Summary:

- The Walt Disney Company subsidiary signs agreement with Penn Entertainment for sports betting, likely to have immediate short-term results and long-term growth.

- Disney’s ESPN subsidiary gives them an advantage in the sports betting industry, potential for future acquisition of Penn.

- Hulu financing concerns, if they even happen, are way overblown.

- Most large companies get market share first and then profits. After that, growth resumes.

- The image of management on top of its problems with solutions underway is extremely valuable to the stock price.

Drew Angerer

The Walt Disney Company (NYSE:DIS) recently announced that the ESPN subsidiary signed an agreement to enter into the sports betting with a partner, Penn Entertainment (PENN). Disney has a habit of finding things that cash flow both quickly and usually a lot. This agreement appears to follow that trend. ESPN has long been a cash flow juggernaut for Disney. That appears likely to continue as well as increase in importance with the betting agreement. For shareholders, such an agreement is likely to have immediate short-term results as well as offer long-term growth (if it works). Disney is assured of a minimum cash flow from Penn if the worst happens.

Betting has long been a human past-time that has proved very popular, with sports betting a major source of revenue for the betting industry. Disney has an advantage through its ESPN subsidiary, which has long been a major name in sports with its own reputation. I very much like the chances of this foray into a new area. One possible implication if this succeeds is that Disney could acquire Penn in the future to open up more areas of growth in the gambling industry.

DTC

Disney also addressed the market concerns about the Direct To Consumer (DTC) division.

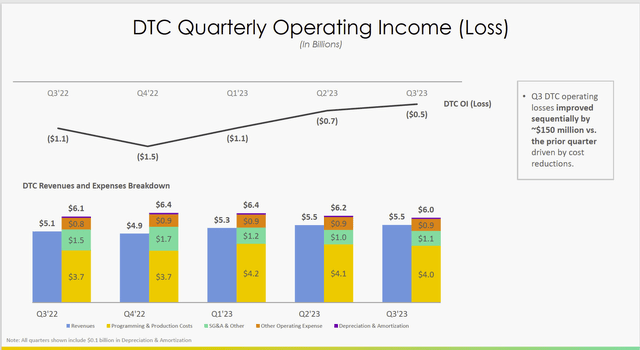

Disney Direct To Consumer Results Trend (Disney Second Quarter 2023, Earnings Conference Call Slides)

Disney reported improved results for several quarters in a row. The most controlled variable, administration, is the one that has shown the most improvement over the previous quarters.

Management is reporting a lower administrative comparison while revenues are up over the previous year. Most of the reported improvement is due to those two reasons.

Content is not going to change as quickly because it takes years to plan content. Therefore, the content is likely “set in stone” or something close to that. The improvement needed there has started, but the content reflecting that improvement will probably happen late next fiscal year. It is hard to make major cost changes for projects already underway.

Even so, management has done well to cut the deficit in half in comparison to the quarter last year, while showing a billion-dollar improvement from the low point on the chart above.

If you read business strategy books (which are really dry) like Michael Porter’s “Competitive Strategies,” you will find that large companies like Disney often gain market share first and then right-size the operation for profitability next. So, what is happening with this division is heading down a “well-worn pathway.”

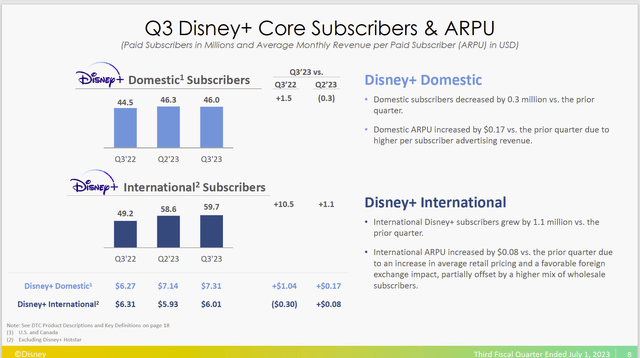

Disney Direct To Consumer Results By The Subscriber Numbers (Disney Second Quarter 2023, Earnings Presentation Slides)

There was some market concern about a lack of subscriber growth. Yet the “right-sizing” of the operation is well established in research and often results in a delay in more profit growth. Yet Mr. Market is reacting as though this research never happened. That implies an investment opportunity.

The entertainment industry is very competitive and also very fractured with no one player having a significant share of that market. Investors have a lot of options and will have a lot of options in the future. Therefore, future growth will depend upon offering a product that competes well in the marketplace.

Disney has franchises that give it an advantage over other competitors. They still have to keep monetizing that advantage as they have in the past. That will continue to be a challenge in the future with periodic “dry spells” that will challenge management creativity. Disney has overcome those periods in the past. But the risk of successfully overcoming those periods in the future remains.

Special Considerations

During the conference call, the two divisions shown below had extra considerations.

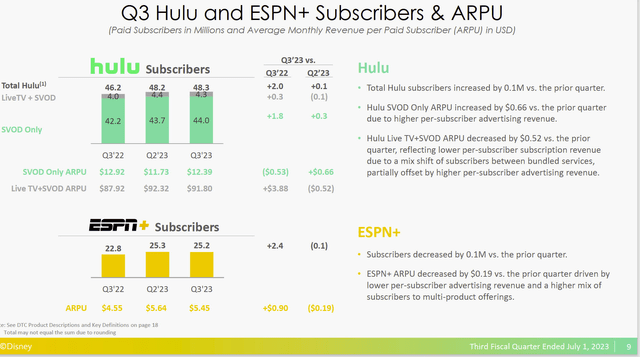

Disney Results Of Hulu And ESPN By The Subscriber Numbers (Disney Second Quarter 2023, Earnings Conference Call Slides)

Management mentioned that they should be able to handle the Hulu buyout issues “if or when” that happens with the finances available.

The thing that many investors do not realize is that lending has a personal relationship component to go with the record and numbers that many associate with lending qualification (process). In this case, the current CEO is a known entity with a track record that will likely put any financing worries about Hulu out of consideration in the future. This alone is a huge advantage over the CEO he replaced. You just cannot buy a good image and the current CEO has one.

Next is the market has been fretting about the lack of growth (and in some cases it has only been one quarter) pretty much “across the board.” However, the signed gambling agreement, if it works (and I like the chances), should quickly allay those fears. Gambling is one of those things that routinely attracts a lot of business when it works correctly (and, of course, that is a risk).

Of all the challenges that Disney faces, the DTC segment, along with ESPN, appears to have a market approved solution to the challenges facing the division for at least the time being.

Movies

Disney has long been held to higher standards when it comes to movie profitability than has many of its competitors. The market got used to one blockbuster after another that was made possible by the franchises the company built as well as acquired.

So, the latest dry spell brought all kinds of opinions out of the “woodwork.” Probably a reasonable expectation is that Disney will examine the results (as does the competition) to get the movie business back on track for what Disney has been used to.

The current year would probably not be a real bad year for much of the competition. But it is definitely below expectations for what Disney management has been used to.

Investors should expect that a management with the long-term record of this management will find a way back to the success it is used and probably some growth as well.

Parks

There was a question about park attendance and some admissions by management as well. However, this division is about more than one or two parks.

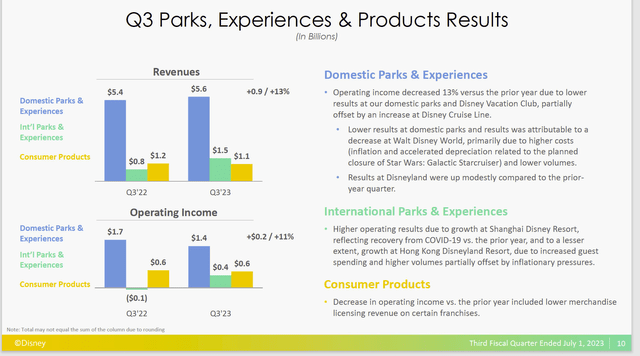

Disney Parks Division Results (Disney Second Quarter 2023, Earnings Conference Call Slides)

The advantages of diversification were demonstrated when the international parks improved to more than offset what happened domestically which allowed the division to report minimally better results in the current fiscal year.

In many ways, this demonstrates how a lot of headlines distorted the relative importance of the challenges of domestic parks. It does also mean that improvements domestically are needed. But it also limits the importance of what happened.

Summary

Disney management now gives the impression that they are working on and “ahead of the game” when it comes to challenges that the company faces. Image is just so important when a company faces challenges. In this case, the image has now moved from fumbling around and uncertain to one of confidence. That can be worth a lot of money in terms of the stock price.

The confidence shown often causes the market to think positively about the future. That “positive” part usually means a valuation based upon lots of future profits. If Mr. Market looks ahead enough, the stock could get ahead of itself. If you happen to take profits when that happens, it is money in the bank before the actual recovery. Stocks that get ahead of themselves often backtrack when the recovery begins.

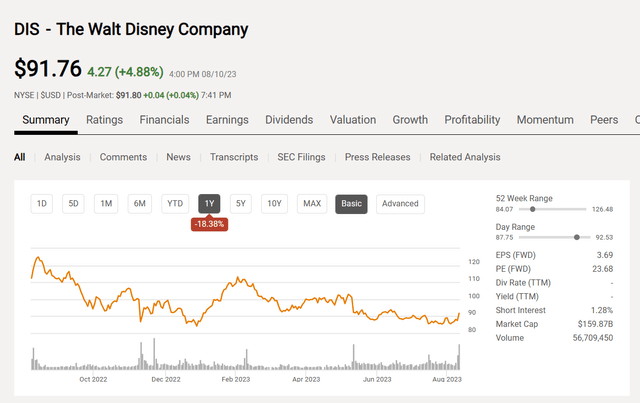

Disney Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 10, 2023)

The common stock responded very well after the conference call as shown above. This most likely reflects the certainty that management projected during the conference call along with enough action or solutions to satisfy the market that management was now “on top of things.” Therefore, the problems would be resolved.

Before this, there were some serious worries under the previous management that the problems were insurmountable. Now management still has to produce (and that is definitely an investment risk). But some managements get more leeway about results than others. A lot of this is the presentation and the image made in the eyes of the market.

The market loves a future story of gushing cash. Disney management can now dangle that story in front of the market. Management did so in a way that the market is likely to give management time to resolve the challenges outstanding.

What is lost in this is that it often took the time in the previous management for management to get to where it is now. Therefore, previous management may well have been a “sacrificial lamb” with the board knowing that the chances of success were “the chance brothers (slim, fat and no).”

This is the business world. So, there is every chance that the current management can now continue where previous management left off. It cost a little money to do things this way. But shareholders will benefit from a very common management strategy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a position in PENN without further notice.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Walt Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.