Summary:

- In Q2 2023, Roku was yet again the number one selling TV OS in America.

- Of particular note in this respect, in the large screen TV segment, Roku achieved 70% year over year gains.

- Today, I explore the flywheel that has produced the network effects inherent to Roku’s business model. I believe these network effects will continue to drive active account growth.

- After 10x’ing its sales over the last 8 years and 15x’ing its gross profits, I believe Roku is poised to materialize similarly stunning feats of growth in the decade ahead, especially once the ad market unfreezes a bit more.

- With $1.8B in cash, diminutive debt, and ~$1.4B in annualized growth profits, which it can use to reinvest whereby it further accelerates growth, and all time high market share, I believe Roku is the strongest it’s ever been as a business, despite what the last year of share price dynamics would suggest.

Justin Sullivan

Delving Deeper

In my most recent publicly shared work on Roku (NASDAQ:ROKU), I detailed for you the state of the ad industry and brought your attention to Mr. Charlie Collier, who was recently hired.

Today, I will principally focus on the network effects inherent to Roku’s business model that continue to drive market share gains and active account adds domestically and internationally.

I will also follow up with you about Mr. Collier, and I will share a couple data points that provide answers to my questions posed in my most recent work, which I would encourage you to read, if you’ve not already:

Roku: All-Time High U.S. Market Share, $1.63B In Net Cash (ROKU)

Roku’s Investment Thesis Simplified

- Like Marqeta (MQ) & Adyey (OTCPK:ADYEY), and like many of the businesses I own, Roku is a vertically integrated platform capturing market share within an existing, stagnant, and mature total addressable market (consisting of traditional cable TV, traditional TV advertising, and traditional physical TVs).

- Principally, Roku must continue to grow active accounts by selling its TV operating system whereby the entire ecosystem spins and reinforces itself (a flywheel effect, as it’s called in equity research). Active account growth is key to my thesis for the company.

- The Flywheel (which creates network effects) is defined as follows: Sales of TV operating systems (active account growth) -> digital advertising growth (growth of OneView) -> The Roku Channel evolves & strengthens -> original content evolves & strengthens/more licensed content can be added -> customer NPS increases -> Sales of TV operating systems (account growth) -> digital advertising (growth of OneView) -> The Roku Channel evolves & strengthens -> original content evolves & strengthens/more licensed content can be added -> customer NPS increases -> Sales of TV operating systems (account growth), and so on and so forth. And it appears to be working, as Roku just hit an all-time high market share in the U.S. in Q1 2023.

- Roku has ~$1.8B in cash and effectively no long term debt, alongside robust gross profit generation of about $1.4B TTM. This gives Roku enormous resources to invest in the aforementioned Flywheel and accelerate its spin, and, by extension, Roku’s sales growth, and by extension, hopefully, over time, its share price (it’s been a wicked ride to be sure).

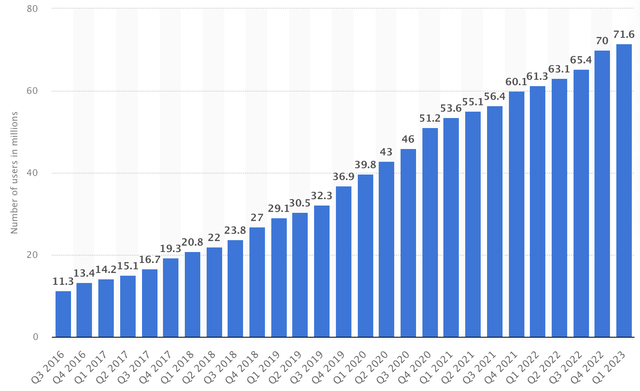

Roku Active Account Growth

The Roku OS was once again the number one selling smart TV OS in the United States and Mexico.

- Note: Roku added 1.9M new accounts in Q2 2023; therefore, it now has about 73.5M total active accounts, and we believe it could achieve 150M+ in the decade ahead. We will further explore this contention together in just a moment.

Statista

Following Q2 2023’s report, as I believed in late 2022 following Roku’s reports at that time, Roku’s investment thesis is the strongest it’s ever been.

Base Case Vs Optimistic Case

In Q2, the Roku operating system [OS] was once again the #1 selling TV OS in the U.S., and year to date, our TV unit share was larger than the next three largest TV operating systems combined (according to Circana). We continued to achieve YoY share gains across the full range of TV screen sizes, particularly in the larger-screen segment which increased more than 70% YoY.

Over the last few years, I’ve thought, “We don’t need to totally dominate the U.S. for Roku to be a fantastic investment over the long run. We simply need to do well in the U.S. and do well internationally, and the stock will do well as a result.”

This has been my base case scenario for Roku, and this base case has underpinned my belief that Roku would ultimately be a successful investment.

The reality, however, has been that Roku’s market share performance in the U.S. has actually, almost incredibly, gotten better, and it’s doing very well internationally. It’s now operating from its greatest position of strength in the company’s history from a market share perspective in the U.S., and that position has continued to strengthen with each passing quarter.

Further, it only recently began international expansion (last few years); yet, it’s already the number of selling smart TV OS in Mexico, and it’s likely that Roku replicates that success in more international markets over the next 10 years.

In Q1 2023, Mr. Wood shared with us,

In Q1, the Roku operating system (Oregon Steel Mills Inc. (OS) Stock Price Today, Quote & News) was once again the #1 selling smart TV OS in the U.S., achieving a record-high 43% of TV unit share, which was more than the next three largest TV operating systems combined (according to Circana). We achieved YoY share gains across the full range of TV screen sizes, particularly in the larger-screen segment.”

In Mexico, the Roku OS was the #1 selling smart TV OS for the second quarter in a row. And in Germany, we expanded our Roku TV program with our third TV OEM partner, Coocaa. With more than 20 licensed Roku TV partners globally, we continue to drive great results across the program.

Incredibly, despite Roku’s market position being assailed by the most well-capitalized, largest businesses in human history, e.g., Comcast (CMCSA), Apple (AAPL), and Alphabet (GOOGL), to name a few, Roku has continued to increase its market share in the U.S.

And, to compound this success, Roku’s international expansion has been highly successful thus far as well, evidence of which we read just a moment ago.

In Mexico, the Roku OS was the #1 selling smart TV OS for the third quarter in a row, and we announced an 8K Roku TV model with TCL. We expanded our Roku TV licensing program to Central America with the launch of RCA Roku TV models in Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua.

These realities have led to incredible account growth.

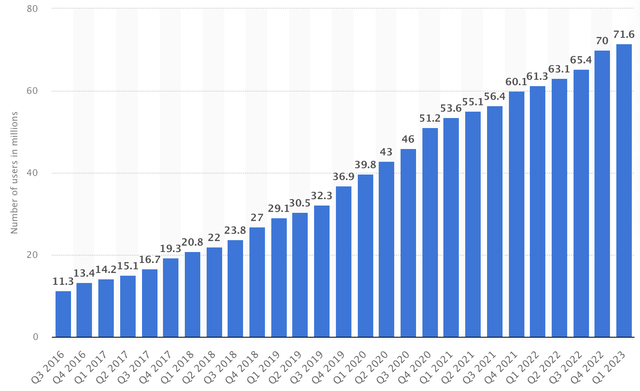

Roku Added 1.9M Accounts In Q2 2023, Bringing Its Total Active Accounts To 73.5M

Statista

Roku Added 1.9M Accounts In Q2 2023, Bringing Its Total Active Accounts To 73.5M

Roku Q2 2023 Shareholder Letter

Regarding ARPU, when the report was released, I initially speculated that ARPU was down due to:

- The ad market being in a state of paralysis currently

- More importantly, Roku has been adding new active accounts so rapidly that monetization has not been able to keep up; thus, the denominator in the equation Average Revenue/User [ARPU] has declined just a bit.

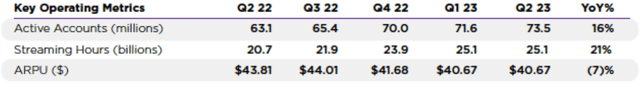

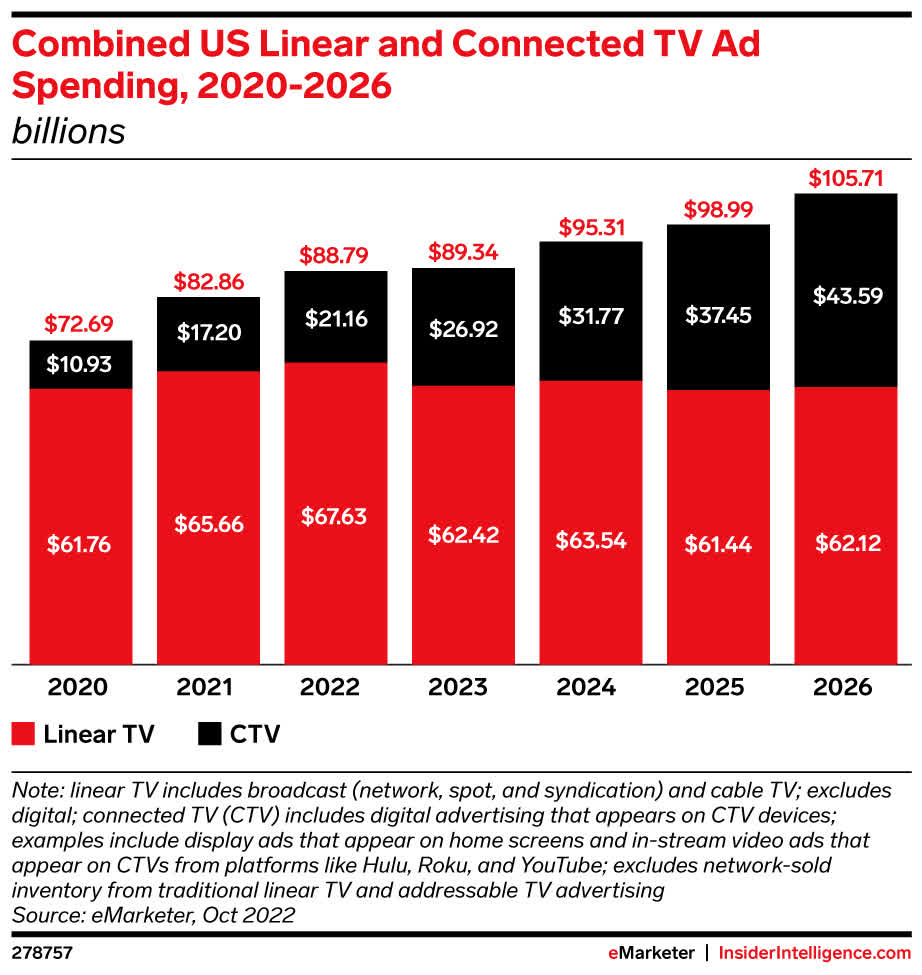

The TV Ad Market Is Paralyzed In 2023

TV Ad Market

And that speculation was confirmed on the Q2 2023 earnings call.

In Q2, ARPU was 40.67 on a trailing 12-month basis, down 7% year-over-year. This decline was due to strong global active account growth outpacing platform revenue growth. We expect that over time, monetization per account will continue to grow as the advertising industry rebounds and as a larger percentage of our U.S. customers cut the cord.

As we can see, the broad TV ad market is in a bit of a state of paralysis on the heels of the fastest repricing of credit in the history of America. That said, the Connected TV ad market will grow in 2023, and Roku’s “modest” (as they called it on Q2 2023 call, implying there’s further room for growth acceleration from here) platform growth of 11% aligns with this reality.

Roku’s Network Effects

In my past works on Roku, I’ve often explored what could create network effects for the TV operating system industry; specifically, Roku.

I delineated that, for Windows, network effects spawned due to a combination of developer and consumer focus. Because developers, specifically game developers for the purposes of the example I used, focused on Windows OS, games were built for Windows OS, which attracted end-consumer gamers. Because gamers were attracted to Windows OS, developers continued to build games for Windows OS and so on and so forth until Microsoft Windows achieved what is today a monopoly on PC gaming.

In the past, I’ve shared my case for how network effects could spawn in the TV OS market such that the market would consolidate into just 1 or, perhaps, 2-3 players. Below, I shared my most concise, yet still detailed, version of what could cause this consolidation.

Note that industries usually swing from consolidation to fragmentation, thought his is a conversation for another time.

We have built a best-in-class TV streaming platform for viewers, advertisers, streaming services and content owners. And we continue to lead the industry with innovation and scale. We remain committed to achieving positive adjusted EBITDA for the full-year 2024 with continued improvements after that.

As Mr. Wood remarked, Roku has built its OS with specific stakeholders/parties in mind. By focusing on these specific stakeholders via Roku’s custom-built TV OS, Roku creates the following “Flywheel Effect,” which is effectively another phrase that communicates “Network Effects.”

- The Flywheel is defined as follows:

- Sales of TV operating systems (active account growth) ->

- Digital advertising growth (growth of OneView) ->

- The Roku Channel evolves & strengthens ->

- Original content evolves & strengthens/more licensed content can be added ->

- Customer NPS increases ->

- Sales of TV operating systems (account growth) ->

- Digital advertising (growth of OneView) ->

- The Roku Channel evolves & strengthens ->

- Original content evolves & strengthens/more licensed content can be added ->

- Customer NPS increases ->

- Sales of TV operating systems (account growth), and so on and so forth.

As each party focuses more on Roku, the value of Roku increases for each party, and so on and so forth, which is the definition of network effect:

a phenomenon whereby a product or service gains additional value as more people use it.

And it appears to be working, as Roku just hit an all-time high market share in the U.S. in Q1 2023!

Roku’s Go To Market Is Getting Fixed: Explaining The Charlie Collier Hire

In my most recent note on Roku, I challenged myself and you, the reader, to think critically about why the CEO of Fox Entertainment would give up his throne to play second fiddle at Roku.

I think we could all come up with answers, but this quarter certainly shed light on the topic.

Cory Carpenter: Okay. Great. And maybe if I can sneak one more in since that was fast. Charlie, just could you – I know on the upfront process (selling digital ad placements), you don’t have numbers to share, it’s taking longer to play out. But any color you can give us in terms of the level of demand you’re seeing relative to last year or your expectations? Thank you.

Charlie Collier: So look, it is a very different year in the upfront for everyone. And you’re right, it is proceeding at a slower pace than usual. Look, we’re making great progress. You’re absolutely right. We’re not quite done yet, but we’re pacing well. Overall, the good news is we’re seeing more advertisers engage with Roku upfront due to our broad reach, our innovative ad products. And the powerful tools we offer to attract, engage and retain audiences. So all signs are good there, and we’re methodically working through the market with our agency partners, but I feel good about where we are.

Anthony Wood: Cory, this is Anthony. I just learned – you may know this, but Charlie has led on with 20 upfronts, which I thought was pretty cool.

In my most recent note, I postulated that Roku brought Mr. Collier on to, in essence, enhance Roku’s Go To Market motion, and we now have data-based evidenced that this was the right way to think about the hire.

We can get a further sense of this idea of Mr. Collier being one of the head salesmen within Roku via comments such as:

Charlie Collier: Yes, thanks. And on the scatter side, I think it is a story of categories. Dan mentioned CPG and health and wellness and a few others are really showing green shoots and we’ve repeated it a few times, M&E, tech and telco, you won’t be surprised to hear, it’s challenging us. So we’re seeing that in the marketplace. And again, I think the overall trends that are benefiting us just – are the viewership trends. We used to have to tell people, even in my early tenure here, the linear decline was continuing and connected TV was growing, and now they say it to us and look to us as a solution. So I think we’ll see that more and more as the scatter markets roll out.

I’ve believed and continue to believe that Mr. Collier’s hire could represent an inflection point for Roku in the decade ahead. In some sense, it may represent the final nail in the coffin for Linear TV. A Linear TV man is now selling Connected TV, and specifically the #1 TV OS in the U.S., to all of his Linear TV buddies, and this could accelerate the ongoing transition.

Let’s now briefly touch on another recent hire Roku made.

Roku’s New CFO

As you are likely aware, Roku’s CFO retired from his role in the last year or so.

Roku’s new CFO is old digital advertising cadre at Amazon (AMZN).

CFO Dan Jedda’s LinkedIn Profile

When asked by an analyst what he liked about Roku, he responded,

Dan Jedda: Hi, Shyam. Thanks for the question. As I spent 10 years at Amazon in the streaming and advertising businesses, I am well aware of the opportunity and the progress in streaming. And I followed Roku from before the company went public. And I’ve been a user of the Roku TVs during this entire time as well. In addition to loving the product, I’ve really admired Roku’s innovation in Anthony’s vision.

And what makes Roku particularly interesting to me is where we’re at as a company. We’re a market leader. We have significant scale and engagement and the leverage in the business is excellent as we’ve shown in our Q2 results. And still the long-term opportunity for both engagement and monetization in front of us is huge, and the people at Roku have been incredible. So I’m truly honored to have the opportunity to be here at Roku. I couldn’t be more excited to be here with Anthony and the entire Roku team.

I think Mr. Wood has been making fantastic hires in the last year, poising Roku to continue to scale and capture market share from here.

The State of the Ad Industry

At this point, you know well: The Digital Ad market has been having a tough time over the last year, creating truly immense opportunity in companies such as Meta (META), MercadoLibre (MELI), Amazon (AMZN), Roku (ROKU), and The Trade Desk (TTD), to name a few, as their share prices cratered in late 2022 and early 2023.

We heard and read commentary that spoke to this train of thought in Roku’s Q2 2023 earnings info.

I want to point out the good news amidst the industry-wide M&E pressure, and it’s that we’re building share versus the competition in M&E. I mean, advertising is still down in some verticals. As we noted, M&E, tech and telco have been broadly actually reported on is down by the ad agency holding companies over the last few weeks.

But as Anthony said, it will come back. We do all know that advertising is cyclical.

Charlie Collier, Q2 2023 Roku Earnings Call

We have begun to see some ad verticals improve, which resulted in modest YoY platform revenue growth in Q2, and we are well positioned to re-accelerate growth as the ad market recovers.

The last quote I’d like to share with you regarding the state of the digital ad market in which Roku operates is as follows:

Anthony Wood: This is Anthony. I’ll kick that off and maybe turn it over to Dan to talk about. I think the margins are primarily related to the mix. And so with the M&E down, there’s less M&E, which is higher margin. And I think there’s two ways. From my point of view, there’s two things that will address that. One is I think the reduction in demand right now is completely cyclical.

It’s related to the slowdown of the ad business impacting our M&E partners.

Concluding Thoughts: Onward To 150M Active Accounts

While Roku’s digital ad revenues are not pure play ad revenues, as Meta or The Trade Desk currently enjoy, I believe the size of Roku’s revenues over the next decade could surprise many.

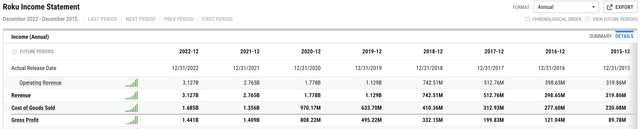

Over the last 8 years, Roku’s top line sales have 10x’d and its gross profits have more than ~15x’d.

Roku’s Total Sales & Gross Profits

YCharts

Today, Roku’s competitive positioning, market share, executive talent, and ability to execute have never been stronger.

The business continues to add active accounts at a torrid pace each quarter, while achieving new market share records in the U.S., while also demonstrating that it can successfully expand internationally, which it only just recently started doing.

Between early international expansion, continued market share gains in the U.S., and the overall growth of the Connected TV and Digital Ad markets, I believe Roku’s revenue ceiling is in the tens of billions.

If it 15x’d gross profits over the last 8 years, I think we could see it 5x to 10x them over the next 10 years, now that the transition to Connected TV ad spend has begun in earnest (helped in part by Mr. Collier!).

With $1.8B in cash and effectively no long term debt, alongside ~$1.6B in annualized gross profits, alongside crisp execution that has created all time high market share, I believe Roku is poised to achieve heights that most will not believe when they come.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU, META, ADYEY, MELI, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.