Summary:

- Meta Platforms is experiencing a recovery in the important advertising business, resulting in sequential revenue re-acceleration in Q2.

- The company reported a strong sequential increase in daily active users and submitted a strong outlook for Q3, indicating confidence that the rebound in the ad business will continue.

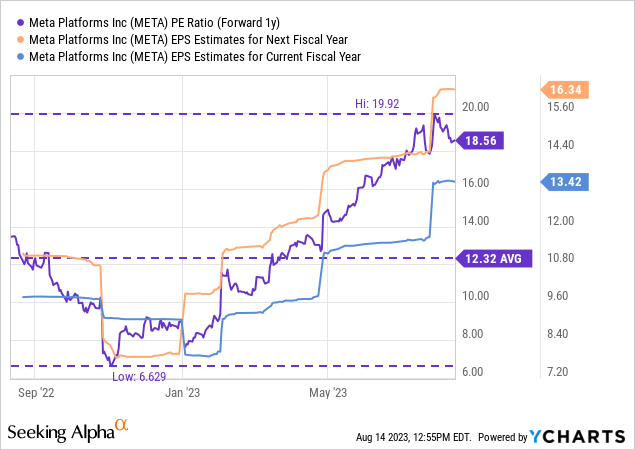

- Despite the positive trends, Meta Platforms’ shares are still expensive based on P/E.

- Improving business trends and the outlook for Q3 justify a rating upgrade.

panida wijitpanya

Meta Platforms (NASDAQ:META) is seeing a recovery in its digital advertising business which has resulted in a sequential revenue re-acceleration in the second fiscal quarter for the firm. Meta Platforms also reported a sequential increase in daily active users, a key growth metric for social media companies, and submitted a strong outlook for the third-quarter. While the recovery in advertising revenues is a strong reason to upgrade the company’s shares from sell to hold, I believe Meta Platforms’ earnings prospects are still expensive and investors may want to wait for a larger drop before engaging!

Previous sell rating

My previous rating on Meta Platforms was sell due to the strong increase in pricing shares experienced year-to-date: Enough Is Enough, Why I Am Taking Profits. While I still believe that shares of the social media company are not yet attractively valued, the re-acceleration of top line growth from Q1 to Q2, strong free cash flow, a robust Q3 outlook and persistent DAU growth justify a rating upgrade.

Advertising market recovery is here, DAU growth still strong, healthy free cash flow margins

The situation in the advertising market keeps improving. Metal Platforms reported 11% year over year top line growth in the second-quarter which followed a 3% top line increase in the first fiscal quarter: this revenue re-acceleration has been driven largely by a recovery in Meta Platforms’ core business, the placement of digital ads.

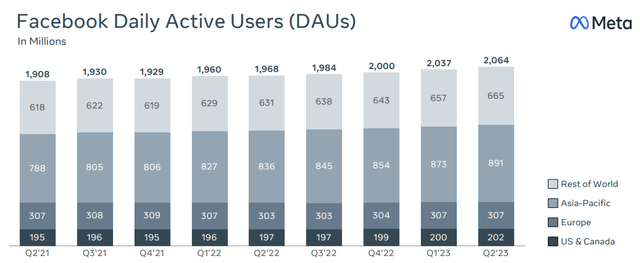

Meta Platforms generated $32B in revenues in its second fiscal quarter, which represented 98% of consolidated revenues. The firm’s second-quarter earnings were not only supported by a fundamentally improving picture in the digital advertising market, but also because the social media company managed to continue to expand its user base. Meta Platforms’ daily active users grew 27M quarter over quarter and the company’s user base reached a new all-time high of 2.06B at the end of Q2’23. Strong platform user trends also suggest that Meta Platforms may not be as deeply affected by the rise of short-video rivals (like TikTok) as feared by some investors.

Long term trend in digital advertising spending benefits Meta Platforms

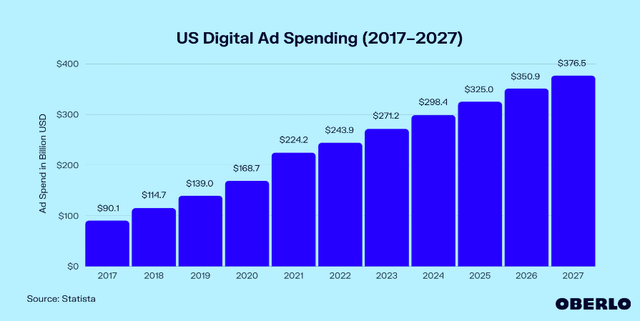

More people spend more time online and this results in favorable tailwinds for Meta Platforms’ core advertising business. Although Meta Platforms has also invested in the Metaverse opportunity, digital advertising trends fundamentally favor the largest online social media company with almost 2.1B users. U.S. digital ad-spend is expected to grow to $376.5B annually, showing 9% average annual growth. As the largest U.S. social media network by users, Meta Platforms is set to benefit from this long term advertising tailwinds. Google also benefited in its Search business from a recovery in ad spending in the second-quarter which indicates that the recovery in the digital advertising market is broad-based.

Free cash flow margins exceeding 30%

Metal Platforms had a fantastic second-quarter in terms of free cash flow generation which of course is linked to the overall rebound in the advertising business. In the second-quarter, Meta Platforms generated almost $11B in free cash flow, showing 146% year over year growth in a 34.2% free cash flow margin. The improved free cash flow picture, and the increase in the company’s free cash flow margin are two reasons why I am upgrading Meta Platforms to hold.

|

in mil $ |

Q2’22 |

Q3’22 |

Q4’22 |

Q1’23 |

Q2’23 |

Y/Y Growth |

|

Revenues |

$28,822 |

$27,714 |

$32,165 |

$28,645 |

$31,999 |

11.0% |

|

Operating Cash Flow |

$12,197 |

$9,691 |

$14,511 |

$13,998 |

$17,309 |

41.9% |

|

Purchases of Property/Equipment |

($7,528) |

($9,355) |

($8,988) |

($6,823) |

($6,134) |

-18.5% |

|

Payments on Finance Leases |

($219) |

($163) |

($235) |

($264) |

($220) |

0.5% |

|

Free Cash Flow |

$4,450 |

$173 |

$5,288 |

$6,911 |

$10,955 |

146.2% |

|

Free Cash Flow Margin |

15.4% |

0.6% |

16.4% |

24.1% |

34.2% |

121.7% |

(Source: Author)

TikTok rivalry set to heat up

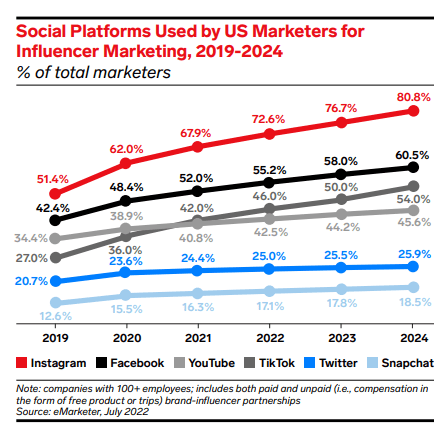

Going forward, investors should pay close attention to any new app that uses short term video formats, like TikTok. Bytedance-owned TikTok has seen rapid success in Western markets and has captured the imagination not only of users, but also of advertisers. TikTok has become a force in influencer-marketing (and already taken over YouTube as an ad platform) and the Chinese-owned social media app is seeing explosive revenue growth… which definitely poses a challenge to Meta Platforms in the longer term. If younger users especially move to other apps, TikTok could take a bite out of Meta Platforms’ ad revenue base going forward.

Source: eMarketer

Strong outlook for Q3’23

Meta Platforms has confidence that the advertising market will continue to rebound: in its Q2 earnings release, the social media company said that it expects Q3 revenue to be in a range of $32-34.5B, implying up to 24% year over year growth as advertisers appear more comfortable spending money in a low-inflation world.

Meta Platforms’ valuation reflects unattractive risk profile

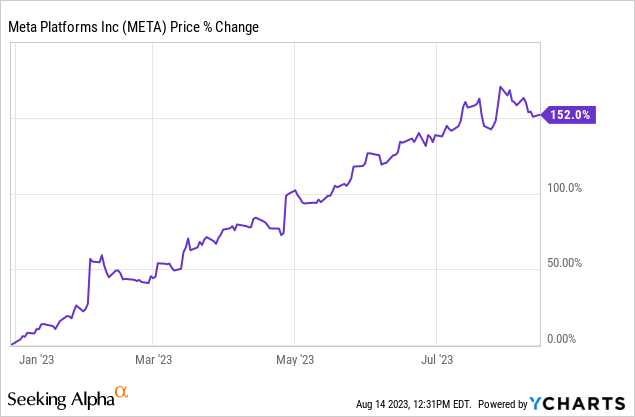

One thing that I don’t like about Meta Platforms, despite an overall solid Q2 earnings release and improving business trends, is the firm’s valuation. Meta Platforms’ share price has increased 150% since the beginning of the year and shares are now still quite expensive: they trade at a P/E ratio of 18.6X compared to a P/E ratio of 8X at the beginning of the year… which leads me to believe that investors are now fully pricing in the prospects of a broader digital ad market recovery.

I believe that a 15X earnings multiplier is a more reasonable factor to value the social media company’s earnings potential at, but this is just my personal opinion. Therefore, I would consider re-buying META at around $240 which would imply a more moderate P/E ratio of 15X. At 15X earnings, I would rate META a buy and a multiplier below 12.3X (the 1-year average P/E ratio) would result in a strong buy rating.

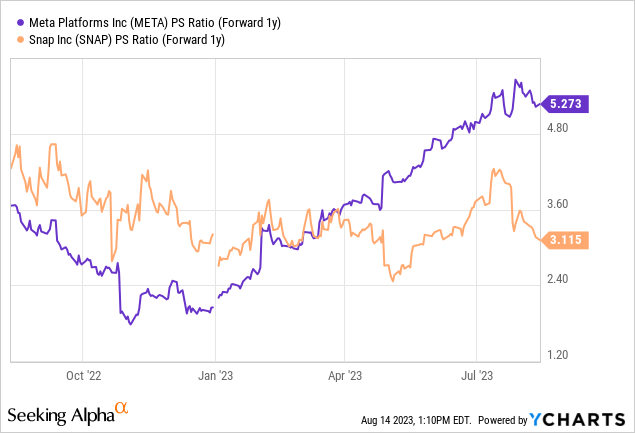

Snap (SNAP) is another social media company with a large U.S. user base, but the company is not profitable, so both companies can only be compared based off of revenues: Meta is valued at 5.3X FY 2024 revenues while Snap has a 3.1X P/S ratio, but Meta Platforms is deeply profitable regarding earnings and free cash flow. Snap, on the other hand, has potential to grow its Snapchat+ subscription service which I believe translates to attractive recovery potential for Snap’s shares.

Risks with Meta Platforms

Although Meta Platforms saw an increase in its user base in Q2, TikTok and other short-form video apps are very successful, especially with younger users. While Meta Platforms is still growing, there is a risk that newer, fresher apps will steal users away from the social media company going forward. What would change my mind about Meta Platforms is if DAU trends reversed and the social media company reported smaller free cash flow margins.

Closing thoughts

The much-awaited advertising rebound is finally here and it led to a re-acceleration of Meta Platforms’ revenue growth in the second quarter. After a fundamental rebound in its core advertising business in the second-quarter and a strong outlook for Q3, I believe META is deserving of a rating upgrade. While Meta Platforms delivered strong results regarding DAU growth, free cash flow (margins) and revenue growth, I believe the valuation, at this point, is rather unattractive since Meta Platforms’ shares have had a very good run this year and are still expensive based off of P/E. I would wait for a drop towards ~$240 (P/E ratio of 15X) before buying shares again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.