Summary:

- Since Google Cloud turned profitable this year, investors are wondering whether this profitability is sustainable.

- While Microsoft Azure is perceived to be ahead in the AI race, Google Cloud holds a key advantage over its rival, which will also underpin long-term profitability.

- A big risk relates to whether Google can successfully fight off Nvidia Corporation’s increasingly powerful ecosystem.

JasonDoiy

In Q1 2023, Alphabet Inc’s (NASDAQ:GOOG, NASDAQ:GOOGL) Google Cloud turned profitable for the first time, and maintained this profitability in Q2 2023. Now the investment community is observing whether Google Cloud can sustain this profitability amid the AI revolution, where Microsoft (MSFT) Azure seems to be the perceived leader.

Google Cloud’s profitability has been the result of prudent reengineering of its cost base for durable cost savings while gaining greater control over its supply chain through the use of its own chips. If Google can induce greater use of its own chips, it should underpin sustainable profit growth over the long term, which means the grass could get greener from here. Though encouraging customers to migrate from Nvidia’s (NVDA) GPUs to its own chips will not be easy. Nexus Research maintains a “hold” rating on Google stock.

In a previous article, Nexus Research covered the progress Google has been making on the advertising front in the new era of conversational search, while challenges remain. In the previous coverage on Google Cloud, Nexus Research covered how the segment is strongly positioned to capitalize on the AI revolution with its Vertex AI platform. Since then, Google recently reported Q2 2023 earnings, delivering sustained profitability for Google Cloud, as well as offering guidance on the AI front.

Google’s cost efficiency driving profitability

While Google has claimed to be an AI-first company for years now, Microsoft is perceived to be racing past Google ever since the competitor’s bet on OpenAI paid off with the launch of ChatGPT. While currently Nvidia’s GPUs are the most sought-after by cloud customers to power their AI application development, Google Cloud holds a key advantage over Microsoft Azure by already designing its own AI chip, namely the Tensor Processing Units (TPUs).

While Google Cloud indeed continues to offer Nvidia’s GPUs to offer customers industry-leading AI solutions and avoid losing customers to rivals like Microsoft Azure, the software giant has indeed been striving to encourage greater use of its own TPUs, as this will be key to driving future profitability.

The use of its own TPUs will grant it direct cost savings by not having to rely heavily on Nvidia’s super-expensive GPUs. Now there is a reason why all the major cloud providers currently have no choice but to offer Nvidia’s GPUs to their customers, which is the fact that these chips are simply the most powerful AI chips available on the market. Therefore, if Google wants to successfully encourage customers to opt for its own TPUs over Nvidia’s GPUs, it will need to offer competitive price-performance.

That being said, a great advantage of producing its own chips is that they are particularly designed to be efficiently integrated with Google Cloud services, granting it more control over the performance and capabilities of both its cloud services and the underlying TPUs. Nvidia’s GPUs are considered an off-the-shelf product meant to serve various cloud services through one solution.

The optimized integration between its TPUs and cloud services should open the door to superior performance capabilities through greater cost efficiencies. Thereby, Google Cloud has the opportunity to lure customers away from Nvidia’s GPUs by offering better price-performance through its own TPUs-powered cloud services.

Hence, the use of its TPUs here could improve profitability in two ways. Firstly, the integration benefits should enable more cost efficiency. Secondly, if these cost benefits are passed onto customers, it could enable Google Cloud to better attract customers, allowing for top line revenue growth, which subsequently flows down to greater profitability. Hence, the grass could get greener for Google Cloud as the use of its own TPUs drives profit growth.

Google’s proficiency in cost-efficiency does not stop there. Let’s not forget that this whole AI revolution would not have been possible without Google. In 2017, Google introduced the Transformer Neural network that underpinned the development of leading large language models like PaLM, as well as OpenAI’s GPT-4.

“The Transformer requires less computation to train and is a much better fit for modern machine learning hardware, speeding up training by up to an order of magnitude.”

Given Google’s role as a pioneer in innovating more computationally efficient/ cost efficient neural networks, investors can be confident that the software giant will be able to sustain this success as it works on the next-generation of its neural network. This should translate to even fewer TPUs/GPUs required for AI training/ inferencing, further lowering the cost of running AI models, and conducive to better profitability. Though to ensure the grass gets greener for Google Cloud going forward, the tech giant may want to reconsider the extent to which it open sources its technology in the future, to avoid giving rise to another rival like OpenAI.

All in all, as the company that innovates industry-leading neural networks to enable the AI revolution, as well as designing its own chips for optimized parallel computing capabilities, Google in essence holds powerful control over the AI supply chain/ development process, which should be conducive to better control over profitability.

A key risk to consider

Despite innovating its own chips, Google Cloud is still spending heavily on offering Nvidia’s GPUs to customers, signaling that Google’s TPUs may not be sufficient for all types of workloads, as well as a reflection of Nvidia’s brand power and moat.

Encouraging customers to migrate to cloud services powered by its own TPUs will not be easy given the extensive software ecosystem built around Nvidia’s chips. AI investors are likely well aware by now of the CUDA software package that augments the value proposition of Nvidia’s chips. In a previous article about Nvidia’s moat, Nexus Research covered how:

“companies that want to effectively compete with Nvidia would not only need to build a comparable AI chip, but also build out a commensurate software ecosystem around the chip that helps speed up the application development process for developers. Nvidia has indeed developed a strong ecosystem around CUDA (or Compute Unified Device Architecture), including a large developer community, third-party software and hardware vendors, and academic institutions. This ecosystem incurs a virtuous cycle whereby the more people use CUDA, the more third-party developers and other partners are incentivized to support it by writing even more programs for Nvidia’s GPUs, which in turn strengthens the ecosystem further.”

Therefore, Google Cloud fights an uphill battle in encouraging cloud customers that are well ingrained into the Nvidia ecosystem to migrate towards TPUs. Building a commensurate ecosystem could indeed incur costs that undermine profitability.

Financials and Valuation

On the Q2 2023 earnings call, CFO Ruth Porat offered guidance on the outlook for CapEx (emphasis added):

“as it relates to CapEx, in Q2, the largest component was for servers, which included a meaningful increase in our investments in AI compute. … We expect elevated levels of investment in our technical infrastructure increasing through the back half of 2023 and continuing to grow in 2024. The primary driver is to support the opportunities we see in AI across Alphabet, including investments in GPUs and proprietary TPUs as well as data center capacity. With all that said, we remain committed to durably reengineering our cost base in order to help create capacity for these investments in support of long-term, sustainable financial value.”

Before the major cloud providers can capitalize on customers’ high demand for AI solutions, they will all need to scale their own AI infrastructure. Hence, for the rest of the year and throughout 2024, investors can expect high capital expenditure, which will inevitably pressure profit margins over this period.

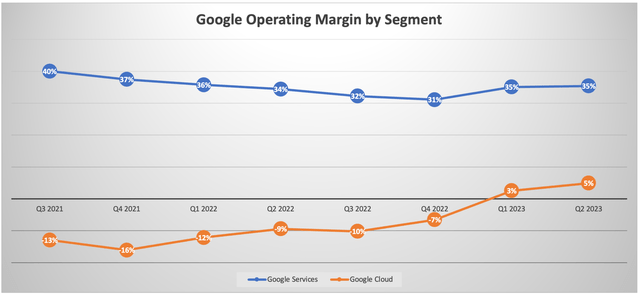

That being said, Google has certainly proven its ability to drive cost efficiencies, growing Google Cloud’s operating margin from -16% in Q4 2021 to 5% in Q2 2023. Therefore, even if Google Cloud’s profitability is underwhelming over the near term amid high capex, investors can be confident that the tech giant is strongly positioned for long-term profitability given its tight grip over the AI supply chain/ development process, as discussed earlier.

The dual impact of top-line revenue growth driven by the AI revolution and long-term cost efficiencies should bolster profitability, enabling Google stock to command a higher price to forward earnings multiple, which stands at over 23x. Compared to its major rivals, Google offers the cheapest exposure to AI-driven cloud computing growth, with Microsoft trading at almost 30x and Amazon at over 65x.

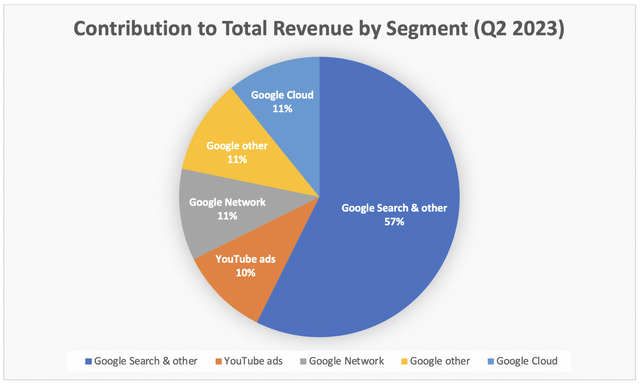

Now while Google Cloud’s profitability prospects are promising, note that it only made up 11% of total revenue in Q2 2023. The majority of Google’s income continues to derive from advertising.

Hence, while the grass could indeed get greener for Google Cloud from a profitability perspective, uncertainties remain around its advertising business amid the AI revolution. Thus, Nexus Research maintains a “hold” rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.