Summary:

- Carnival Corporation’s shares have increased by 56% since I announced my plan to lock in a 61% gain.

- I believe it would not be prudent to buy back into Carnival Corporation due to the company’s financial results and valuation.

- The company’s financial performance has improved compared to last year, but the cost structure and capital structure have worsened, and the shares are trading at a high premium.

JHVEPhoto

It’s been about 6.5 months since I announced to the world that I was planning to lock in my 61% gain on Carnival Corporation (NYSE:CCL) in an article with the mind-numbingly boring title “Taking Profits in Carnival Cruise Lines.” Since then, the shares are up about 56% against a gain of about 11.7% for the S&P 500. It seems that my nervousness has cost me an additional gain here. In this article, I want to explore whether or not it would be prudent to buy back in, or continue to eschew the shares. I’ll make that determination by looking at the most recent financial results, and by comparing them to the valuation. In my earlier piece, I lamented that “this is no longer the same firm that it was in 2019.” That was a reasonable observation, but I should have pointed out that neither is the stock price, which was down about 70% from 2019. So, I’m quite open to owning again at the right price.

You’re busy, and I’m busy. For that reason, I put a “thesis statement” at the beginning of each of my articles, so you can get in, get the gist of my thinking, and get out before you’re exposed to too much Doyle mojo. This thesis statement is for those people who want a little bit more than they can get from a title and bullet points, but a whole lot less than they get from a 1,650-word screed from your humble servant. So, I’m going to continue to eschew these shares for a few reasons. First, although the latest financial results are “less bad” than they were in 2022, they are still “bad” in my view, especially when compared to 2019. The evidence available to us so far suggests to me that the cost structure has been permanently changed for the worse. The capital structure, too, is much worse, with about $23 billion more debt on the balance sheet today than August 2019. In spite of this, the shares seem to be trading at a pretty hefty premium, and even sport an all-time high price to book value. This combination of an optimistic market and ongoing losses is a dangerous combination and is not worth the risk in my view. Writing of “risk”, it should be noted that investors are buying this risky stock against the backdrop of a 10-year Treasury Note that’s currently yielding about 4.23%. These notes also have the potential for capital appreciation if rates fall. I’ll remind investors again: we’re not seeking “returns.” We’re seeking “risk-adjusted” returns, and the risks here aren’t worth it in my view.

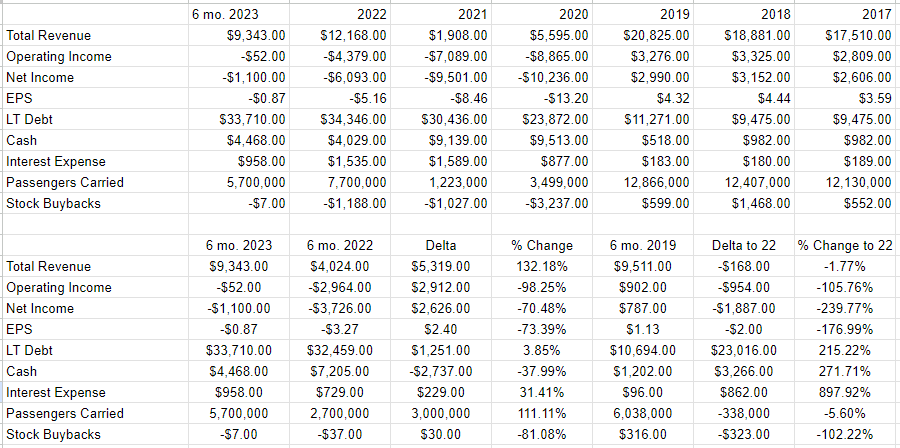

Financial Snapshot

I think the financial performance here is interesting. Relative to the same period last year, it’s extraordinarily good, with revenue and net income higher by about $5.3 billion, and $2.62 billion, respectively. The company posted a loss, but it was one that was much lower than the same period a year earlier. The result is that the EPS loss was only $0.87, as opposed to the $3.27 loss posted last year. All of this was a function of the uptick in passenger traffic, which rose from 2.7 million last year to 5.7 million this year. The one fly in the proverbial soup here is the capital structure, given that debt jumped by $1.251 billion, while cash declined by about $2.74 billion. The result of this was a 31.4% uptick in interest expense, from $729 million last year to $958 million this year. If this company was two years old, the current results would be pretty good. Although the balance sheet suffered greatly, sales and profits were up massively. The problem is that this company is not two years old, and I have records that go back in time. When compared to the prior period, the most recent results are actually pretty bad.

The most recent half year saw revenue that approximately matched that of the same period in 2019. Sales in the first six months of 2023 were $9.343 billion, and it was $9.511 billion in 2019. While revenue is approximately the same as it was previously, the cost structure is higher by about $876 million. For instance, food expenses of $636 million in 2023 were $98 million higher than they were in 2019, in spite of a 338,000 reduction in passengers carried. Similarly, fuel, selling and administration, “onboard and others” expenses were up 27.4%, 15.8%, and 8.5% respectively. Note that none of these items are “one-offs.” The evidence so far suggests that this company has a cost structure that is permanently higher. Most distressing of all is the fact that the level of indebtedness here has grown by about $23 billion, or 215% over the past four years.

Given that the company is making about $1.887 billion less on approximately the same revenue as it did in 2019, I’d be comfortable buying, but it’d need to be at a pretty significant discount. That’s because the evidence suggests to me that the Carnival Cruise of 2019 no longer exists. At this point in my thinking, I should point out that I’m very open to buying. Although the 2019 version of this company no longer exists, the price has fallen from the mid-$40s back then to just under $17 today.

Carnival Corporation PLC Financials (Carnival Corporation PLC investor relations)

The Stock

I’ve written it before, and if you were a betting person and bet that I’d write it again, you’d be certain to win. I may risk boring my readers by pontificating about this yet again, but boring you is a risk I’m absolutely willing to take. The more you pay for $1 of future gains, the lower will be your subsequent returns. This is as close to a mathematical certainty as you’re going to find in finance, and this is why I try my best to buy shares when they are cheaply priced.

In case you’re still of the view that “we don’t buy stocks, we buy businesses”, then please consider the following thought experiment involving two investors who bought these shares a short time apart. The first of these mythic investors bought on August 9, and is down about 5.6% on their investment. The second of these happened to acquire shares two days later, and they’re basically flat. The 5.6% variance in returns in such a short period of time comes down to the price paid for the shares. I called these investors “mythic” earlier, but they’re quite real. There are people who bought six days ago who’ve suffered a near 6% loss of capital, and they have peers who bought four days ago who are basically flat. The variance comes down to the price paid, and the person who bought shares at a lower price did less badly.

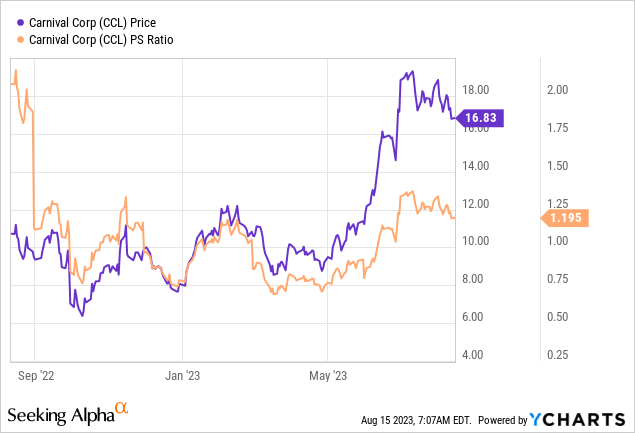

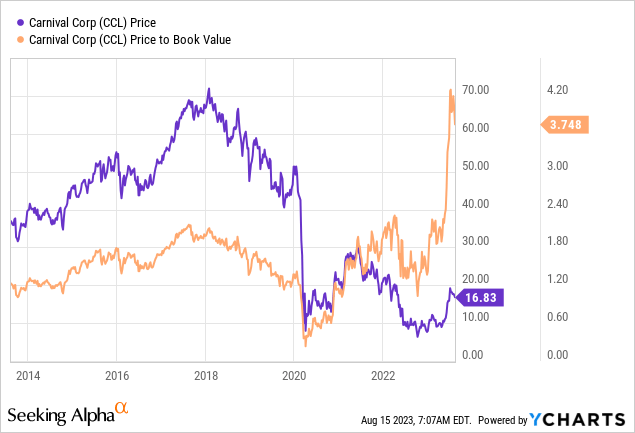

With that sermonizing out of the way, I should point out that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at ratios of price to some measure of economic value, like earnings, free cash, book value, and the like. I like to see shares trading at a discount to both their own history and the overall market.

When I decided to lock in my mere 61% return on this stock, the shares were trading at a price to sales ratio of 1.069 times and were trading at a price to book of about 2.028 times. Fast-forward to the present, and here’s the lay of the land. The shares are between 11.8% higher, and 85% higher, per the following:

I think it’s noteworthy that the market is paying a record amount for the book value here, given that return on equity has plummeted. I should also point out that this valuation is against a backdrop where the 10-year risk-free rate is sitting at about 4.23%.

As my regular readers know, in addition to looking at simple ratios, I want to try to understand what the market is currently “thinking” about a given company’s future. In order to do this, I turn to the work outlined in books like Penman’s “Accounting for Value” and Mauboussin and Rappaport’s “Expectations Investing.” The idea expressed by these books is that the stock price itself has some interesting information embedded within it, including the market’s “thoughts” about a given company’s future. The greater the expectations, the more risky the investment. According to the approach outlined by Penman’s work, the market currently “thinks” that Carnival Cruise will grow at a rate of about 6.3% from current levels. I consider that to be a bit rich. I also think the analyst community’s view that this company will earn $0.97 by the end of the next fiscal year is ridiculously optimistic.

So, to sum up, so far, the company remains unprofitable, in spite of a massive improvement over the past year. The cost structure seems to me to be permanently changed for the worse. The capital structure is in much worse shape now than it was in 2019. The market is paying a record price to book for the shares, and the price to sales is as high now as it was in September 2022. Finally, it’s possible for an investor to earn a safe, predictable 4.23%. Additionally, this risk-free return comes with the potential for a capital gain if interest rates fall over the next few years.

At the risk of sounding even more preachy than usual, we investors aren’t seeking “returns.” We’re seeking “risk-adjusted” returns and the return here is too low given the risks, especially when considering easily available alternatives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.