Summary:

- Despite its soft guidance in May, Medtronic buyers didn’t give up the $80 level. As such, I assessed that its worst is likely over as it bottomed in December 2022.

- The company is scheduled to report its first-quarter earnings release on August 22. Buying sentiment remains cautious, suggesting investors expect a relatively tepid scorecard.

- However, MDT is no longer overvalued and could outperform its cautious outlook if the market dynamics improve further.

- I make the case why investors anticipating a more optimistic performance from the leading healthcare technology company should capitalize on the market’s pessimism.

- Comment and let me know whether you concur with my Buy rating.

Chris Hondros/Hulton Archive via Getty Images

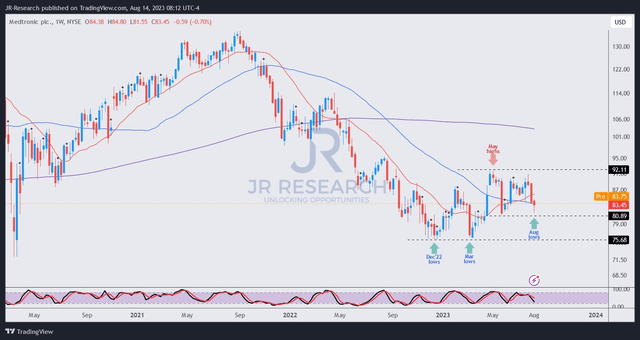

Investors in leading healthcare technology company Medtronic plc (NYSE:MDT) saw the stock recover remarkably from its March lows as it outperformed the S&P 500 (SPX) toward its May 2023 highs. In an early April update, I highlighted to investors that I assessed MDT’s late December 2022 bottom seemed robust and should hold.

Notwithstanding MDT’s early outperformance, the company’s FY24 guidance promulgated at its late May 2023 earnings call disappointed investors. While it led to a steep decline post-earnings, buyers returned in force to defend against the slide before MDT consolidated.

As such, MDT’s price action since May’s significant selloff has remained in a consolidation zone but nonetheless still constructive. Therefore, investors are likely anticipating that Medtronic’s operating performance should inflect upward from here, in line with the recent recovery in the healthcare sector (XLV).

MDT’s valuation is no longer at its overvalued highs, as it last traded at a forward EBITDA multiple of 14.6x, compared to its 10Y average of 13.8x. Notwithstanding the normalization in its valuation, it remains priced at a premium against its peers’ median multiple of 12.2x (according to S&P Cap IQ data). My observation is supported by Seeking Alpha’s Quant valuation grade of “D,” suggesting relative overvaluation.

Hence, the early 2023 recovery thesis has dissipated, as buying sentiment remains cautious, given the company’s “more conservative” guidance. Management suggested its caution is designed to set the company up for success. However, I believe the company’s caution doesn’t quite align with improved market dynamics, as highlighted by management. Coupled with improved macroeconomic conditions increasingly pointing to a soft landing, Medtronic’s soft guidance suggests increased execution risks in underlying demand that the company needs to address.

With Medtronic slated to report its first quarter (Q1FY2024) earnings release on August 22, investors are likely assessing the company’s pivotal outlook update before deciding whether to add further.

The revised analysts’ estimates suggest Medtronic is expected to post revenue growth of 3% in FY24, below its expected long-term run rate. However, it suggests that FY23’s revenue decline of 1.4% likely marked the bottom in the company’s growth inflection. As such, I believe buyers defending MDT’s December 2022 bottom at the $75 level is justified if the company can post more robust operating results moving ahead.

Furthermore, while management wasn’t ready to update when it could return to an adjusted EPS growth rate of 8%, analysts penciled in a 7.6% growth in FY25. However, that’s predicated against Medtronic’s “more conservative” midpoint guidance of $5.05 for FY24. In other words, the company could have sandbagged its outlook to bolster its ability to outperform from FY25, suggesting the worst is likely over.

MDT price chart (weekly) (TradingView)

I gleaned that buying sentiment on MDT is constructive, even after its steep May 2023 selloff. As such, buyers are likely confident about the company’s execution in FY24, as its sandbagged outlook lowered the bar for potential outperformance from FY25.

Investors must watch the $80 level carefully, representing a critical support zone underpinning MDT’s nascent uptrend recovery that must be resolutely defended.

MDT’s price action last week suggests that a bottom could be in play as Medtronic heads toward its FQ1’24 earnings card. Its higher low market structure corroborates my belief that the current buy levels are appropriate from a risk/reward perspective.

With that in mind, a better-than-expected earnings release could see momentum buyers returning to send MDT potentially surging and re-testing its May 2023 high of $92.

Therefore, I urge MDT holders to capitalize on its possible bottoming profile to add to their positions, as market operators have likely priced in a pretty tepid release.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!