Summary:

- Nvidia Corporation hit our target price of $480 providing the opportune time to exit on momentum at a premium price.

- The company is facing an AI GPU chip shortage potentially limiting sales growth and pushing customers to seek cheaper alternatives from AMD.

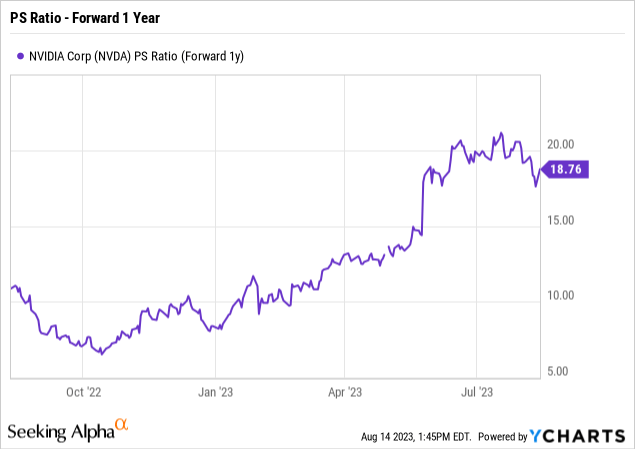

- The stock still trades at a very expensive 17x FY25 sales that appear increasing difficult to meet, much less exceed.

BING-JHEN HONG

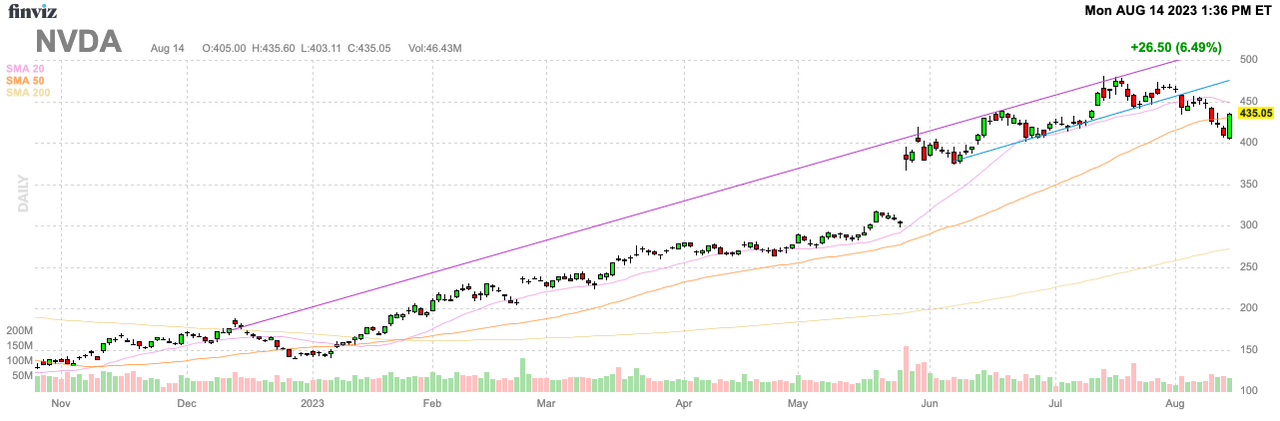

Unfortunately, these articles can’t be written fast enough, but Nvidia Corporation (NASDAQ:NVDA) hit our prior price target and rolled over the last few weeks. The stock jumped nearly 200 points on soaring AI GPU demand, but the company is likely running into supply issues that will dampen sales. My investment thesis is now Neutral on the chip stock with the momentum dead, especially after the 5% bump from Morgan Stanley.

$480 Target Hit

In our previous research, Nvidia was trading around $400 after reporting a quarterly beat and guiding up to huge demand for the recently ended July quarter. Due to the surge in demand and the expectation for growth to continue in the quarters ahead, the prediction was as follows:

At somewhere around $450 to $500, investors should probably look for an exit point. The stock has to hit $480 to match the previous forward P/E multiple of 50x… As Nvidia Corporation stock approaches $500, the positive returns will start to diminish and investors would be wise to finally take profits.

The stock topped $480 on July 14 and investors had nearly 2 weeks to unload the shares close to this level. Nvidia now trades at $408, and investors that weren’t ready to unload the stock have seen the gains of the last month disappear.

Investors are now back in no man’s land without Nvidia having the momentum of back in late May. A big problem with the GPU chip company hitting aggressive financial targets is an apparent lack of supply.

According to Adam D’Angelo, CEO of Quora and former Facebook CTO, AI GPUs supply issues are drastically limiting AI model training:

One reason the AI boom is being underestimated is the GPU/TPU shortage. This shortage is causing all kinds of limits on product rollouts and model training but these are not visible. Instead all we see is Nvidia spiking in price. Things will accelerate once supply meets demand.

Nvidia H100 GPUs are so hot, Elon Musk suggested it’s easier to get drugs. The bottleneck could create a negative outcome where customers end up reaching out to competitors with cheaper AI GPUs hitting the market soon.

Supply Problems

According to some research by GPU Utils, the major cloud providers and LLMs have demand for up to 432K H100s. At $35K each, the sales backlog was up to $15 billion before including any of the Chinese cloud providers, whom will want to grab any Nvidia AI GPUs the U.S. government will allow.

Nvidia reported $4.3 billion worth of data center revenue in the April quarter and guided to around $8.2 billion for the recently ended July quarter. The chip company will report quarterly numbers on August 23, after the market close, with revenue estimates of around $11.1 billion. Oddly, the analyst estimates barely top the company estimates.

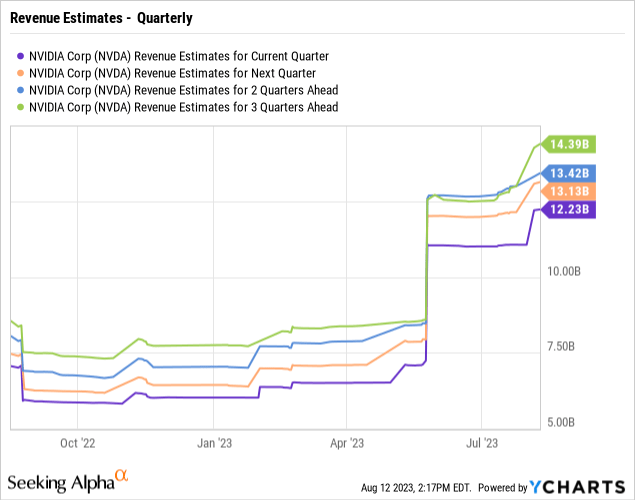

The biggest issue is that Nvidia appears incapable of meeting the massive demand for AI GPUs. Analysts have forecast the following quarterly sales numbers, following the ~$11.1 billion target for FQ2’24.

Nvidia needs to add ~$1 billion in additional revenues each sequential quarter to meet analyst forecasts. The demand appears to be there, but the supply is a big question.

In addition, the delays in supply only means that Advanced Micro Devices (AMD) absorbs some of the additional demand when the MI300 hits market in Q4. In the recent Q2’23 earnings release, CEO Lisa Su was clear that multiple cloud providers were engaging AMD for major GPU orders, with engagement for AI chips seeing a 7x increase in demand just during the June quarter:

Our AI engagements increased by more than seven times in the quarter as multiple customers initiated or expanded programs supporting future deployments of Instinct accelerators at scale. We made strong progress meeting key hardware and software milestones to address the growing customer pull for our data center AI solutions and are on-track to launch and ramp production of MI300 accelerators in the fourth quarter.

Both companies rely on Taiwan Semiconductor Manufacturing Company Limited (TSM) for GPU supply, convoluting the supply situation. Data suggests Nvidia and AMD are the largest customers for the chip on wafer on substrate (CoWoS) advanced packaging capacity needed for the MI300 from AMD and the H100 from Nvidia.

On the Q2 ’23 earnings call, CEO Lisa Su suggested AMD had already gained significant capacity for the MI300, possibly suggesting these orders with TSM were in place prior to the huge sales ramp seen by Nvidia recently (emphasis added):

So, I’m not going to comment on the exact units, but what I will say is that we’ve been focused on the supply chain for MI300 for quite some time. It is tight. There’s no question that it’s tight in the industry. However, we have sort of commitments for significant capacity across the entire supply chain. So, CoWoS is one piece of it, high bandwidth memory is another piece of it and then just the general capacity requirements and look, our goal is to make this a significant growth driver for AMD, I think it’s a great market opportunity. We love the engagements with customers, it’s our responsibility to provide the supply for the demand and so that’s what we’ve been working on.

Without the extra TSM supply, customers appear to be lining up at AMD. Nvidia will face a tough road growing exponentially from a $11 billion quarterly revenue base needed to maintain a stock back closer to $500 with TSM apparently lacking wafer supply growth until the end of 2024, when wafers will nearly double to 20,000 per month.

The other major question is whether AMD has a better GPU product than Nvidia. The MI300 has glowing reports from sites like SemiAnalysis highlighting greater bandwidth and higher capacity compared to the H100 from Nvidia. Even Cambrian AI Research questions whether the MI300 isn’t the better GPU, though a lot is still unknown about when the chip hits the market in volume and what the H100-next looks like next year.

Nvidia still trades at over 19x FY25 revenue targets. The stock only trades at 39x FY25 EPS targets, but the supply bottleneck appears problematic for hitting the current aggressive growth targets requiring sales to grow over 31% in FY25 to hit $57 billion, or the equivalent of over $14 billion in revenues per quarter.

Takeaway

The key investor takeaway is that Nvidia Corporation already likely has peaked for the short term. Investors paying attention to targets were prepared to jump ship at $480, instead of facing a scenario where the stock has fallen and the quarterly earnings targets appear at risk due to supply and upcoming competitive threats. For this reason, Nvidia isn’t a stock we want to own at this price going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.