Summary:

- Disney stock price has fallen 20% this year, underperforming the market significantly compared to the S&P 500.

- I see the company’s plans to implement cost-cutting measures and its strategy to monetize its streaming platforms as a great sign to improve its future profitability.

- DIS’s strong intellectual properties and global reputation differentiate it from competitors, making it a company with a strong moat.

- At its current price level, I see an upside potential of 20-30% based on my DCF estimation.

JHVEPhoto

Investment Thesis

The share price of Disney (NYSE:DIS) has significantly underperformed the overall market. While the S&P500 returned investors an average of 20% YTD, the share price of Disney has fallen by an eye-watering 20%, from its peak in 2023. Despite the fact that its Q2 Revenue and earnings were in line with Wall Street Analysts’ estimates, investors were fearful of the reported loss of 4 million Disney+ subscribers and were also sceptical about Disney’s position in the streaming market given the rising competition and uncertainties from Paramount, Netflix and YouTube. As a result, the massive spread of contagion among investors has caused a massive sell-off of Disney, leaving the stock trading at a 10-year low right now.

Despite the huge price correction, DIS remains fundamentally strong. I consider Disney well-positioned for future growth as the management team plans to further monetize its online streaming platforms like Disney+, ESPN+ and Hulu by charging customers a higher retail price. Furthermore, I expect Disney to implement more cost-cutting initiatives including layoffs and content cost reduction to improve cost efficiency, which will likely turn its profitability around. Alongside the recent rebound in the number of visitors to Disney Resorts, Disney remains well-positioned to turn around under the leadership of Bob Iger.

Given it’s now trading at 10-year lows alongside the grossly magnified market pessimism, I rate Disney as a “Buy”. I think that investors shall ignore short-term headwinds and focus on the long-term economic strength, brand reputation of Disney.

Business Overview

Disney is a global entertainment company, operating in 2 segments, including the Disney media and entertainment distribution (DMED), as well as Disney Parks, experience and Products (DPEP).

The DMED segment includes popular sports & TV brands like ESPN and ABC respectively, as well as DTC platforms like Disney+, ESPN+ and Hulu. Disney also operates a number of theme parks and hotel resorts in California, Florida, Paris, Tokyo, Hong Kong and Shanghai respectively alongside the Disney Cruise Line under the DPEP segment. The company is committed to elevating customers’ experience at its park and expanding its value & audience from its entertainment content.

Increasing Monetization rates from Disney+

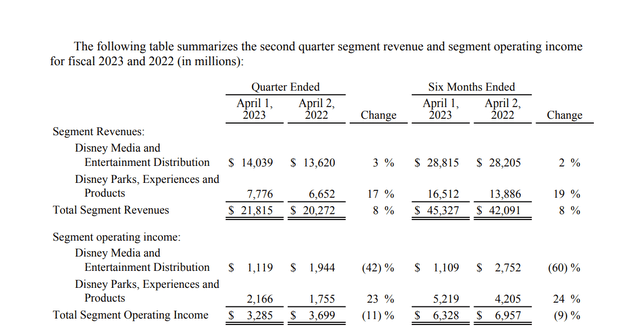

Disney+ Subscribers Growth (Disney)

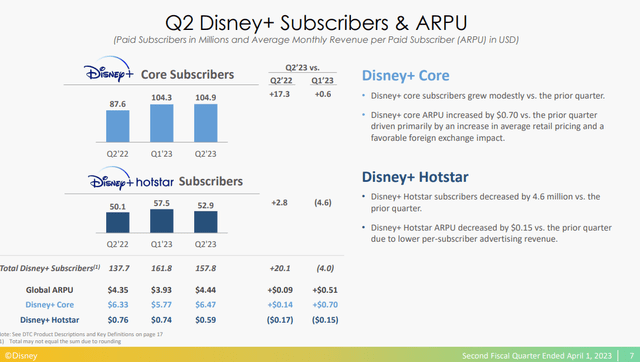

I think that Disney could expand its revenue stream and capture more market shares by further monetizing its DTC platforms, which is expected to be a strong catalyst for its top-line growth. Despite the fact that the number of Disney+ subscribers dropped by 4 million vs Q1 2023, Disney+ was still able to grow its subscribers’ number by more than 20 million compared to last year. In fact, Disney+’s average revenue per user grew by $0.70 vs Q1 2023 due to its hike in retail prices from Disney+. The average monthly revenue per paid subscriber for Disney+’s domestic users in the US and Canada increased by 20% from $5.95 to $7.14, whereas international customers have also seen an increase of 6% from $5.62 to $5.93.

Yet, the increasing monetization efforts from Disney+ have only resulted in a minor reduction of paid subscribers, which has illustrated the customer stickiness and price inelasticity of Disney+ and other DTC platforms. I expect Disney to leverage this price leadership to continue its price hikes for viewers, which will likely boost its DTC revenue segment for years to come.

Average monthly revenue per paid subscriber (Disney)

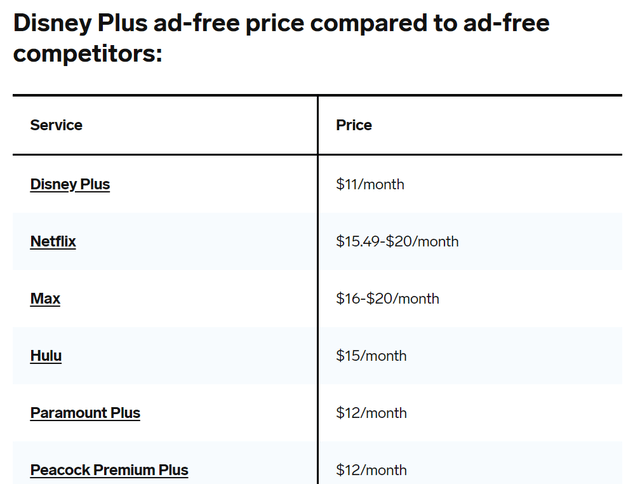

To add on, Disney+ is currently charging customers around $8 and $11/ month for ad-supported streaming and ad-free streaming respectively, which still trails behind Netflix’s $15/month ad-free streaming services. I expect Disney to leverage its pricing power to raise prices for its future streaming services to catch up with Netflix, which will likely boost Disney’s top-line growth.

Furthermore, Disney+ is now starting to crack down on its accounts sharing function to prevent subscribers from sharing its streaming content with others, and I think that such crackdowns likely prompt more non-subscribers to subscribe to Disney+ and boost its subscriber growth in the foreseeable future, which is expected to bring in more cash flows to the business.

Disney+ pricing vs competitors (Disney)

Differentiated Intellectual Properties And Brand Reputation

Nonetheless, despite its recent headwinds, I believe that Disney still has a strong competitive advantage. Disney has an assortment of intellectual properties and blockbusters, like Frozen, Marvel Avengers, Spiderman, Avatar and Mickey Mouse that differentiates itself from other competitors. In addition, the cartoon image of Disney-produced characters has been deeply embedded into the minds of kids and teenagers. Personally, I used to get hooked on Marvel movies when I was a kid. Thus, given its strong global reputation and the successful brand image it has built in the past, I don’t see Disney’s moat getting demolished in the foreseeable future.

In fact, Disney and Marvel Studios have debuted popular movie series like Avatar: The Way of Water, Antman and Guardians of the Galaxy Vol. 3 recently, while movies like Captain America: Brave New World are also in the pipeline. I expect these blockbusters to generate more cash flows ($2 Billion from Avatar in 2023) and licensing royalties to Disney given the popularity and appeal of their movies to the general public.

Avatar: The Way of Water (Disney)

Cost-saving Initiatives To Kindle Profitability

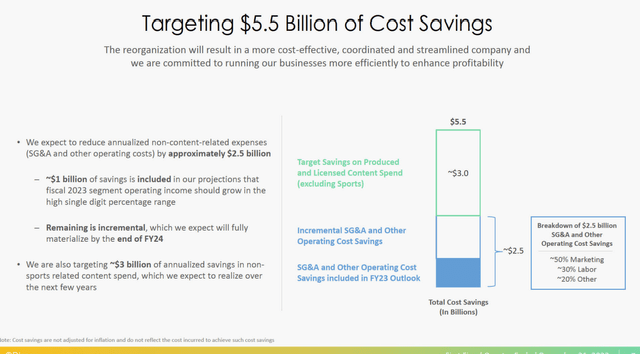

Disney cost-cutting measures (Disney)

I expect future improvements in Disney’s margins as the management team is planning to revitalize its profits through a series of cost-cutting measures. First of all, Disney is planning to save ~$2.5 billion annually from its operating and SG&A expenses, which will likely come from headcounts reduction and cut back on low-efficiency marketing expenses. For example, Disney has cut back on 7,000 jobs this year. I expect these cost-cutting initiatives to streamline its operating efficiency and result in better margin expansions in the future.

Furthermore, Disney is planning to save up to $3 billion in content production and related spending. I think this will likely lead to a reduction in the quantity of entertainment content produced by Disney and a more strategic focus on the quality of movies that they produce. This prioritization will likely optimize the value of content to audiences and enhance Disney’s productivity & efficiency, which will likely improve customers’ satisfaction in my opinion.

Strong Performance In Parks, Entertainment And Products Segment

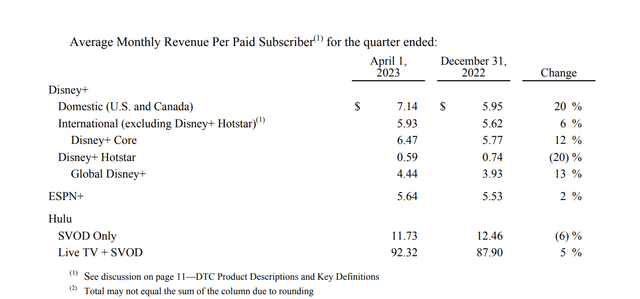

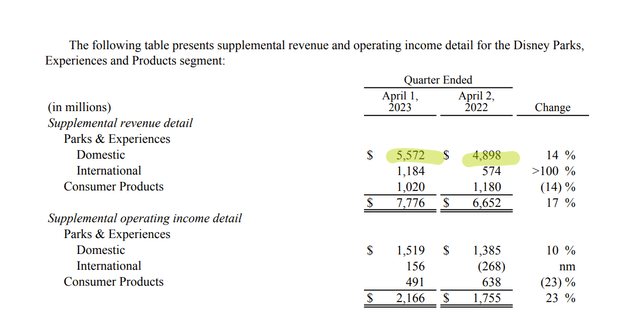

Disney’s theme parks, entertainment and products segment has seen a significant turnaround over the past year. Its segment revenue grew by an astonishing 17% YoY from $6.6 billion to $7.78 billion. This was primarily driven by the robust performance of the international theme parks, which has seen their revenue more than doubled. For example, the reopening of borders from China and Hong Kong has significantly contributed to more traffic volume and guest spending in both theme parks.

Furthermore, Disney has increased its average ticket prices in Paris, Shanghai and Hong Kong Disneyland Resort, without losing any customers. This demonstrates the pricing power that Disney encompasses and its wide competitive moat in Asia & Europe. Given its high hotel occupancy rates and the expansion of Disney Cruise Line’s fleet, I expect the future performance of its park, entertainment and products segment to look bright in the future.

Disney parks, experience and products financial performance (Disney)

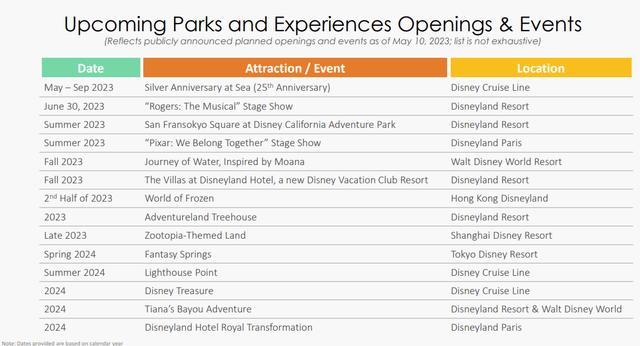

To add on, Disney is now utilising its CapEx to upgrade its facilities across its theme parks, by creating more new attractions and experiences in an attempt to improve guests’ experience and add value to them. The elevated customer experience will likely drive more family or household visits to Disneyland.

New openings in theme parks (Disney)

Financial Analysis

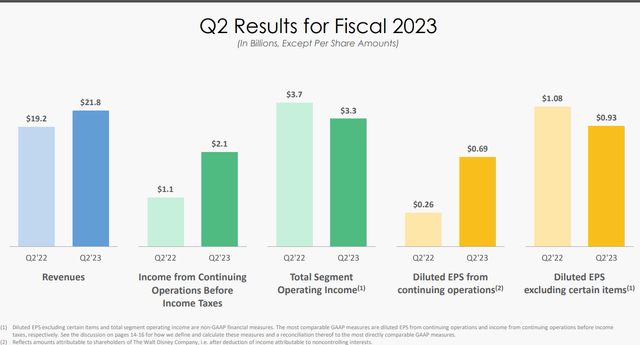

Q2 2023 Financial Performance (Disney)

Overall, I consider Q2 2023 to be a mixed result for Disney. Its total revenue grew by 13% YoY from $19.2 billion to $21.8 billion. Its Diluted EPS from continuing operations has risen from $0.26 to $0.69 YoY. However, total segment income was down by close to 10% from $3.7 billion to $3.3 billion.

The mixed results can be attributed to the underwhelming performance of the Media & Entertainment Distribution division, mainly offset by the robust performance of the Disney Parks, experience and Products segment division.

However, despite its underwhelming performance in DMED segment, I see a bright future for Disney to grow its DPEP sector.

For example, the DMED segment revenue has risen by merely 3% YoY, from $13.6 billion to $14 billion. This was primarily driven by the underwhelming performance of its Linear Network segment, which has seen its revenue fall from $7.1 billion to $6.6 billion due to the lower ad revenue and higher production costs from sports and TV programs from ESPN and ABC respectively. However, this was offset by the robust performance of the DTC segment, which has seen its revenue rise from $4.9 billion to $5.5 billion and Disney + is expected to achieve financial breakeven this year.

As for its DPEP segment, its revenue grew by an astonishing 17% YoY from $6.6 billion to $7.78 billion. This was primarily driven by the robust performance of the international theme parks and post-pandemic recovery of its cruise line and resilient consumer spending on durables in the US this year. Thus given its robust performance in the DPEP segment, I expect Disney to further raise its ticket price for the next 2 years across its theme parks, which will further boost its revenue and top-line growth for years to come.

Valuations

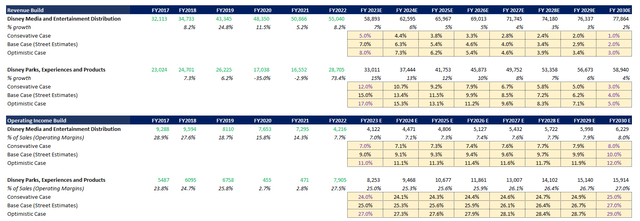

Revenue and Operating Income forecast (Author)

Based on my personal assumption, I am forecasting growth in Disney’s Media and Entertainment Distribution segment revenue of around 7% in 2023 (i.e., $58 billion) and decrease progressively to around 2% in 2030 (i.e., $77 billion), given the underwhelming performance in ESPN & ABC, partly offset by the increasing monetization efforts from Disney+. As for Disney’s Parks, Experience and Products segment revenue, I am forecasting double-digit growth in this segment of around 15% in 2023 (i.e., $33 billion) and decline to around 4% in 2030 (i.e., $58 billion) based on its pricing power to raise ticket prices, increase in traffic volume due to better new games attractions across globe and expansion of the cruise fleet.

As for its Operating Margins, I predict DIS’s operating margins to be around 7-8% for its DMED and 25-27% for its DPEP segment, which is in line with the company’s historical track record. After subtracting the ~$6-7 billion of capital expenditures for future theme parks expansion and content creation annually, and around $ 1-2 billion for changes in NWC, we’re left with $8-10 billion of annual unlevered free cash flow for the business annually.

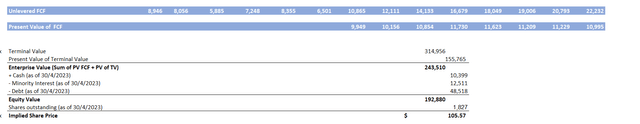

By using a Discount Rate of 9.2% and a perpetual growth rate of 2%, I have arrived at an Enterprise Value for Disney of around $243 Billion. By adding back, the $10 billion of cash while subtracting its total debt of $48 Billion and minority interest of $12 billion, and dividing it by the total amount of outstanding shares of 1.8 billion shares, I have arrived at a Fair Value of DIS for around ~ $105.5-110 per share, implying a 20-30% upside!

Disney intrinsic value (Author)

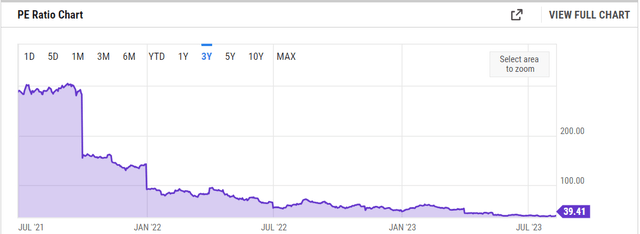

Just to provide another perspective, by using comparable company analysis, DIS is now trading at a P/E of 39x, well below its triple digits P/E last year, which could be an indicator that Disney is now finally trading at a fair value.

Potential Risks

Despite its growth prospect as well as its underappreciated valuation, there are still some underlying risks behind the business that are worth considering before you make an investment.

Legal Disputes In Florida

First of all, Disney has been entangled in a legal dispute in Florida. Governor Ron DeSantis has launched an “Anti-Woke” campaign and has terminated Disney’s privileges in Florida. As a result, this has tarnished Disney’s reputation among conservatives in America and has led to criticisms from the GOP Party.

However, I believe such a phenomenon shall be insignificant. Despite its recent political struggle, Disney’s domestic theme parks revenue has also risen by 14% from $4.9 billion to $5.6 billion YoY despite the recent legal dispute. Hence, short-term political headwinds shall not impair DIS’s long-term entertainment reputation in the US, which shows that investors’ fear shall be grossly magnified.

Underperformance From The Linear Network Segment

To add on, the Linear Segment network has been considered underwhelming, given the decline in revenue from $7.1 billion to $6.6 billion and operating income from $1.9 billion to $1.1 billion, due to the lower ad revenue and higher production costs from sports and TV programs from ESPN and ABC respectively. To add fuel to the problem, subscribers’ engagement and number of subscribers have also seen declining trends. As a result, the underperformance of ABC and ESPN has hampered the growth of Disney as a whole.

While investors’ concerns are valid, I expect the problem to be alleviated in the foreseeable future. The CEO of Disney Bob Iger is planning to spin off ESPN next year, and I think such a spin-off will likely allow Disney to concentrate on its content productions and DTC businesses, including Disney+ and focus on delivering better customer experiences and building more new attractions for its theme parks, allowing Disney to unlock its value by concentrating on its main business.

Thus, if the spin-off were to happen, I expect such M&A transaction to reduce the debt for Disney and generate extra cash for the company to distribute dividends or buy back shares for shareholders, which will be great news for shareholders.

Conclusion

Despite the recent plummet in share price, I personally think that Disney remains well-positioned for future growth, supported by its continued monetization effort for Disney+, its cost-saving measures as well as my forecast for its future robust performance from its theme park segment. Its differentiation in its reputation and intellectual properties also make DIS strongly positioned among its competitors over the long run.

Given its recent dip in price and is now trading at a nearly 10-year low, I rate Disney as a great “Buy” from a current perspective given its reasonable valuation with a 20-30 % upside potential from my fair value assumption.

Thus, I think that investors shall ignore Disney’s short-term headwinds and focus on its long-term economic strength and its strong brand reputation. As Warren Buffett mentioned, “Be greedy when others a fearful”. Time to be greedy when Mr. Market is pessimistic!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.