Summary:

- Amazon.com, Inc. seems like a much better company today than three months ago despite little change in fundamentals.

- Ads and AWS were the highlights in Q2, but for very different reasons.

- Profitability and cash flow took many by surprise despite being pre-announced.

- Amazon’s management is exhibiting long-term thinking. We explain how.

Kirk Fisher

Introduction

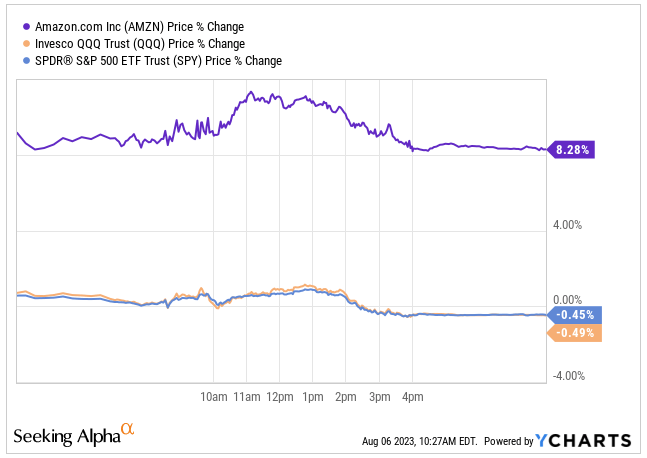

Amazon.com, Inc. (NASDAQ:AMZN) reported its Q2 earnings last week. The numbers looked great, just like last quarter, so the stock surged significantly the following day despite the market’s lousy performance:

YCharts

Recall that the market reacted similarly to Amazon’s earnings last quarter, but the stock declined sharply when management mentioned that the Amazon Web Services (“AWS”) growth rate was trending 500 basis points below Q1. We didn’t get such a specific message on AWS’ growth rate this quarter, but it seems pretty clear the tide has changed and the segment might be reaccelerating. More on this later.

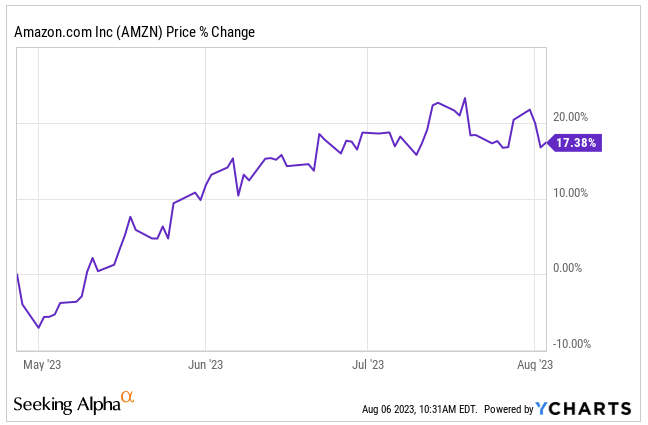

We must also remember that Amazon’s stock had seen a good run since its Q1 earnings release heading into these earnings:

YCharts

Everything that’s happening today at Amazon was already known last quarter. The only difference is the stock price action. Price drives narrative and many investors are not really objective but emotional.

Without further ado, let’s get started with the numbers.

The numbers

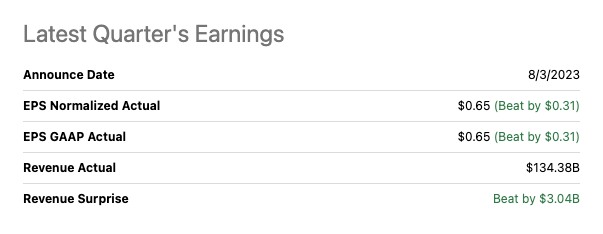

The headline numbers

Amazon significantly beat top and bottom line estimates in Q2. The company beat the top line by 2.3%, but Earnings Per Share (“EPS”) by a whopping 90%:

Seeking Alpha

As many of you might know, Amazon’s bottom line is misleading due to the company’s investment in Rivian (RIVN). However, as we’ll discuss later, profitability was undoubtedly the highlight of the release.

Looking at the different business lines

Amazon’s top line grew 11% year-over-year to $134.4 billion. Just so you get a sense of this scale, Amazon generates revenue of around $62 million every hour.

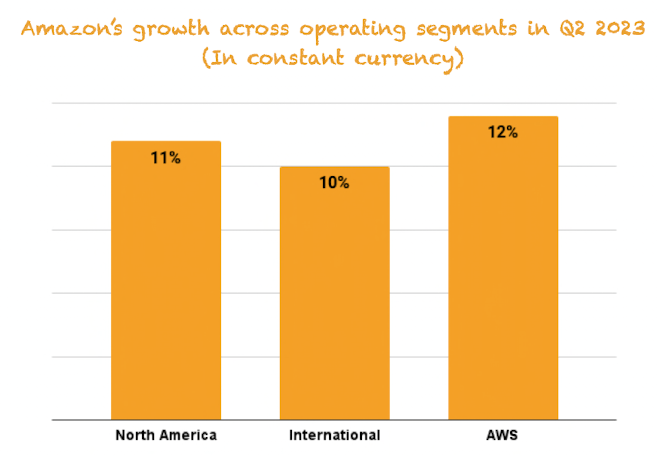

Growth was pretty balanced across the company’s operating segments, with AWS outpacing North America and International but not by much. FX did not impact growth rates this quarter:

Made by Best Anchor Stocks

North America remained resilient, International accelerated slightly, and AWS decelerated from 16% year-over-year growth last quarter. As we’ll see later on, the good news on AWS was that it came above expectations and that management continues to play the long game here. Growth was slower than last quarter, but the forward-looking commentary was very different.

As we always say, despite Amazon reporting across these three operating segments, they don’t give us the most useful information on the company’s operations. The company’s business lines are more important to understand how the business is doing.

Two critical variables for Amazon that underscore its margin expansion potential are product and service revenues. Amazon continued marching firmly on its path to becoming a service-based business. Service revenue (+17% year-over-year) significantly outpaced product revenue this quarter (+4.3 year-over-year). Service revenue made up 56% of Amazon’s sales year to date, a record for the company. This ratio was “just” 43% in 2019, so the shift is happening quite fast:

Made by Best Anchor Stocks

Note that services carry, in general, higher margins and lower risk than product sales, meaning that as Amazon continues to transition to this revenue source, we should see margins improve significantly. The shift makes Amazon a better company.

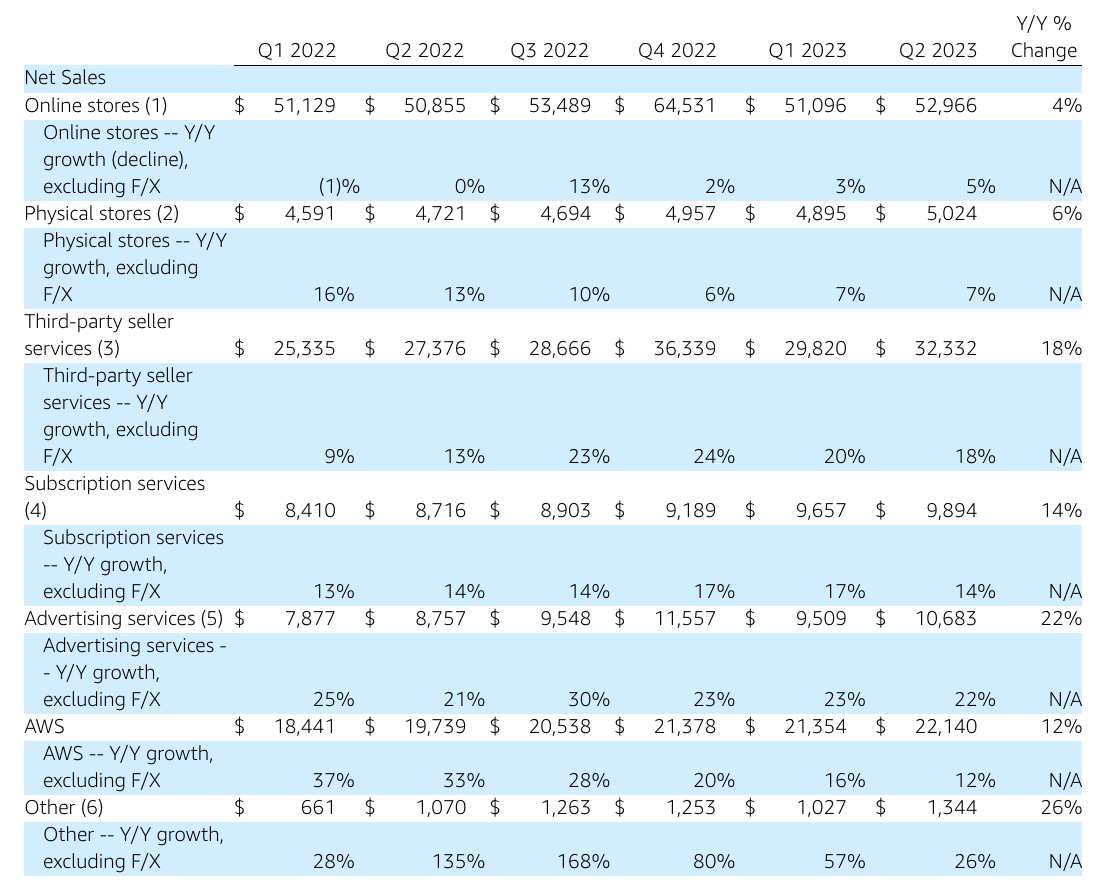

Product and service are going in the right direction, but let’s look at their underlying drivers. Amazon reports revenue (but not operating income) across several segments, all of which you can see below. Product revenue is the sum of the first two lines (online and physical stores), whereas service revenue is made up of the rest:

Amazon’s Earnings Press Release

Let’s go over these individually.

Both online and physical stores grew moderately in Q2. As discussed last quarter, this seems like a conscious decision by management as they shift the company to service. However, we should not be surprised if physical stores reaccelerate in the future. Management claimed last quarter that most retail sales still occur at physical stores and that Amazon needs a bigger presence there. They said something somewhat similar this quarter, but specifically for grocery (emphasis added):

But if you want to be able to serve more customers, which we do, and there are a whole number of reasons for that and customers want it, you have to have a strong physical presence.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call.

Amazon had slowed the expansion of its physical stores, claiming they needed to find the proper store format. They are getting closer to this format:

We have spent a lot of time thinking and rethinking how we want the formats to look. And we’ve just started rolling out some of those new formats, starting in our Chicago stores and then moving to our Southern California stores shortly thereafter.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

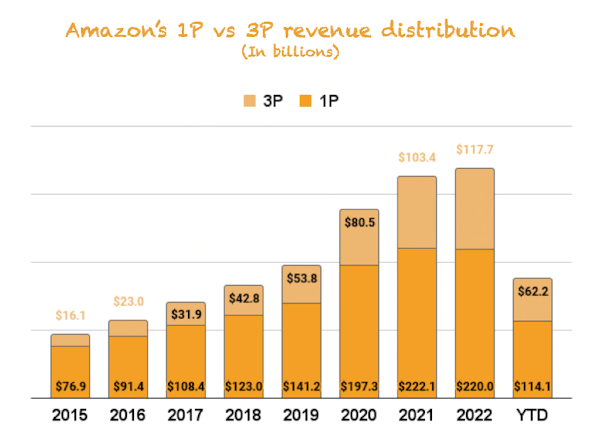

3P seller services decelerated somewhat compared to the prior quarter but grew strongly, at 18% year-over-year. 3P continues to take share of 1P in Amazon’s retail operations, which is not only good for margins but also for regulatory reasons:

Made by Best Anchor Stocks

Note that the graph above shows revenue, not Gross Merchandise Value. GMV for 3P is significantly higher than 1P GMV, but Amazon doesn’t disclose it, probably due to antitrust concerns.

In unit volume, 3P sellers increased to 60% during the quarter, which is the highest ratio the company has ever seen. Considering the company’s new focus, we should expect this uptrend to continue in the coming quarters/years. Amazon is in a clear path to become an enabler of eCommerce transactions rather than a direct seller.

Buy With Prime is yet another growth driver for 3P seller services, although management did not give too much detail on this venture:

Buy with Prime is continuing to show a lot of progress. Merchants in early trials who use Buy with Prime saw their shopper conversion increased by 25% on average, which makes a real difference to their business. Also, merchants who participate in Prime Day activities, in aggregate, experienced a 10x increase in daily Buy with Prime orders during the sales event period versus the month before we announced Prime Day.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

(If you don’t know what Buy With Prime is, remember we wrote a two part series which you can read here and here).

We already know that Amazon is not the most transparent company in the world, so we’ll probably need to wait until Buy With Prime is significant enough before we see it disclosed separately. Management did give, however, information on Amazon Business. This business line is already generating $35 billion in TTM sales, and management believes there’s a credible path to a $100 billion business:

Just on your Amazon Business question, Mark, $35 billion annual run rate for gross sales is pretty strong growth. And if you look at it year-over-year, it continues to be very strong. But I like the way you’re thinking, Mark, and it’s almost like you’re in some of the meetings that we’re in where I asked the very same question. The team is working hard to build a $100 billion-plus business over time.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

We want to caution against thinking that Amazon Business is a completely independent business line because the most likely outcome is that it will cannibalize some of the current marketplace GMV. Consider that many SMBs already bought on Amazon before Amazon Business was launched. Their GMV might simply be moving from one place to the other. Of course, we do think that, in the aggregate, it will have a net positive effect on Amazon’s sales. The bottom line is that 1 plus 1 does not equal 2 here, it might equal 1.5 or 1.75.

Subscription services also decelerated significantly but grew nicely at 14% year-over-year. There’s not much to comment on here, but we wanted to bring an extract of last quarter’s earnings call that portrays what Amazon is trying to do with subscription services. As Amazon provides increasing value, the gap between value and price is getting larger, which screams pricing power:

If you step back and think about a lot of subscription programs, there are a number of them that are $14, $15 a month really for entertainment content, which is more than what Prime is today.

If you think about the value of Prime, which is less than what I just mentioned, where you get the entertainment content on the Prime Video side and you get the shipping benefit, the fast shipping benefit you can’t find elsewhere and you get the music benefit, you get the Prime Gaming benefit and you get the photos benefit and you get the Buy with Prime capability, use your Prime subscription on websites beyond just Amazon and some of the grocery benefits that we provide, and RxPass like we just launched to get a number of medications people take regularly for $5 a month unlimited, that is remarkable value that you just don’t find elsewhere.

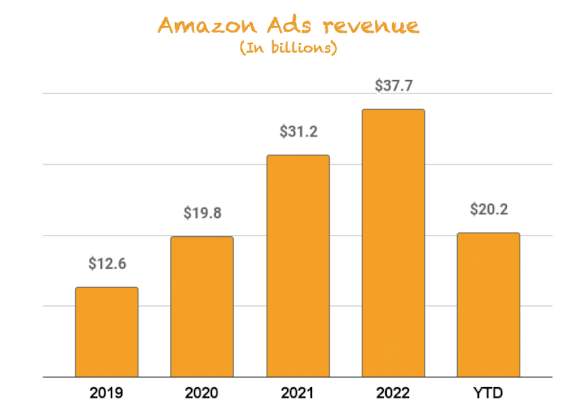

Advertising was, unsurprisingly, the highlight again. Amazon Ads grew 22% year-over-year and have generated $20.2 billion in the first 6 months of the year. For context, this is already a larger amount than the segment made in 2020!

Made by Best Anchor Stocks

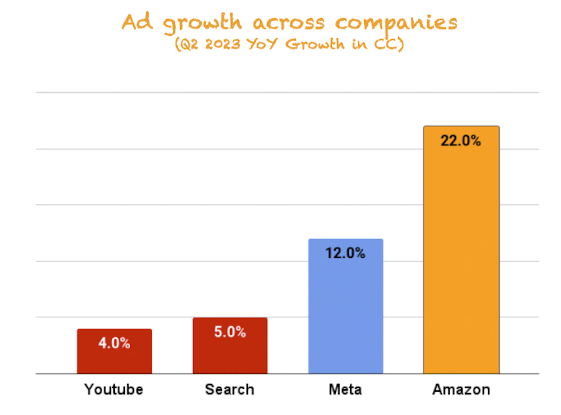

The secret to building such an ad empire has been Amazon’s access to first-party data and the fact that people open Amazon’s app or website with clear intent. When iOS announced its IDFA update, other companies faced a headwind, but Amazon did not because it’s fully in control of its 1P data. This means the segment continued growing significantly above its peers. Now that peers are facing easier comps and have learned how to work with IDFA, the gap is closing, but Amazon Ads is still growing significantly faster:

Made by Best Anchor Stocks

We found it pretty interesting how Amazon is taking this 1P data to its media services now:

We’re also continuing to see strong demand for our advertising services as the team keeps innovating for brands, including the ramp-up for Thursday Night Football with the ability for advertisers to tailor their spots by audience and create interactive experiences for consumers.

Source: Amazon Earnings Press Release (emphasis added).

Whatever Amazon does that can include ads will have the potential to build off the company’s treasure trove of data.

Now let’s look into AWS, which was not a highlight due to its high growth but due to the change in trend. The segment’s growth rate decelerated to 12% year-over-year, which was slightly above the expected 11% growth rate and was followed by quite an upbeat tone by management:

And while customers have continued to optimize during the second quarter, we’ve started seeing more customers shift their focus towards driving innovation and bringing new workloads to the cloud. As a result, we’ve seen AWS’ revenue growth rate stabilize during Q2 where we reported 12% year-over-year growth.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

Recall that Amazon has been working alongside its customers to help them optimize their AWS workflows. It sounds strange, but the company was basically helping customers pay less to retain them over the long term. Of course, this negatively impacted growth, but it seemed like a good long-term move. Amazon knew these workloads would eventually return, and Q2 might have been the inflection point.

We also need to contextualize AWS’ growth during this period, and we think Andy Jassy did a good job of doing this:

Just if you think about the AWS business being an $88 billion revenue run rate business, to grow double digits on a business that size with the amount of cost optimizing that’s been happening, to grow double digits, you have to be adding a lot of new customers and a lot of new workloads just to grow double digits.

So when I talked about last quarter, how I liked a lot of the fundamentals that we were seeing in the business with respect to customer pipeline, the new workloads, the migrations happening, what the team is rolling out functionality-wise, that’s kind of what I’m talking about. And as we start to see cost optimization attenuate and more of the workloads, new workloads that people took those cost optimizations and actually started to plan come to fruition, not to mention what’s coming with generative AI, there’s a lot of growth in front of us on AWS.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

Context is always necessary, and we believe there’s still a lot of room ahead for AWS. This was also the case last quarter, by the way, as the segment was decelerating. As it always does, Amazon took the long-term move and avoided succumbing to investor pressure. Could AWS have grown faster over the last quarters? Sure, but that would’ve meant that the customer might not have been happy, which is always bad for the long term.

All in all, Amazon reported a great quarter from a top-line perspective. Growth was more than adequate in North America and International, especially on the services side, as Amazon continues to become a service-based business. AWS’ growth decelerated again, but the tone was very different this quarter.

Profitability – Expected, but the increase took many by surprise

Profitability was undoubtedly the highlight of Amazon’s release. The company had been showing good progress in the prior quarters, but this quarter seemed an inflection point.

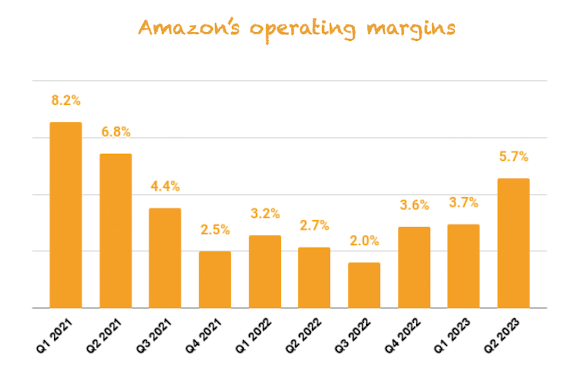

Amazon posted an operating income of $7.7 billion in Q2, a 5.7% margin, and growth of 131% year-over-year.

Made by Best Anchor Stocks

Funnily enough, the operating income increase was primarily driven by much better performance in the company’s retail business, which many thought could never be profitable. AWS’ operating margin continued to decrease, which makes sense when one considers the recent optimization efforts for customers and the fact that the company continues to build capacity for future growth.

So, what drove the improvement in the North American retail margins? A good portion of it came from the restructuring of the supply chain. Management announced several quarters ago that it was splitting up North America into 8 distinct regions to become more cost-efficient. It’s already showing good progress:

Regionalization is working and has delivered a 20% reduction in number of touches for our delivered package, a 19% reduction in miles traveled to deliver packages to customers and more than 1,000 basis point increase in deliveries fulfilled within region, which is now at 76%.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

This does not only have a positive impact on profits, but it’s also helping Amazon deliver packages much faster:

Our speed of delivery has never been faster. In this last quarter, across the top 60 largest U.S. metro areas, more than half of Prime members’ orders arrived at the same day or next day. So far this year, we’ve delivered more than 1.8 billion units to U.S. Prime members the same or next day, nearly 4x what we delivered at those speeds by this point in 2019.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

Lower costs and better customer service seem like a powerful combination. Andy Jassy reiterated that there’s still work to do to become more efficient and that Amazon will most likely blow past the prior peak in retail margins:

And I continue to believe what I said last quarter, Brian, which is I do believe that we’ll get back to margins like what we had pre-COVID. And I don’t think that’s the end of what’s possible for us there.

Source: Andy Jassy, Amazon’s CEO, during the Q2 2023 earnings call (emphasis added).

This makes sense due to the current optimization efforts and because retail is becoming more of a service-based business.

Profitability was great this quarter, but we were surprised to see it took many by surprise, especially since management has been anticipating this margin rise. It was just a matter of when the margin expansion would come, not if. Of course, believing that margins will expand after a 40% drop in the stock is much harder for many than believing they will expand when the stock is up 60% year-to-date!

Significant improvement in cash flows

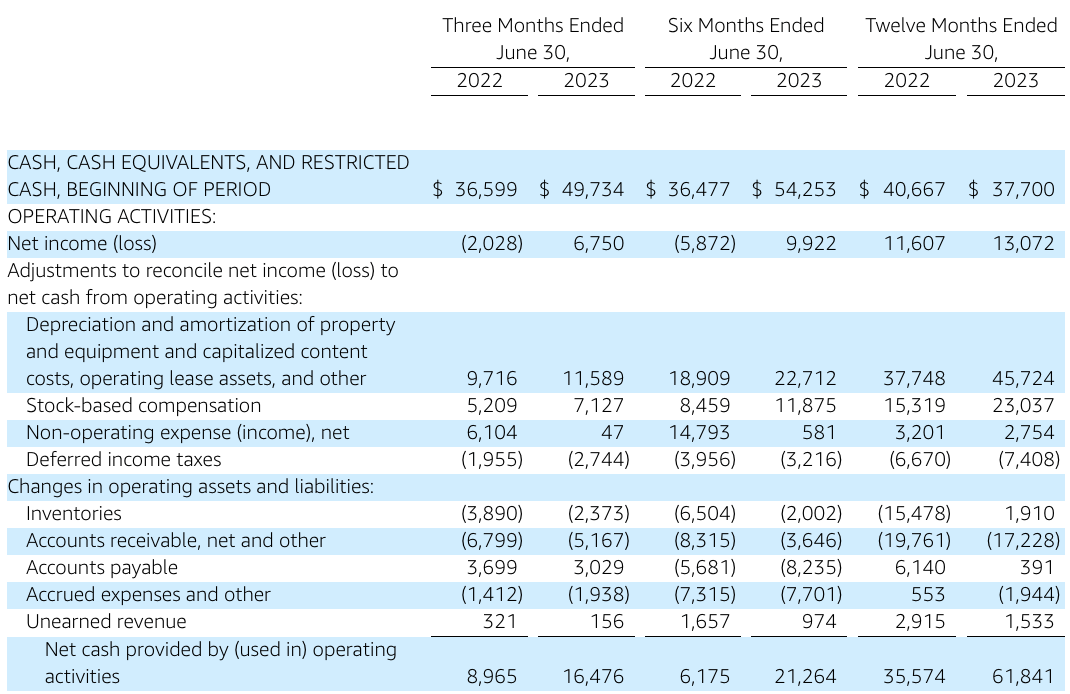

Profitability was not the only good news of the release; cash flows were too, albeit they are somewhat related. The company’s operating cash flow improved significantly, growing 84% year-over-year in the quarter:

Amazon’s Earnings Press Release

The improvement came from several things, namely better profitability and better cash conversion as the company leaves the pandemic period behind:

We’ve also seen improvements in our working capital contributions to free cash flow. Over the past couple of years, working capital hasn’t been as efficient as we’ve held higher weeks of cover of inventory in the face of supply chain disruptions. Most recently, as these disruptions continue to ease, we are improving our inventory efficiency, resulting in improvements in our working capital. We will remain focused on continued free cash flow improvement moving forward.

Source: Brian Olsavsky, Amazon’s CFO, during the Q2 2023 earnings call (emphasis added).

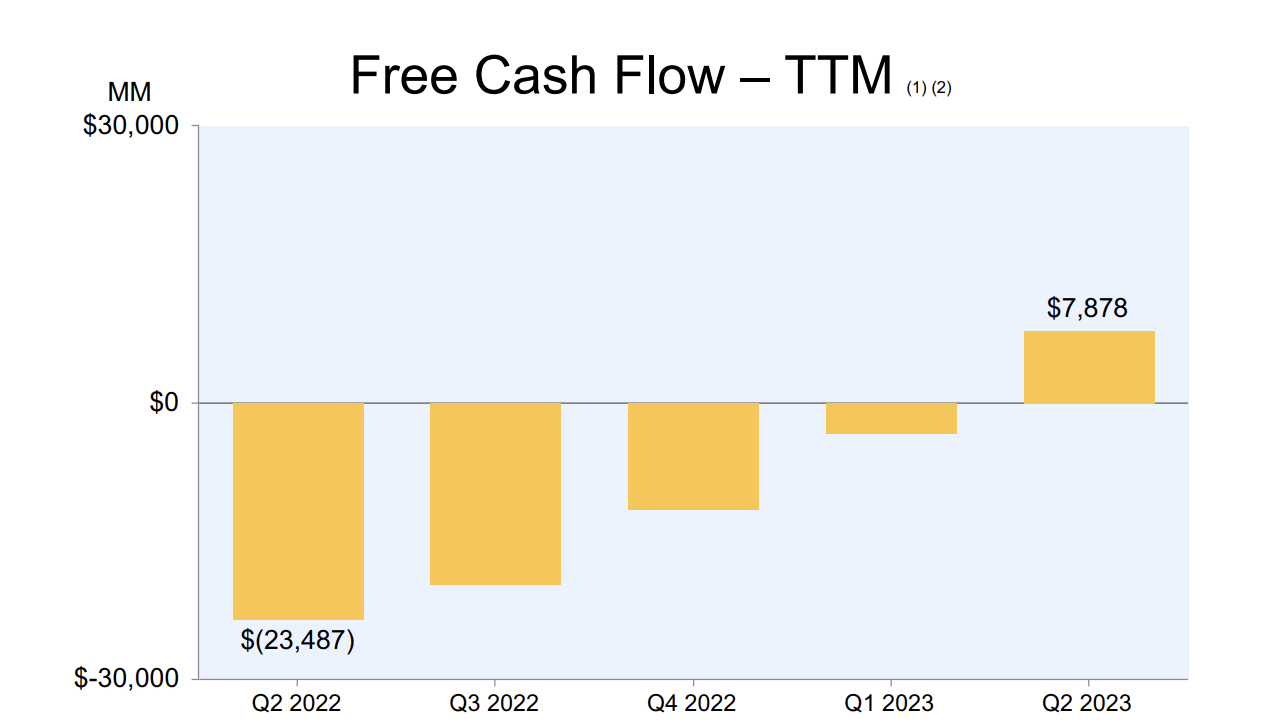

Free Cash Flow was even better. The company went from negative $6.76 billion in free cash flow in the comparable quarter to positive cash flow of $5 billion this quarter. If we look at the trailing twelve-month chart, we can see the improvement has been notorious:

Amazon Earnings Presentation

This shouldn’t be a surprise either. During the pandemic, Amazon went through an extreme Capex cycle to build capacity in its e-commerce operations. As we’ve discussed several times, the company faced two choices:

-

Underinvest and potentially lose market share

-

Overinvest and gain share during the pandemic, which could translate into lower margins during the next few years.

The company chose the second route, and while it has been criticized for it, we believe it was the right choice. Management has needed a couple of quarters to run through the excess capacity in the network, but we are already seeing the optimization efforts flow into the margins. As the company overinvested during the pandemic, some of the Capex was pulled forward, meaning that the company’s Free Cash Flow generation was misleading.

Note that it’s very different to own a company that struggles to make Free Cash Flow than owning one that chooses not to generate Free Cash Flow. Understanding if it was a deliberate choice or, on the contrary, if it’s a consequence of a bad business model or terrible unit economics is vital. We believe Amazon is a company that chose not to generate Free Cash Flow to strengthen its competitive position rather than a company that can’t generate it.

It’s also worth noting here that Capex will still be elevated for the year but that its destination will be different:

Looking ahead to the full year 2023, we expect capital investments to be slightly more than $50 billion compared to $59 billion in 2022. We expect fulfillment and transportation CapEx to be down year-over-year, partially offset by increased infrastructure CapEx to support growth of our AWS business, including additional investments related to generative AI and large language model efforts.

Source: Brian Olsavsky, Amazon’s CFO, during the Q2 2023 earnings call (emphasis added).

The company almost doubled its size in AWS and its retail operations during the pandemic, but the retail “hype” wore out a bit with the rollout of the vaccine.

Qualitative highlights

A management team that demonstrates long-term thinking with actions

We believe this is one of the most important takeaways of the earnings release. Amazon’s management has demonstrated, through actions, not just words, that they think long-term. In our opinion, there are two clear examples of this behavior.

The first one is the overinvestment during the pandemic. If management would’ve taken a short-term view, they would’ve probably underinvested to see how things played out. This way, they would’ve protected their margins. However, management chose a different route and overinvested to gain market share despite potentially sacrificing margins over the short term.

The other one is the company’s efforts to help their AWS customers optimize their workflows. Very few companies would proactively help their customers pay less, but Amazon’s management thought this was a good idea because it would help them secure them long-term. They were confident that workloads would increase eventually, so securing these relationships was what mattered.

This behavior is what we look for in management. We are taking this from my Texas Instruments’ earnings digest, as we mentioned something similar there (emphasis added):

This ability to swim against the current is one of the most important traits to look for in a management team. Being publicly traded is great because we get to participate in the successes of great businesses, but it also brings challenges because the market’s short-termism might make managers succumb to the short-term game, a game that I particularly am not interested in playing. I aim to own publicly traded companies that can be run as private companies.

We believe this applies to Amazon too.

Price drives narrative

The last three years have been a rocky ride for Amazon. The company started the pandemic as a clear beneficiary and invested significantly to capture the growth ahead. Not only did eCommerce become integral to our lives, but technology did too, powering the growth of AWS as companies looked for capital-light ways to scale their businesses. Back then, nobody knew what would happen with vaccines (even though some people seem to be great forecasters with the benefit of hindsight), so management decided to go on a Capex spree to prepare for what would apparently be a surge in demand.

Once the vaccine was rolled out, it was obvious that Amazon had overinvested in its retail operations. This overcapacity started to act like a strong force against margins. Amazon’s profitability collapsed, and so did its stock price, aided by a broad bear market. The stock went as low as $88 at the start of the year, and many thought the best days for Amazon were over.

This said, management assured investors that margins would be back once they worked through the excess capacity but that it would take some time. Mentioning “excess capacity” should’ve also let investors see that the Capex cycle was over. I guess it’s difficult for many to trust a management team when the stock price is at the lows, but what they were saying made quite a bit of sense.

These optimizations eventually showed in the numbers, with Q1 and Q2 showing good progress in profitability. The stock shot up to $140 despite not much changing for the company. That higher margins and lower Capex would come was a question of “when,” not “if.” Now, many investors seem to believe in Andy Jassy as CEO and in Amazon’s long-term story. All it took was a 60% rise in the stock price!

Remember that price always drives the narrative, and that’s precisely why long-term investors get opportunities. Sometimes, the narrative will justify the price, but in many cases, investors will be trying to justify the price using a narrative, falling into a trap.

Guidance

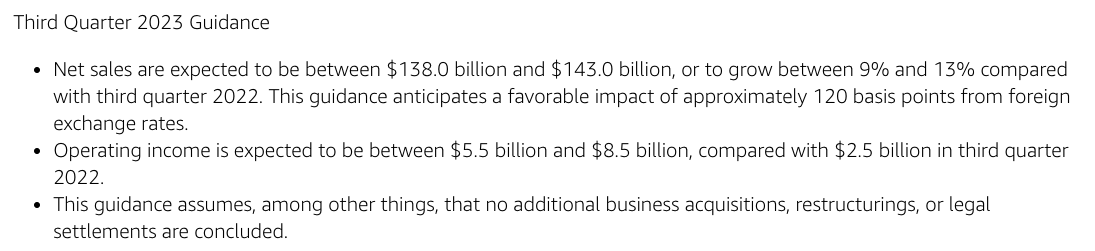

Amazon provided wide guidance ranges. Management expects sales to grow 11% year-over-year and operating income of $7 billion at the midpoint, which, if you ask us, sounds pretty conservative:

Amazon Earnings Press Release

Conclusion

We hope this article helped you better grasp Amazon’s earnings. Not much has changed for the company over the last three months, and nothing was unexpected in the release. However, as the stock price has done well, many view Amazon from a different perspective. Price always drives narrative in the market, and Amazon has been a perfect example of this. To avoid price driving our narrative, we should understand very well what we own so we can love it when it’s cheap and not hate it, as many people do!

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has outperformed the S&P 500 by almost 12% (on 05-16-2023).

At Best Anchor Stocks, we follow up our quality compounders meticulously, so you don’t have to worry about your portfolio.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!