Summary:

- Due to its solid position in the CPU and GPU space, Intel’s stock has the potential for a strong turnaround.

- Additionally, Intel has significant AI-related opportunities, and the market may be underestimating Intel’s potential in the space.

- Moreover, Intel’s technical image has turned bullish and sentiment continues to improve.

- Intel can illustrate improving growth and increasing profitability, delivering better-than-expected results in future quarters, leading to a much higher stock price in the long run.

hapabapa

Intel’s (NASDAQ:INTC) stock has been in the dog house for years, with AMD’s (AMD) and Nvidia’s (NVDA) advancements. However, Intel remains a top player in the CPU and GPU space and has significant AI opportunities. Intel’s recent earnings announcement was excellent, suggesting Intel is turning the corner and its comeback could be epic. Therefore, I’ve adjusted my sell rating to a buy for Intel’s stock.

Intel’s fundamental backdrop and technical image have improved substantially, leading to improved sentiment. Thus, Intel’s revenue growth and EPS could expand faster than anticipated, leading to multiple expansion and a much higher stock price in the coming years.

The Technical Image – Finally Bullish for Intel

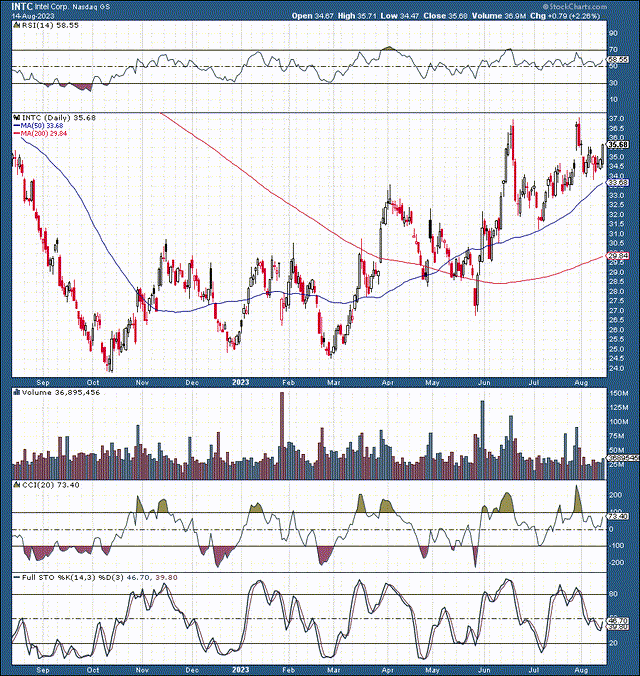

INTC (StockCharts.com )

Intel’s technical image turned bullish after its successful double/W-shaped bottom in late February. Since then, Intel has made a bullish series of higher lows and higher highs. Moreover, Intel’s 50-day MA moved decisively above the 200-day MA, helping to enable a highly bullish dynamic for Intel’s stock. Now we see Intel’s stock marching higher along with the 50-day MA, and this bullish trend will likely persist.

CPU Market – Intel’s Lead Could Accelerate

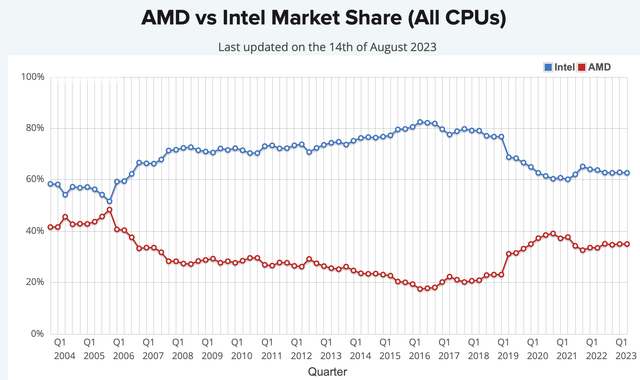

CPU market share (cpubenchmark.net )

Despite AMD’s advancements in recent years, Intel remains the CPU king, with its processors accounting for about 63% of global market share vs. AMD’s 35%. Intel’s lead was much greater several years ago, and with Intel’s upcoming lineup of advanced CPU chips, it may claw back some market share from AMD in future years and quarters.

The primary takeaway may be that Intel has invested considerably in the future, and that investment should pay off with excellent CPU chips that could increase Intel’s market share in the CPU segment. The market share gains should help Intel’s top and bottom lines, leading to better-than-anticipated revenue growth and higher EPS in the coming quarters.

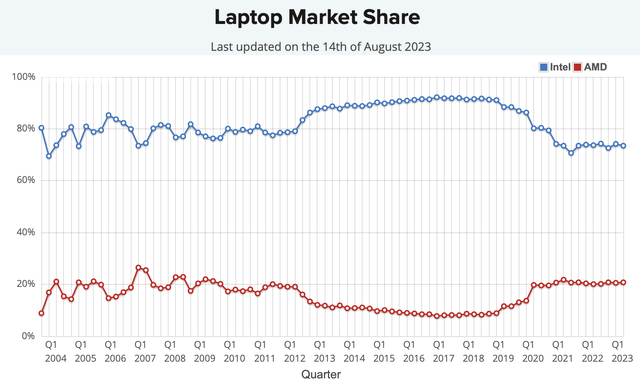

Laptop market share (CPU) (cpubenchmark.net)

Intel has an exceptionally high lead in the lucrative global laptop segment, commanding a 73.5% market share vs. AMD’s 21%. Moreover, Intel’s new and improved chip lineup could help it improve and extend its lead over AMD in the laptop CPU market. Intel’s 13th-generation desktop CPU chips also delivered an impressive performance, outgunning its counterpart (AMD’s Zen 4).

This dynamic brings us to the desktop CPU space –

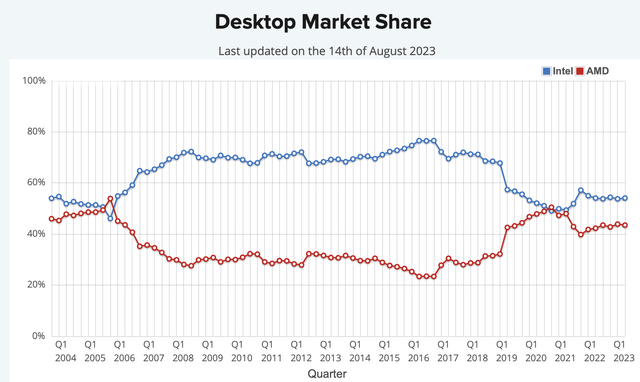

Desktop CPU market (cpubenchmark.net)

AMD has narrowed the desktop CPU race to nearly 50/50. The most recent quarter illustrates around 54% vs. 44% market share in Intel’s favor. However, with the delivery of Intel’s new and improved high-quality desktop chips and future lineups, we could see Intel’s market share improve in the desktop space, increasing to 60-65% or higher in future years.

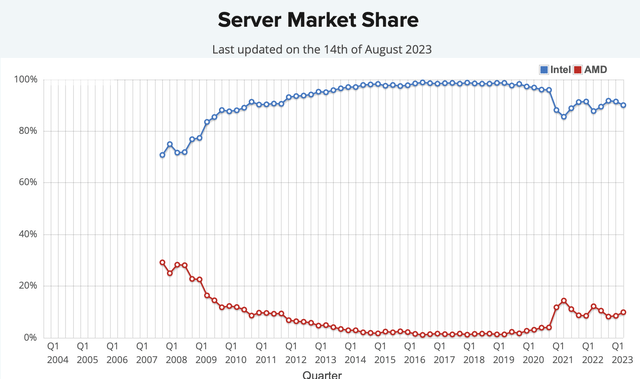

Server CPU share (cpubenchmark.net )

Intel has a massive lead in the server CPU market and could continue commanding a substantial lead over AMD as we advance. Additionally, the server segment represents significant growth opportunities for Intel. Therefore, Intel could benefit significantly due to its expanding AI capabilities in future years. Over 70 percent of successful AI inference deployments in the data center are already run on Intel.

Intel’s Expanding AI Solutions

Intel’s AI technologies and partner solutions enable companies to solve critical business challenges. Intel’s AI helps accelerate scientific research, improves patient outcomes, helps financial institutions identify fraud and mitigate risks, enables companies to deliver a much better customer experience and more.

Intel’s AI solutions enable numerous companies across various industries to harness the power of AI to solve their most advanced challenges. Intel offers a full suite of software and hardware technologies for the entire data and machine learning pipeline.

Enterprises can streamline AI projects with Intel’s software tools and AI optimizations. Moreover, Intel’s flexible AI hardware supports projects and infrastructure needs at every point, from development to deployment. Moreover, Intel’s high-performance hardware optimized for the software enables companies to improve decision-making with advanced analytics. Intel’s optimized environment, supported by its partner’s ecosystem, deploys AI-workloads from edge to cloud, providing its enterprise clients with a complete suite of AI hardware and software solutions to solve the most complex problems.

GPU Market – Intel’s Gaining Momentum

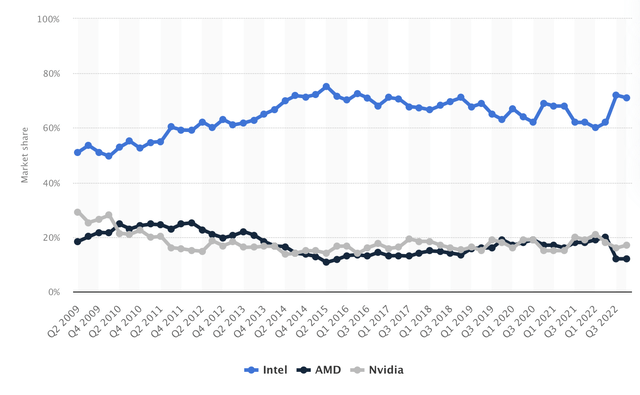

GPU market (Statista.com )

Despite AMD’s and Nvidia’s dominance in the discrete GPU market, Intel remains the king of integrated GPUs. Due to its dominance in the integrated GPU segment, Intel enjoys a massive 71% market share in the overall GPU market. Moreover, Intel should continue holding a distinct advantage in integrated GPUs and expand its market share in the discrete GPU market.

Despite Intel’s lackluster launch of its discrete Arc GPU aimed at mid and lower-end gamers, we see progress. Intel is not giving up on its Arc graphic cards. Instead, it’s fixing the software issues. Due to the fixes, many popular games have illustrated significantly improved performance, doubling Intel’s discrete GPU market share to 4%.

Intel has a golden opportunity to capitalize in the discrete GPU market. For years, there’s been two players in the market, AMD and Nvidia. These two desecrate GPU giants continuously battle for dominance in the GPU space with increasing power chips and higher prices. However, not all gamers want to pay up significant money for graphic cards.

At $199, Intel’s Arc A750 is about $70 cheaper than AMD’s RX7600, simultaneously providing a similar gaming experience. Intel also provides more bang for the buck than Nvidia’s chips in a similar price range. Due to Intel’s economies of scale capabilities, it can continue delivering mid-level GPUs, potentially at lower prices than its competitors. Moreover, Intel can continue to improve its GPU technologies, aiming at the higher end of the market in future years. Additionally, improving GPU technology could enable Intel to increase growth in its enterprise business.

Intel’s Massive Beat – What A Quarter!

Intel’s recent quarter was a blowout, enabling me to change my mind regarding Intel’s prospects as we advance. It delivered non-GAAP EPS of $0.13, beating the consensus estimate by $0.16. Moreover, Intel delivered $12.9 billion in revenue, $760 million above the consensus estimate. Additionally, Intel guided to a higher revenue range than the street expected and expects Q3 non-GAAP EPS of $0.20, better than the $0.17 consensus figure.

Intel posted a net income of $1.5B in Q2 vs. the $454 million loss in the same quarter a year ago. Intel’s adjusted gross margin was almost 40%, bettering the company’s previous forecast of 37.5%. Despite the transitory global slowdown, Intel illustrates improving growth prospects and increased profitability potential. This dynamic should enable Intel to report better-than-expected revenues and higher-than-anticipated EPS in future quarters. Therefore, we could see Intel’s price move substantially higher in the coming years.

AI Sentiment Gauge – Intel scored a +45 for its Q2 earnings in the “AI-sentiment gauge.” This score, combined with the more than doubling from the Q1 sentiment score (+21), indicates Q2 was a significant improvement for the company. A high positive score for the target event, in combination with a significant QoQ sentiment increase, is often an indicator of a significant upside following the event.

This is where Intel’s stock could be in future years:

|

Year |

2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $53 | $62 | $69 | $76 | $83 | $90 | $96 |

| Revenue growth | -16% | 17% | 11% | 10% | 9% | 8% | 7% |

| EPS | $0.80 | $2.50 | $3 | $3.54 | $4.21 | $4.97 | $5.82 |

| EPS growth | -56% | 213% | 20% | 18% | 19% | 18% | 17% |

| Forward P/E | 14 | 15 | 16 | 18 | 17 | 16 | 15 |

| Stock price | $35 | $45 | $57 | $76 | $85 | $93 | $108 |

Source: The Financial Prophet

Let’s Talk About the Risks to Intel

Despite my blush outlook, Intel has significant risks to consider. Intel faces substantial competition in the CPU, GPU, data center, AI, and other segments. While Intel is a company of vast resources, leadership and management could have been better at times. Intel’s been behind its rivals due to missed deadlines, mismanaged opportunities, and other mishaps. Issues with Intel’s management could persist. Also, Intel may not achieve the growth I imagine.

Moreover, Intel may not become as profitable as envisioned in future years. Also, Intel’s AI aspirations may not materialize or be as fruitful as anticipated. And, of course, any turnaround story can become exaggerated, dragged out, and Intel’s stock could become a value trap. Investors should consider these and other risks before investing in Intel’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!