Summary:

- Capital One is downgraded to Sell today; I’m more bearish than the consensus rating from analysts and the quant system.

- Positives: capital strength, valuation lower than the sector average.

- Headwinds: dividend yield not competitive vs sector, poor YoY net income growth, share price does not present a buy right now but an opportunity to take gains from the spring lows.

- Increasing trend of credit loss provisions, and Fed stress test result, have been addressed.

Win McNamee/Getty Images News

Research Brief

In today’s analysis, I am revisiting a bank I rated “hold” back in May, which since my rating came out has appreciated almost 24%, probably to the benefit of most investors who ended up agreeing with me and holding it from an earlier price point.

Capital One Financial (NYSE:COF) has seen the bulls come through for it since this spring.

Capital One – prior rating (May) (Seeking Alpha)

However, the question is whether this rating stands going forward, and that is what I will determine today.

First, if you are new to this stock, here are a few key points about Capital One from their website which I think are relevant data points: its 2022 revenue topped $34B, it’s known for being a market leader in credit cards particularly branded cards, and a fun fact is they are opening their own “Capital One airport lounges” across America starting with Dallas-Ft. Worth airport which will have WiFi and yoga, according to their 2022 annual report.

Rating Method

The goal is to find value-buying opportunities in these sectors I focus on exclusively: financials/insurance, tech/innovation/managed services.

My 5-step approach is to break down the overall rating into 5 categories: share price, dividends, valuation, earnings growth, and capital strength.

If I recommend this stock in at least 3 of these categories, it gets a hold rating, and if I recommend at least 4 out of 5 then it gets a buy rating.

This 5-step process aims to increase productivity and lessen time spent on analysis by my readers, providing a “holistic” score based on multiple data points with a focus on financial fundamentals of a company.

Share Price: Not Recommended

Instead of picking magic prices out of a hat, I have created a simple but systematic approach to determining a buy price for this stock, based on my maximum risk tolerance for capital losses and my target goal for return on capital invested.

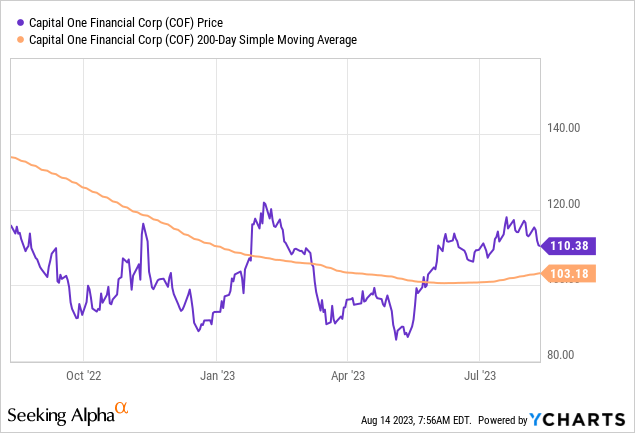

First, let’s look at the current trending share price, as of the writing of this article. In early morning pre-market hours on Monday Aug. 14th, shares sat around $110.38, above the 200 day SMA (orange line) which I am comparing to, as the YChart below shows.

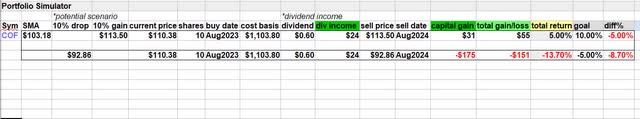

I created this handy spreadsheet below, plugging in the current 200 day SMA and current share price, as well as the dividend per share, with a goal of achieving a 10% total return on capital in 1 year and willing to accept a maximum capital loss of 5%.

Capital One – trade simulator (author spreadsheet)

In the above scenario, I bought a fictitious block of 10 shares at the current price of $110.38, held for 1 year until next August to earn the full-year dividend income, then sold at $113.60 which is assuming by then the share price will rise 10% above the current 200-day average.

In the top row, I achieve a total return of 5%, which is 5% short of my targeted goal of 10% return.

In the bottom row, the loss scenario exceeds my risk tolerance for loss by almost 9%, since it projects a total return on capital of negative -13.70%, in the event that the price drops 10% below the current 200 day average.

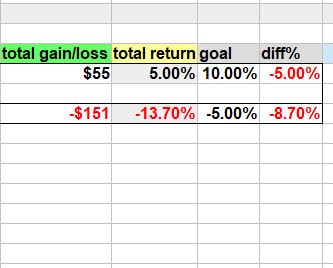

Below is a close-up of the simulated trade results:

Capital One – trade simulator closeup (author spreadsheet)

So, at the current share price therefore I would not recommend to buy it, based on this model. Your own portfolio and risk goals may differ, however this is a framework that an investor can go by in a structured manner to think about a long-term play in terms of both potential gains and potential losses too.

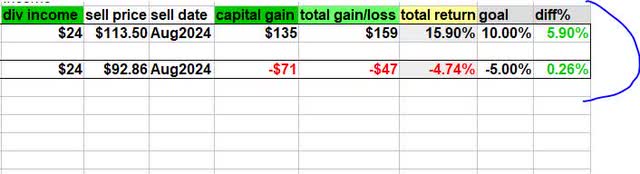

Now, here is the projected outcome if I buy the stock at $100:

Capital One – trade simulation 2 (author spreadsheet)

In this case, I buy at $100, hold for a year, and if I can sell at $113.50 I exceed my target return on capital by almost 6%, but if I have to sell at a loss at $92.86 it is still under my 5% loss limit.

So, my highest buy price I am willing to pay for this stock right now is $100 a share.

Dividends: Not Recommended

In looking for dividend quick picks, I often compare a dividend yield of a stock to that of the sector it is in, since there may be a better deal by investing in a peer.

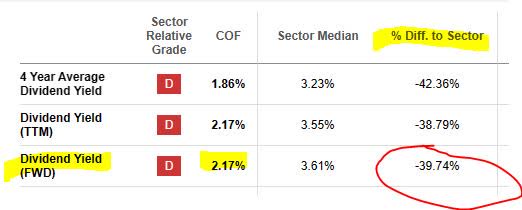

For starters, this stock has a modest dividend yield currently at 2.17% as of August 14th, with a payout of $0.60 per share:

Capital One – dividend yield (Seeking Alpha)

However, on closer look, when comparing it to the sector average, it is almost 40% lower than its sector average, whose median yield is past 3.5% already. It even earned a “D” grade from Seeking Alpha Quant!

Capital One – dividend yield vs sector average (Seeking Alpha)

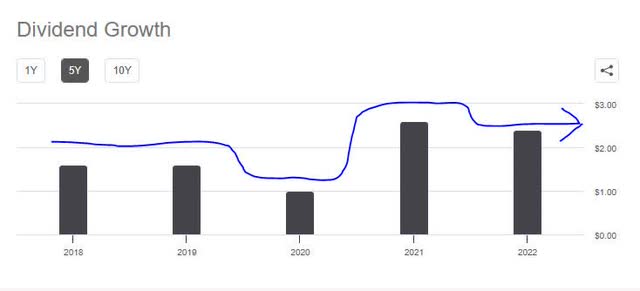

In addition, unlike several stocks in the banking & insurance sector I covered lately, who have positive 5-year dividend growths, this stock has a very lopsided 5-year growth trend with dividends, as the chart below shows, with a few bumps along the way.

I cannot say it is impressive when comparing to some peers.

Capital One – 5 year dividend growth (Seeking Alpha)

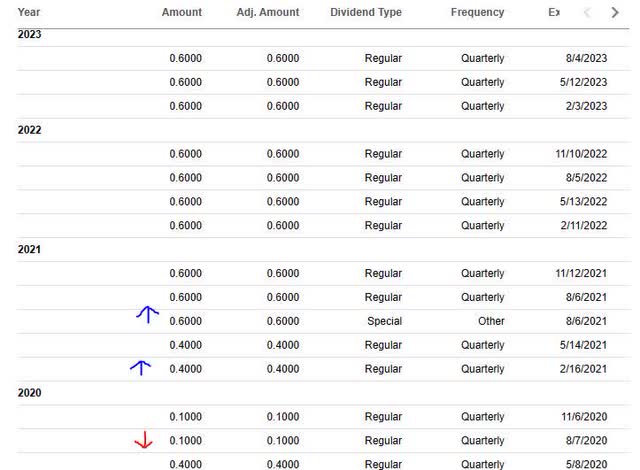

What is a positive, though, is that dividend payments seem to be regular ever since 2020, in addition to having a “special” dividend payment in August 2021, as the table below shows. Only some firms offer a special dividend, so it is worth noting.

Capital One – dividend history (Seeking Alpha)

Returning to the topic of yield, however, since as an investor I want the best return on capital invested, when looking at some banking peers they are blowing Capital One out of the water on this category.

Ally Financial (ALLY) currently has a dividend yield of 4.16%, while PNC Financial (PNC) has a yield of 4.77%.

So, if you are building a dividend-yield driven portfolio in this sector, I would not currently recommend this stock, however that does not mean the yield cannot improve down the road if the stock price drops and you get more shares for your buck.

Valuation: Recommend

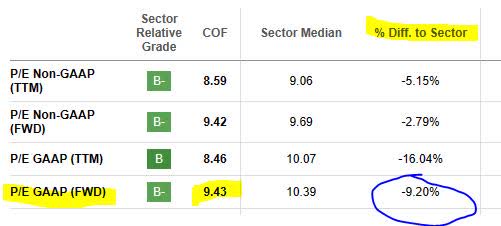

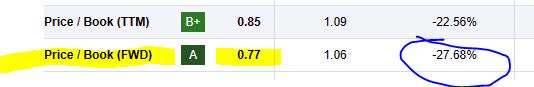

Is this stock overvalued or undervalued? That is often the question of the hour on many analysts’ minds. To answer it, I have been turning to the forward P/E ratio and the forward P/B ratio, from data on Seeking Alpha.

I like the price to earnings at around 9.4x right now, which is over 9% below the sector average, with the sector median at closer to 10.4x earnings, still not terrible either.

Capital One – PE ratio (Seeking Alpha)

The price to book is also impressive at less than 1.0, putting it almost 28% below the sector average which is also interesting at around 1.06x book value:

Capital One – PB ratio (Seeking Alpha)

Although in the same banking sector but not necessarily the same level of bank, if you went for a stock like JPMorgan Chase (JPM) you are currently looking at valuation closer to 1.5x book value, or 43% above the sector average.

So, I think in terms of valuation, Capital One is reasonably valued vs its sector, and can be recommended in this category.

Earnings Growth: Not Recommended

On a positive note, from a top line view I want to give credit to this bank for YoY growth in net interest income, especially in this current rate environment which should be in its favor.

Capital One – NII (Seeking Alpha)

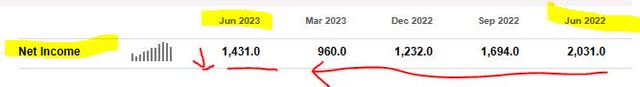

In terms of earnings growth YoY, however, I am concerned with the trend this bank has been following. If you look at the data, YoY there has been a drop in net income in the most recent quarterly results but also seemingly a downward trend in net income for much of the last year.

It went from over $2B in net income in June 2022 to around $1.4B in June 2023:

Capital One – net income YoY growth (Seeking Alpha)

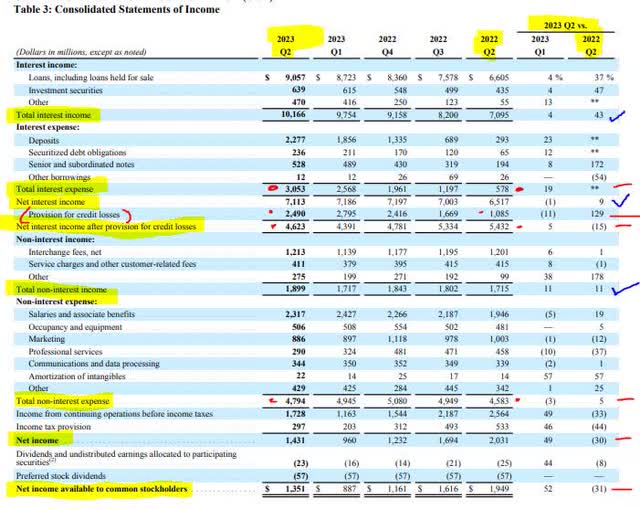

In deep-diving further into their official Q2 income statement, in comparison to the same quarter a year earlier, we see some interesting data points:

Capital One – consolidated income statement (Capital One – Q2 results)

For example, we see quite the increase in provision for credit losses, which ended up reducing the net interest income. Also, non-interest expense went up slightly YoY. Finally, we see the bottom line with negative YoY growth.

In the credit card business segment alone, the company commented that “provision for credit losses up $1.5B year-over-year.”

This amount was also true for the domestic card business segment.

If you look at the table, provision for credit losses have steadily been increasing since 2022Q2. This is not a favorable trend I think, and will continue to impact the bank going forward for some time.

Consider, for example, the recent early August article by S&P Global highlighting the trend of increasing credit loss provisions at several banks actually.

According to the article:

Many US banks continued to recognize increases in credit costs amid rising net charge-offs and concerns about potential future credit deterioration. Provisions increased sequentially at nearly two-thirds of the banks included in an S&P Global Market Intelligence analysis that examined results from publicly traded companies with at least $10 billion in assets that reported second-quarter earnings by July 28.

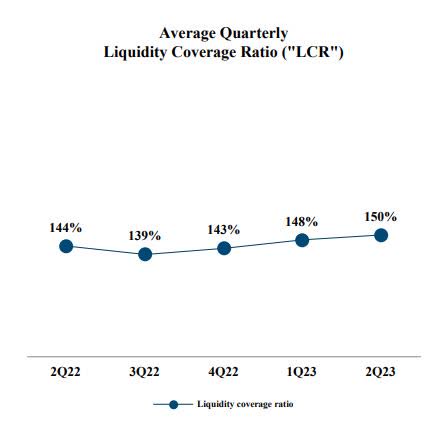

Capital Strength: Recommended

I am not at all concerned about this bank’s financial position, and here is evidence to prove that point as to why I would recommend this bank for its capital strength.

First, its liquidity coverage ratio is in a great spot and has been improving each quarter, as the chart below shows.

Capital One – LCR (Capital One – q2 presentation)

Second, according to its Q2 release, it has “total liquidity reserves of $118B as of June 30, 2023. $41.6B in cash and cash equivalents.”

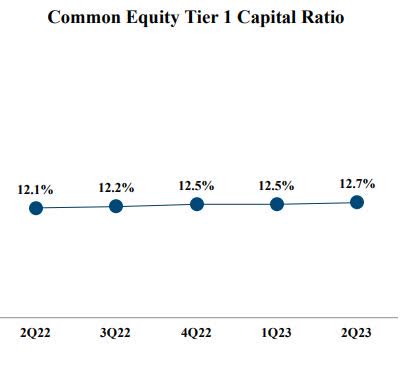

Third, the banking industry standard metric of “CET1 ratio” is looking well above regulatory minimums for this bank, going up to 12.7% in the most recent quarter Q2:

Capital One – CET1 ratio (Capital One – q2 presentation)

Fourth, the bank is in a solid position to return capital back to shareholders, always a positive sign.

Consider that it “repurchased 1.5MM common shares for $150MM in the second quarter of 2023; YTD repurchases of $300MM.”

I think, therefore, that it can be recommended on capital strength.

Rating: Sell (downgrade)

Today, this stock won in 2 of my 5 rating categories, so I am downgrading it from my prior “Hold” rating in May to a new rating of “Sell”. This is more bearish than the consensus from analysts and the Seeking Alpha quant system, as shown below:

Capital One – ratings consensus (Capital One)

A sell rating is not necessarily a negative, however, since those investors with unrealized gains after holding the stock since my May rating are now likely seeing a nice portfolio gain, and can choose to cash in the chips so to speak and take a capital gain if they wish.

Risk to My Outlook: Bullish Value-Buyers

A risk to my sell rating is something another SA analyst, Chance Tacia, discussed in his July 15th coverage of this stock, where he highlighted that two major whales, Warren Buffett / Berkshire Hathaway (BRK.A) (BRK.B) and Michael Burry, took a large position in Capital One.

According to the analysis,

It is always important to consider when a super investor takes a new position. Berkshire acquired 9,922,000 shares, and Burry, with a much smaller portfolio, snapped up some 75,000 shares.

Bullish moves like this from big whales looking for very undervalued stocks, which I already showed that this one is compared to its sector, could mean more tailwinds for the share price going forward, as other investors take interest, and thereby making my sell rating call a bit too early… leaving a lot of money on the table!

However, my counterargument to that, besides the 3 reasons I already gave why I think this is a sell and not a buy right now, is that Capital One fared worse off in the recent Fed stress test this year.

According to a late June article in Seeking Alpha:

Capital One’s stress capital buffer rises to 4.8% after Fed stress test. The increase in the 2023 SCB would require the bank to set aside more capital to help it navigate any upcoming economic downturns.

So I think this will be a headwind going forward to excessive bullishness on this bank, since there are other banks to invest in that did far better in the Fed stress test.

Analysis Wrap Up

Key points we went over today:

I downgraded this stock to a sell rating, currently more bearish than the consensus from analysts and the quant system.

Positives: valuation vs sector average, capital strength.

Headwinds: share price vs 200 day average, earnings growth YoY, dividend yield vs sector average.

Concluding thoughts:

I want to reiterate, as someone who has banked with Capital One before, that it is a great consumer bank and serves a purpose in that space for customers, but as an analyst and investor at this point I stand by my sentiment that it could be time to sell this stock at a gain and redeploy that capital elsewhere.

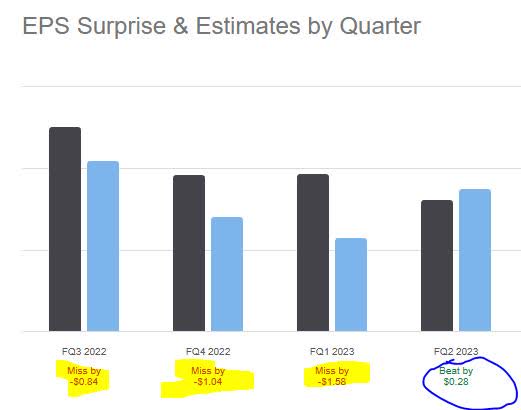

In looking at the last four quarters, this bank missed earnings estimates three out of four times. So, I will venture to guess that in the next quarterly results they have a 25% likelihood of beating analyst estimates.

On a positive note, however, I believe it will continue to benefit from the high interest rate environment as many banks, and the market is past the spring banking shock, with this bank coming out as one of the survivors, another fact I am happy about.

Capital One – earnings beats (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.