Summary:

- Nvidia Corporation is heading into its upcoming Q2 report with one of the highest expectations I have seen in recent times.

- Should Nvidia meet the expectations, it would show an impressive EPS growth of 300% and revenue growth of 65%.

- I believe the stock is priced for beyond perfection that even great numbers may not be enough.

- I believe in the long-term potential of Nvidia, but please consider hedging your bets.

jetcityimage

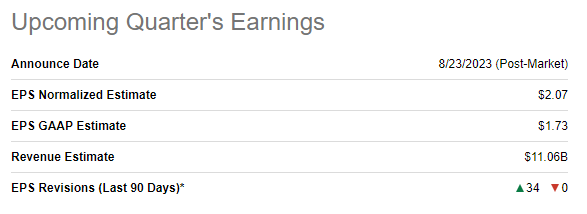

Nvidia Corporation (NASDAQ:NVDA) is expected to report results for its FY 2024 Q2 that ended July 30th, 2023, post-market on Wednesday, August 23rd. Analysts expect NVIDIA to report a Non-GAAP EPS of $2.07 on revenue of $11.06 billion. Should Nvidia meet these numbers, it would represent an EPS growth of 300% and revenue growth of 65%. Yes, you read that right. No wonder the stock has been on a run for the ages, despite the recent 15% pullback.

NVDA Earnings Summary (Seekingalpha.com)

In my last coverage on NVIDIA, I suggested investors to use Covered Calls to avoid selling their shares too early, while rating the stock a “Hold.” Since then, the stock has lost nearly 7% compared to the market’s ~2% gain.

With that background out of the way, let’s preview Nvidia’s fiscal Q2 without any further ado.

Enormous Expectations+

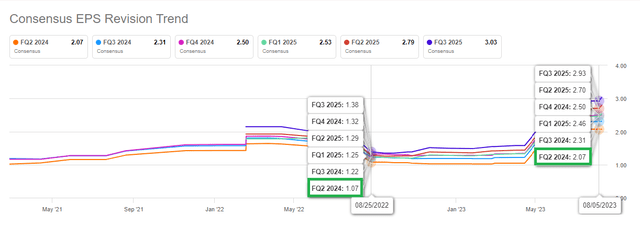

You may recall that it was the guidance for this quarter that sent Nvidia stock soaring after its Q1 results. Analysts now expect the company to report $2.07/share, and this number was about half of it a year ago.

FQ2 Revenue Estimate (Seekingalpha.com)

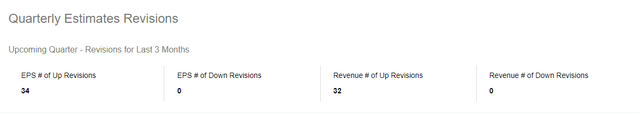

In the last 3 months, 100% of the EPS revisions and 100% of revenue revisions have been to the upside. Obviously, Nvidia helped its case with its own massive guidance but the company is going into the quarter with a lot more pressure than previously. I find a lot of similarities between Palantir Technologies Inc.’s (PLTR) situation, which I previewed (and was right) recently. Palantir met its Q2 numbers on both top and bottom-lines and also increased full-year sales forecast but the stock sold-off in a classic case of “buy the rumor, sell the news.” I expect a similar report from Nvidia, where it mostly beats or meets on all metrics, but I believe the expectations are super-sized at this point for the stock to have a meaningful run up in price.

NVDA Estimates Revisions Count (Seekingalpha.com)

Beat or Miss? I Say A Beat Which May Not Be Enough

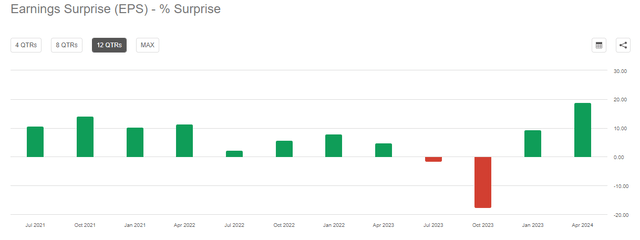

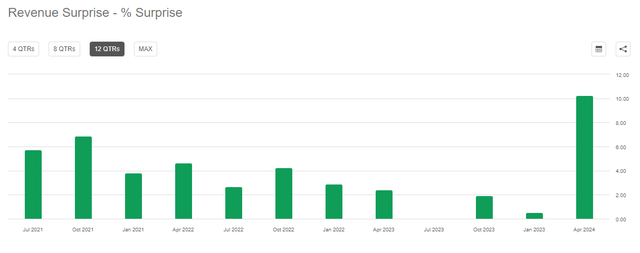

In the last 12 quarters, Nvidia has beaten EPS estimates 10 times and revenue estimates 12 times. In the 10 quarters that Nvidia beat, the average surprise to the upside was a healthy 9.60%. Revenue beats in these 12 quarters average a much smaller 3.83%.

Going by this history, I expect a very small miss or beat on revenue combined with an EPS beat by at least 10%. But I don’t expect these to move the stock higher given the lofty expectations. I believe the entire market, not just Nvidia investors, will be looking at the company’s guidance for Q3 with more interest than Q2’s results.

NVDA EPS Surprise (Seekingalpha.com) NVDA Revenue Surprise (Seekingalpha.com)

Main Stories – No Prize For Guessing

- Nvidia’s earnings plus guidance will provide a company-specific as well as general economy-wide indication of demand for AI. More than just demand, this report is also likely to provide an early insight into the economic viability of the AI mania.

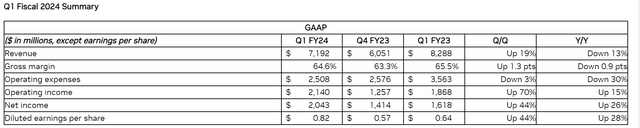

- I’ll be paying special attention to the company’s gross margin, which was guided for 70% (non-GAAP) and is a significant step-up from the already impressive mid 60% the company reported in Q4 2023 and Q1 2024.

NVDA Q1 Numbers (investor.nvidia.com)

- It will be interesting to hear the company’s comments, if any, on U.S. ban of investment in key Chinese Sectors. It was reported recently that some major Chinese companies placed orders as much as $5 billion to buy Nvidia’s chips as a result of this ban.

- Nvidia reported a slight reduction in cost of revenue YoY in its Q1. I expect this trend to reverse and for the company to report a higher cost of revenue in Q2 given the monumental increase expected in revenue. However, the key will the increase as a percentage when compared to the revenue increase as it factors directly into the margin discussed above.

Valuation – The Multi-Billion Dollar Question

Just like in my Palantir review, I admit here, too, that it is hard to value a trend setter. Nvidia is not just the trend-setter, but the one who sells shovels (chips) when everyone is digging the AI gold rush. Irrespective of who finds the gold first or how many companies share the gold mine, Nvidia appears like the undeniable leader in selling the shovels.

However, in the short to medium term, it is hard to not acknowledge the stock’s overvaluation as indicated by the following metrics:

- a forward multiple of 50

- a sales multiple of nearly 40 based on 2022’s revenue of ~$27 billion

- a sales multiple of 7 based on 2033’s revenue estimate of $136 billion. That means, the company is expected to grow revenue at a compounded annual growth rate of 16%/yr for the next 10 years. This may sound easy given the expected 65% revenue growth this quarter but this is easier said than done over 40 quarters.

NVDA in the AI Ecosystem (Linkedin.com)

Technical Strength – Showing Cracks

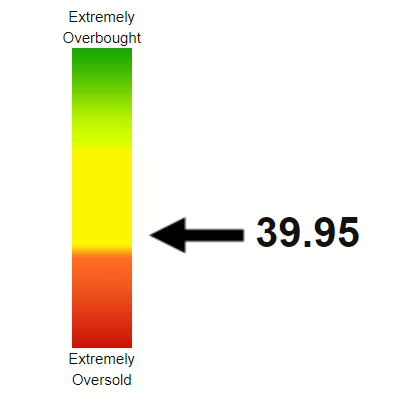

If you feel like Nvidia jumped straight from $108 to $480 before you could blink, you are not alone. It was a ferocious move, backed by general AI craze and the company’s unprecedented guidance surprise to the upside in Q1. But that also means there are technical gaps to fill in the chart. Experts believed a couple of days ago that the recent downtrend was extremely likely to take the stock to at least $400 (it is at $408 right now) and a weak earnings report combined with macro weaknesses may take the stock to as low as $350.

The stock’s Relative Strength Index (“RSI”) of ~40 is not surprising given the 15% pullback to $408 from recent high of $480. As everyone would have known and seen by now, this stock thrives on momentum. So, while an RSI for 40 may make a case for oversold conditions by textbook definition, I believe the set-up here indicates a sharp selloff, should earnings and guidance not exceed the lofty expectations.

NVDA RSI (Stocrsi.com)

Conclusion

Over the long-term, I fully expect Nvidia investors to come out with handy profits. This is a company that has reinvested itself over the years under the man I consider the most-grounded CEO in his field, Jensen Huang. It is hard to believe at this point, but NVDA stock was trading around $5 till 2015 and the recent move to $480 meant that those who stuck had a 96 bagger on their hands. Obviously, this is a load of hind-sight bias and cherry picking but the larger point is that the company has shown the ability to survive through tough times to thrive later.

But even the best of companies can have their stocks completely disconnected from reality. Despite eating crow after my Q1 review, I still believe Nvidia Corporation stock is extremely overvalued at present heading into Q2 report. I expect Nvidia to report impressive numbers but not impressive enough for the stock to run higher at its current valuation. If you are sitting on massive gains, it may not be a bad idea to trim your gains or hedge your bets by using strategies like Covered Calls.

What do you think of Nvidia’s upcoming report? Please leave your comments below.

Disclaimer: I do not currently hold a position in Nvidia Corporation stock but may trade it on either long or short side for leading up to and after earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please see disclaimer.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.