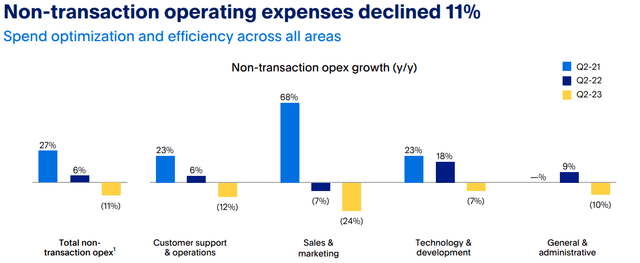

At the same time, if PayPal’s recent improvement in operating leverage is retained, the company should be able to expand its GAAP profitability during the next fiscal year.

Q2 marked the third quarter in a row that we’ve delivered meaningful expansion in our operating margin on both a GAAP and non-GAAP basis. Ongoing discipline in managing our cost structure allowed us to more than offset transaction margin compression with operating expense leverage. On a non-GAAP basis, non-transaction related operating expenses declined 11%, with reductions across each of our principal operating expense categories contributing significant leverage.

Source: PayPal Q2 2023 Earnings Transcript

Overall, this puts PayPal in a good spot to continue growing its earnings per share in FY 2024 and beyond. The unchanged guidance when it comes to EPS numbers and Non-GAAP operating margin expansion during the latest quarter only confirm this view.

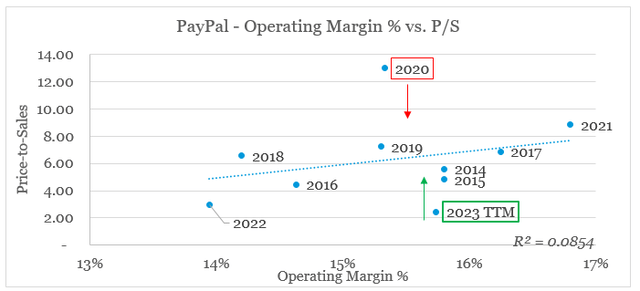

The situation of PYPL shareholders looks even better once we consider operating profitability relative to the company’s sales multiple over the years. The relationship between the two does not appear as strong due to two outliers – the P/S multiple in 2020 and the current one. Contrary to the 2020 period, this time around PYPL is priced at a significant discount to what its current margins would suggest.

prepared by the author, using data from SEC Filings and Seeking Alpha

Capital Allocation

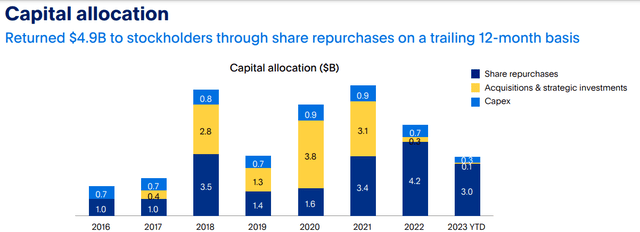

The last area that I think is worth exploring is that of capital allocation and more specifically how PayPal’s management creates shareholder value by properly utilizing its free cash flow.

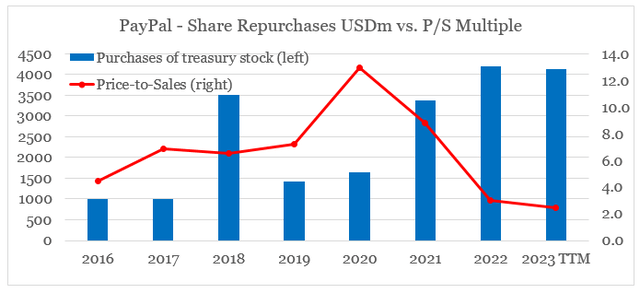

As we see from the graph below, PYPL’s management has shifted its attention from acquisitions & strategic investments during the 2018-2021 period to share repurchases.

The amount of share buybacks increased significantly in 2021 and is expected to remain elevated at $5bn for the current fiscal year.

For the full year, we now expect to allocate approximately $5 billion to our buyback program.

Source: PayPal Q2 2023 Earnings Transcript

By plotting the amount of share repurchases against PayPal’s price-to-sales multiple we could see that the company decision to reduce share buybacks in 2019 and 2020 was well-timed. Moreover, the company is now repurchasing shares at the lowest multiples since 2016.

prepared by the author, using data from Seeking Alpha and SEC Filings

Conclusion

As the market continues to punish PayPal on the basis of potentially lower topline growth and contracting margins, the stock itself has become too cheap to ignore. At the same time, the risks that are currently priced-in appear to be short-term in nature and PayPal still has a significant competitive advantage over most of its peers. That is why, the stock is now among my top picks within the sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

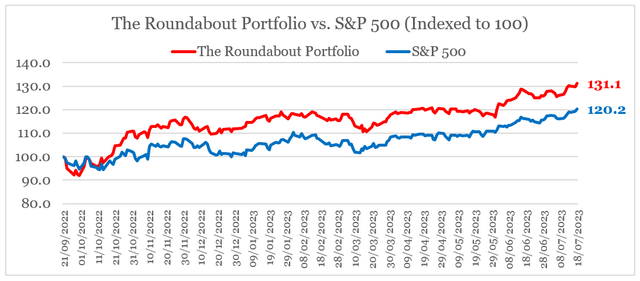

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.