Summary:

- The Walt Disney Company has a strong IP portfolio that is monetized through various channels such as affiliate fees, subscriptions, theme parks, and consumer products.

- Theme park attendance is still below pandemic levels and has limited room for improvement due to inflationary pressure.

- The Media & Entertainment distribution business is facing challenges due to cord-cutting and competition from streaming services. The transition to a DTC model is difficult and may not fully offset the decline in traditional media revenue.

Tomohiro Ohsumi

Company Overview

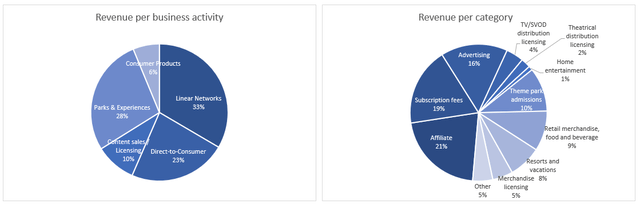

The Walt Disney Company (NYSE:DIS) is well-known for having created characters, stories, TV shows, and movies over the last century. These assets are the foundation of a strong IP portfolio which is monetized through affiliate fees, subscriptions, distribution agreements, theme parks, cruise ships, and consumer products. The group reports under two segments: Media & Entertainment distribution (66% of 2022 revenue) and Parks, Experiences and Products (34% of 2022 revenue).

The Parks, Experiences and Products business (34% of revenue)

The Parks, Experiences and Products segment encompasses the sale of admissions tickets, food, beverage, and merchandise at theme parks and resorts as well as the sale of room nights at hotels and cruise ships. In addition, it includes revenue related to the IP portfolio (trade names, characters, visual and literary) such as royalties on the sale of consumer goods from many different players such as Hasbro, Mattel, Nintendo, LEGO, Kimberly-Clark… Disney also sells branded merchandise through its owned-retail locations (Disney Stores and ShopDisney websites) as well as wholesale channels.

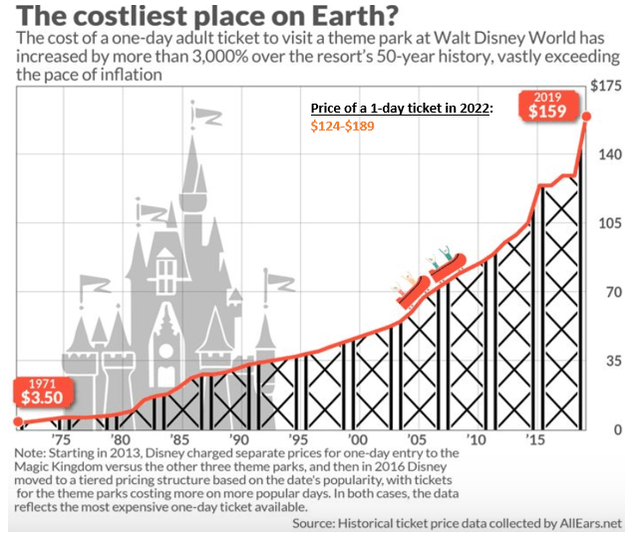

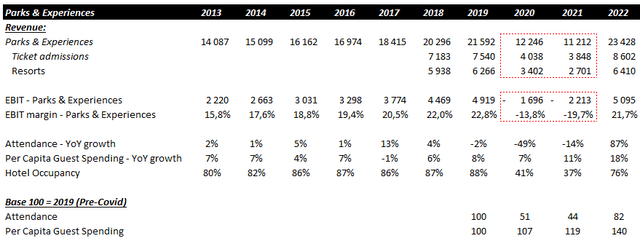

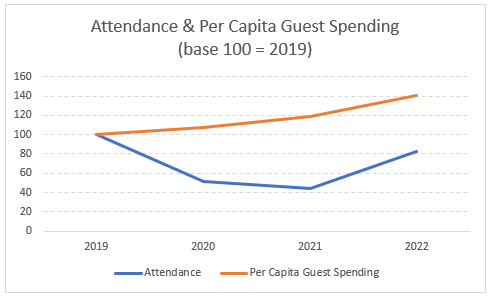

We believe the number of people attending, the price of admission tickets, and the amount of money spent during their stays for accommodations and food & beverage are the main growth drivers for the Parks & Experiences business line.

(Disney annual report & Author) (Disney annual report)

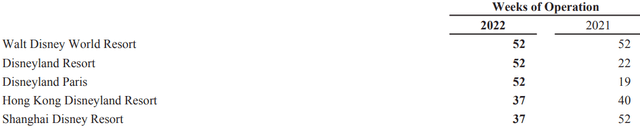

While the Parks & Experiences business has fully recovered from the pandemic in terms of revenue and operating income, attendance and hotel occupancy remain below their pre-pandemic levels. Besides, theme parks in Shanghai and Hong Kong were opened only 37 weeks in 2022 due to Covid restrictions. These elements suggest that the post-pandemic recovery is not fully over and explain the strong performance of the park business. However, per capita guest spending is now 40% above what it used to be in 2019. A large part of that increase is the result of higher ticket prices as well as an increasing number of fee-paying services that are no longer covered by the initial ticket.

For instance, the company removed its FastPass ride reservation system, requiring visitors to pay for the Genie+ service if they still want to reduce their wait times. Another example is the decision to end the Magical Express airport shuttle service, which was a free service. It is now replaced by the fee-paying Mears Connect service.

(Disney annual report & Author)

As a result, we believe that attendance growth will remain muted going forward and could even remain below its 2019 level given that “going to Disney” became significantly more expensive than it used to be. Besides, we think that the company will most likely implement a more measured approach to pricing over the coming years, which should limit the growth of that business from 2024.

The Media & Entertainment distribution business (66% of revenue)

The Media & Entertainment distribution business encompasses the creation and distribution of TV content such as movies and TV shows. It includes studios (Pixar Animation, Lucasfilm, Marvel, Disney, 20th Century Fox), cable (Disney, ESPN, FX, National Geographic) and broadcast networks (ABC) and the Direct-To-Consumer business (video streaming services such as ESPN+, Disney+, HotStar, Hulu). The segment is further segmented in three business lines: Linear Networks (33% of 2022 revenue), DTC (23%), and Content Sales/Licensing (10%).

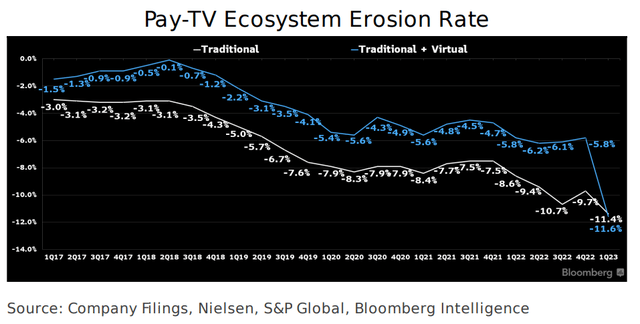

The traditional media business (including both linear networks and content sales/licensing businesses) is facing structural challenges. Indeed, the number of pay-tv subscribers is declining as the subscription to multichannel services over cable or satellite is at least >2 times more expensive than other media such as streaming services. This phenomenon is known as cord-cutting and recent data suggest that subscribers decline is accelerating.

(Bloomberg Intelligence, Nielsen, S&P Global)

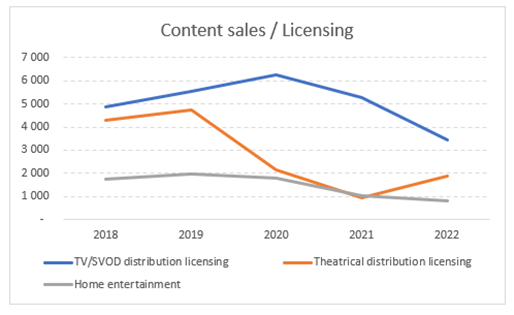

Given that Disney gets an affiliate fee on a per subscriber basis, the declining audience is worrisome for the company. An affiliate fee is a multi-year licensing agreement in which an affiliate fee is paid from a cable operator to a content producer for the right to include the producer’s network (such as ESPN) in the operator’s bundled offering. Even if Disney can renegotiate a higher affiliate fee per subscription, fewer cable subscribers are exposed to the Disney universe, which is a clear negative given it would become more difficult for Disney to monetize its other businesses (parks, products…). Besides, content sales/licensing revenue is also under pressure as fewer contents are licensed to TV/SVOD providers (in order to be exclusive on Disney+) and attendance to movie theatres has been declining for years as well as DVD consumption.

(Disney annual report)

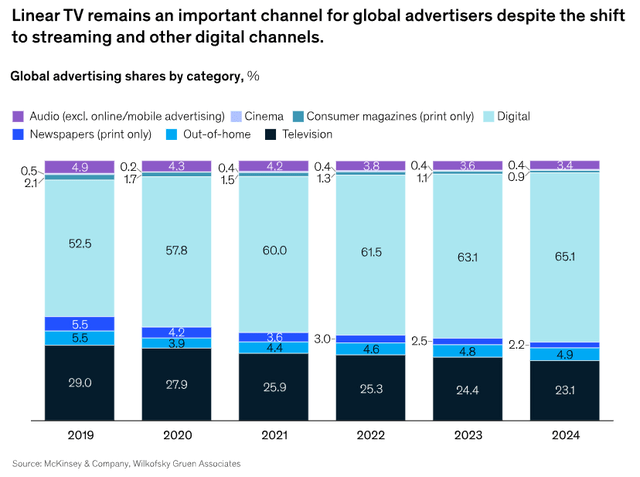

In addition, the linear networks business generates advertising revenue, which accounts for roughly 30%/40% of the segment’s revenue. This revenue stream is also challenged as advertisers allocate a higher share of advertising budgets to digital media to the detriment of linear TV (including cable and broadcast channels).

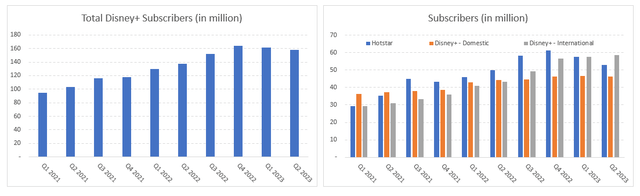

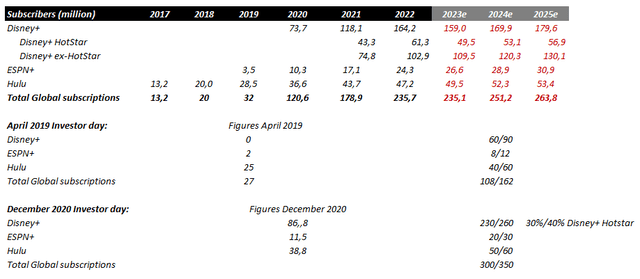

DTC is considered as the future of entertainment, slowly replacing linear TV. Disney entered the streaming business with the launch of Disney+ in November 2019. Disney wants to reduce its reliance on cable providers and movie theatres (which are facing a decline in audience) and deliver media directly to end-consumers. The rollout of Disney+ has been one of the most successful streaming launches ever. Indeed, it took 6 years to Netflix (NFLX) to enrol 74.8 million of subscribers while Disney+ enrolled 73.7 million subscribers during its first year. The group is also expanding its streaming business into the bigger general entertainment market with Hulu (US) and Star (international) as well as sports with ESPN+.

Back in April 2019, Disney released its guidance during its capital market day. The company did expect 60/90 million Disney+ subscribers, 8/12 million EPSN+ subscribers, and 40/60 million Hulu subscribers by 2024. Twenty months later (in December 2020), the company significantly upgraded its guidance as most recent numbers, helped by lockdown restrictions, were already very close of the 2024 guidance. For instance, Disney increased its Disney+ guidance from 60/90 million to 230/260 million subscribers.

(Disney annual report & Capital market day)

Nowadays, the situation is more difficult as the Covid tailwind faded and competition is fiercer. For instance, Disney+ saw three consecutive quarters of subscribers decline in 2023. Most of the cancellations came from HotStar after Disney lost streaming rights to Indian Premier League cricket matches while the US business barely grew due to price increases (the company announced another round of price increases during its Q3 results).

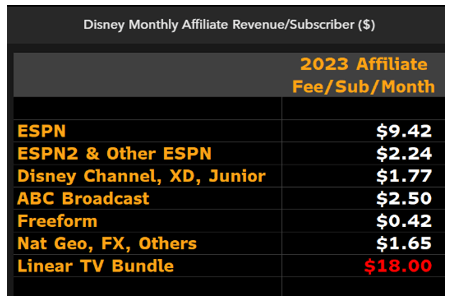

The transition towards a DTC model, if successful, will not be easy. Indeed, this transition requires to give up highly profitable revenue streams such as affiliate fees and advertising revenue. For instance, Disney gets about $ 18 affiliate fees per subscriber a month and an additional $ >5 of advertising revenue across its portfolio of TV networks, which is significantly more than the price of a streaming subscription such as Disney+. Disney+ subscription price is currently at $10.99 (will increase to $ 13.99 in September 2023) and generates an ARPU (excluding HotStar) of $6.58. The ESPN suite is the largest contributor to affiliate fees with almost $ 12 (does not include any advertising revenue) while the ARPU for ESPN+ (which includes advertising revenue) is around $5.50.

(S&P Global Intelligence – Kagan)

Besides, Disney’s linear networks post a 30% operating margin with $ 28B of revenue while Netflix’s operating margin is around 20% for $ 32B of revenue. The proliferation of streaming services also pushes media companies to produce more content at a time of increasing sports rights and TV content production costs. In addition to increasing content budget, this pressure for creating content may hurt content quality. Disney could be the most at risk given it relies heavily on few franchises (more difficult to create additional content while keeping consumers’ interests). Therefore, streaming companies must deal with higher costs while selling subscriptions at a much lower price than what they get in affiliate fees and advertising revenue. Moreover, streaming services offer the opportunity to easily subscribe/unsubscribe on a monthly basis, which may lead to a high churn rate (especially if content quality deteriorates).

The highly profitable advertising revenue stream will most likely face headwinds in a DTC model because advertising will reach a lower audience. For instance, ABC channels are reaching almost 100% of US television households. Even if Disney+ sells its streaming services to all US television households, only a portion of them ( 65%/70% nowadays) will opt for ad-supported streaming services, so reducing the total audience. At the moment, Disney+ serves 46 million subscribers in North America (including US and Canada), which is significantly less than the 124 million television households in the US. Finally, the number of ads displayed through streaming videos will most likely be lower than what is broadcasted on linear TV in order to keep subscribers engaged on the platform.

A Difficult Transition is Underway

Having retired in 2020 (after being CEO since 2005), Bob Iger is now back at the helm of the company. He aims to transition the business towards the DTC business and improve the company’s profitability, especially the loss-making streaming business. He announced a $5.5 billion cost-cutting program in which $3 billion is related to content (excluding sports). In addition, he has suggested that the linear networks business ex-ESPN (ABC broadcast and cable networks such as FX, Freeform, and National Geographic) is non-core, thus possibly up for sale. However, selling these assets at an attractive valuation will be difficult given only a few buyers could be interested in acquiring these assets.

According to Bloomberg Intelligence, Disney could get $ 19/23 billion in proceed if it gets rid of the assets. However, most of the proceed will most likely be used to purchase Comcast’s 33% minority stake in Hulu. The agreement set up a $ 27.5 billion floor valuation, which implies a minimum payment of $ 9.1 billion. However, negotiations will most likely yield a higher price. Per Bloomberg Intelligence, Disney would have to pay Comcast at least $12 billion. The $9 billion difference, accounting for roughly 5% of the current market cap, will most likely be used to pursue deals/acquisitions (given the track record of the CEO) or to strengthen the DTC business. Indeed, even though these assets are facing structural headwinds, they are still a cash cow for Disney and enable the company to invest in its loss-making DTC business. Without them, it would be more difficult to compete with giants such as Netflix or Amazon. If the company decides to retain these assets (or does not find a buyer), the improvement in the DTC business will most likely be insufficient to offset the deterioration in the high-margin traditional media business over time.

Valuation

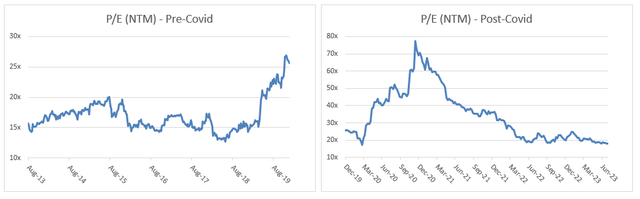

The company used to trade between 15x-20x EPS. The valuation expansion around 25x was related to the successful launch of Disney+. Then, the Covid spread out, leading to a collapse in EPS expectations and a surge in the P/E ratio. The stock is currently trading around 18x and <1% FCF yield, which does not seem very attractive unless to be very optimistic about the business transition (thus, about a strong EPS growth acceleration). Indeed, bulls will point out that Netflix posted a 13% EBIT margin in 2019 while its business had a similar scale to Disney+ (roughly USD 20B revenue) whereas Disney reports operating losses (operating margin of -20% in 2022). Therefore, a quick improvement in the profitability of the DTC business combined with a slow deterioration in linear TV could lead to such EPS growth acceleration.

Conclusion

Disney is a 100-year-old company that has been through several challenging periods and was still able to thrive over time. However, the business is now facing a major and complex business transition, which the company may or may not overcome with success. We believe that it would be difficult at best (if not impossible) to offset the declining traditional media business (accounting for >40% of sales and ~70% of operating income) with the improvement of the DTC business. In addition, even if Disney’s turnaround is successful, we are still not huge fan of the streaming business because it requires the constant creation of a huge amount of TV content, which, in our view, does not bode well for Disney given its reliance on a few key franchises. As a result, we prefer to remain on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.