Summary:

- Home Depot has experienced a slower rally compared to the overall market but is expected to see a new tailwind that will push its stock higher.

- The housing sector, as tracked by the iShares U.S. Home Construction ETF, has seen increased demand, leading to high housing prices and profitability for homebuilders.

- Home Depot is well-positioned to benefit from economic tailwinds in the coming years, as high interest rates make people less likely to move and will rely on the company for home maintenance and improvement.

Justin Sullivan

Investment Thesis

Home Depot (NYSE:HD) is up 13.3% in the past three months after missing out on the first half of the year’s rally. As of August 6, 2023, the S&P 500 is up 17.33% year-to-date (YTD), while HD has been climbing back up and is only up 3.33% YTD. HD had a rough end to 2022 and start to 2023 as demand slowed and inventories rose. COVID created abnormal headwinds and tailwinds for the company, but I believe a new tailwind is about to occur that will push the stock higher and continue to make it a long-term winner.

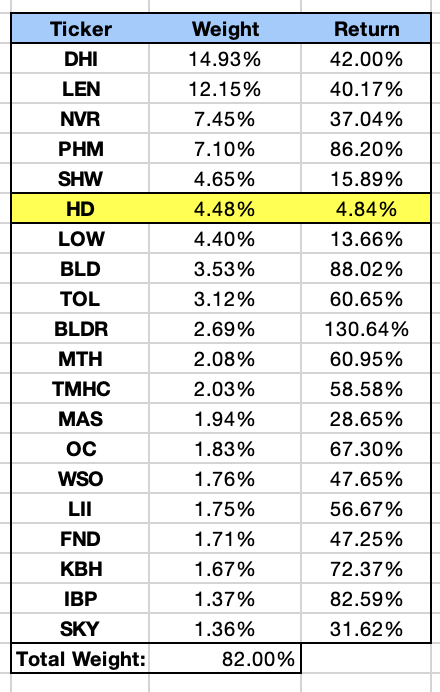

The iShares U.S. Home Construction ETF (ITB) is the fund I use to track the housing sector. It is up 43% YTD due to increased demand for home builder stocks. Freddie Mac estimates that there is a 3.8 million housing shortage. This imbalance in supply and demand is likely to keep housing prices high. Additionally, as inflation and input prices slowly come down, homebuilders will become even more profitable. This is why the industry has done so well. However, of the top 20 stocks in the ITB, only two have returned less than 20% YTD: Lowe’s (LOW) at 13.6% and HD at just over 4.8%.

ITB Top 20 Holdings Weight and YTD Return (Data From Koyfin)

Home Depot is the world’s largest home improvement retailer with Lowes right behind them. They are both currently facing headwinds due to pulled-forward demand during the COVID-19 pandemic, when people were forced to spend more time at home. However, I believe that current economic conditions will soon create tailwinds that could send Home Depot higher.

With high interest and mortgage rates, people are less likely to leave their current homes for new ones. 30-Year Fixed Rate Mortgage Average in the United States is currently 6.9%, but the five-year average is only 4.22% and the three-year average is even lower. I believe that higher rates for longer will force people to stay in their current homes for longer, either to keep the low rates they have locked in or to wait to renegotiate rates down in the future.

Either way, people staying in their current homes for longer will benefit Home Depot, as they will look to the biggest and best home improvement retailer to keep up with maintenance around the house. Additionally, the rapid building of new homes creates mass potential for the company in the coming years, as demand for home improvement products is expected to increase.

The global real estate market is valued at $3.7 trillion in 2021 and expected to grow at a 5.2% compound annual growth rate (CAGR) until 2030. Home Depot is perfectly positioned to be a long-term winner, given its massive scale and growing online presence. The stock should be included in any retirement portfolio.

Stock Fundamentals

Home Depot’s operations and growth are currently heavily funded by debt. The company has an equity multiplier (EM) of over 200, which means that it is financed with more debt than most other companies. However, this is not a cause for concern, given Home Depot’s strong balance sheet and cash flow.

The company takes on debt to invest in growth, such as building out new stores and investing in its online e-commerce business. Home Depot’s cash flow allows it to do all of this and more. The company generates massive amounts of cash, which allows it to pay off its expiring debt, pay out a very steady dividend, and reduce its share count by over 14% in the last five years.

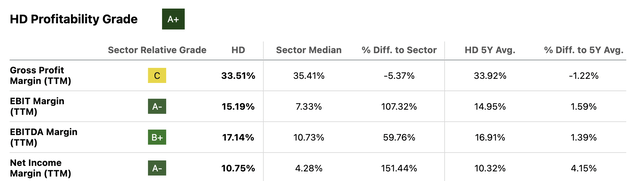

In the last twelve months, Home Depot generated $16.4 billion in cash from operations (CFO) and $13 billion in free cash flow (FCF). This is well above its peers and up from its own five-year CFO average. The company’s true advantage comes from its net income margins, which came in at 10.75%. This is well above its main competitor Lowe’s, which had net income margins of 6.68%, and the industry median of 4.28%.

Margins have been getting better in recent years, and I believe that there is still room for steady margin expansion, 4-6%, over the next five to ten years. This is due to the maturing and reliable e-commerce business, as well as stabilizing lower input prices (lumber).

Home Depot Profitability Overview (Seeking Alpha)

Home Depot’s encouraging profitability and cash flow lead me to talk about its dividend. In my opinion, Home Depot is one of the best dividend growth stocks, with 14 consecutive annual dividend increases and a 15.75% 5-year CAGR. The company has a healthy payout ratio of 47.44%, which has been trending higher. In its last fiscal year, Home Depot paid out over $7 billion in dividends total, which is barely half of its cash from operations. This shows that the company is returning money to shareholders through dividends while also investing in its growth.

I believe that Home Depot will soon become a dividend aristocrat, which is a designation given to companies that have increased their dividends for at least 25 consecutive years. I also believe that Home Depot will continue to outperform market returns, as it has done for the past several years.

Valuations & Price Target

Home Depot currently trades at a price-to-earnings (P/E) ratio of 21.8x for the fiscal year 2024. This is a premium to the industry average, but it is justified by the company’s size, scale, and profitability. Home Depot’s P/E ratio is above its five- and ten-year averages, so it is fair to say that the stock is currently overvalued. However, the company’s dominant global presence and market leadership justify the premium valuation. Home Depot has a 60% market share in the home improvement industry as of Q1 2023. The company’s brand name and 2,300 stores globally give it a dominating edge over its competitors.

Analysts expect low earnings and sales growth for Home Depot in the near term. This does not help the stock’s valuation case. However, I believe that Home Depot’s premium valuation is justified by its long-term growth prospects. The company is well-positioned to benefit from the continued growth of the home improvement industry.

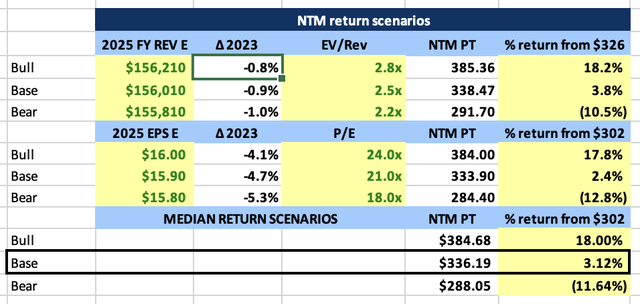

I have created a price target scenario table based on analyst estimates and historic valuations. This table shows a bull, base, and bear scenario for Home Depot’s stock price. At $326, the stock currently trades at a 1.5x risk-to-reward ratio, which indicates that it is around fair value. I believe that the stock is a good buy for long-term investors, but I would wait for a pullback to below $312 before buying. At that price, the risk-to-reward ratio is greater than 3x.

2025 FY Price Target scenarios (Author’s Calculations Based on Data From Analyst Estimates on Koyfin)

The Morningstar research platform has a fair value for Home Depot at $259 per share, which seems a bit outdated. Its strong sell price is $349, so they believe the stock is slightly overvalued.

I ran a dividend discount growth model to generate a current price of Home Depot based on the predicted growth of the company’s dividend. This model found a base case fair value of $328 per share, showing the company is fairly valued, with a $353 bullish price target if the company saw higher than expected cash and profitability growth.

This leads me to believe that Home Depot’s new consolidation range may be in the mid-320s, and it is creating a launch pad to go higher when ready.

Risk

There are only two main risks to Home Depot. The company is now so relied upon and experienced that it has almost a “too big to fail” feeling, so risks have condensed.

The first risk, if it wasn’t obvious, is the company’s valuation. They are trading above their five-year averages and have room to fall if given bad news from management or a change in economic conditions that could slow demand further. The risk would come in a contraction of the multiple, where the P/E could go from 21.8x to 18x-19x, which would put the stock between the low 280s and 290s.

I mentioned before that the stock had a risk-to-reward of 1.6x, which is not the best entry point. However, the thesis and moat around HD make the stock a long-term play because it is not just a trade, but an investment.

The second big risk is a change in economic conditions surrounding the housing market. The Federal Reserve (monetary policy) is still trying to steadily slow down the economy, and that could include the housing market. President Biden and his team (fiscal policy) are spending billions to continue to expand the country. Unemployment has been resilient and sticky, and the Fed has been oddly more data-dependent and driven than ever. Economic conditions can continue to be weird and uncertain, and that could lead to volatility and possible downside risk in a company so closely related to the housing market and economy as a whole. Morningstar analysts continue to state, “We believe the biggest risk is a slowdown in the real estate market, signaled by increased home inventories for sale, slower price growth, or higher mortgage rates.”

Conclusion

Home Depot’s brand reputation and management’s commitment to continued growth and shareholder return have made the stock a great buy. The stock has tremendously outperformed the S&P 500 over the last 10 years, and I expect the stock to do the same in the next 10 years.

Their dominant store presence and convenience, paired with the quickly growing and improving e-commerce business, will only make the company and brand more dominant. The balance sheet will only get better with consistent cash flow, and they will have to invest less into growing the online business. They have had over $10 billion in free cash flow (FCF) stashed away since 2018, and I only see that going higher. Management will continue to intelligently allocate capital, splitting it between internal growth and shareholder return through share buybacks and dividends. I truly believe Home Depot will be one of the best dividend appreciation stocks over the next two decades.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Jake Blumenthal is a Registered Investment Advisor and Portfolio Analyst with Meridian Wealth Management, a SEC Registered Investment Advisor. The views and opinions expressed in the following content are solely those of Jake Blumenthal and do not necessarily reflect the views and opinions of his employer, Meridian Wealth Management. The content provided is for informational purposes only and should not be considered as financial advice or a recommendation to engage in any investment or financial strategy. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions. Meridian Wealth Management does not endorse or take responsibility for any content shared by Jake Blumenthal outside of his official duties at the company.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.