Summary:

- AAPL’s FQ3’23 performance has spooked investors due to the lower iPhone sales and decline of its US smartphone sales for the past three quarters.

- However, we posit that consumers are likely postponing their next purchases prior to the launch of iPhone 15, with the same downtrend similarly observed over the past few years.

- While AAPL’s TTM top and bottom lines have been decelerating sequentially, these are mostly attributed to tougher sequential comparison and pulled forward hyper-pandemic growth.

- Thanks to its robust product pipeline and stellar shareholder returns, we maintain our long-term conviction that the AAPL stock remains a safe haven for the next decade’s portfolio growth.

- This correction is merely a temporal loss of momentum due to the peak recessionary fears.

Tomas Ragina

The iPhone Investment Thesis Remains Robust, Similar To AAPL’s Historical Trend

We previously covered Apple (NASDAQ:AAPL) in June 2023, discussing its next phase of computing platform, thanks to the introduction of the Vision Pro headset in the recent Worldwide Developers Conference 2023.

With the product’s impressive specifications and spatial experience well demonstrated in the marketing video, it was clear why AAPL had been so successful with its target audience. These factors had allowed the company to command its premium selling prices compared to its peers.

This was also why we believed that the stock had been able to command its premium valuations while remaining well-supported, despite the uncertain macroeconomic outlook.

For now, AAPL’s FQ3’23 performance has spooked some investors, due to its lower iPhone sales of $39.66B (-22.7% QoQ/ -2.4% YoY). This is on top of the consecutive decline of its smartphone sales in the US over the past few quarters.

We suppose the reversal of the optimistic sentiments is to be expected, since iPhones comprise $205.48B (+7% YoY), or the equivalent of 52.1% (-0.3 points YoY) of the Cupertino giant’s FY2022 top-line.

However, the pessimism has been overdone indeed, since we posit that consumers are likely postponing their next iPhone trade in or purchases for a few more months, while waiting for the iPhone 15’s launch on September 13, 2023.

With the iPhone 15 Pro rumored to come with the next-gen A17 processor with the latest 3nm technology, we may expect faster processing speeds and improved computing power. This is on top of expanded battery capacity and enhanced LiDAR camera sensor for “augmented reality purposes.”

Furthermore, the iPhone QoQ downtrend has been long observed over the past few years, with AAPL’s recording lower FQ3’22 iPhone sales of $40.66B (-19.5% QoQ/ +2.7% YoY) and FQ3’21 sales of $39.57B (-17.4% QoQ/ +49.8% YoY).

While other smartphone makers, such as Samsung (OTCPK:SSNLF) may have reported an elongated replacement cycle, with Mobile eXperience sales of 24.61T KRW (-19.9% QoQ/ -12.1% YoY) in the latest quarter, we are confident that AAPL can overcome the temporal headwind.

For example, AAPL’s manufacturing partner, Foxconn, has already guided “third-quarter sales to rise sequentially and be higher than the average level of the past two years.” This may result in the continuation of the robust double-digit growth in the Smart Consumer Electronics Products as those reported in July 2023.

This corroborates the Cupertino giant’s guidance that “iPhone and Services YoY performance (will) accelerate from the June quarter.” This is likely to trigger the expansion of the iPhone active installed base from the latest quarter’s record high.

Many other e-commerce and fintech companies have also recorded promising H2’23 outlooks, including PayPal (PYPL), Amazon (AMZN), Shopify (SHOP), and MercadoLibre (MELI), with expanding MoM discretionary spending. This promising development is likely attributed to the decelerating July 2023 CPI of 3%, compared to 9.1% a year ago.

With market analysts already pricing in zero hikes in the next FOMC meeting, we may see the elevated interest rate environment abate earlier than expected.

While there may be moderate headwind from the repayment of federal student loan debt from October 2023 onwards, we remain confident about AAPL’s prospects. Telecoms such as AT&T (T), Verizon (VZ), and T-Mobile (TMUS) have long offered free smartphones, depending on the mobile and financing plans. Otherwise, consumers may also turn to AAPL’s Apple Pay Later.

Therefore, we maintain our long-term conviction that the AAPL stock remains a safe haven for the next decade’s portfolio growth. This correction is merely a temporal loss of momentum, due to the peak recessionary fears.

So, Is AAPL Stock A Buy, Sell, or Hold?

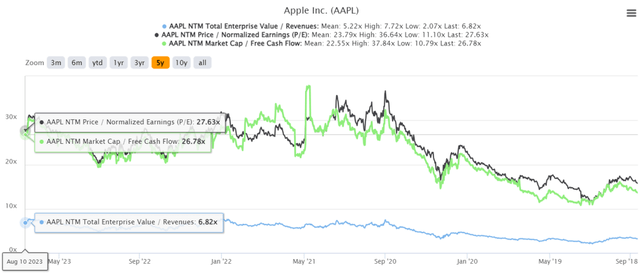

AAPL 5Y EV/Revenue, P/E, and Market Cap/ FCF Valuations

For now, AAPL is trading at NTM EV/ Revenues of 6.82x, NTM Market Cap/ FCF of 26.78x, and NTM P/E of 27.63x, elevated compared to its 1Y mean of 6.17x/ 25.56x/ 24.53x, respectively.

On the one hand, we must not ignore the Cupertino giant’s rich Free Cash Flow generation of $100.96B (-6.1% sequentially) over the last twelve months [LTM].

With all of the cash flow returned to long-term shareholders, comprising $14.97B of dividends and $86.4B of share repurchases (retiring 0.49B of shares) over the LTM, we believe that its premium Market Cap/ FCF valuation appears to be well deserved.

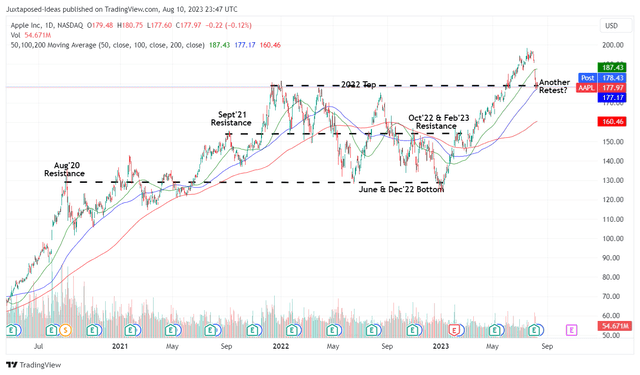

AAPL 3Y Stock Price

On the other hand, AAPL’s revenues have declined sequentially to $383.93B (-1% sequentially) and EPS to $5.95 (-1.6% sequentially) over the LTM, worsened by the tougher sequential comparison and pulled forward hyper-pandemic growth.

As a result of the moderated top/ bottom line growth, we are not surprised that some of the exuberance in the AAPL stock has moderated by over -7% since the recent earnings call, retesting the previous 2022 top. Depending on how the market sentiments shape over the next few weeks, we may see the stock remain somewhat volatile.

With its upside potential mostly baked in to our long-term price target of $199, based on its NTM P/E valuations and the market analysts’ FY2025 adj EPS projection of $7.22, we prefer to rate the AAPL stock as a Hold here.

Due to the reduced margin of safety, it may be more prudent to observe the situation a little longer, before adding at any dips depending on individual investors’ dollar cost averages and risk tolerance.

Therefore, we are rating the AAPL stock as a Hold here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, PYPL, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.