Summary:

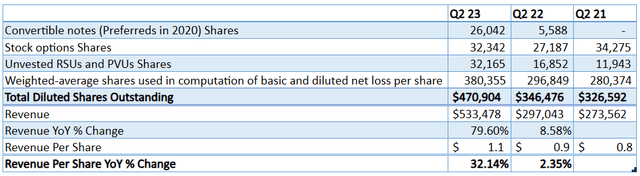

- Unity’s 31% YTD price surge is commendable but not special, with the company underperforming the Nasdaq Index.

- The path to profitability remains unclear, with a significant portion of R&D channeled towards sustaining market share as opposed to generating growth.

- The public’s interest in VR/AR applications is encouraging. However, the pace of adoption leaves much to be desired.

Arsenii Palivoda

Investment Thesis

As consensus grows around the idea that the Fed has successfully navigated a soft landing, the bullish sentiment in the market is palpable. The economy’s 2% growth in Q1 2023 and the more recent 2.4% rise in Q2 2023 are evidence of this resilience, reinforcing investors’ confidence.

Sensing that the tumultuous phase of the downcycle is ebbing, investors are now reconfiguring their portfolios to leverage the likely rebound. This optimism has been instrumental in driving the S&P 500 Index (SP500) up by 17% this year.

With the broader market setting a positive tone, certain individual players have made remarkable strides. Notably, Unity Software Unity Software Inc. (NYSE:U) has surged by 31% YTD.

This impressive rally can be attributed to multiple factors. Firstly, the ironSource acquisition seems to have addressed Unity’s data gaps from last year’s embarrassing glitch that permanently corrupted the Audience Pinpointer database, the cornerstone of its gaming ad business, thus, allowing the ticker to regain momentum.

Secondly, Unity’s foray into the burgeoning realm of AI has garnered significant enthusiasm, with the launch of Muse and Sentis, and generative AI libraries, including those incorporated in the Barracuda Project. These company-specific advances and the optimistic macroeconomic landscape have contributed significantly to the stock’s rally.

However, while Unity’s 31% surge is notable, suggesting a recovery after the stock’s steep 80% plunge since 2022, it is important to view it within the broader market context. Comparatively, the NASDAQ (NDX) index rose 38%, outperforming Unity on most trading days this year, as shown in the graph above.

Several underlying challenges continue to cast shadows over Unity. The company’s core mobile gaming business has matured, with current growth primarily driven by acquisitions rather than organic expansion and, to a lesser extent, the slow adoption of VR and Industry (non-gaming) 3D applications.

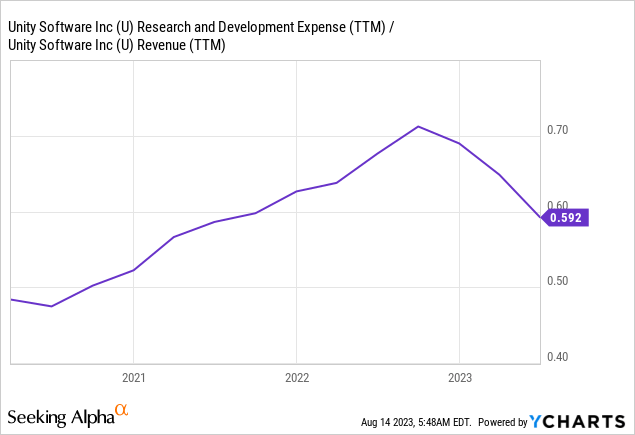

Valuation-wise, the stock doesn’t come off as a bargain, despite its decline from November 2021 highs. Finally, the company still has an unclear profitability path, and a significant portion of its R&D investments are channeled toward sustaining the functionality of its existing business lines, as opposed to driving growth.

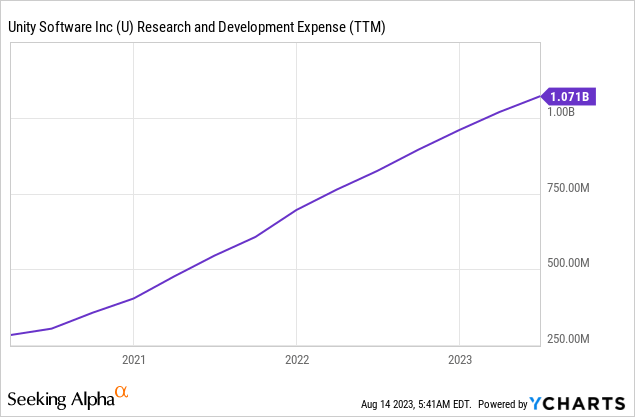

R&D

Unity’s commitment to R&D is unmistakable. A cursory look at their financial statements shows substantial investments in this area. The common perception is that such aggressive spending on R&D is a strategy to fuel growth. While not entirely misguided — as seen with the recent introduction of the PolySpacial Service for Apple’s (AAPL) Vision Pro, which expanded Unity’s Total Addressable Market ‘TAM’ — it paints a partial picture of the driving forces behind Unity’s R&D commitments.

Unity spends a significant portion of its R&D expenses just to sustain its current markets. Hardware and software changes to the broad range of devices supported by Unity, from the PlayStation to the iPhone, often bring a sea of changes, requiring immediate optimization to ensure that the games made on its platform run without glitches. For example, the introduction of the ‘Share’ button on the Xbox X/S controller required Unity to upgrade its input system to support the new button. Sony’s (SONY) PlayStation One’s high-end graphics and ray tracing forced Unity to upgrade its rendering pipeline. Such upgrades are less about harnessing new tech and more about not losing ground. This is the case each time Nvidia (NVDA) introduces a new Graphics Processing Unity ‘GPU,’ or Microsoft (MSFT), a new Windows OS or Google (GOOG) a new security feature upgrade to its Android OS, or Samsung a new device, or Sony a new Console and everything in between.

Thus, R&D is less of a choice and more a necessary, and I believe that investors should look at it as a Fixed Cost rather than an engine for growth.

Acquisitions

Unity’s acquisitions play a pivotal role in driving revenue and expanding its product portfolio, and given its high R&D obligations, operating leverage exists. This has been particularly noticed since the ironSource acquisition.

However, in pursuit of these acquisitions, Unity frequently issues new shares, which dilute the ownership stake of existing shareholders.

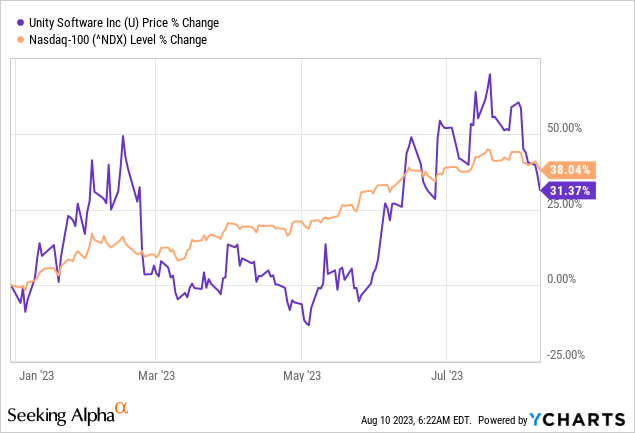

When calculating diluted Revenue Per Share, one notices that despite Total Sales nearly doubling between Q2 2021 and Q2 2023, revenue per share grew much less, at 30%.

Below is a table adjusting Unity’s outstanding shares to incorporate dilutive assets.

Whether Unity’s 15% arithmetic (30% divided by 2) annual growth is sufficient or not is subjective. However, I believe that the ironSource acquisition significantly distorted the leverage and dilution metrics, given that the funding came at highly favorable and likely unrepeatable covenants from two associates and minority equity holders of Unity; Silver Lake and Sequoia Capital, two well-known technology-centered investment funds.

The 2026 notes have a principal value of $1.7 billion, bear no interest, and have a conversion price that is ridiculously high at $308 per share. At the time the deal was negotiated, Unity shares hovered around $35 per share. I don’t believe that Unity can secure a similar funding deal with such favorable terms, especially in the current macroeconomic environment.

The covenants of the 2027 notes are a bit better to lenders, bearing an interest of 2%, and have a more reasonable strike price of $48 per share.

To put the deal into perspective, if Unity funded the ironSource acquisition via an At-The-Market ‘ATM’ equity offering instead of the convertible notes, diluted shares outstanding would have risen by 67 million shares instead of 26 million shares.

Beyond Mobile Gaming

The rapid development and interest in Virtual Reality ‘VR’ and Augmented Reality ‘AR’ presents significant opportunities for Unity, which is known for its robust 3D game development platform.

However, while the pitch above is appealing, and the promise of these technologies might lead to bullish sentiments and a willingness to pay a premium on U stock, investors would be wise to consider the broader factors that temper the pace of growth.

The first that comes to mind is the discomfort and nausea from using VR, and AR for that matter, in addition to the strain from headset straps around the head, at least from my experience using Meta (META) Quest 2. From my understanding, the nauseous feeling, also called VR sickness, is due to the discrepancy between the speed of the headset and neural signals in the brain. At this stage, the gap between headset speeds and human neurons is wide, and the technology has a long way to go.

Second, you have the fast depletion of the battery. VR requires significant processing power, and balancing the battery capacity with consumer price points will depend on electric storage tech developments.

Unity’s strongest bullish points are not VR/AR or generative AI. Instead, it’s the expansion into non-gaming ‘industry’ 3D applications. Currently, about 30% of Unity’s Create segment revenue comes from non-gaming users, ranging from real estate to vehicle manufacturers to marketing professionals.

The exact growth trajectory of non-gaming revenue is unclear, given that management does not regularly breakdown gaming and non-gaming users. Still, it is undeniably more than it was a few years ago. This growth was significantly influenced by acquisitions such as Finger Food in 2020 and internally-developed technologies such as Pyxis (third-party integration plugin), Forma, and Reflect.

Summary

Unity Software’s 31% rally this year may seem appealing, but a closer look reveals points of caution for investors. Here’s what you need to know before diving in:

- R&D Spend is a Necessity: Unity’s significant investment in R&D isn’t just about growth; it’s about keeping up with the tech landscape. Don’t mistake this for optional spending.

- Share Dilution Concerns: Unity’s frequent acquisitions, often funded by issuing new shares, dilute the value for existing shareholders. Watch the diluted Revenue Per Share metric.

- VR/AR Growth Isn’t Guaranteed: VR/AR significantly expanded Unity’s TAM, and interest has been encouraging, but adoption is slower than desirable, especially at the current valuation.

Given these factors, investors should be cautious. Evaluate the risks, and if you’re not happy, you can always gain risk-adjusted exposure to Unity by buying the Russel 3000 index via (IWV) or (VTHR) or any of the 56 ETFs holding Unity with various concentrations, from 5% ARK Next Generation Internet ETF (ARKW) to 0.1% Vanguard Information Technology Index Fund (VGT).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.