Summary:

- The last couple of years were painful for PayPal investors due to a myriad of disappointing earnings and key metrics downgrades over multiple quarters.

- The stock now trades almost five times cheaper than all-time highs, while the business is still growing, and the management works hard to improve profitability.

- My valuation analysis suggests the stock is massively undervalued.

Justin Sullivan/Getty Images News

Investment Thesis

PayPal (NASDAQ:PYPL) stock experienced hard times in the last two years. Today’s share price is about five times lower than the all-time highs of summer 2021. This was due to many disappointing earnings and downgrades over several quarters. But the business still demonstrates decent revenue growth and stellar profitability. The balance sheet is in excellent shape, and the stock is significantly undervalued with massive upside potential. I think that a recent stock price plunge after the latest quarterly earnings release provides investors with an excellent investment opportunity, and I assign the stock a “Strong Buy” rating.

Company Information

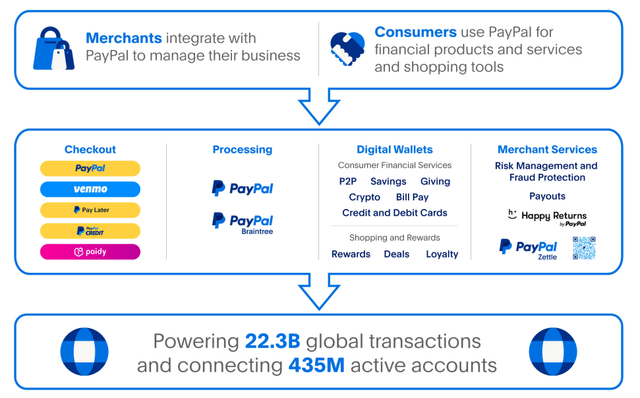

PayPal is a global technology platform company that provides digital and mobile payments on behalf of consumers and merchants.

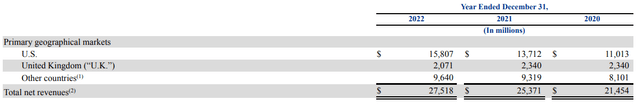

The company’s fiscal year ends on December 31 with a sole operating and reportable segment. About 92% of total PayPal’s sales are generated from transaction revenues. According to the latest 10-K report, about 43% of FY 2022 revenue was generated outside the U.S.

Financials

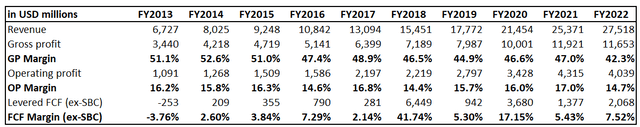

The company’s financial performance over the past decade was solid. Revenue compounded at an impressive 15% CAGR. Despite robust revenue growth, the gross and operating margins stagnated and narrowed despite the business scaling up. On the other hand, the free cash flow (FCF) margin ex-stock-based compensation (ex-SBC) has improved significantly.

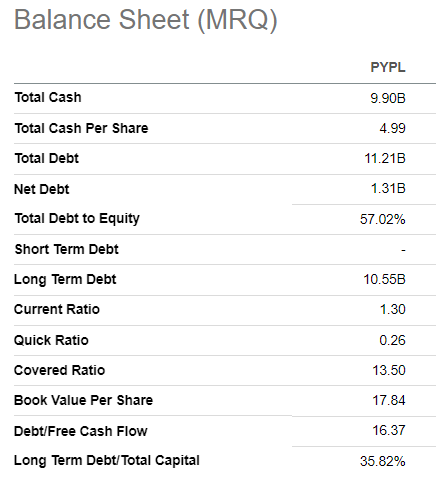

PayPal’s balance sheet is solid, with about $10 billion of cash as of the latest reporting date. The capital structure looks prudent, with a below 60% leverage ratio and a relatively high covered ratio. Short-term liquidity metrics also look healthy. FCF is reinvested in growth and share repurchases. Over the last twelve months, the company repurchased more than $5 billion in shares. I do not expect the company to pay dividends in the foreseeable future.

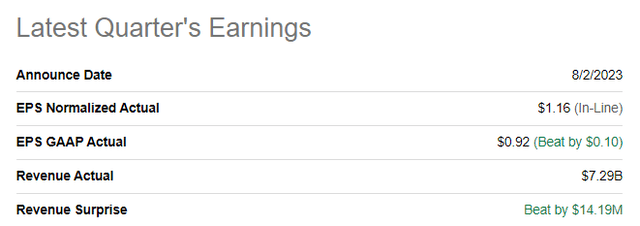

Seeking Alpha

The latest quarterly earnings were released on August 2, when the company topped consensus estimates on revenue and the bottom line. Revenue demonstrated a solid 7% YoY growth, and the EPS expanded from $0.93 to $1.16. Despite solid performance across key headline financial metrics, the stock price declined dramatically after the latest earnings release. A few reasons caused investors’ disappointment. One is the deteriorated loan portfolio due to more strict underwriting standards. Another reason is the decline in active accounts from 433 to 431 million. The third reason is the consensus estimates miss from the operating margin perspective, though the metric expanded YoY. I consider these three points as minor issues and prefer to focus on the improving trend for both revenue and the operating margin as well as the bottom line.

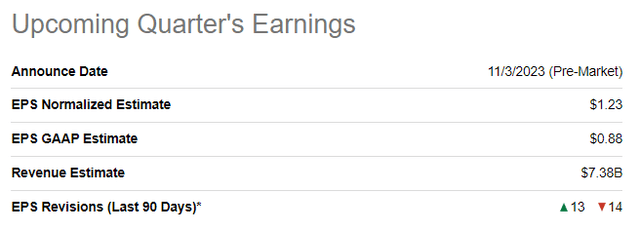

The upcoming quarter’s earnings are scheduled on November 3. Quarterly revenue is expected by consensus at $7.38, which is a 7.7% YoY growth. The adjusted EPS is expected to follow the top line and expand from $1.08 to $1.23. I like this steady improvement in financial performance, which we saw in the latest quarter and are expected to see in the upcoming quarter.

During the latest earnings call, the management reaffirmed its full-year guidance, which is a solid indicator for me, given the challenging environment where many companies are downgrading their estimates. I also like that the management expects a notable 20% non-GAAP EPS growth. Efficiency initiatives implemented by the team will achieve this, and they are not done yet. According to Daniel Schulman, the CEO, more than 200 improvement experiments are planned to be tested in Q3. The company also implements AI in its internal processes to streamline and increase efficiency. I am very optimistic about the management’s initiatives to boost profitability and create value for shareholders.

As an investor, it is crucial for me to see the management’s commitment to innovate and implement changes to streamline internal processes. Because over the long term, the most efficient players in the market will be able to sustain a notable growth pace. Secular trends are favorable for companies like PayPal. According to statista.com, the global digital payments industry is projected to compound at about 12% yearly. The secular shift to consuming more via e-commerce will be a significant tailwind for the industry. Given PayPal’s strong brand, the company can generate superior profit margins and reinvest them in innovation. A vast customer base, though slightly deteriorating, also gives PYPL a solid competitive advantage. All in all, PayPal is firmly positioned to absorb the industry growth.

Valuation

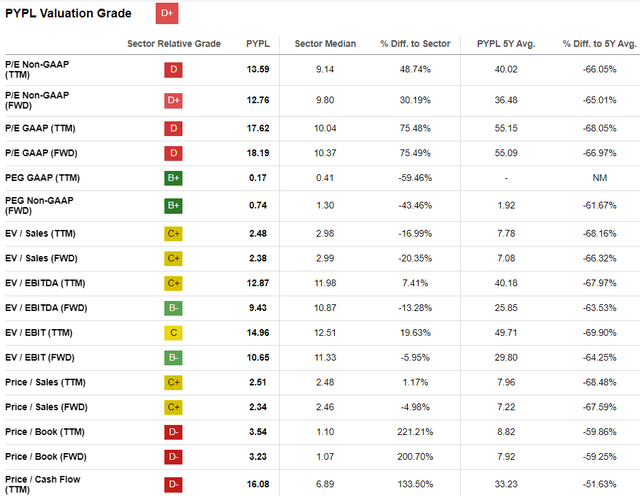

The stock significantly underperformed the broad market, with a 17% year-to-date price decline. PYPL’s share price is now about five times lower than its all-time highs in the summer of 2021. Since then, the stock has experienced a sharp bearish trend with rarely sustainable rallies. It is also important to mention that the stock now trades almost two times lower than the pre-pandemic level of February 2020. Seeking Alpha Quant assigns the stock a low “D+” valuation grade due to substantially higher multiples than the sector median. On the other hand, current valuation ratios are substantially lower than historical averages. For a highly profitable company compared to peers, I would better compare the current and historical multiples. That said, from the perspective of the valuation ratios, PYPL looks massively undervalued to me.

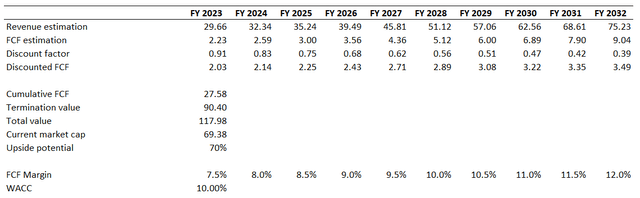

Now, let me continue with simulating the discounted cash flow (DCF) approach. I use a 10% WACC for discounting future FCFs. I have consensus estimates for revenue available for the next decade projecting an 11% revenue CAGR, which looks fair to me. I use the last fiscal year’s FCF margin as a base and expect it to expand by 50 basis points yearly. I believe that the assumptions I use for my simulation are conservative.

The stock is massively undervalued, even under very conservative assumptions. The fair value of the business suggested by my DCF simulation is far above a hundred billion, meaning there is vast upside potential for the stock price to appreciate.

Risks to Consider

While the digital payments industry benefits from secular shifts to e-commerce and other channels of use for digital payments, it makes the industry more attractive to more players. That said, nowadays, PayPal faces much more intense competition than it did a decade ago. The competition is fierce, and competitors are massive, including Apple (AAPL), Visa (V), Mastercard (MA), Google (GOOG), and Meta (META). The intensifying competition could erode PayPal’s market share and adversely affect its growth potential. It is crucial for PYPL to be able to differentiate itself from competitors and maintain an appealing value proposition for customers.

Another substantial risk is the ever-evolving payments landscape, with customers’ preferences constantly shifting. PayPal shall be proactive and promptly adapt to changing environment to attract and retain customers. Being in line with technological advancements is also crucial. Many years ago, PayPal became a disruptor to the payments industry, and there is a risk that the company might be adversely affected by new disruptive advancements that will outpace the ability of PayPal to adapt.

Bottom Line

To conclude, PYPL stock is a “Strong Buy”. It is rare to see such a profitable business with consistently growing revenue and a clean balance sheet with massive upside potential. I think that the share price plunge after the latest earnings release was a massive overreaction, providing a strong buying opportunity for investors seeking high-quality business traded with deep discounts. The competition in the industry is intensifying, but the overall pie is poised to continue long-term growth as secular tailwinds will contribute. The upside potential far outweighs all risks and uncertainties.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.