Summary:

- Although AT&T is not suitable as a long-term investment, the price drop to sub $14.50 is too good to pass up.

- AT&T is coming through a cycle of high spectrum license spend and other capital expenditures, freeing up cash flow to pay down debt.

- The risk of interest rate costs consuming AT&T’s balance sheet appears minimal given their desire to pay down debt by $18.5B over the next 2 years.

- The lead cable issue is serious but the selloff is overblown.

Storm clouds are brewing but sunnier days are ahead Ronald Martinez

Back in May, we recommended selling AT&T (NYSE:T) in an article entitled AT&T: A Long-Term Disappointment because the stock is unsuitable as a long-term investment for the following reasons:

- Earnings from continuing operations are flat over 10-years

- Their history of public acquisitions has been disastrous, especially DirecTV

- Although their fiber and wireless businesses are growing nicely, their copper/wireline business is a drag on earnings

All that remains true, and the Wall Street Journal piled on more reasons to sell with their article entitled, “America is wrapped in miles of toxic lead cables.” The implication was that AT&T is on the hook for billions in clean-up costs to remove miles of lead-clad copper wires and this led to a series of sell-side analyst downgrades. Clearly their wireline business continues to challenge their stock price and balance sheet. The stock which had been selling for $20 in April is now down to $14 and change. If AT&T remains a sell based on any long-term thesis, is it worth buying on a short-term tradable basis? That’s the question we will answer in today’s article.

AT&T’s EPS

In the previous article, we determined that EPS (earnings per common share) was a good proxy for the return on common stock. Knowing this, let’s provide a 1H 2023 recap and compare it to previous years EPS from continuing operations:

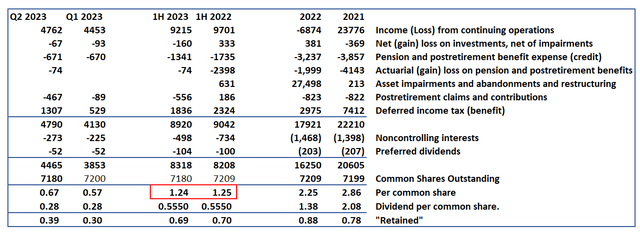

AT&T’s EPS Q2 2023 (AT&T’s SEC filings)

Figures are in millions of dollars. From the chart we can see that earnings per share (excluding certain one-time impacts) are $1.24 in 1H 2023 vs. $1.25 in the 1H 2022 (red box). AT&T’s earnings appear consistent but flat. This dovetails with the long-term analysis which showed a similar trend.

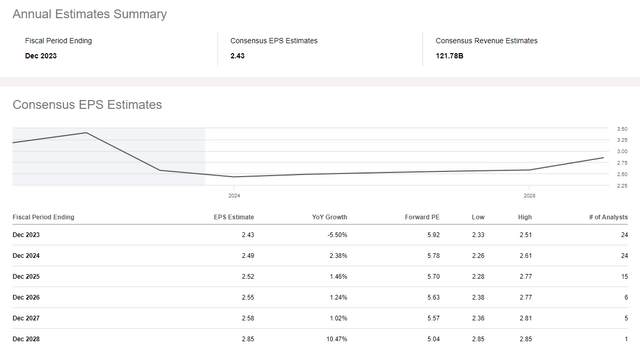

Earnings estimates put AT&T in this flat earnings cycle through 2028 with full 2023 estimates at $2.43 rising slightly to $2.58 by 2027 (5 analysts providing guidance).

AT&T Earnings Estimates through 2028 (Seeking Alpha)

Is AT&T a Fair Buy at $14

If AT&T isn’t a growth stock, is the $2.43 to $2.58 EPS per share a bargain at $14? It depends on your time horizon. At $14, AT&T is a broken stock. The only thing that fixes a broken stock with little growth is free cash flow and time. A $2.49 per share yield in 2024 at $14 is 17.8%. That’s a healthy return. Typically, the cure for a volatile stock price is to take the following measures, in this order:

- Reduce headcount and cut costs (in progress)

- Reduce debt (in progress)

- Initiate a new stock buyback program (may come as soon as 2025)

In 2022, AT&T repurchased approximately 34 million shares under a March 2014 share repurchase authorization (which has 144 million shares remaining as June 30th 2023). To materially affect the stock price, a larger stock buyback program is needed, and this will require a significant amount of free cash flow.

Spectrum License Spend

AT&T generates a lot of free cash flow, but that cash flow has been consumed recently by purchases of spectrum licenses (along with billions in additional capital expenditures that are also required under normal circumstances).

AT&T’s Spectrum License spend per year (Author with data from AT&T’s annual reports)

Figures are in millions of dollars. A negative number indicates a sale of spectrum licenses. AT&T expects to pay another $2.1B for spectrum licenses in the 2H of 2023 for a total of $2.615B for all of 2023. This has come down from a peak of $25.4B in 2021 and down from an average of $6.453B per year.

A quick note about spectrum licenses. These are wireless licenses auctioned by the FCC in competitive bids, and they support AT&T’s wireless business. Those licenses typically run for 10-15 years and are periodically renewed for relatively modest sums. The licenses are valuable and get reported on the balance sheet as assets (not expenses). AT&T owns $124B in licenses, a sum almost equal to their entire long-term debt which is currently clocked in at $128B. (If we were to convert the cost of the spectrum licenses into a per year expense, it would be equal to the interest payments of that debt or $6.6B per year).

While licenses don’t show up as expenses, they consume lots of free cash flow which is bad for a stock price recovery. The great news for AT&T is that major purchases of spectrum licenses move in cycles, and they’ve just come through a big one. This has opened a window for AT&T to pay down their debt and potentially return cash to shareholders in the form of a buyback.

Cash Flow and Debt Reduction

Let’s look at cash flow (figures in millions of dollars):

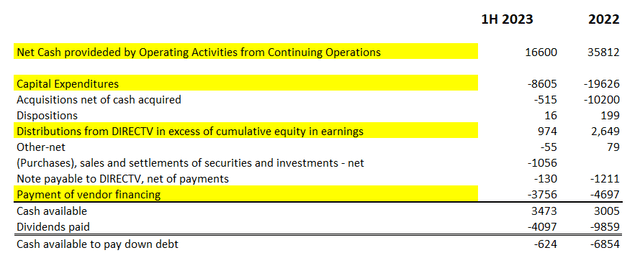

AT&T Cash Flow Statement (Author with data from AT&T’s SEC filings)

AT&T’s definition of free cash flow includes only the items highlighted in yellow. They are guiding to $16B in free cash flow and through 2 quarters, they’ve earned $5.2B (by their definition). That leaves $10.8B for the 2nd half of which we will subtract $2.1B in spectrum licenses. They are done with the note payable for DirecTV related to the NFL ticket costs, so they will have about $9B total to pay $4B+ in dividends and $4B in debt and then increasingly pay down debt in 2024.

John Stankey stated in the earnings call that AT&T remains “committed to achieving the 2.5 times range for net debt to adjusted EBITDA in the first half of 2025.” Interest expenses rose 6% (1H 2023 vs. 1H 2022), but this rise in interest expenses will be offset by debt reduction on a go-forward basis. As of the end of 2022, their weighted average interest rate of AT&T long-term debt portfolio was 4.1% (rising 0.3% over 2021).

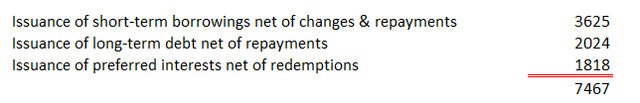

Given the negative free cash flow after dividends of negative $623MM in 1H 2023, how did AT&T fill the shortfall? They borrowed more and sold preferred interests, and in fact borrowed more than the shortfall (stated in millions of dollars):

AT&T’s Financing Activities (AT&T SEC filings)

Leverage Ratio

Adjusted EBITDA in 2022 was $41.5B (by AT&T’s definition) and net debt was $132.2B or a net debt to adjusted EBITDA of 3.19. They have covenants ranging from 3.75 to 4.0 net debt to EBITDA and are not in danger of breaching them, but they need to pay down debt to maintain their credit ratings and keep their interest costs from rising out of control. Their goal is to pay down debt and increase adj. EBTIDA incrementally to achieve their goal.

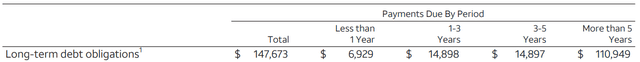

Net debt is up to $133.8B as of Q2 2023 and adj. EBITDA was $21.74B (annualized is $43.48B) or a ratio of 3.08. They’ve committed to saving an additional $2B per year over the next 3 years (primarily through a workforce reduction and other cost-cutting measures). Summing that up, it’s grow a bit, save a bit and pay down $18.5B of debt. With their capital and spectrum investments decreasing in subsequent quarters, leadership seems confident they can hit their targets. In any case, paying off $18.5B in long-term debt will cover most notes due in the next 3 years. Again, figures are in millions of dollars:

AT&T’s Long-Term debt by maturity year (AT&T’s 2022 annual report)

The next $19.4B in notes comes due from 2025 to 2029. If that tranche of notes were due today, AT&T would see interest costs rise by $409MM per year. However, they can pay down debt by $1.75B per year starting in 2026 to offset these rising costs. In short, their debt bubble, while large, appears to be under control. With debt estimated to be under control by 1H 2025, more free cash flow is potentially available for buyback.

Lead Cables Risk Assessment

Lead is a hazardous substance that when ingested can cause adverse health effects in humans, especially children. Because of this, the Environmental Defense Fund has taken aim at over 2000 lead-sheathed telecom and power cables across the nation with more than 300 of them posing a potential risk to drinking water.

Analysts at Goldman Sachs (GS) and Morgan Stanley (MS) both estimated that the removal of these lead-sheathed cables across AT&T’s entire network is between $2 billion and 4 billion about $0.28 to 0.56 per share. Raymond James put the figure at between $264MM and $1.2B spread out over 15-25 years or an annual cost of $84MM. Let’s be clear, AT&T is not going to let $4B or even $264MM walk out the door without objective evidence, but the $4B figure gives us a place holder until more information is gathered by the EPA and other qualified and independent laboratories. The EPA and DOJ have both initiated investigations to help quantify the potential exposure.

According to AT&T’s public court filings in the case of the lead cables buried beneath Lake Tahoe, the plaintiff must prove in court that lead cables pose a danger to the public health by showing that the cables are leaching significant quantities of lead into the environment and must show that this lead is being consumed in sufficient quantities to pose a hazard to human health. Previous testing by AT&T’s retained environmental consulting firm in 2021 showed no such contamination even when samples were taken 4 inches from the surface of the cables. (Note: these water samples were filtered to remove sediment which could contain lead, but this is a common practice for treating drinking water.) To date, this is the only quantifiable test that has been filed with the court.

If the cables under Lake Tahoe are leaching lead into the surrounding waters, then that tiny amount of lead would be diluted into tens of trillions of gallons of water. Both the Environmental Defense Fund and AT&T agree that further testing should be done before removing the cables. A bet on AT&T at $14 is a bet that the exposure to AT&T’s balance sheet remains at $4B or less. As stated, this is a high estimate and represents $0.56 per share or about one quarter’s free cash flow.

Conclusion and recommendation

The risk of interest rate costs consuming AT&T’s balance sheet appears minimal given their desire to pay down $18.5B over the course of 2 years. While the lead cable issue is serious, the selloff is overblown. As stated in the previous article, AT&T is not a long-term investment, but can be used as a vehicle for short-term gain (3 years). I recommend buying AT&T at $14.50 or less with a 3-year price target of $19.50. You can also synthesize a long position using options by selling the put and buying the call. Be greedy when others are fearful.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.