Summary:

- Roku’s stock price has experienced big jumps and drops, making it difficult for many investors to hold onto the stock for the long term.

- The company lived up to what it had promised in the previous quarter. It also posted better results than other ad-based models like YouTube, Pinterest and Snap.

- The company’s active accounts and streaming hours continue to increase, demonstrating strong engagement numbers.

- Charlie Collier, brought in from Fox, is becoming Roku’s secret weapon and functions as Anthony Wood’s right-hand man.

- We look at the highlights from the conference call, including thoughts and facts about Barbie, Shopify and The Trade Desk.

Justin Sullivan

Introduction

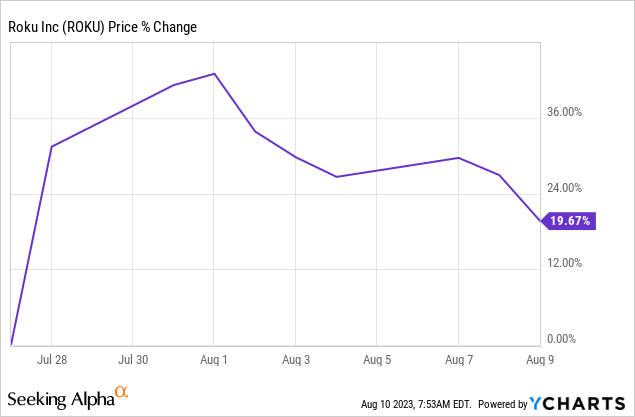

With all the earnings releases, Roku’s (NASDAQ:ROKU) earnings already seem far away, even though it’s been just two weeks. The stock price shot up 40% but right now, the price is just 20% above the pre-earnings price.

This is how it often goes in growth investing. The drops AND the jumps are often unexpected and very big. Many investors consequently have trouble holding Roku’s stock for the long term. I understand that. After all, Roku didn’t make it easy to stay convinced, venturing into new businesses, losing more money than most thought and showing flat revenue for a while.

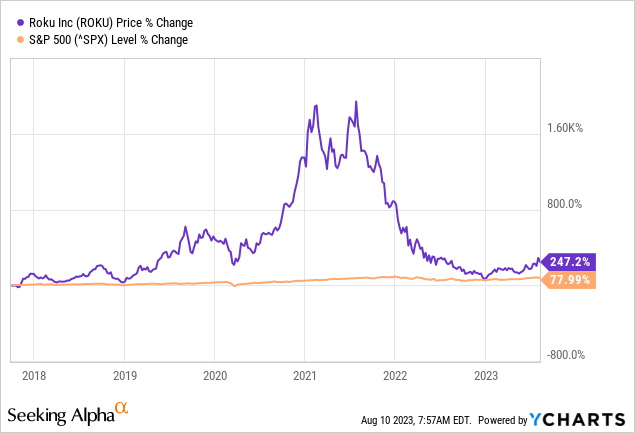

Many have called Roku an awful investment, but that all depends on your perspective. If you invested in the IPO, you are up 247%, beating the S&P 500 by a huge margin of 169%. It also represents a CAGR of 23%.

At the same time, the stock is still down 83% from its all-time high. This shows you have to be careful about judging from and at one single moment in investing.

Let’s look at what caused the big jump in the stock price.

The Q2 Numbers

Roku’s revenue was up 11% for Platform Revenue and 9% for Devices year-over-year. In this environment, that’s strong. If you look at other ad-driven media outlets, you see that Roku’s Platform Revenue, mainly driven by ads, is doing better than YouTube, at 7.8% growth, Pinterest (PINS), 6%, Snap (SNAP) -4%, etc. Only Meta (META) also had 11% revenue growth. Very strong and better than most had anticipated.

This shows a few things:

- The ad market is really rebounding and Q1 seemed to have been the bottom.

- Roku will always be cyclical, like all ad-based models. But some of the best companies in the world have been built on ads (Facebook, Google, and more and more, Amazon (AMZN) and even Apple (AAPL) following).

On a GAAP basis, Roku lost $0.76, but right now, the company is not focusing on profitability. It’s in full land-grab mode, trying to convince as many people as possible to watch through or to Roku. Through Roku means TVs powered by Roku’s operating system. Too many investors still only think of the sticks, but that is just a small part of Roku. To Roku means, of course, The Roku Channel.

And for the first time, we got numbers for The Roku Channel. It was 1.1% of total U.S. TV viewing in May, according to Nielsen. That’s a market share of 3% of streaming, comparable to players like Peacock and HBO Max. To me, that’s very impressive and an underestimated asset for Roku.

Misunderstandings about Roku

Every time I write an article about Roku, people in the comment section ask me why they would want to buy shares of a company that just makes these sticks to put in your TV. This is not what Roku is about. Probably less than 5% of its revenue comes from the sticks and it’s a loss leader to get into people’s houses.

Roku provides the operating system for a whole slew of TVs. Think of brands like Hisense, TCL, JVC, Onn (Walmart’s in-house brand), Sharp, Philips and many others. And just like the operating systems Android and iOS, it charges app makers to use the platform. But where app makers have to give a part of the payments they collect to Apple and Google, Roku is paid with ad time. If there is an ad slot, Roku is allowed to insert a certain percentage of the ads it sells. When it comes to The Roku Channel, their own content channel, Roku can keep 100%, of course, although they have to pay for content.

Too many investors have seen The Roku Channel as a big negative. And I can understand that. If you look at how much Netflix (NFLX) had to spend on content for years (and still does today), you might see this as a bottomless money pit.

But I have always emphasized that Roku is NOT playing Netflix’s game. It spends very cautiously on content. If you allow me the comparison, Roku is the value investor of TV content. For example, it paid much less than $100 million for Quiby’s content, which is probably comparable to Buffett buying Apple shares in 2016.

The Engagement Numbers

Because Roku invests so much of its time and effort on grabbing market share, active accounts and streaming hours are more important than financial results right now. Roku is financially in a very strong position, with no debt and $1.8 billion in cash. So, it doesn’t need profitability.

So, let’s look at the most important numbers, the engagement numbers.

Active accounts were up 16% year-over-year. That’s very strong. There are already 73.5 million accounts now and despite the bigger base to start off, Roku has done a great job in consistently adding active accounts. That’s execution, as this is the main goal right now. Look at the consistency and tell me again Roku is not executing.

- Q1 2022: +14%

- Q2 2022: +14%

- Q3 2022: +16%

- Q4 2022: +16%

- Q1 2023: +17%

- Q2 2023: +16%

If you look at streaming hours, you see an even better evolution, with a surge of 21% year-over-year to 25.1 billion.

- Q1 2022: +14%

- Q2 2022: +19%

- Q3 2022: +19%

- Q4 2022: +23%

- Q1 2023: +20%

- Q2 2023: +21%

To put this in context, in Q2, viewing hours on traditional pay TV fell by 13%.

There is a reason why I haven’t sold my Roku shares and even added cautiously every now and then, when the stock traded around $60. I didn’t add too much because I already had a substantial position and I didn’t want it to become too big, but I never lost faith in what the company did.

But if you lost your patience and sold, I understand that. I went into the earnings with that mindset a few times as well. But the execution always remained good enough to convince me for another quarter. For my subscribers, I give an Overall Quality Score and Roku’s never been subpar up to now. I feel pretty confident that if the ad market continues to improve, Roku will as well. And the results of the second quarter showed this again.

ARPU

Another number that Roku gives each quarter is ARPU, or average revenue per user. In the past, I found that a crucial metric, but that has changed. The reason is simple: ARPU will go down if Roku does well internationally.

Next to the US, Roku is number one in Canada and that market may be comparable to the US, but it’s also number one in Mexico and we all know the ARPU of a Mexican user will be much lower than an American. Roku is also competing in Brazil, where it is a close second after Samsung, and this, too will have an effect on ARPU. So, success abroad will mean lower ARPU and that’s totally fine.

The second and maybe most important reason for the decline in ARPU now is the overall ad market slowdown we have seen in many companies. If you add more new users with slowing ad spending, you get overall lower ARPU numbers.

It’s important to know that this is not the only reason Roku’s ARPU is down. I mostly hear the “increased competition” argument about ARPU pressure. I put it in quotation marks, as I see no increased competition. Yes, behemoths like Amazon, Apple, Google, and Samsung are also in this space, but that has been the case for a very long time, and Roku continues to be the clear leader.

Because of the reasons I named, I don’t mind that ARPU is down 7% year-over-year, from $43.81 to $40.67. In Q3, you should even expect a bigger drop, as the comparables in Q3 2022 are tougher. But, you can ignore that. It’s good to see that ARPU doesn’t fall off a cliff, despite the international success. That probably means the American ARPU continues to rise slowly, despite the advertisement headwinds.

Margins

The same can be said about gross profit margins. With international markets, you should expect these to go down. For Platform, these were down 2.7% year-over-year, from 55.9% to 53.2%. Of course, international was not the only reason and not even the most important. The ad scatter market is still weak, especially in media and entertainment and tech. Roku doesn’t see improvement before next year, also considering the strike in Hollywood. Other categories are slowly improving.

At the same time, Roku also delivered on what it promised in the previous quarter: scaling back on operating costs. With revenue up 11%, the total operating expenses were only up 8%.

But if you look at the separate numbers, I like it even more. General and administrative: +1%, R&D -2% and Sales and Marketing +23%. In other words, Roku spends the money where I want it to spend the money.

These numbers are year-over-year comparisons. If you look at quarter-over-quarter numbers, the execution is even clearer:

- R&D: -14.4%

- G&A: -13.5%

- S&M: -3%

Companies executing on their promises, I love that! Roku’s founder and CEO Anthony Wood shared how it thought about cutting costs while not seeing an impact on the quality of R&D on the conference call:

We have – obviously, we have offices in Silicon Valley, but we have great teams in Manchester, England, Cambridge, U.K. Taipei and in other places. And so one of the things that we’ve been doing is doing a lot more of our hiring in regions outside the United States to have great engineering talent, but are just less expensive than Silicon Valley engineers. So that’s one of the ways we’re controlling our R&D costs and still getting lots of great engineers.

Roku also reiterated that it wants to be EBITDA-positive in 2024:

We remain committed to achieving positive adjusted EBITDA for the full-year 2024 with continued improvements after that.

Having seen that Roku does what it says it will do, this is very promising. In this quarter, adjusted EBITDA was negative $18 million, $57 million above the company’s guidance. That again shows the same thing, management making big improvements on the financial side. That the company can continue growing its engagement numbers despite cutting on spending is a testament to its strength.

Roku’s Secret Weapon: Charlie!

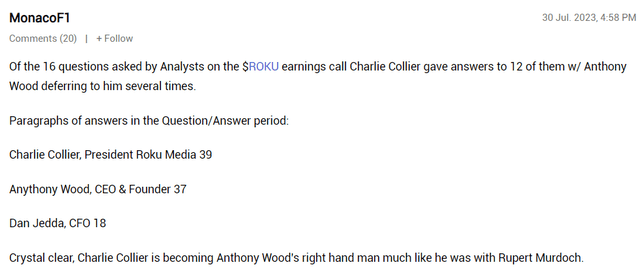

First, I want to give a big shout-out to one of my subscribers, Multi MonacoF1. Look what she wrote in the comment section of the Overall Quality Score update:

Potential Multibaggers Investing Group

I would have written something about this but I wouldn’t have thought about quantifying this, and these numbers make the point much stronger. I feel blessed to have such smart and kind subscribers!

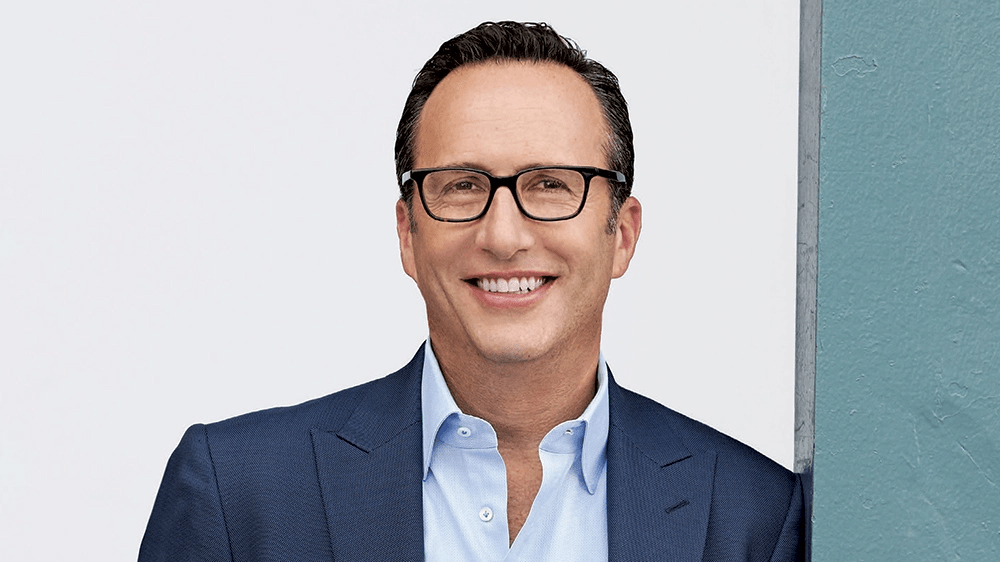

For those who wouldn’t know, Charlie Collier is an industry veteran. Roku brought in Collier in September 2022. He previously served as the CEO of Fox Entertainment Group, where he was seen as Rupert Murdoch’s right-hand man, as MonacoF1 wrote.

Collier serves as Roku’s President of Media and is primarily focused on growing Roku’s platform which involves creating, promoting and selling ads for Roku’s original content. Collier has a very strong track record in this realm.

Variety

As the CEO of Fox Entertainment beginning in 2018, Collier helped the company rebuild their production infrastructure following Rupert Murdoch’s sale of his 21st Century Fox assets to Disney (DIS). Collier helped Fox see a resurgence in their ratings the past few years on the strength of programs such as TMZ, Studio Ramsay Global, and the acquisitions of Bento Box Entertainment, the animation company behind “Bob’s Burgers.”

Before Fox, Collier was the President and General Manager at AMC (AMC), where he oversaw the development of several Emmy Award-Winning shows, including “Breaking Bad.”

I think this was a homerun hire for Roku and Charlie Collier is already proving his value to Roku. He may well be the missing piece in the Roku puzzle. The strategy seems to be clearer and when it comes to communication, I criticized Roku in the past for not communicating their strengths well enough.

The management team kept repeating that Roku was the only “purpose-built operating system for CTV,” but they didn’t explain that this meant that TV OEMs (original equipment manufacturers) could use cheaper chips than those for the other operating systems, which brought down the price for OEMs to produce TVs. If you want a competitive advantage for Roku outside its number one market position, there you have it. Google and Amazon probably have to pay OEMs the difference in costs for chips to have their Operating Systems installed. And even with those more expensive chips, Roku’s OS still works better because it’s not as heavy as the Android-based operating systems of the other two.

With Charlie Collier, things are phrased more explicitly and, therefore, clearer. Look at this quote from the Q2 earnings call, for example.

I think M&E is a great category. And I’ve enjoyed it more actually in my time at Roku because we have the best highly performing tools, and we deliver great ROI. So before I go at what Anthony spoke about on the M&E side, I want to point out the good news amidst the industry-wide M&E pressure, and it’s that we’re building share versus the competition in M&E.

And here’s another quote from the conference call to prove this:

I think it’s important to note that will help our M&E partners transfer their focus from account acquisition and account growth to engagement and churn management and retention. It’s something we do really well. We’re the perfect partner for this, too, because we are closest to the viewing decision for more than 73 million homes.

I could go on, but I think the quotes make it clear that Collier can really make you enthusiastic about Roku and its future. That was missing at Roku before he was there.

Such things are essential. If you listen to the greatest company builders of all time, think of Sam Walton, Elon Musk, Steve Jobs, Jeff Bezos, Warren Buffett, Bill Gates and others, they all have this trait. It’s pure enthusiasm and Charlie Collier clearly has that about Roku’s prospects.

That’s clear, optimistic and strong language. Anthony Wood is not enough of a salesman to emphasize Roku’s strength, but Collier does this very well now. And not in a salesy way, but just stating the facts clearly.

Since Collier joined Anthony Wood on conference calls, the latter is also much more relaxed than he used to be, probably because he knows he has someone experienced next to him who has seen it all. Anthony Wood mentioned this on the conference call to an analyst:

Cory, this is Anthony. I just learned – you may know this, but Charlie has led on with 20 upfronts, which I thought was pretty cool.

And Collier has a great sense of humor, which may also help. Just look at his opening sentence after the first question.

Thanks for congratulating us on the quarter and for the sneakiest-ever three-part opening question.

And a bit further in the call:

Cory, you’re our second three-question-asker. Well done.

I find this funny and I think it shows that Collier is not just a business asset for Anthony Wood, but also just a great guy overall and essential for a relaxed mood during executive meetings. That’s not something often talked about in investing, but from personal experience and reading a few stories, I know that if there’s humor in the conference room, creative ideas flow easier.

I think Charlie Collier may be Roku’s secret weapon, which could help it become an excellent investment.

There is also a new CFO, Dan Jedda, the former CFO of Stitch Fix (SFIX) and previously 15 years at Amazon’s streaming and advertising businesses. While I liked the former CFO Steve Loudon, I have the feeling this is more than a worthy follow-up and fresh blood can bring fresh energy. Jedda started in May and was guided through the transition by Loudon, who left on August 1.

Earnings Call Insights

Third-party DSPs

Important is that Roku is “ramping up our work with third-party DSPs to capture incremental demand while not reducing existing revenue streams.” This is another correct Jeff Green prediction. Green is the founder and CEO of The Trade Desk (TTD). He often makes predictions. While I have followed The Trade Desk for about five years now, I have never heard him predict something that didn’t become a reality.

Green said last year that walled gardens would start working with third-party DSPs, like The Trade Desk, and Roku is doing that. This is not totally new, but Roku focuses on it more now. I think this will benefit them. Management talked about strong growth but from a small basis. Charlie Collier added this important nuance:

I think we’re very conscious of making sure that it’s not cannibalistic.

In other words, it must be additional, not taking any existing business away from Roku. That even strengthens my belief this could be an important growth driver for Roku for years to come.

Roku City

Roku introduced Roku City in 2017. It’s a screen saver, seen by more than 40 million people a month. Roku now started using it as a way to advertise more and more. This is, for example, the Barbie movie ad, with Barbie’s dream house and a cinema with the movie on the bill.

Roku

But before that, McDonald’s also did a much-talked-about campaign on Roku City.

Roku

Charlie Collier about Roku City:

The advertisers love it. In fact, today, we have more demand than capacity in Roku City, and we’re looking for ways to expand thoughtfully.

Like Charlie Collier, I’m optimistic about the Shopify (SHOP) partnership.

We’re really excited about the Shopify partnership I should note upfront that our goal is to make the TV screen accessible by businesses of all sizes, not just the largest businesses. And so this first of its kind partnership with Shopify provides viewers the ability to seamlessly purchase products from Shopify merchants directly from their TV using Roku shoppable ads.

So literally, you just click okay on your remote, you check out automatically with Roku Pay. And an order confirmation from the Shopify merchant hits your inbox. It really is that easy.

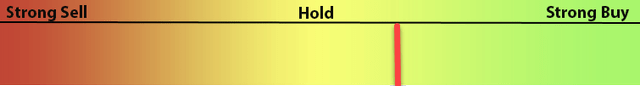

Buy-Hold-Sell Scale

I rate Roku a buy but not a strong buy.

Made by From Growth To Value

The reason is that I think that as a Roku investor, you will need more patience. This is an investment for the future. No matter how you look at it, at a certain moment, a company must make money and Roku is not there yet. But we saw with many great companies (Facebook, Google, Amazon…) that they first took market share before they focused on monetization. I think Roku has that potential as well.

But just like it took Amazon, Google and Facebook a long time to become cash machines, that time will also be needed for Roku and of course, over such a long period, a lot can go wrong. Nevertheless, Roku is the clear leader in CTV and has big potential in front of it for a long time.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN,, ROKU SHOP TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am the custodian over an account in my child's name and the account does own a few shares of Apple, Disney, and one Netflix share.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Potential Multibaggers focuses on stocks that have the potential to go up 10x or more over the next decade.

With many high-growth stocks still 50%+ under their 2021 highs , there is more fish in the pond, more opportunities for outsized returns.

Potential Multibaggers is for long-term investors who want to fill their portfolio with potentially life-changing returns and have the patience and equanimity to hold through volatility.

Feel free to start the free trial now!