Summary:

- We’re downgrading The Walt Disney Company to a hold. We expect the increasingly challenging macro environment will impact its studios, parks, and streaming businesses.

- While we credit management for prioritizing profitability over subscriber growth, we’re concerned the price hikes of the ad-free tier of Disney+ and Hulu could result in higher-than-expected subscriber share loss.

- We think management moves could yield mixed results in the near term as we see an increasingly competitive environment in the streaming business.

- We believe the returning CEO will probably need more time to turn the company around.

- The bottom line: we think Disney stock will continue to underperform through 2H23.

jhorrocks/E+ via Getty Images

We’re downgrading The Walt Disney Company (NYSE:DIS) from a buy to a hold, as we expect the company prioritizing profitability over subscriber growth will take longer to improve financial performance amid the current macro backdrop. We expect the increasingly challenging near-term macro headwinds to impact Disney’s studios, parks, and streaming businesses in the second half of the year. While we credit management’s focus on profitability after the return of CEO Bob Iger, we don’t see the “significant transformation” moment happening in the near-term. We see a less favorable risk-reward profile for Disney in 2H23.

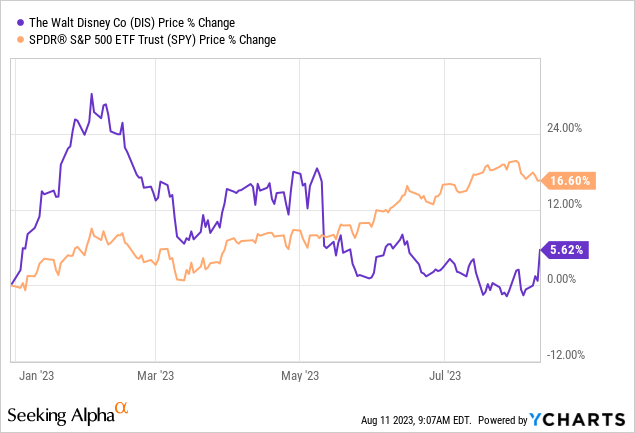

The stock is up slightly YTD by around 6%, underperforming the S&P 500 (SP500) by around 11%. Over the past six months, the stock is down 15%, underperforming the S&P 500 by 6%. We see the stock underperforming in the near term and recommend investors to stay on the sidelines and wait for macro headwinds to pass.

The following graph outlines Disney’s YTD stock performance against the S&P 500.

YCharts

A closer look at Q3 2023 & What’s Next

This quarter marks Iger’s third quarter back at the company and Disney’s second consecutive quarter of worst-than-expected subscriber loss in Disney+; the company reported 146.1M Disney+ subscribers this quarter, a 7.4% decline QoQ after a 2% decline in membership last quarter. This marks a second significant drop in India’s Disney+ Hotstar subscriptions, down 24% this quarter and 8% last quarter.

Our downgrade is driven by our concern over subscription growth after Disney announced they will be hiking prices on ad-free Disney+ subscriptions by 27% to $13.99 and the no-ad version of Hulu by 20%. While we understand this is Iger’s attempt to boost revenue, we don’t expect the price hikes to bode well under the current macro environment. The hikes place Disney at the more expensive end of the streaming service business; Netflix’s (NFLX) most expensive “premium” subscription costs $9.99/month. We think management moves are likely to yield mixed results in the near-term as we see an increasingly competitive environment in the streaming business; Disney is not only competing with Netflix but also with Warner Bros. Discovery (WBD), Amazon Prime (AMZN), and AppleTV (AAPL).

Additionally, we think Disney will continue to feel the pressure from softer ad spending in the near-term. We’re seeing the entertainment and media industry be impacted by softer ad spending; Warner Bros. Discovery management touched on this on their earnings call this quarter, highlighting the “overall advertising market remains soft.”

A positive note for Disney is its improved profitability this quarter due to management’s aggressive cost reductions, including thousands of layoffs earlier in FY23 and slashing over $5.5B in costs. On the earnings call, management noted that they now expect capex for the year to total $5B. Management also lowered their FY2023 content spend to $27B this quarter, largely due to lower product content spending resulting from ongoing writers’ and actors’ strikes.

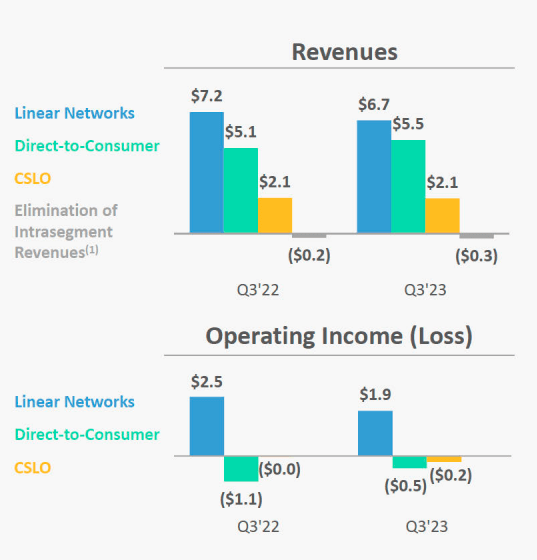

Direct-to-Consumer operating results improved by $1B in three quarters, and operating losses improved by $150M QoQ and $550M Y/Y. However, Disney did see operating income decline in other segments compared to the prior year, largely due to a decrease in advertising and affiliated revenue; Linear Networks’ operating income declined by $580M. While we think Disney is headed on the right path, we think the turnaround moment will take longer to materialize and don’t see Iger’s vision of “sustained growth and profitability for streaming business… to weather future disruption and global economic challenges” happening in 2H23.

The following graph outlines Disney’s revenue by segment results this quarter versus a year ago quarter.

Disney 3Q23 earnings presentation

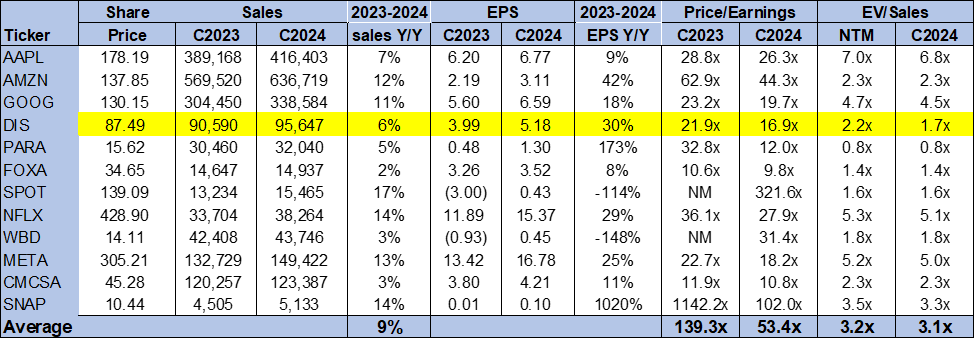

Valuation

The stock is trading well below the peer group average, but we recommend investors against buying the stock on weakness. On a P/E basis, the stock is trading at 16.9x C2024 EPS $5.18 compared to the peer group average of 53.4x. The stock is trading at 1.7x EV/C2024 Sales versus the peer group average of 3.1x. We don’t see favorable entry points at current levels, as we don’t see Disney outperforming in the near-term.

The following chart outlines Disney’s valuation against the peer group average.

TSP

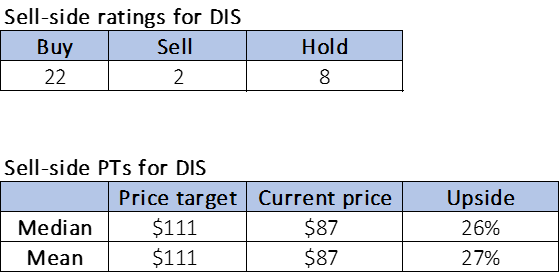

Word on Wall Street

Wall Street is bullish on the stock. Of the 32 analysts covering the stock, 22 are buy-rated, eight are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment to Disney’s improving profitability and management under Iger. We share Wall Street’s bullish sentiment on the stock in the longer run but see the stock underperforming in the near term. The stock is currently priced at $87 per share. The median and mean sell-side price target is $111, with a potential 26-27% upside.

The following charts outline Disney’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re downgrading The Walt Disney Company to a hold, as we don’t see the stock outperforming in the near term. We now think the company’s comeback story will take longer to take place and don’t see price hikes boosting revenues in the near term. We continue to expect Disney to outperform in 2024 but see an unfavorable risk-reward profile for the stock in the back end of this year due to the challenging macro environment and increased competition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.