Summary:

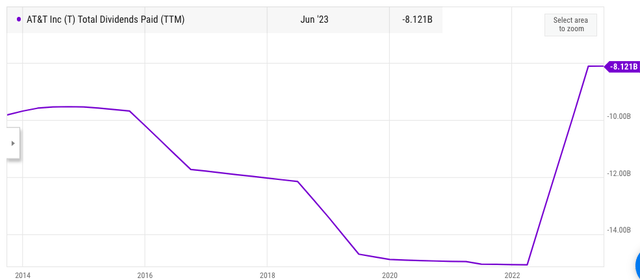

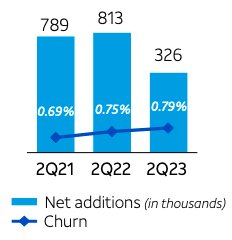

- AT&T’s churn rate in the recent quarter was 0.79% compared to 0.75% in the year-ago quarter and 0.69% in the 2Q21.

- AT&T is losing the perception battle in terms of network coverage to T-Mobile, which has posted a better churn rate at 0.77%.

- T-Mobile’s churn rate is only 2 basis points better than AT&T, but it shows the possibility of a long-term trend as more customers sign up and stay with T-Mobile.

- This could force AT&T to increase investment in plan pricing and network coverage, both of which will hurt free cash flow.

- T-Mobile’s lack of dividend is a massive competitive advantage which would be difficult for AT&T to overcome.

Brandon Bell

AT&T (NYSE:T) reported reasonable results in the recent quarter in a few metrics. However, its churn rate increased YoY to 0.79% and the net additions came at only 326,000 compared to 813,000 in the year-ago quarter. At the same time, T-Mobile (TMUS) has reported a lower churn rate than AT&T for the first time in history. This shows that T-Mobile is able to attract more customers and also retain them with better offers. T-Mobile’s churn rate at 0.77% is only 2 basis points better than AT&T, but it could show the start of a long-term trend. Last year, there were several third-party estimates which pointed out that T-Mobile’s 5G network coverage was better than AT&T and Verizon (VZ). This is now reflected in actual metrics reported by the companies in terms of their churn rate.

In my previous article, “AT&T: Further correction likely due to multiple headwinds” published on 30th May, it was mentioned that AT&T will continue to show price correction. Since then, the stock has dropped by another 11%. One of the key reasons is that Wall Street is not convinced that the company will be able to maintain this hefty dividend over the long run. It is now facing further competitive pressure as T-Mobile has started to report this better churn rate. This is another major headwind for AT&T that will make it difficult for the company to gain pricing leverage.

The higher churn rate reported by AT&T compared to T-Mobile shows me that it has lost the perception battle. More customers believe that T-Mobile offers better value than AT&T. This can have a massive impact on AT&T as it will be forced to spend heavily on plan pricing and network coverage. This will negatively impact the FCF and also cause delays in the debt reduction efforts of AT&T. We could also see the 8% yield of AT&T come into question if T-Mobile continues to grab more customers and report lower churn rates. AT&T stock is quite cheap, but this new trend could give second thoughts to investors looking to make a long-term bet in the company.

AT&T falls behind in key metric

The churn rate is closely watched by analysts due to its impact on other metrics of a telecom company. AT&T has only two options to improve its churn rate. One is to offer more competitive plan pricing, and the other is to increase investment in network coverage. Both these options will cause a significant negative impact on AT&T’s free cash flow.

Company Filings

Figure 1: AT&T’s churn rate and net additions data. Source: Company filings

Churn rate also have a direct impact on net additions. If AT&T had a churn rate similar to 2Q21, its net additions would have been close to 400,000 which was the level forecasted by analysts. This would have certainly helped the bullish sentiment towards the stock.

T-Mobile’s CEO Mike Sievert mentioned in the recent earnings, “there’s still going to be some back and forth between us and the other guys before we consistently put them in the rearview mirror for good on churn”.

This seems like a very confident statement by T-Mobile’s management. A long-term trend where AT&T’s churn rate is consistently worse than T-Mobile will certainly cause further bearish sentiment towards AT&T stock.

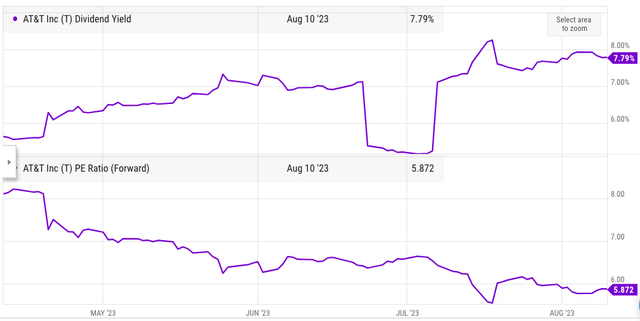

Dividend is the problem

AT&T spends over $8 billion on dividends, while T-Mobile does not have to spend any resources on this. The dividend yield of AT&T is close to 8% which is attractive to dividend investors, but it also gives AT&T a massive competitive disadvantage. T-Mobile can easily spend the savings from not having dividend payments into more attractive plan pricing and increasing investment in network coverage.

Figure 2: Dividend payments by AT&T in the last decade. Source: Ycharts

AT&T has spent more than $120 billion on dividends in the last decade, while its market cap currently is only $100 billion. The dividends have not been able to provide a floor to AT&T’s stock price. Another 10% correction in market cap can push the yield over 9% and there would be greater calls on the management to right-size dividends. This fear has caused a negative cycle of expectations were lower stock prices lead to higher dividends which increases the risk of dividend cut which in turn leads to more bearish sentiment towards the stock.

Cost optimization

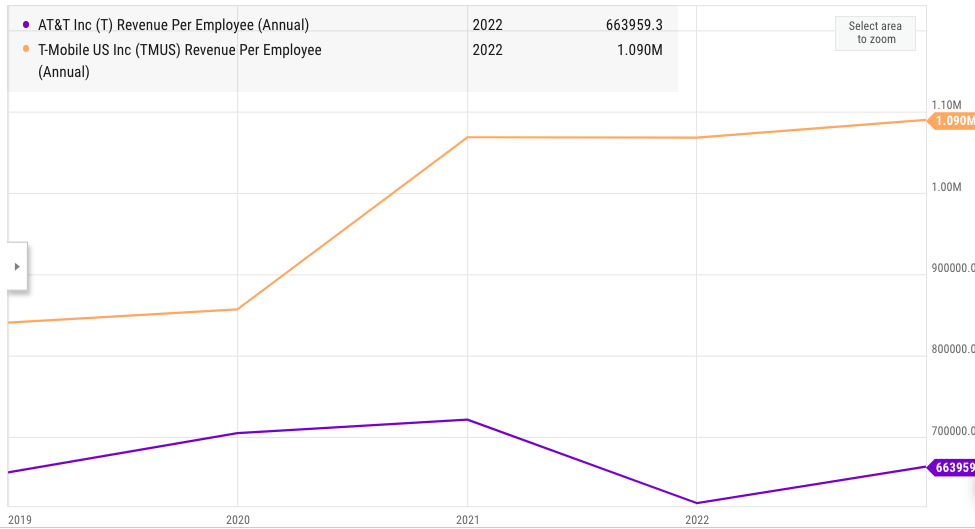

AT&T has undertaken a massive cost optimization program, which can help cut some of the excess costs and free resources to invest in network and debt reduction.

Ycharts

Figure 3: Comparison of AT&T and T-Mobile’s revenue per employee. Source: Ycharts

AT&T has a more diverse operation than T-Mobile, which leads to lower revenue per employee. However, AT&T’s revenue per employee is still 40% less than T-Mobile, which shows that there is space for cost optimization.

Company Filings

Figure 4: Cost optimization by AT&T has improved margins. Source: Company filings

AT&T’s management has announced another $2 billion in cost-savings that can further improve the margins. However, it is unlikely that these cost reductions can cover the impact of the massive dividends. T-Mobile is likely to perform better than AT&T in terms of net adds, churn rate, network coverage, and other metrics in the next few quarters as it does not have to divert resources towards massive dividend payments.

Valuation problems

Most analysts point to the low PE ratio or the sky-high dividend yield of AT&T while giving bullish forecast for the stock. However, AT&T’s dividend has not been able to provide a floor to the stock price.

Figure 5: AT&T’s PE ratio dropped by more than 25% in the last three months alone. Source: Ycharts

The recent earnings showed a decrease in net adds due to an increase in churn rate. This is a fundamental metric for the company which investors should not ignore. Most of the future free cash flow generated by the company will end up going to improve the network coverage and make more competitive plan pricing. This can impact the dividend negatively, making the stock less attractive to investors looking for a stable dividend stock.

Impact on AT&T stock

The churn rate is a key metric that is closely followed by most analysts. If the gap between AT&T’s and T-Mobile’s churn rate increases, it can lead to an increase in bearish calls toward AT&T stock. In a worst-case scenario, if AT&T’s churn rate is 10 basis points or higher than T-Mobile by the end of this year or mid-2024, it could cause a bigger correction in AT&T stock.

We have already seen that AT&T’s dividend has not been able to stem the decline in stock price. Hence, it would be very important to see the churn rate trend in AT&T and T-Mobile in the next few quarters. If T-Mobile’s management is correct in estimating that it will build a long-term lower churn rate compared to AT&T and Verizon, then it might be difficult to get bullish calls on AT&T stock.

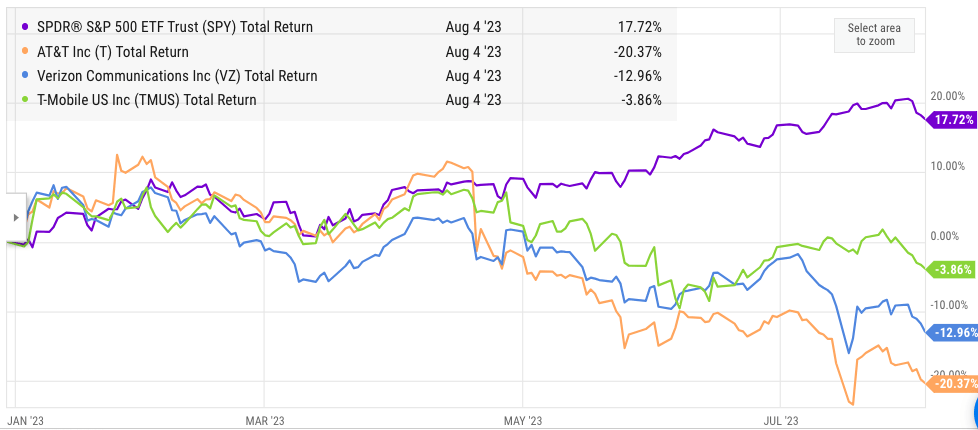

Ycharts

Figure 6: Comparison of YTD returns of telecom stocks and S&P 500. Source: Ycharts

All the telecom stocks have performed poorly in the recent bull run. However, AT&T takes the leadership in terms of poor performance. Despite a massive dividend, its total returns in the year to date have been negative 20%.

Many analysts point to the cheap price of AT&T, but this would not help the stock if the key metrics like churn rate keeps on going bad. There is no short-term fix to this issue because it requires greater investment in network coverage over the long term and also making the plan pricing more competitive. Investors looking to make an entry into AT&T’s stock should closely look at the churn rate in comparison to T-Mobile and gauge the potential of the stock in case AT&T continues to perform poorly in terms of this metric.

Investor Takeaway

AT&T’s churn rate was 0.79% in the recent quarter. This was 4 basis points higher than in the year-ago quarter and 10 basis points higher than 2Q21. At the same time, T-Mobile reported churn rate of 0.77% beating AT&T for the first time in history. This could be a start of a long-term trend, as T-Mobile has already won the perception battle in network coverage. T-Mobile is also investing aggressively in plan pricing to retain the customers it has added.

AT&T pays over $8 billion in dividends, and this has not given any steady floor to the stock price. It is difficult to see how AT&T can continue to compete with T-Mobile while giving this massive dividend payout. A further 10% decline in market cap can increase the yield to over 9% which will lead to greater calls about a dividend cut. In this scenario, it would be important for AT&T to deliver a good churn rate and net adds metric in the next few quarters. Unless this happens, we could see a further bearish correction in AT&T stock despite the cheap valuation multiple.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.