Summary:

- Roku reported double-digit growth in active accounts and revenues for Q2, but also a decline in average revenue per user.

- The decline in ARPU raises concerns about the company’s monetization potential and profitability target.

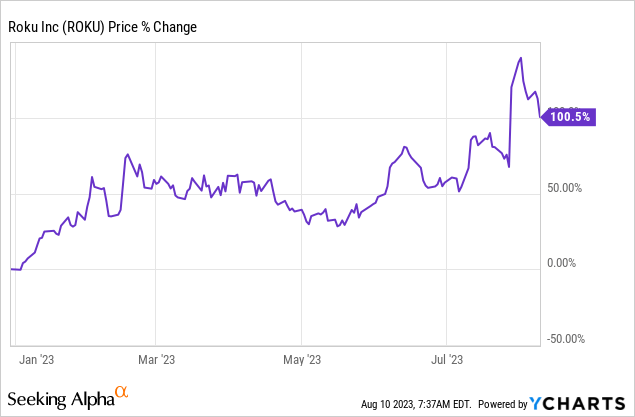

- Roku’s shares have more than doubled in value this year and now have an unattractive risk/reward.

Justin Sullivan

Although Roku (NASDAQ:ROKU) managed to deliver double-digit active account and top line growth in the second fiscal quarter, the streaming company unfortunately also reported a high single-digit decline in its average revenue per user, indicating mounting monetization pressures. While the streaming platform managed to still add a considerable number of new users to its platform in Q2’23, the second consecutive decline in ARPU (on a Y/Y basis) is a concern for me and has caused me to sell into the post-earning strength. Given the strong increase in pricing after the streaming company presented its second-quarter earnings card, I believe investors may want to at least consider taking profits!

Reasons for rating change

I am changing my rating on streaming company Roku due to the firm’s second consecutive decline in the important average revenue per user figure. In my work “Roku: Attractively Priced Growth Stock”, I mentioned Roku’s tailwind drivers such as a declining Pay T.V. share, account growth, strong engagement and the company’s low valuation based off of revenues as reasons to buy ROKU. However, given the massive increase in valuation after earnings, I believe the risk profile has deteriorated here.

Roku beats earnings, but investors should be concerned about declining ARPU

Roku generated better than expected revenues/earnings for its second fiscal quarter, causing shares of the streaming company to soar immediately after earnings. The streaming firm reported revenues of $847.2M which beat consensus expectations as well as Roku’s own guidance of $770M in Q2 revenues. Roku also beat EPS expectations by a large margin.

Roku generated 11% top line and 16% active account growth in the second fiscal quarter and ended Q2’23 with 73.5M users on its platform. Compared to the previous quarter, Roku added 1.9M new accounts, in large part because of the success of Roku’s TV licensing program.

On the engagement level, the trend also remained widely in favor of Roku which saw 25.1B hours streamed on its platform in the second-quarter, showing 21% year over year growth. Unfortunately, not everything was sunshine when it came to the firm’s earnings release: Roku saw its second straight Y/Y decline in its average revenue per user metric in the second-quarter, raising concerns about monetization and Roku’s ability to achieve adjusted EBITDA profitability in FY 2024. Roku’s Q2’23 average revenue per user declined 7% year over year to $40.67, indicating that the streaming company is having a harder time monetizing existing customers.

| Actual Results | Q2’23 | Q1’23 | Q4’22 | Q3’22 | Q2’22 | Growth Y/Y |

| Active Accounts (millions) | 73.5 | 71.6 | 70.0 | 65.4 | 63.1 | 16% |

| Streaming Hours (billions) | 25.1 | 25.1 | 23.9 | 21.9 | 20.7 | 21% |

| Average Revenue Per User/ARPU ($) | $40.67 | $40.67 | $41.68 | $44.01 | $43.81 | -7% |

(Source: Author)

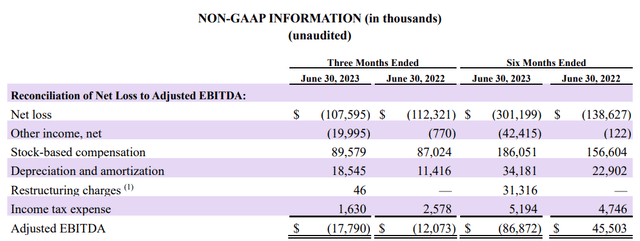

Road to EBITDA profitability and growing risks

Roku generated an adjusted EBITDA loss of $17.8M in the second-quarter which narrowed from a first-quarter loss of $69.1M. Roku confirmed that it is working towards achieving positive adjusted EBITDA in FY 2024, a target that I now believe might be more challenging to achieve… especially if Roku were to see continuing weakness in terms of customer monetization in the coming quarters. According to Roku’s Q3’23 forecast, the streaming firm expects a $50M EBITDA loss next quarter.

Roku’s valuation, unattractive risk/reward

Roku’s shares have soared after the streaming company presented its second-quarter earnings card at the end of July. The 30% post-earnings surge pushed Roku’s year-to-date return way past 100%… which was a good enough reason for me to sell my shares at the beginning of the week.

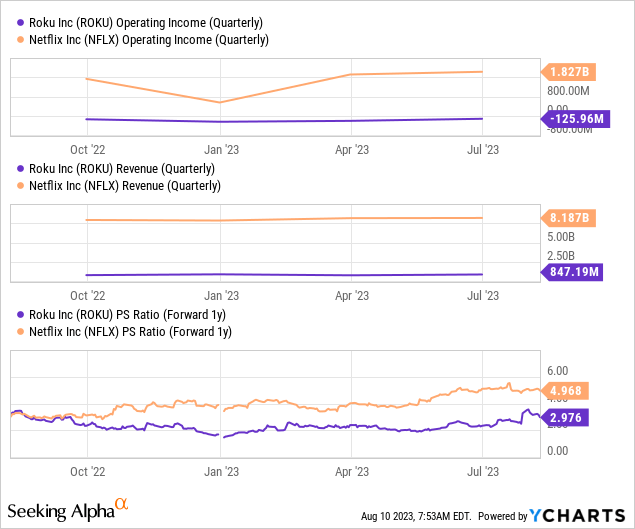

Given the strong share price performance of Roku this year, the firm’s potential in the streaming market is now rather expensive, given the context of a declining ARPU: Roku is valued at 3.0X FY 2024 revenues compared to a price-to-revenue ratio of 5.0X for Netflix. While I believe that Netflix also has its challenges and that the valuation is high, Netflix is profitable on a net income and free cash flow basis while Roku is still generating a ton of operating losses.

Risks with Roku

After reporting the second consecutive quarter of declining average revenue per user, there is a growing risk that the streaming company’s monetization potential is weakening. In the worst case, this could translate to Roku abandoning its goal of achieving EBITDA profitability in FY 2024. A second risk that I see with the streaming firm relates to its revenue growth potential: with increasing competition in the streaming market, Roku’s top line growth is likely to remain pressured going forward.

Closing thoughts

Roku submitted a mixed earnings sheet for a second-quarter that included healthy account growth and streaming engagement, but the company once again fell short in the ARPU department. The decline in average revenue per user is concerning to me as it could put the company’s profitability target in jeopardy next year. Most importantly, because of the drastic increase in Roku’s valuation after submission of the Q2 earnings card, I believe the valuation and the risk profile are no longer good enough reasons to buy into the streaming company at this point!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.