Summary:

- Microsoft has sold off in the days since their FY23 Q4 earnings report.

- Investors may be concerned about a ramp in net capex and a slowdown in Azure growth.

- Management has a sense of urgency in our view regarding the future of their business and are taking a long-term view on value creation rather than focusing on short-term shareholder returns.

- We believe that the company is making the necessary investments to secure their future competitive positioning.

- Microsoft remains undervalued relative to their fundamentals, growth prospects, and risk profile.

Jean-Luc Ichard

Thesis

Microsoft (NASDAQ:MSFT) has sold off since they reported FY23 Q4 earnings. We believe that investors are too heavily focused on short-term concerns and are missing the long-term investments that Microsoft is making in the future of computing and AI. In our opinion, Microsoft is currently trading below their intrinsic value and has roughly 19% upside from these levels.

What’s New

Our previous article was about how Microsoft benefits from AI adoption and our thesis has been materially strengthened since then. The key update we learned from their FY23 Q4 earnings is evidence of Microsoft spending even more on computing and AI through an increase in capex and R&D as well as through their venture investments. A stark increase in net capex and AI spend demonstrates that management has a sense of urgency in our view regarding the future of their business, which is an essential characteristic of tech firms that win across multiple eras. We are upgrading our rating from a buy to a strong buy, which is the first strong buy we have ever assigned to a stock.

Microsoft’s Post-Earnings Decline

We believe that Microsoft’s earnings results were good all things considered. Revenue of $56.2 billion increased 8% year over year. Operating income of $24.3 billion increased 18% year over year. Net income of $20.1 billion increased 20% year over year. And finally, diluted EPS of $2.69 increased 21% year over year. Of particular interest to investors, Azure and other cloud services revenue grew 26% year over year. Microsoft continues to demonstrate their effectiveness at consistently improving profitability and leveraging the advantages of their (mostly) software and computing based business model. In this environment, operating income growth of 18% is about all an investor can ask of a company as large as Microsoft already is.

Despite all of these positives, the stock has sold off since the earnings report was released. Investors may have been concerned about capex and a slowdown in Azure growth rates.

As far as capex is concerned, for the three months ended June 30 additions to property and equipment were 8,943,000,000 vs 6,871,000,000 in the year ago period. This compares with depreciation and amortization of 3,874,000,000 vs 3,979,000,000 over the same timeframe. This rapid increase in net capex may have caught some investors off guard and is now causing them to question if those dollars are being spent in the right place.

We believe that Microsoft is making the necessary investments now in order to thrive in the future. While over the short-term this results in less cash flow available to equity holders, over the long-term a high level of capex will be required to ensure that Microsoft remains competitive.

The slowdown in Azure growth is to be expected as the segment gets larger. It’s possible that at some point down the road, the growth rate of Azure and other cloud services re-accelerates as the economy rebounds and Microsoft incorporates more AI services into their cloud offerings.

Investments in Computing and AI

We believe Microsoft is making massive investments into hardware, software, and private companies in order to make sure that they are positioned well for the shifting technological landscape.

Microsoft is spending considerable time and capital to build out their cloud computing capabilities and are improving their software offerings in order to best serve their business customers going forward. This involves expanding their data centers and making sure that they are using the most cutting edge hardware. It also involves providing their customers with AI-based software that will drastically improve the efficiency of their business.

The race to create the most value in cloud computing and AI is an intense competition between Amazon (AMZN), Google (GOOGL), and Microsoft. One thing Microsoft has going for them is their robust software offerings that many businesses already use, making Microsoft an easy choice in some cases. Even if Microsoft ends up with a slightly worse cloud offering, it’s likely they will still be able to compete on price and convenience.

In addition to their internal efforts, Microsoft has made numerous investments in private companies such as OpenAI and Inflection AI. Whether these investments pan out or not, one thing is clear: Microsoft wants to have a part in shaping “the future of AI” and knows that their internal efforts may not be as successful as they hope. The company understands that innovation often comes from smaller companies and is not afraid to invest in those companies and help them grow. Their private company investment strategy could end up being an insurance policy in case one of these companies would begin to disrupt Microsoft.

Microsoft has made many good investments over the years and many poor ones. This is natural for a company that understands they must continue to spend and innovate in order to remain in a favorable competitive position. Over the long term, a company that succeeds also has to be willing to fail. Say what you want about Microsoft, the company has found ways to reinvent themselves and resume growth in the past. Management believes that their spending on computing and AI is going where it needs to and we have no reason to doubt that as of now.

As far as the Activision acquisition, we don’t like it and think they could have pursued far better targets at that price tag, however what’s done is done. Many people have doubted the acquisitions of Microsoft and have been proven wrong. At the end of the day, management will likely find a way to make it value accretive.

Price Action

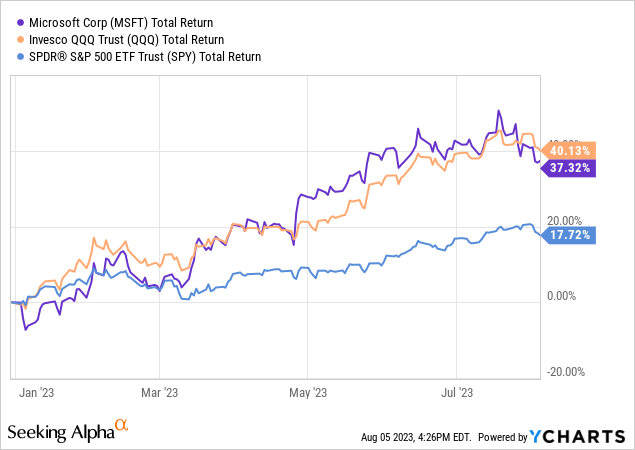

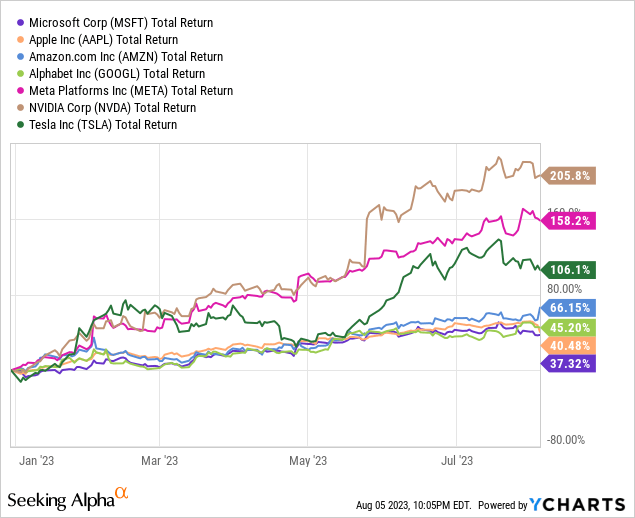

Microsoft has been roughly tracking the Nasdaq 100 (QQQ) this year and has beaten the S&P 500 (SPY). Unfortunately for investors, it has lagged the six other members of the MAG7 in 2023. Investors in Microsoft should have tempered expectations for what the stock will do going forward. It’s unlikely that Microsoft will have a short-term run as ferocious as some of their peers, however this also comes with the positive of not being prone to as sharp of drawdowns as some of their peers. While all stocks carry risk and can go to zero, some investors may value the relatively lower volatility of Microsoft compared to some of their big tech peers. We believe that Microsoft will continue to beat the market over the coming years, but will likely do so to a lesser degree than they have in recent memory.

Valuation

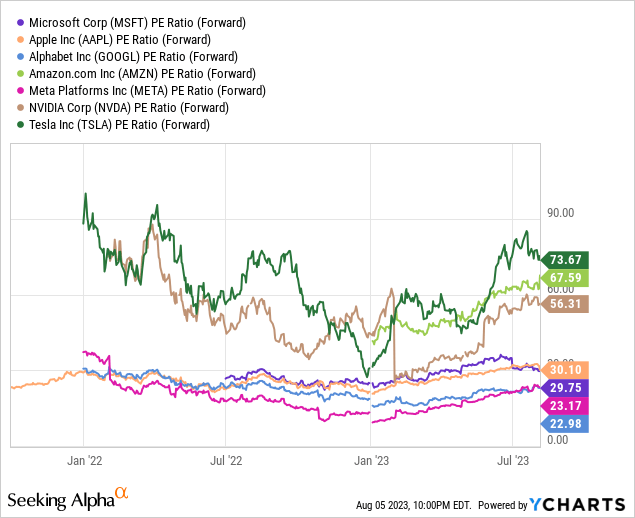

On a forward PE basis, Microsoft appears to be middle of the pack when compared to their MAG7 counterparts.

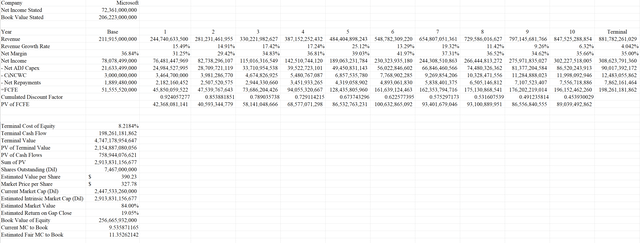

We value companies primarily on a free cash flow to equity basis. The base year numbers come from Microsoft’s results over the trailing twelve months. Net adjusted capex is normal net capex with R&D capitalization and amortization and company/IP net acquisition costs factored in. Change in non-cash working capital uses an estimated normalized number because for a company such as Microsoft it shouldn’t be modeled as being negative but can be negative in some years. If anyone is wondering why some numbers look different (such as base year net income used) there are adjustments we make such as capitalizing and amortizing R&D. The estimates for growth, margins, and inputs such as terminal cost of equity originate from our propriety models, but at the end of the day these are nothing more than our opinions and estimates. Rather than simply taking our word for it, investors creating a DCF should come to their own conclusions regarding where they expect the fundamentals of Microsoft’s business to be over the coming years and what they believe an appropriate discount rate is.

Our current estimated intrinsic value for Microsoft comes out at $390.23 per share which represents roughly 19% upside from here. We believe a nearly $3 trillion valuation is fair for Microsoft given their fundamentals, growth potential, and risk profile.

FCFE DCF of Microsoft (Author)

Risks

The main risk with Microsoft’s spending on computing and AI is the potential for that spending to not bear fruit. While this is always a possibility, one of the worst things a technology company can do is stand still and be complacent (or any company for that matter). We believe that Microsoft’s management is taking proactive steps to position the business for future success. In a world where managers have been tempted and incentivized to maximize short-term shareholder returns, Microsoft is focused foremost on investing in the future of their business. This mindset is what separates companies that win across multiple eras and companies that lose their dominance. Much like the movement of a glacier, it’s difficult to see in the moment, but come back in five years and the benefits of their spending will become apparent.

If we were forced to pick only one of the “Tech 5” and had to hold for 20 years, we would pick Microsoft. Their business is reasonably diversified compared to the others and their management appears to have a sense of urgency regarding the future of their business. Minimal exposure to China is a plus. The risk profile and valuation is favorable and Microsoft will likely deliver for investors over the coming decades, just perhaps not as much as they have in recent memory.

For those curious, our second choice regarding the above hypothetical scenario would be Amazon.

Key Takeaway

Microsoft’s stock has sold off since their FY23 Q4 earnings release, but we believe this is an overreaction and represents a buying opportunity for long-term investors. Microsoft is taking the necessary steps to secure their future competitive positioning. The company is undervalued given their fundamentals, growth prospects, and risk profile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AAPL, GOOGL, AMZN, META, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to MSFT, AAPL, GOOGL, AMZN, META, TSLA, and NVDA. UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. This is not investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.