Summary:

- PayPal will continue to show strong growth in total payment volume driven by expansion in product portfolio, geographic diversification and industry segment expansion.

- It has recently shown better financial discipline with control over fixed operating expenses to counter the trend of dropping take rates.

- PayPal is getting closer to a buy with a recommended price target of $40.

Spencer Platt

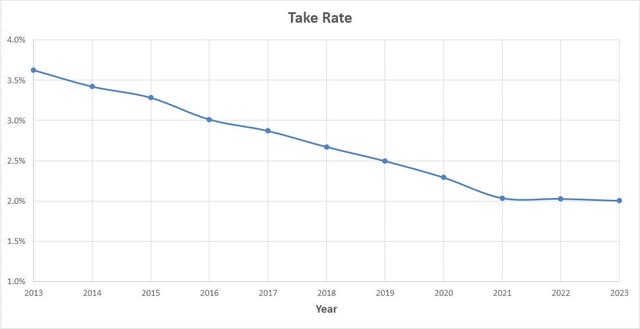

PayPal (NASDAQ:PYPL) is a technology platform that is dedicated to democratizing financial services by enabling digital payments and transfers for customers and merchants. It operates in peer-to-peer transfers, checkout services, payments processing, business & risk services, and marketing tools segments of the evolving fintech industry. Being part of eBay until 2005 helped PayPal gain customer trust and userbase in a captive environment and lay the foundations of strong growth. However, fintech industry has become quite competitive with consistent innovation from start-ups and existing giants. Additionally, there is a chance of disruptive technology from a blockchain or mobile native application to upend the industry as we know it today. In midst of this backdrop, PayPal has seen good growth in total payments volume but its take rate (revenues as % of payments volume) has been consistently declining and is now at 2%.

PYPL has come down ~80% from its all-time of $310 in mid-2021 and is now trading at levels seen in 2017. Though it still shows slightly overpriced on an intrinsic valuation basis, the level of overpricing has decreased over the course of last year. The value enhancement has been driven by improvements in operating margins offset by decline in take rate. On a relative valuation, however, the stock does appear underpriced, with estimates in the $76-$117 range. Given these levels, I think the stock has come down enough to deserve a consideration to add to one’s portfolio. To get a sufficient margin of safety, I recommend a buy price of around $40.

Investment Thesis

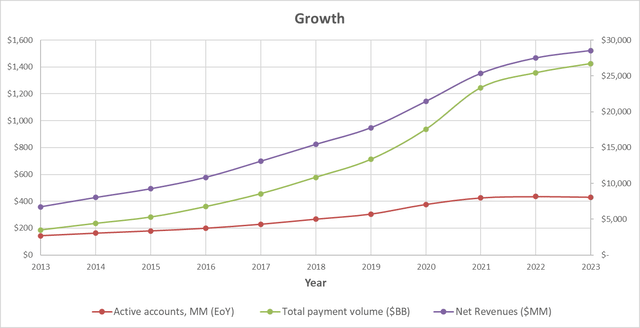

A key component for any financial firm to succeed is trust. Fortunately for PayPal, given its 20+ years of history and being a captive unit of eBay until 2005, has helped it gain customer and merchant trust. Being a long-time trusted partner in the fintech industry has helped PayPal gain new users and new markets at an aggressive pace. Over the course of last 10 years, active accounts on its platform have grown at a CAGR of 12.3%, total payment volume has grown at a CAGR of 23.9% while its revenues have seen a growth of 16.4%.

Coming from this position of strength, I reckon PayPal will continue to maintain its market dominance as a trusted partner for financial transactions like money transfers, checkouts, lending and more. It is likely to continue expanding the breadth of its product portfolio and diversifying both geographically and across industry segments (most importantly small & medium size enterprises). Existing scale and reach of PayPal will continue to serve as strong tailwinds in this expansion.

I reckon the fintech industry to keep moving towards increased digitization and reduced transaction costs. There may be a more widespread adoption of crypto with dedicated/native crypto transaction platforms, confining traditional players like PayPal to deal with fiat currencies only. Given the move towards crypto and mobile commerce and the emergence and expansion of native service providers may limit the playing field for PayPal. Furthermore, I believe PayPal would not gain share in markets already dominated by giants such as Alipay, WeChat Pay and Paytm. While PayPal will continue to expand its total payments volume building on its brand reputation and proliferation its product portfolio, its growth will be limited given its current size, market share, and changing forces towards native m-commerce, social payments platforms and rise of crypto payments. Given these factors, I assume the total payments volume transacted on PayPal platform to grow at a CAGR of 11% over the next 5 years, driven by the growth in new accounts as well as increased transaction/account.

However, a worrisome trend that is obvious in the PayPal story is its declining “take rate” (revenues/ total payments volume). As can be seen from chart below, its take rate has been shrinking for the last 10 years and has just breached the 2% mark.

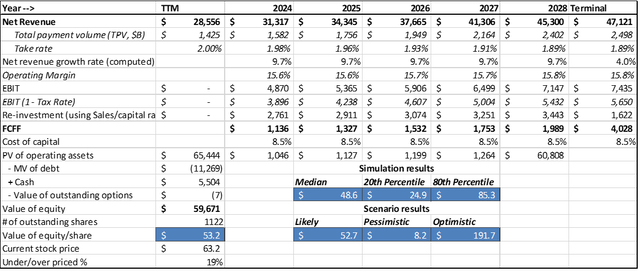

With such signs of a maturing industry and increasing competition, I believe the take rate is going to continue declining though at a slower pace. I assume the take rate will stabilize at around 1.9% over the next 5 years. Coupled with the increased payment volume, this gives PayPal a revenue CAGR of 9.7% over the next 5 years.

Total transaction expenses for PayPal have remained fairly static over last few years at around 1% of total payments volume. I believe this level will continue to hold. This implies that its gross margins will fall as transactions costs continue to become a bigger component of the revenues. Recently, PayPal has demonstrated better control over the fixed portions of its operating expenses. I assume these recent gains in reduction of fixed operating costs will hold with such economies of scale kicking in, which will help offset the declining gross margins. Consequently, the operating margins for PayPal (after capitalizing its R&D expenses) will grow slightly from 15.6% to 15.8% over the next 5 years.

From a reinvestment perspective, PayPal would continue to invest in cloud services, data centers, computing equipment as well as acquisitions. Its net working capital needs increase gradually as loan portfolio expands. However, I do see some slowing in capex requirements particularly in acquisitions given the scale differences. Therefore, I see the sales/capital ratio for PayPal improving from current ~1 to 1.2 over the next 5 years to be in line with industry average.

The current weighted average cost of capital for PayPal was estimated at 8.5% and I assume it to stay constant given a mature firm.

Using these inputs, my valuation below results in an equity value just shy of $60B for the company or ~$53/share. This is about 20% lower than the current price of ~$63. As I have valued PayPal over the course of last year, I find the discrepancy between its intrinsic value and price has shrunk considerably from 93% at the end of 2022 to 20% now.

FCFF Valuation Model ($ million)

Simulation Results

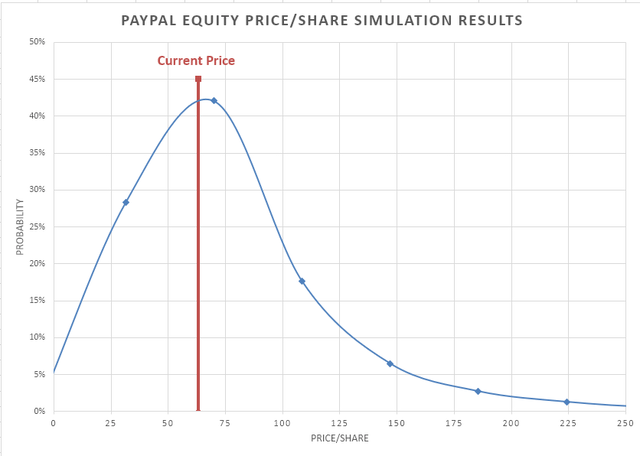

Results from the DCF model are highly dependent on the key assumptions outlined earlier. Total payment growth rate, take rate decline, terminal operating expenses and terminal ROC are the key variables here. Monte Carlo simulations were run on the DCF model with these inputs as variables, with their values being picked from distributions shown in the table below. A set of 10,000 random iterations were performed and the results from this simulation are shown in the figure below.

Input Variables for Simulation

|

Variable |

Distribution |

Baseline |

Std. Dev. |

Min |

Max |

|

Total payments growth rate |

Normal |

11% |

2% |

||

|

Take rate decline |

Normal |

-1.2% |

1.1% |

||

|

Terminal operating expenses |

Triangular |

31.2% |

29.2% |

35% |

|

|

Terminal ROC |

Triangular |

14% |

10% |

22% |

Frequency Plot of Intrinsic Valuation from Monte Carlo Simulation

My range for intrinsic value provides a band from 20th percentile of $25 to the 80th percentile of $85. With PYPL currently trading at $63, it lies around the 65th percentile, being slightly overpriced.

Relative Pricing

To analyze how PYPL is trading vis-à-vis its peers, I selected a group of 18 public companies in the broader fintech and financial industries. I regressed the commonly used multiples against fundamental value drivers for each multiple. Based on these regression models, I calculated the predicted values of the multiples that PYPL should be trading at, given its fundamentals (growth rate, margins, beta, payout ratio, ROC etc.). I selected the multiples where regressions R2 was relatively high. As is seen from the table below, I found PYPL to be undervalued currently on each of the 4 multiples. The range that I get using relative multiples is $76 – $117. While its trading at above its intrinsic value, I find that PayPal is currently cheap on a relative basis.

|

Multiple |

Predicted Value of Multiple |

Equity Price/ share |

|

EV/Sales NTM |

4.4 |

$117 |

|

EV/Invested capital |

4.1 |

$96 |

|

EV/EBITDA NTM |

14.9 |

$76 |

|

P/E |

22.6 |

$96 |

Risks

I see a couple of important risk factors here that are worth mentioning.

Increased competitive headwinds – The payments industry can become even more crowded with new/expanded players from fintech, big tech as well as start-ups. Not only would this put pressure on the total payments volume, it could have an even bigger impact on take rate as the transaction prices decline given increased competition.

Lack of capital discipline – In recent past, PayPal has made some significant acquisitions, including Paidy for $2.7B in 2021 and Honey Science Corp for $4B in 2020. It is not clear to me how much value add has come through these acquisitions. If PayPal gets back on the acquisition bandwagon, it may end up destroying value. Secondly, PayPal has been the midst of a large share buyback program. It had $10B total authorization in July 2018 and plans to do $5B of buybacks in FY2023. While not too concerned with the buybacks at the current price levels, I would be worried of any buybacks that come at a substantially higher average share price.

Conclusion

Based on my outlook, I find the intrinsic value of PYPL to be $53/share while its relative valuation to be in the range of $76 – $117/share. With its current price of $63/share, it has come closer to deserving a place in the portfolio. To get a sufficient margin of safety here, I recommend a buy price of $40/share or better.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.