Summary:

- Unity reported strong Q2 results, beating analyst estimates on revenue and earnings.

- The company also raised Q3 and FY 2023 guidance and reiterated the $1 billion adj. EBITDA target by 2024.

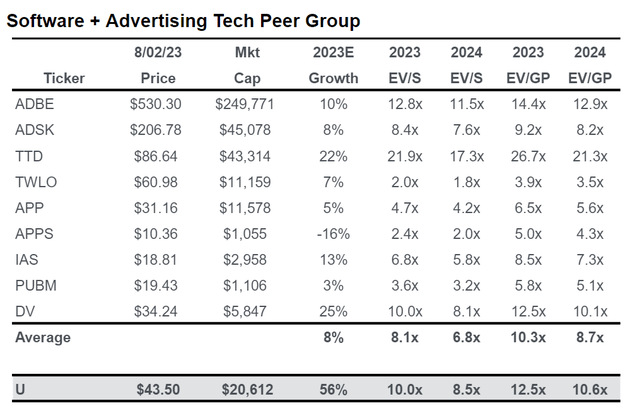

- Despite the solid business performance, however, Unity’s valuation looks stretched at 7x EV/ Sales, especially when compared to key peers.

- On valuation concerns, I rate Unity stock an Underperform/ Sell.

Sundry Photography

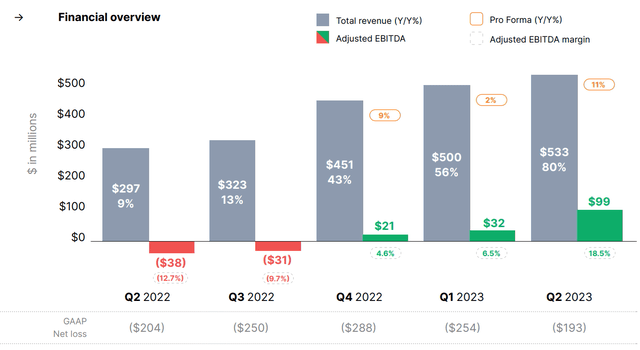

Unity (NYSE:U) software reported strong Q2 results, beating analyst consensus estimates on both top- and bottom-line. The firm’s headline 80% YoY growth is inflated, however, due to the ironSource merger. Unity’s revenue on a pro-forma basis excl. M&A would have resulted in a topline expansion of “only” 11%.

Unity’s pro-forma growth is only slightly above/ in line with the growth rates of leading FAANG giants such as Google (GOOG), Amazon (AMZN) and Microsoft (MSFT); however, Unity stock arguably trades at valuation multiples that would suggest a 5 year CAGR of ~20-30%YoY, referencing an EV/ Sales of approximately 7x.

Overall, I see a discrepancy of what the market is pricing vs. what the company is likely to deliver; and thus, reflecting on a likely overvaluation argument, I rate Unity stock an Underperform/ Sell.

For reference, Unity shares have outperformed YTD vs. the broader U.S. equity markets: Since January 2023, Unity shares are up about 36%, as compared to a gain of approximately 17% for the S&P 500 (SP500).

Unity Beats Expectations, But Hurdle Set Low

On August 2nd, Unity opened its books for Q2 2023, and delivered results above street expectations on both revenue and earnings: During the period from April to end of June, the software Company generated $533 million of revenues, which compares to $297 million for the same period one year earlier (80%) YoY growth, and to ~$515 million estimated by analysts at midpoint (~$18 million beat, according to data collected by Refinitiv). However, investors should note that Unity’s monster YoY growth was driven mostly by the acquisition of IronSource; on an ex. M&A pro-forma basis, the combined entity’s topline only expanded by about 11% YoY.

With regard to profitability, Unity’s adjusted gross margin increased by about 700 basis points YoY, to 81%; Unity’s EBITDA margin jumped 3,200 basis points, to 19%. In monetary terms, Unity’s EBITDA was reported at $99 million, beating analysts’ expectations of $58 million; free cash flow came in at $34 million. Finally, earnings per share were $0.25, topping the $0.08/ share estimate.

Looking at Unity’s Q2 performance in more detail, the “Create” business stands out: As compared to the same period in 2022, topline for create increased 17% YoY, to $193 million. “Grow”, on the other hand, only managed to expand revenues at a 7% YoY rate, to $340 million.

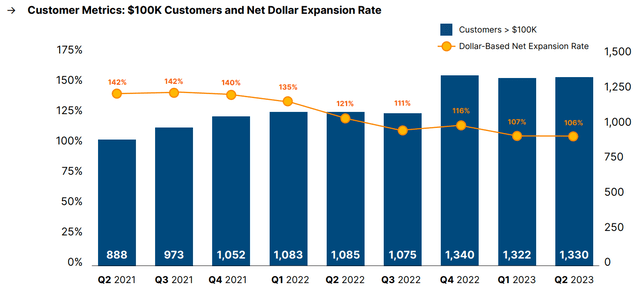

Finally, I would like to highlight Unity’s overall customer metrics, which are a bit concerning, in my opinion. Specifically, I am concerned about the downtrending dollar-based net expansion rate, as well as the “topping-out” of the number of customers.

Guidance: Beat and Raise, But Likely Not Enough

Looking ahead, Unity management remains optimistic about the company’s business; and together with Q2 results, management raised the FY 2023 guidance for Q3 and FY 2023.

For the third quarter, Unity now expects revenues in the range of $540-550 million, which would suggest a 7-9% YoY growth vs. a pro-forma benchmark; adjusted EBITDA for the third quarter is expected to fall somewhere between $90 and $100 million, with a midpoint margin of 17.4%. Notably, Unity’s profitability outlook for Q3 is considerably above Street consensus estimates, which have projected adj. EBITDA of about $79 million (according to data collected by Refinitiv).

For the FY 2023 revenue is now expected to be in the range of $2.12 to $2.20 billion, vs. $2.08 to $2.20 billion guided previously. Likewise, adjusted EBITDA has been raised to $320 million to $340 million, vs. an earlier range of $250 to $300 million.

Reflecting on Unity’s FY 2023 guidance, I am positive about the company’s ability to meet the $1 billion EBITDA target “promised” in connection with the ironSource merger.

So far, Unity’s synergy/ integration execution has been solid for multiple quarters; and, paired with a commitment to OPEX discipline, the company’s EBITDA margin has been steadily trending upwards – having almost achieved $100 million of EBITDA in Q2 2023. Accordingly, if questioned, I would give management the benefit of the doubt that they could target a $250 million EBITDA run rate by end of FY 2024.

Valuation Ahead Of Fundamentals & Peers

While Unity’s Q2 performance looks solid, and the company’s outlook encouraging, I would like to point out that U’s valuation looks stretched nevertheless. Because needless to say, at an EV/ Sales of approximately 7x, markets are pricing a lot of growth.

Piper Sandler recently published a research note comparing Unity’s valuation multiples to respective multiples of software-/ advertising-peers. As per the results highlighted below, it is evident that Unity trades at a premium to the peers’ average on all metrics.

Interestingly, Unity’s valuation is not really justified on a growth premium, because also the comparable peers are operating a growth business model. In fact, many of the names highlighted below have outgrown Unity on a YoY benchmark in 2023 YTD. Accordingly, I feel markets are overpricing Unity stock on a relative basis; and, I suggest at least 20% downside until the risk reward becomes more balanced.

Conclusion

Unity reported strong Q2 results, beating analyst estimates on revenue and earnings. Moreover, Unity raised Q3 and FY 2023 outlook, and the 2024 adj. EBITDA target of $1 billion looks reasonable.

While Unity’s business performance is solid, the company fails to outgrow comparable peers in the software/ advertising industry, despite U trading at a growth premium. Accordingly, I see little alpha potential for investors who buy U stock at a 7x EV/ Sales multiple; and, I suggest approximately 20% downside before the risk/ reward for an investment looks more balanced. I rate Unity stock an Underperform/ Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.