Summary:

- Meta’s recent earnings were mostly positive, with consistent growth in Daily Active Users and an uptick in Monthly Active People.

- Reality Labs, Meta’s venture in virtual reality, is facing challenges with declining revenues and high expenditures.

- Meta’s strengths lie in software, and its future strategy should focus on its flagship products to increase cash flow margins.

MangoStar_Studio/iStock via Getty Images

I initially wanted to write this article with a more positive title. Although I’m still optimistic about the stock and very bullish on Meta’s (NASDAQ:META) future, today I need to discuss the company’s recent earnings.

Yes, the recent earnings were mostly positive. I’ll cover those parts. There was, however, one glaring weakness that we’ll hit on too.

The Good: Users Continue to Climb

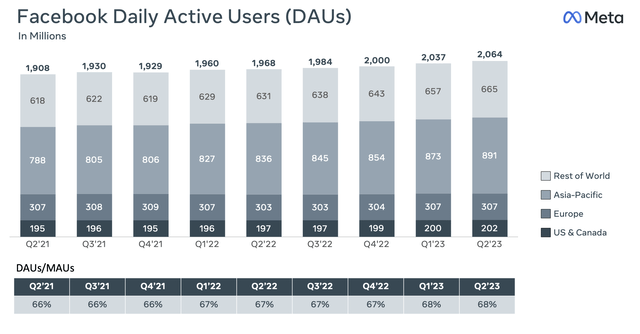

While I’m aware that the world extends beyond my immediate surroundings, the consistent, albeit slow, growth of Daily Active Users (DAU) on Facebook never ceases to astonish and impress me.

Facebook DAUs (Meta Earnings Report)

It’s worth mentioning that a large portion of these users hail from regions with a lower Average Revenue Per User (ARPU). Yet, impressively, 2 million more DAUs emerged from the U.S. and Canada.

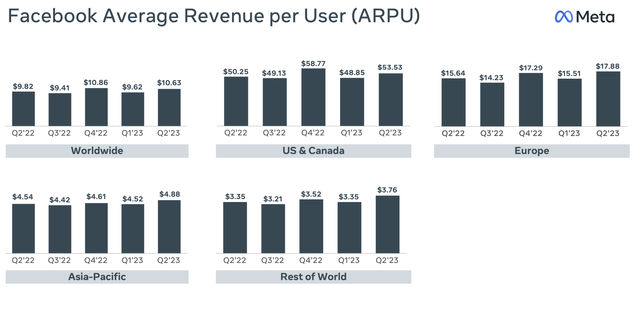

Facebook ARPU by Geography (Meta’s Earnings Report)

If you’re questioning the significance of regional differences, the slide above illustrates the disparity clearly: a North American user contributes approximately three times more than their European counterpart. Given these numbers, it’s tempting to say that if Facebook could populate its platform solely with North Americans, it probably would.

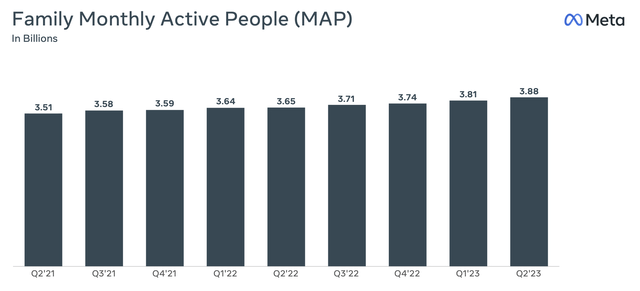

However, it’s crucial to remember that these statistics represent just a slice of the pie – specifically, Facebook’s slice. Meta’s umbrella extends to include Instagram, WhatsApp, and Oculus, and their combined user base is significantly broader.

Meta’s Monthly Active People (Meta’s Earnings Report)

In fact, Monthly Active People (MAP) totaled a staggering 3.88B across all of Meta’s platforms in Q2. This marks a 6.3% uptick from the previous year. When considering that this encompasses over 40% of the global population, a 6.3% growth is genuinely commendable.

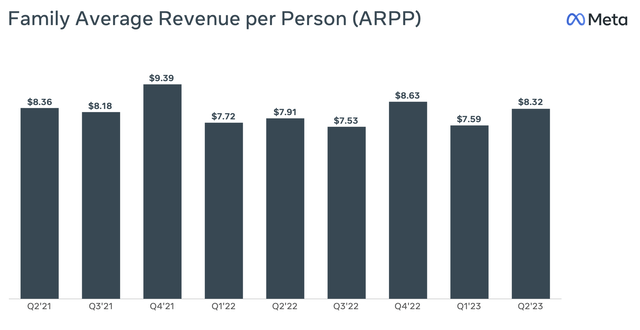

Meta’s Average Revenue per Person (Meta’s Earnings Report)

Moreover, the Family Average Revenue per Person (ARPP) experienced an uptrend this quarter. This is an encouraging indicator, suggesting that the advertising market isn’t on a downward trajectory in the long run.

The Bad: Reality Labs

Oculus Quest 3 (Meta)

Those who keep a keen eye on Meta probably anticipated that Reality Labs might not shine brightest in the report. Should Zuckerberg manage a substantial return on this venture, it would undoubtedly solidify his reputation as one of the most committed and forward-thinking leaders of our era.

Even with declining revenues and a product that, at first glance, seems inferior to Apple’s Vision Pro (mind you, “seems,” as Apple hasn’t started shipping yet), Zuckerberg remains unwavering in his investment in virtual reality and the metaverse.

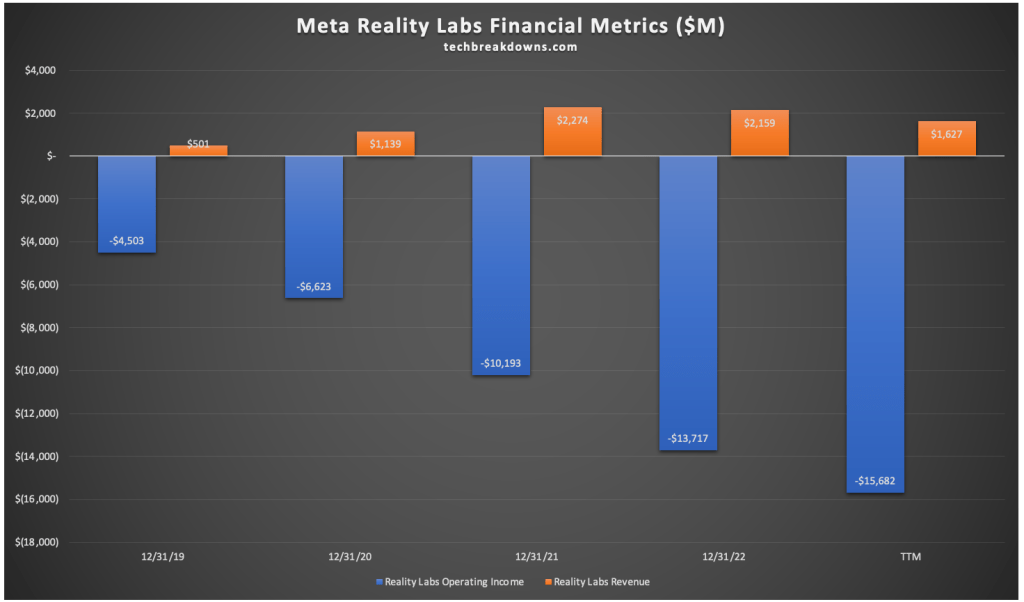

Relying solely on competitive pricing might not be the best strategy for Reality Labs. With expenditures nearing a hefty $40B, the path to profitability is steep.

Meta’s Reality Labs financial metrics. (Author compiled from Meta data. )

The chart above underscores just how challenging it is for Meta to rebound, especially with the added weight of decreasing revenues.

What options are on the table? In reality, not many. With Zuckerberg holding the reins tightly, both in leadership and on the board, he has the autonomy to chase the Metaverse dream, regardless of potential risks. This unchecked authority can be a daunting prospect for some observers.

However, there’s a potential silver lining: If Zuckerberg decides to curtail spending significantly, Meta’s stock could soar. The project’s strain on free cash flow is evident, and mitigating that could be a boon for the company’s profitability.

Being Zuck: What Could Reality Labs Become?

While I mentioned the idea of “moving past” the project, it’s clear that Zuckerberg envisions more. He hasn’t funneled $40B of the company’s resources into this venture only to abandon it. He genuinely views this as Meta’s future trajectory.

So, what could this future look like?

The foundational assumption is that it becomes the succeeding major platform. I’m inclined to believe this. However, my confidence leans more towards Apple’s “Vision” (yes, pun intended), rather than Meta’s interpretation.

Meta posits a future where the primary draw to donning these headsets is entertainment. They ventured into the enterprise realm, but the results were less than stellar. Conversely, I foresee a ubiquitous headset-driven future, albeit with a slightly dystopian flavor, and I believe Apple will be the trailblazer.

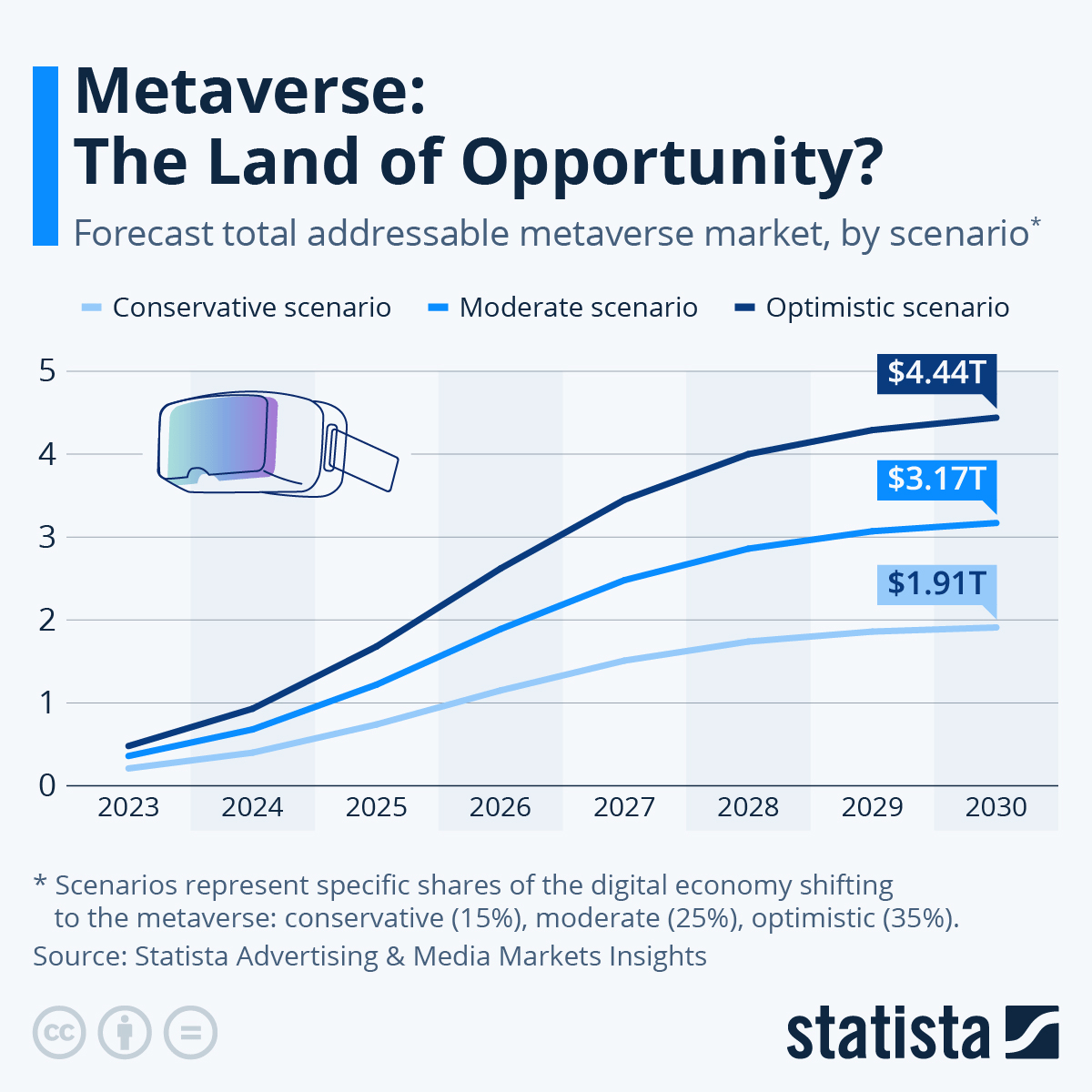

Future metaverse market projections (Statista)

But let’s entertain a different scenario: Suppose Meta does secure the dominant position in this market. Estimations about the metaverse’s market size vary widely – from $1.3T (as per Precedence Research) to a staggering $4.44T. And then there’s McKinsey’s eyebrow-raising prediction of $5T by 2030. Even for someone rooted in technology, such figures can seem a tad exaggerated.

Nonetheless, consensus points to an enormous market. If Meta plays its cards right and the market indeed evolves as projected, Reality Labs could potentially garner anywhere between $100B to $1T.

Yet, I perceive considerable risk in this venture. In my view, Meta’s strengths lie in its software prowess. Their hardware endeavors, however, haven’t borne fruit. While Zuckerberg aims to stake a claim in the hardware realm of tomorrow, I’m skeptical about its payoff. The sooner the company recognizes this and refocuses its efforts, the brighter their long-term prospects become.

Long-Term Outlook

I’ve maintained a favorable view of Meta for a significant duration, so my continued optimism shouldn’t raise eyebrows.

The company’s foundational operations continue to defy skeptics and demonstrate resilience, irrespective of market conditions. Admittedly, my most pressing reservation revolves around what I perceive as the suboptimal investment in Reality Labs. But, like any hopeful investor, I’d be elated to be proven mistaken on this front.

I’ve always championed the idea that Meta’s strengths lie in software. Their historical success with platform-agnostic applications like Facebook, WhatsApp, and Instagram underscores this. Thus, their future strategy should accentuate these strengths.

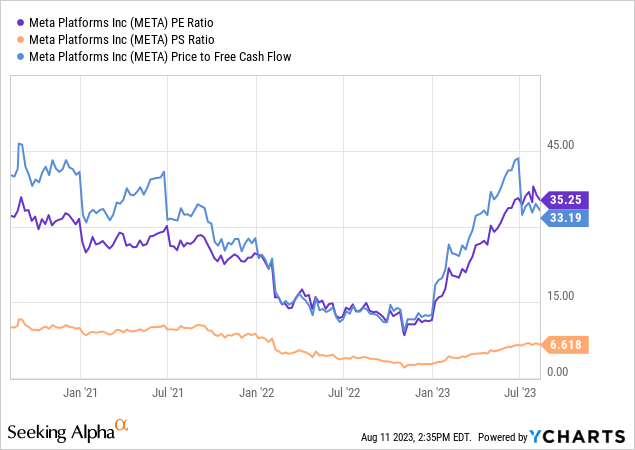

As can be inferred from the data above, Meta’s current valuation seems justifiable when juxtaposed against its historical metrics, which leads me to classify this piece under the “Hold” recommendation.

I personally have a stake in Meta, and while I harbor hopes for Reality Labs, I’m also pragmatic. Even if Reality Labs underwhelms, Meta’s potential to witness cash flow margins surge to around 30% remains – especially if they recalibrate their focus towards their flagship products.

Turning our attention to analyst sentiment, the consensus is predominantly bullish. Out of the 41 analysts scrutinizing the stock, a notable 35 advocate a “buy” stance at the current valuation. Among those who offer price projections, there’s anticipation of a climb to $378 within a year, translating to an approximate 24% appreciation.

While I respect this perspective, my stance deviates slightly. As alluded to earlier, I’m circumspect about any substantial upside within the upcoming year. Looking further ahead, I do envisage Meta reclaiming its position beyond the $1T valuation, but I’d hesitate to bank on such a trajectory unfolding in 2023.

Closing Thoughts

The potential, and lack of potential from Reality Labs, share buyback policy, and outrageously consistent core application user base make Meta a great long-term hold for those already in the name. However, aspiring investors will likely find a better entry point over the coming months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.