Summary:

- Tesla, Inc. has a strong net cash position and generates robust free cash flow, making it a potential winner in the stock market.

- Stocks with strong net cash positions and robust free cash flow have outperformed dividend-paying stocks in recent years.

- Tesla’s existing financial profile and potential growth, including the upcoming Cybertruck, make its current market capitalization reasonable.

jetcityimage

By Brian Nelson, CFA.

A company’s intrinsic value is a function of its net cash on the balance sheet and future enterprise free cash flows. Changes in expectations of future enterprise free cash flows result in part in changes in the price of the stock, and become a key determinant of total returns. In the event expectations of future enterprise free cash flows increase, the stock price should advance. In the event expectations of future enterprise free cash flows decrease, the stock price should fall. In addition to expectations of future enterprise free cash flows, net cash on the balance sheet also helps to form the foundation of the cash-based sources of intrinsic value, while providing the company with significant option value to grow its business during difficult times.

For those not familiar with financial statements, the past couple years with respect to the Tesla, Inc. (NASDAQ:TSLA) story may have been very confusing. For one, there were a large number of onlookers and perhaps short sellers that were questioning Tesla’s long-term potential, and some were even suggesting the firm may declare bankruptcy. Do you remember the hashtag on X (formerly Twitter) #TSLAQ? The Q at the end of the ticker symbol represents a company that is trading over-the-counter and is operating under bankruptcy protection. Many thought Tesla was heading for bankruptcy.

Certainly, there were some exogenous events related to Tesla concerning potential contingent liabilities, but to suggest that the firm may declare bankruptcy is rather a stretch. There seemed to be a large cohort of market observers that may have believed this, however.

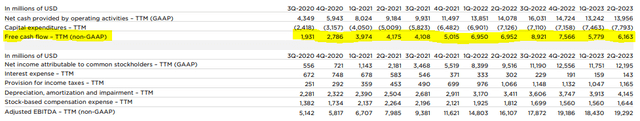

Tesla is generating billions and billions of dollars in free cash flow. (Tesla)

When Tesla reported its second quarter 2023 results July 19, the firm showed that it ended June 30, 2023, with $23.1 billion in cash and just $2.3 billion in debt–good for a material net cash position. Net cash is an add back to the present value of expectations of future enterprise free cash flows in determining a company’s intrinsic value. For the trailing twelve months ended June 30, 2023, as well, Tesla hauled in an impressive ~$6.2 billion in free cash flow. Both of these measures are solid, and while free cash flow generation has slowed a bit in recent quarters, for the second quarter of 2023, it was still up more than 60%. Tesla fits the bill of a net-cash-rich, free-cash-flow generating, secular-growth powerhouse, a far cry from what one might have thought given the sentiment on the name over the years.

For us, we’re huge fans of stocks that have strong net cash positions and are generating large sums of free cash flow. Net cash generally skews a company’s fair value distribution to the right (higher) because it generally reduces a firm’s capital-market dependence (i.e., its need for new capital via the debt or equity markets), as it reduces the probability of a credit event and bankruptcy risk. Robust free cash flow generation and the prospect of ever-higher expectations of future free cash flow is a key component of changes in the stock price. For companies that have net cash positions and an elevated prospect of receiving ever-higher expectations of future free cash flow by the market, their stocks, in our view, have the financial foundation to become strong winners.

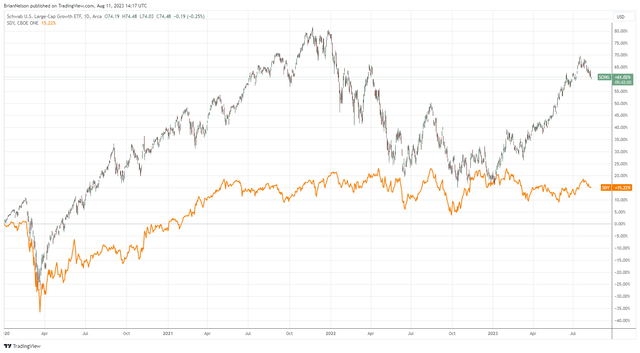

Stocks in the category of large cap growth that generally have strong net cash positions and generate robust free cash flows have outperformed those that have long track records of raising their dividends. (Trading View)

A look at performance since the beginning of 2020, the year of the onset of the COVID-19 pandemic, or at least its major impact on the market, indicates that stocks that generally have had strong net cash positions while generating robust free cash flows have done extremely well, even relative to a grouping of stocks that have multi-decade track records of raising their dividends. Though the above graph only looks at price changes (and does not take into account the dividends within both ETFs), it speaks to the underlying strength of stocks that have strong cash-based of intrinsic value: net cash on the balance sheet and future expectations of enterprise free cash flows. We would expect this trend to continue as most dividend payers with long track records have large net debt positions and hefty future expected dividend liabilities, both of which weigh on their capital appreciation potential.

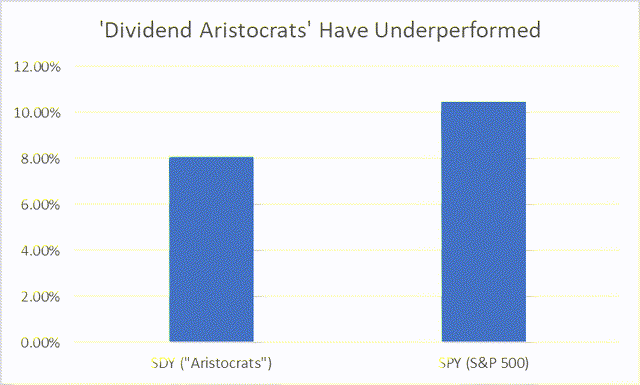

A myopic focus on dividend payments may be steering many investors away from some of the best-performing stocks on the market. To some degree, we think it has to do with the concept of the free dividends fallacy. The free dividends fallacy explains that the stock price is not independent of the dividend payment. When a stock pays a dividend, its share price is reduced by the amount of the dividend payment on the ex-dividend date. For example, if a stock priced at $10 pays a $1 in dividends, one doesn’t have a stock that is still $10 and a $1 in dividends. One instead has a stock that is now $9 while shareholders have the $1 in dividends. Chicago Booth’s Samuel Hartzmark explains this dynamic in a video here. This myopic focus on dividend-paying stocks has cost investors roughly 2 percentage points per year over the past decade (via the graph below).

Return after Taxes on Distributions and Sale of Fund Shares (10-year) (State Street)

Now back to Tesla. The big challenge in valuing Tesla’s shares is assessing the company’s long-term outlook–its long-term future enterprise free cash flow stream. One way of thinking about Tesla’s valuation, however, is backing into its current market capitalization (~$776 billion as of the trading session August 11) with what it would take in terms of normalized enterprise free cash flow. For a company with meaningful secular growth prospects, strong existing net cash on the books (on the balance sheet), and considerable future free-cash-flow generating capacity, perhaps a discount rate between 7%-9% may be reasonable. The discount rate is a function of the risk-free-rate such as the 10-year Treasury rate and credit (debt) spread as well as an estimate of the firm’s cost of equity (its required return by most investors).

Using a growing perpetuity with a 3% growth rate assumption for free cash flow, Tesla would eventually need to haul in ~$31-$47 billion in annual free cash flow in the decades ahead to justify its current price. For the twelve months ended in the third quarter of 2022, its peak trailing twelve-month free cash flow generation, Tesla hauled in $8.9 billion in free cash flow. The question then becomes whether over the course of Tesla’s lifetime, will the electric-vehicle maker be able to 3x-5x its free cash flow? Well, it’s impossible to know for sure, but it seems possible to us, especially as Tesla expands its product lineup (i.e., Cybertruck, etc.).

It’s sometimes easy to forget, too, that Tesla was still burning through operating cash flow as recently as 2017, and now it has become a cash-generating machine. Growth may be phenomenal in the years ahead, and if Twitter is an example, Tesla CEO Elon Musk knows how to run an efficient operation.

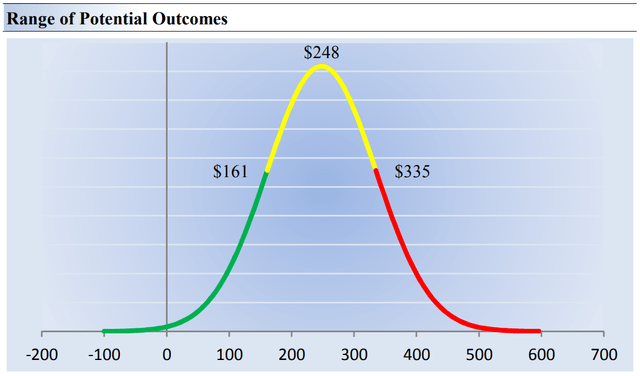

Our fair value estimate of $248 per share is about in-line with where share of Tesla are trading. (Valuentum)

What we’re trying to explain is that Tesla’s existing market capitalization is not as far-fetched as many may believe given the company’s existing financial position and potential growth that may be ahead of it. The Cybertruck is still in the pipeline, and it’s difficult to know just how much the consumer will love the new product, but it’s fair to say that as consumers become more and more comfortable with electric-vehicles, adoption of the Cybertruck may be considerable. We love the look of the Cybertruck, and we posit that many other observers do, too. Pick-up trucks have traditionally been dominated by the Big 3, but the Cybertruck has all the potential to disrupt them, much like Tesla’s electric-vehicles have disrupted the sedan market. Twenty years ago, very few people could have predicted that Ford (F) would no longer sell sedans, but here we are today, and that’s the case.

All told, not only does Tesla’s existing financial profile look great, but the Cybertruck provides one of many future potential catalysts for the market to continue to build in ever-increasing expectations of future enterprise free cash flows, helping to increase the probability of future share-price advances. Tesla is a key component in one of our favorite areas, the stylistic area of large cap growth, and the stock could make a lot of sense in the context of a widely diversified portfolio seeking long-term capital appreciation potential.

Unlike what one may have thought without looking at its financial statements, Tesla’s valuation is not absurd, even as it may be fair to say that, as expectations of its future enterprise free cash flows ebb and flow, continued rampant volatility in its shares should be expected. If Tesla may not make the cut for consideration, in your opinion, please read about five more of our favorite stocks for long-term capital appreciation in this article.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCHG, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.