Summary:

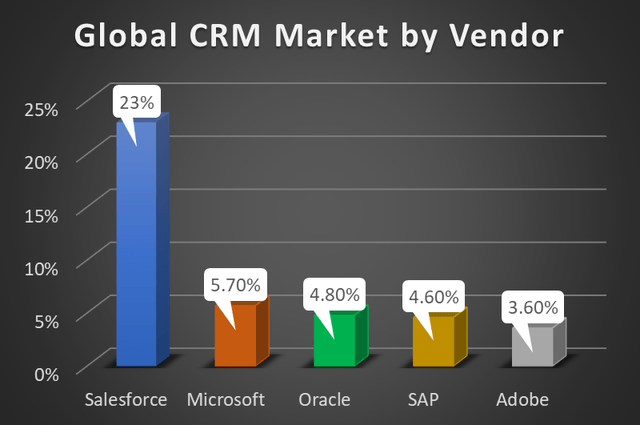

- Salesforce is a recognized CRM leader, as its global market share has reached 23% in 2022. Its customer base is huge and growing: more than 150K clients in 181 countries.

- The company’s mission is to “help businesses create meaningful connections with their customers”.

- The natural evolution for such a leader is its generative AI Einstein GPT, officially presented on June 12th Salesforce AI Day by the Company CEO Marc Benioff and his Team.

- I believe that the true value could be represented by its AI offer, with customer knowledge and “trust at its core” as its main assets.

- Target price at $250-$255; main risks: core AI competitors, like Microsoft, are pushing to expand their CRM and CDP market share.

Sundry Photography

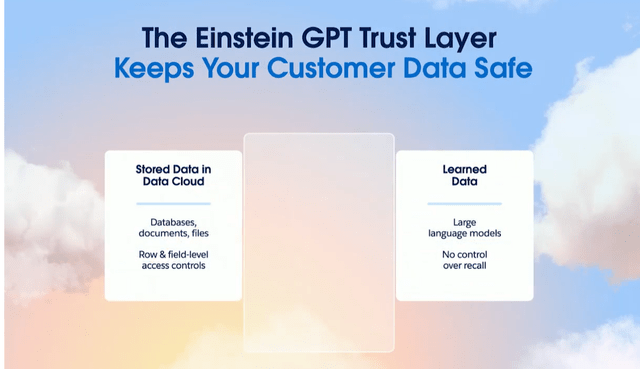

“Your data is not our product” Marc Benioff said at Salesforce AI Day. This is the most remarkable sentence of that event, in my opinion.

Trust and ethics were two further recurring words during Marc’s and his Team’s speech. It summarizes what Salesforce has been able to do in the past years: helping companies better know their customers by using data that those customers provide and ensuring that their information is accurately safeguarded.

Einstein GPT has been developed on that premise. Salesforce Generative AI (or Gen AI) comes with three main purposes: 1) improve efficiency, by automating service agents’ activity, which is a labour intensive one 2) cause the customer to convert and buy, thanks to personalized interactions with her/him 3) create e-commerce product and service description and help customers get oriented in their selection: customers will no more search for things, but for answers to their specific questions/requirements.

That could generate a virtuous circle, where the more efficient service agents will help know the customer better, while a better knowledge of the customer will improve service efficiency as well.

Market and value proposition

The AI field is dominated by big corporations like Microsoft (with its ChatGPT), Google (which launched its Bard Gen AI), and Palantir (one year ago I wrote a contrarian article defining the company as an AI Pioneer). So, why and how Salesforce could be an interesting opportunity in this business? Here are some good reasons:

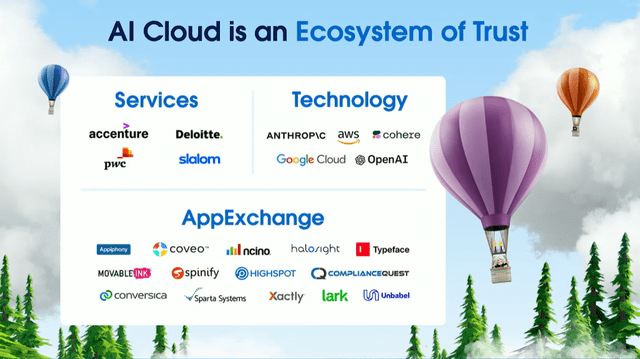

- “Collaboration” and not “competition” will be the AI mantra in the next years. ChatGPT is a source to Salesforce: OpenAI’s ChatGPT technology is combined with Salesforce’s private AI models “to deliver relevant and trusted AI-generated content”. Several recent announcements regarding Palantir are stressing the concept of partnership; Google has recently launched its free AI Bard, defined as a “new tool for creative collaboration”.

- AI top companies already have their own focus and specialization. Microsoft and Google are significantly present in the B2C market; Palantir is strong in cybersecurity solutions, thanks to its experience in the government sector. Salesforce is the undiscussed leader in the CRM field: among the above players, only Microsoft is present in this specific market, but its share is just 5.7%.

Author’s Elaboration on Ventionteams Data

3. Major players have built AI competencies, mixing inside skills with external acquisitions. That means that they have been able to build teams where their people work together with the startups and companies they have acquired.

4. The sales channels that Salesforce has been using to expand its core business both in the domestic and in foreign markets are represented by well-recognized consultancy multinationals, from Accenture to Deloitte to PWC, just to cite some brands. These are the same that are now going to support the expansion of generative AI solutions. In fact, they can leverage on the competencies and reputation already built in CRM and CDP design and implementation.

Historical data and financial projections

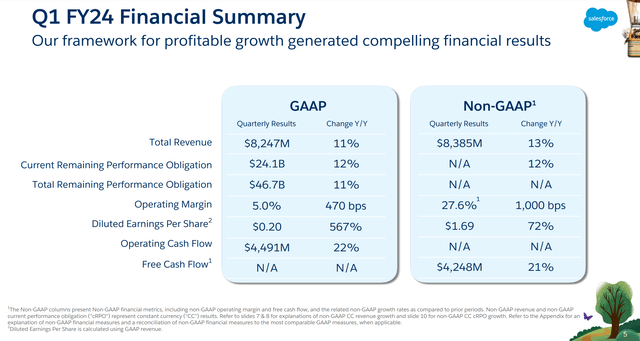

The latest Salesforce financial report, referred to Q1 FY24, shows a tremendous boost versus the same quarter of FY23: revenues were up 11%, operating profit increased by 470 bps and Operating Cash Flow improved by 22%.

Salesforce Financial Updates – Q1 FY24

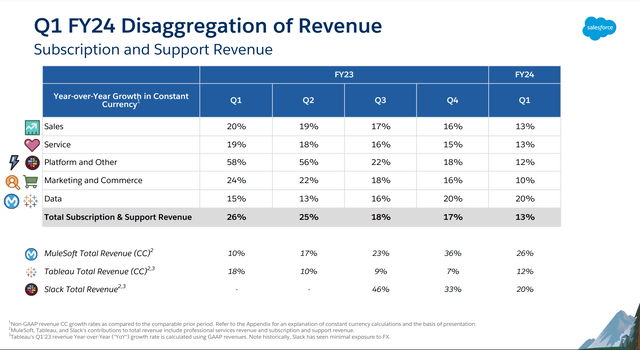

In terms of revenue composition, subscription and support management are the main contributor, representing 93% (or $7642M) of Q1 2024. The disaggregation of that amounts shows that the data component represents 14.8% (or 1131M) and it’s the one growing at the highest pace (20%):

Salesforce Financial Updates – Q1 FY24

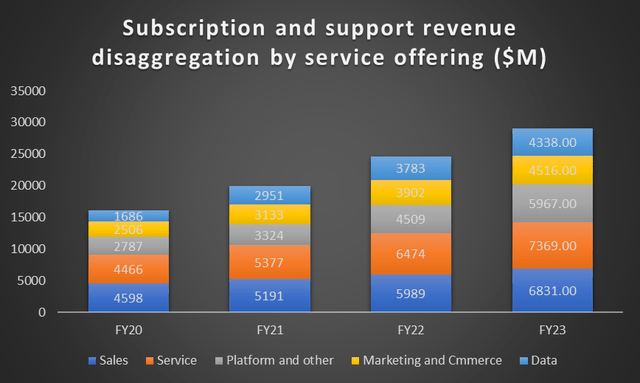

The picture, in terms of revenue composition, is consistent with past years’ results, as the data component is the one showing the highest increase (+157% in FY23 vs. FY20), followed by platform revenues (+114%).

Author’s Elaboration on Salesforce Investor Day FY23 Data

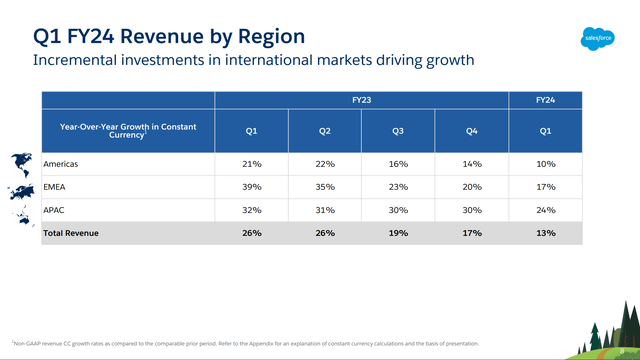

A further source of growth is represented by geographical expansion, where the company is counting on APAC and EMEA increasing volumes:

Salesforce Financial Update Q1 FY24

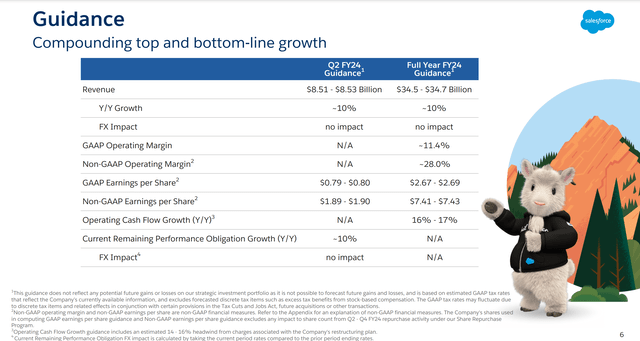

So, how will Einstein GPT impact those figures? The company Gen AI will be a cross-app tool. Looking at FY24 forecast, anyway, the projections seem prudential (10% Y/Y revenue increase, with a final figure in the $34.5B-34.7B range) and maybe only partially taking into account the Einstein GPT component.

Salesforce Financial Update Q1 FY24

Considering that Generative AI for CRM is expected to grow at a CAGR of 20.8% during the 2022-2032 timeframe, by reaching $119.9M, while the global CRM market should reach $215.72B in 2032, at a 13.4% CAGR between 2023 and 2032.

Based on that, and considering Salesforce’s leadership in B2B CRM solutions, I expect revenues to grow at least consistently with those estimates. My model is also based on the assumption that expense % impact should be higher than the present level considering that, at least initially: 1) the company should still be in a “learning curve” phase 2) pilot customers may receive more favourable pricing conditions, maybe subject to their availability to witness and share their experience in public events.

Based on those assumptions, my model forecasts a target price of $250-$255/share, with an upside potential of 18%-21% versus current quotations.

Main risks

While a more traditional CRM arena is undoubtfully dominated by Salesforce, Gen AI for CRM is still a fragmented territory, where some big corporations are trying to conquer positions and several newcomers (mainly private companies) may play a pivotal role in defining the future order.

Even though such a risk can’t be ignored, one may argue that the dominant position of Salesforce in the business-as-usual CRM is an asset to upsell Gen AI solutions to existing customers. Don’t forget that software licensing tend to develop long-term relationship between customers and suppliers, especially when the software provider is a high value-added player, surrounded by “brain channels” like consultancy corporations.

A more tangible risk, in my opinion, should be related to talent acquisition and retention, both as individual excellence and through additional strategic acquisitions. The right people to deliver the right product is what makes the difference in this kind of business where “the early bird catches the warm” and Microsoft is always up to speed.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition – open to all contributors – is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.