Summary:

- On August 1, Pfizer released its financial report for the second quarter of 2023, which showed mixed results.

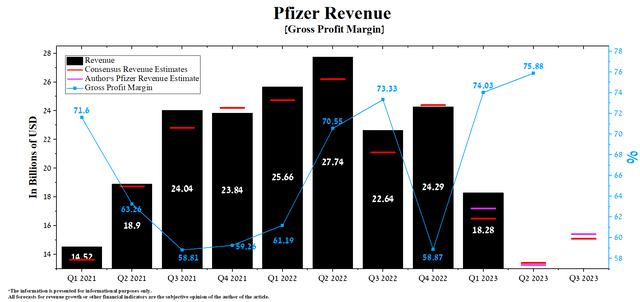

- Pfizer’s revenue for the second quarter of 2023 was $18.28 billion, down 24.7% from the previous quarter and 34.1% from the second quarter of 2022.

- However, we believe that sales of Pfizer’s COVID-19 products bottomed out in Q2 and could now turn higher due to the rapid spread of a new variant of COVID-19 called EG.5.1.

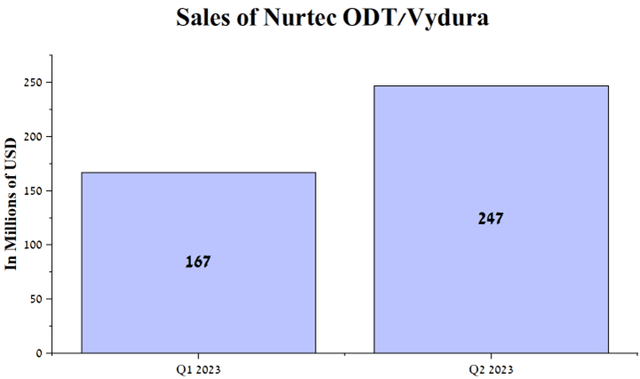

- Nurtec ODT/Vydura sales were $247 million in Q2 2023, up 47.9% QoQ.

- We continue our analytics coverage of Pfizer with an “outperform” rating for the next 12 months.

Rpsycho/E+ via Getty Images

On August 1, Pfizer (NYSE:PFE) released its financial report for the second quarter of 2023, which, despite its mixed results, showed that demand for innovative medicines such as Lorbrena, Nurtec ODT/Vydura, and Ultomiris is growing at a faster rate than many on Wall Street expected.

Pfizer’s revenue was about $12.73 billion, $0.52 billion below our expectations. In contrast, Q2 Non-GAAP EPS was $0.67 per share, $0.05 more than we had forecasted. This was mainly due to higher combined sales of Xeljanz and Vyndaqel of $1.25 billion, up 24.4% QoQ. On the other hand, the share price of Pfizer reached its lowest point in 2023 as a result of a significant decrease in sales of Paxlovid, a COVID-19 treatment that was one of the company’s key revenue generators in 2022.

TradingView

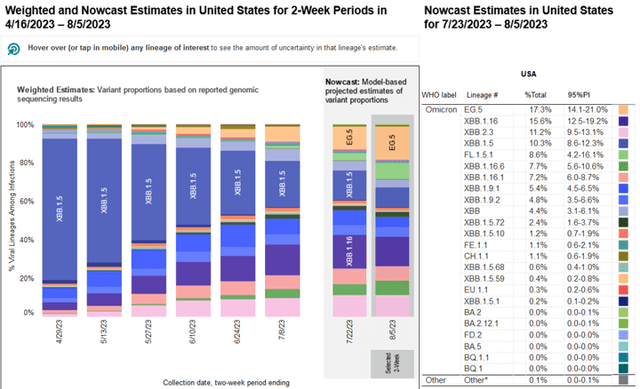

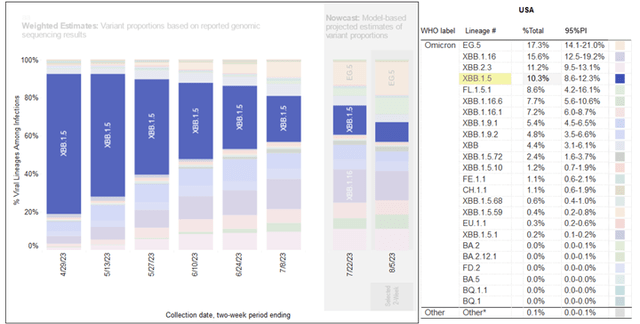

Sales of the company’s COVID-19 products bottomed out in Q2 2023 due to the rapid spread of a new sub-variant of Omicron called EG.5. EG.5 is an exceptionally rapidly spreading variant with numerous mutations in its spike protein relative to previous variants and has already been found in over 50 countries.

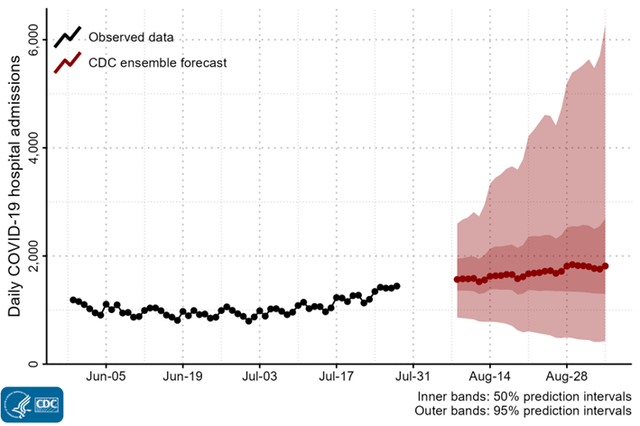

According to the Centers for Disease Control and Prevention, it accounts for 17.3% of new COVID-19 cases as of August 5. At the same time, the number of hospitalizations in the United States due to coronavirus continued to grow and amounted to 9,056, which is 12.5% more than the previous week.

We continue our analytics coverage of Pfizer with an “outperform” rating for the next 12 months.

Pfizer’s Q2 2023 financial results and outlook for the second half of 2023

Pfizer’s revenue for the second quarter of 2023 was $18.28 billion, down 24.7% from the previous quarter and 34.1% from the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

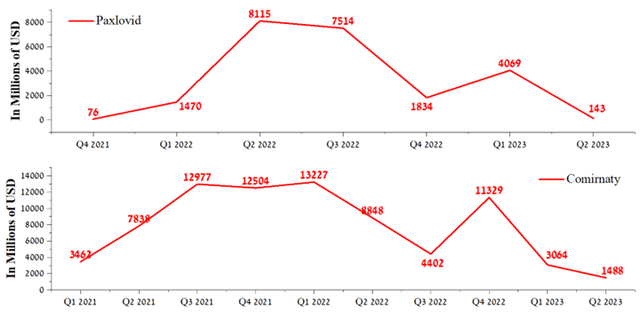

The year-on-year decline in Pfizer’s revenue was mainly due to a sharp drop in sales of Paxlovid and Comirnaty, widely used from 2021 to 2022 to fight COVID-19. However, demand for the COVID-19 vaccine continues to decline in most countries. This is due to a decrease in public interest in vaccination after the cessation of funding for advertising and motivational programs from governments. Additionally, many people are reluctant to get vaccinated due to concerns about the safety and efficacy of vaccines against newer virus variants.

Comirnaty sales were $1,488 million in the three months ended July 2, down 83.2% year-over-year. In addition, one of the risks to the company’s financial position is the expiration of government contracts for the supply of Comirnaty in the second half of 2023. As a result, Pfizer and its partner BioNTech (BNTX) will become more vulnerable to the public desire to be vaccinated ahead of the new respiratory season, when viral activity is expected to increase worldwide.

The worst sales dynamics were shown by Paxlovid, which became the almost unanimous leader in the global COVID-19 therapeutics market after the withdrawal of many monoclonal antibodies from the market. Despite this, its sales were $143 million, down $7.97 billion from the previous year.

Author’s elaboration, based on quarterly securities reports

However, we believe that sales of Pfizer’s COVID-19 products have bottomed out due to the rapid spread of a new variant of COVID-19 called EG.5. On August 9, 2023, the World Health Organization classified this strain of coronavirus circulating in the US, European Union, and China as a “variant of interest.”

At the same time, according to the CDC, on EG.5 variant accounted for about 17.3% of COVID-19 infections, up 5.4% from two weeks ago.

Centers for Disease Control and Prevention

According to our estimates, the number of new cases will continue to increase because the updated boosters produced by Pfizer and Moderna were mainly intended only against the XBB.1.5 subvariant, whose share of the Covid-19 pie continues to decline at a high rate.

Centers for Disease Control and Prevention

Moreover, according to the Centers for Disease Control and Prevention, an increase in the number of hospitalizations due to COVID-19 is expected in the coming weeks. This could lead to increased demand for Paxlovid, as it remains effective in the fight against coronavirus despite its rapid mutation.

Centers for Disease Control and Prevention

At the same time, Pfizer’s full-year 2023 financial guidance includes Paxlovid sales of $8 billion and Comirnaty sales of $13.5 billion.

Year-to-date we have booked slightly over 40% of the $21.5 billion full-year revenue forecast for both Comirnaty and Paxlovid with the important fall vaccination and respiratory infection season ahead of us.

However, according to our model, total sales of COVID-19 products will range from $21.8 billion to $22.5 billion.

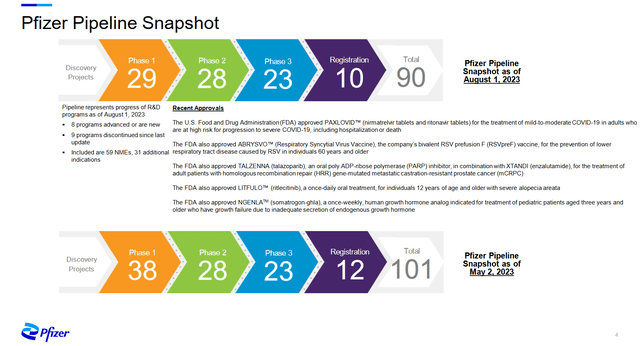

2023 is a year of transformation for Pfizer. Since the beginning of this year, the FDA and EMA have approved six of the company’s drugs and a vaccine against respiratory syncytial virus. Some of these medicines are well ahead of competitors in terms of efficiency, allowing Pfizer to minimize the impact of declining sales of COVID-19 products on its financial position and return to the top of the rapidly developing pharmaceutical industry.

Pfizer Pipeline

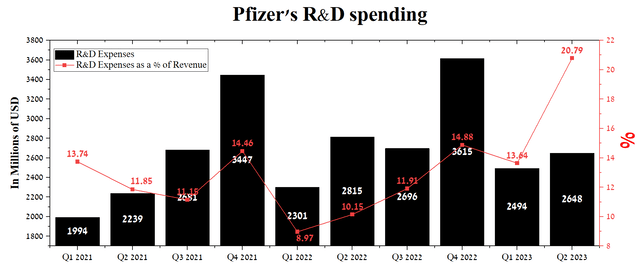

At the same time, Pfizer’s R&D expenses amounted to $2.65 billion for the second quarter of 2023, or 20.79% of total revenue, an extremely high value in the healthcare sector.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, Pfizer’s revenue for Q3 2023 is expected to be $12.43-$18.32 billion, up 12.5% from analysts’ expectations for Q2 2023. At the same time, following our model, the company’s total revenue will be slightly higher than the median value of this range and will amount to $15.4 billion.

This is mainly due to higher sales of Nurtec ODT/Vydura (rimegepant) due to its competitive advantages, reflected in the rapid increase in its share in the global migraine drugs market. The company’s drug sales were $247 million in Q2 2023, up 47.9% quarter-on-quarter.

Author’s elaboration, based on quarterly securities reports

Pfizer’s earnings per share (EPS) for the second quarter of 2023 was $0.67, down 45.5% from the previous quarter. Despite its growth, the company’s management left the guidance for 2023 unchanged.

We are narrowing our expectations for revenues to between $67 billion to $70 billion and maintaining guidance for adjusted diluted earnings per share of $3.25 to $3.45 for the full year.

According to Seeking Alpha, Pfizer’s Q3 EPS is expected to be $0.31-$0.93, up 8.6% from the consensus estimate for Q2 2023. While we believe this is slightly underestimated, our model puts Pfizer’s EPS at $0.67.

Conclusion

On August 1, Pfizer released its second quarter 2023 financial report, which, despite its mixed results, showed that demand for newly FDA-approved medicines is snowballing. At the same time, while sales of COVID-19-related products declined sharply, the company’s 2023 financial guidance for Adjusted diluted EPS remained unchanged.

We believe sales of the company’s COVID-19 products bottomed out in Q2 2023 due to the rapid spread of a novel coronavirus variant known as EG.5.1, with multiple mutations in its spike protein. So, according to the Centers for Disease Control and Prevention, the number of hospitalizations with COVID-19 in the United States reached 9,056, up 12.5% from the previous week.

Moreover, due to the rapid expansion of the company’s portfolio of product candidates, as well as its dividend yield exceeding 4.5%, we believe Pfizer’s current share price represents an attractive risk/reward ratio for long-term investors.

We continue our analytics coverage of Pfizer with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.