Summary:

- Lucid has realized $150 million in revenue, which represents a $50 million miss from analysts’ estimates.

- Lucid has produced and delivered 2,173 and 1,404 vehicles respectively in Q2.

- Lucid has reiterated its 10,000 delivery target for the year, despite the Saudi Arabia plant starting production in September.

- Saudi Arabia’s PIF has shown its commitment to Lucid after it invested $1.8 billion in June and facilitated a $450 million deal with Aston Martin.

hapabapa

Thesis

When I wrote in June, I rated Lucid Group, Inc. (NASDAQ: LCID) as a buy due to the continued PIF backing and its potential to capture the Middle Eastern EV market. While I believe that Saudi Arabia showed its commitment to Lucid with its latest $1.8 billion investment and by facilitating the $450 million deal with Aston Martin (OTCPK:AMGDF), I believe it is time to revise my rating following its disastrous Q2 production and delivery numbers. Since the EV maker has fallen short of its Q2 delivery estimates and has only produced 4487 vehicles, it has said that it is on track to reach its 10,000 production target, which is disappointing since it will start production in the Saudi Plant in September. This all makes me question how much demand its vehicles are actually seeing, which is why I’m downgrading Lucid from buy to hold.

Lucid’s Financials

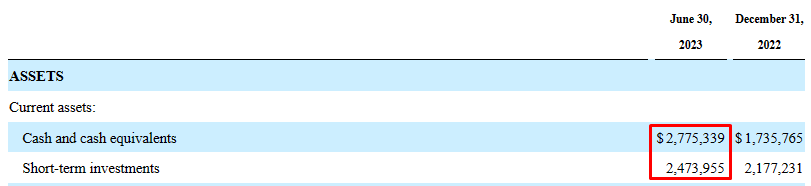

With the latest private placement, Lucid’s liquidity has increased to $5.2 billion including $2.4 billion it has in short-term investments. While it may seem that with this much cash, Lucid will be set financially for the next few years, with the current cash burn rate it will only be enough for it to operate till the first quarter of 2025 since it has burnt through $1.5 billion in the first half of 2023.

LCID Q2 report

Lucid has missed revenue estimates by more than $50 million. What I believe is often overlooked is the company’s profit margins, since it has posted negative gross margins in every quarter since it started deliveries.

|

Quarter |

Revenue (million) |

Cost of Revenue (million) |

Gross Profit (million) |

Gross Margin |

|

Q1 2022 |

$58 |

$246 |

-$188 |

-326% |

|

Q2 2022 |

$97 |

$292 |

-$195 |

-200% |

|

Q3 2022 |

$196 |

$493 |

-$297 |

-152% |

|

Q4 2022 |

$258 |

$615 |

-$358 |

-139% |

|

Q1 2023 |

$149 |

$501 |

-$351 |

-235% |

|

Q2 2023 |

$150 |

$555 |

-$405 |

-270% |

Even if we excluded the added $295 million in inventory write-downs, Lucid’s gross margin in Q1 would still be around -73%, which is especially concerning since Lucid is an expensive luxury EV that normally has high margins.

Another Drop in Production & Deliveries

Lucid suffered another drop in production in Q2 since it produced 2,173 vehicles, down 6% from Q1. Furthermore, the EV maker missed its target to increase its deliveries in Q2 over Q1 since it has only delivered 1,404 vehicles in Q2 compared to 1,406 in Q1. Another thing that is concerning is the low delivery-to-production ratio the company has seen for the last four quarters.

|

Quarter |

Production |

Deliveries |

Delivery/Production |

|

Q3 2022 |

2,282 |

1,398 |

61.26% |

|

Q4 2022 |

3493 |

1932 |

55.31% |

|

Q1 2023 |

2314 |

1406 |

60.76% |

|

Q2 2023 |

2173 |

1404 |

64.61% |

Having this low production-to-delivery ratio at such low production numbers raises a concern about how much demand Lucid is actually seeing and if scaling production is even worth it with such low demand.

Another proof of the low demand Lucid is suffering from is the latest price cuts across all its models. The EV maker has cut the price of the Air Pure by $5,000 and both the Touring and Grand Touring by $12,400. These hefty cuts will worsen Lucid’s margins even more.

That puts Lucid in a really tough spot since it needs to scale its production to improve its production efficiency and its margins, but if it did so without actual demand, it would be just increasing its inventory, which in turn will cost it more money to store.

Saudi Arabia Support

The only thing that can save Lucid from the horrible production and delivery numbers it has been putting in is the Saudi plant starting the assembly process in Q4 2023. In Q2 2023 earnings call the management announced that deliveries from the facility should start in Q3 and is expected to produce 5,000 vehicles per year. Starting the assembly process in Saudi Arabia means that the EV maker would be able to start delivering its vehicles directly to the Saudi Arabian market which should see its delivery to production ratio increasing since it has the 50,000 vehicle agreement with the Saudi Arabian government.

So in the short term, Lucid’s production numbers will depend on how much material it has sent to the assembly line in Saudi Arabia, and in the long term, it will depend on how fast it can get the Saudi Arabia plant to start full production.

I believe the Saudi Arabian market and the continued support from the PIF are the only ways for Lucid to turn its current situation around. If it can capture the Saudi Arabian and other Middle Eastern markets with the help of the PIF, it will be a huge win for the company since the Middle Eastern EV market is growing rapidly and is expected to reach $7.65 billion in 2026 according to Mordor Intelligence.

Moreover, Lucid’s $450 million deal with Aston Martin was potentially facilitated by the PIF since it is the second largest shareholder in the British luxury car maker.

Conclusion

If we were judging Lucid in a vacuum without the backing of PIF, it would’ve been another story of an EV manufacturer that couldn’t execute its production ramp and generate demand for its vehicles successfully. This is due to the company’s declining production numbers and underwhelming deliveries. Furthermore, it has negative gross margins that won’t be easy to improve. That said, the company can turn around its current situation with the backing of the PIF, which seems to be still committed to supporting it given its latest $1.8 billion investment in June and potentially facilitating the deal with Aston Martin. It is for these reasons I’m downgrading my rating on Lucid from a buy to a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.