Summary:

- Amazon delivered excellent Q2 results a couple of weeks ago and is finally reporting significant margin improvements in its retail segments.

- I believe investors should shift their focus from AWS to the potential in the retail segments to fuel their bull case on the company as these are often underestimated.

- Amazon has amazing potential to drive strong operating cash flows once it further expands its margins, which I expect it to do over the next few years.

- Growth potential in advertising, e-commerce, and subscription services should not be underestimated and is key to my bullish thesis.

- While AWS has been overestimated over recent years and might continue to lose market share, I do remain bullish on the segment, although expect growth to sit at around 12% to 15% going forward.

georgeclerk

I upgrade my rating on Amazon.com, Inc. (NASDAQ:AMZN) from a Hold to a Buy and update my revenue and EPS estimates following the company’s Q2 results, despite a 35% share price increase since I last covered the company. I believe Amazon’s outlook is very promising and that improved profitability and cash flows show that management is able to make this a cash-generating machine.

It has been some time since I last covered Amazon here on Seeking Alpha. My last update on the company came after it reported its 4Q22 results, which led to me downgrading my rating from a strong buy to a hold as the company continued to disappoint in terms of growth and profitability. While I believed that improved profitability was right around the corner as the company started to focus on driving cost efficiencies, a slowdown of the highly regarded AWS segment was starting to become another drag on the company’s long-term outlook.

Also, the company’s financial position had deteriorated following several quarters of negative cash flows, which altogether led to me downgrading the company to hold in waiting for better times and visible financial improvements. The profitability of the retail segment and the deteriorating competitive position and growth of the AWS segment, in particular, have been focus points for me over the last six months. I believe now is a good time to look at these factors again after the company reported very strong Q2 results. Crucially, the company performed much better than anticipated by analysts as it beat the revenue consensus by slightly over 2% and the EPS consensus by a staggering 91%.

Amazon reported revenue of $134.4 billion, up 11% YoY, which sits in line with the growth reported in Q1 and above the 10% reported in the same quarter one year ago. Amazon remains very well capable of reporting double-digit growth, even in a challenging and treacherous environment. This shows that Amazon remains a top choice among customers, driven by its focus on attractive pricing and an industry-leading customer experience.

Amazon Quarterly data (Amazon)

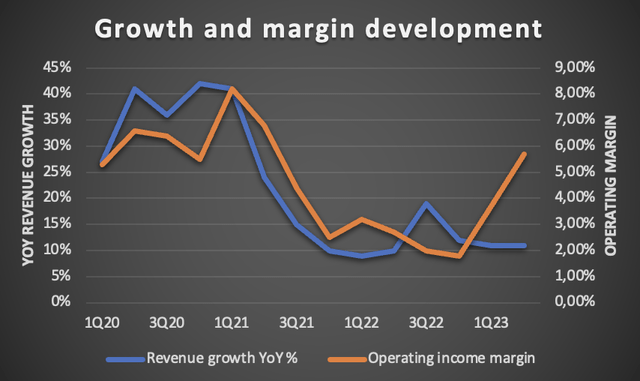

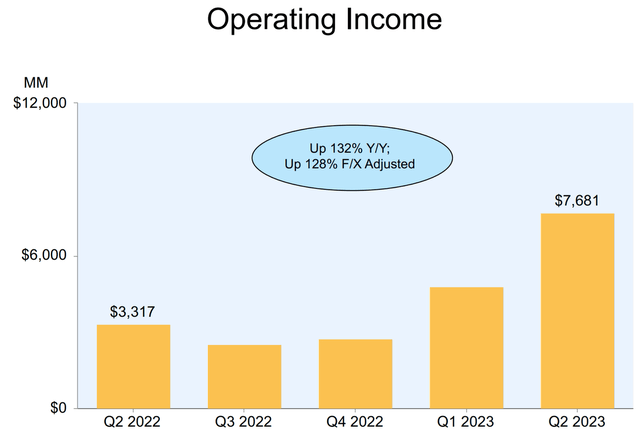

Demand turned out to be much stronger in both retail and cloud and the company was able to drive significant profits in its retail segments, something investors long believed to be impossible. It saw a substantial improvement in profitability as the operating income margin jumped to the highest level in 2 years and operating income totaled $7.7 billion. This was driven by the North American retail segment turning profitable and AWS still reporting strong operating margins, although down slightly YoY. I will dive more into the underlying trends later in this article.

The improvements in operating income also drove an improved bottom-line result as Amazon reported a net income of $6.7 billion, up from a $2 billion loss in the year-ago quarter. This resulted in an EPS of $0.65. Excluding the impact of the Rivian (RIVN) investment this difference gets quite a bit smaller ($6.5 billion versus a positive $1.9 billion one year ago), but still meaningful.

Finally, TTM free cash flow also turned positive again after a number of negative TTM FCF quarters. Amazon reported a TTM FCF of $7.9 billion, a massive improvement from the negative $23.5 billion reported one year earlier. I view this as crucial as the negative cash flows have significantly impacted the company’s financial health. With this now turning positive again and rapidly expected to improve, I believe the company’s financial health should quickly improve as well.

My bull case focuses on Amazon’s retail segments

Over the last couple of years, analysts and investors were fully focused on the AWS segment of the company and completely disregarded the retail segment. Of course, this made much sense over recent years as AWS kept reporting impressive growth and started to account for a larger share of Amazon’s total revenue while accounting for all of its profits. Meanwhile, the retail segment was lagging as sales plummeted after reporting incredible growth during COVID-19, and both the American and International retail segments reported negative margin growth quarter after quarter. Titles like “Focus on AWS”, “Amazon should spin off AWS”, and “Buy Amazon for AWS” emerged all over the internet, including on Seeking Alpha. Investors started seeing the retail segment as a drag on the company.

Yet, the retail segment is now posting solid profits after management started focusing on cost and operational efficiencies. Furthermore, growth for this part of Amazon has been accelerating as the operational environment normalizes. Also, it includes very promising aspects like subscriptions, primarily Amazon Prime, and advertising.

At the same time, growth in the AWS cloud segment has been slowing down, in part as a result of customers focusing on optimization instead of expansion. So, part of this slowdown is temporary, but I believe another factor contributing to AWS’ underperformance to peers like Microsoft (MSFT) and Oracle (ORCL) is due to its inferior product offerings and limited strength in AI in my view.

I want to add that I am not disregarding the cloud segment here. It is still an $80 billion run rate segment and the cloud industry leader. In the long run, I remain bullish on the segment, but I think its strength is often overestimated. In contrast, the potential and strength of the retail segment are incredibly underappreciated by investors and analysts alike.

I want to make the case here that investors should not be buying Amazon for its cloud segment alone but should also consider its retail segment, which, to me, is just as important to Amazon’s long-term outlook, if not more important.

I will first explain my retail bull case before moving to the AWS performance, outlook, and competitive position. The quarter-over-quarter development tells an interesting story.

Start appreciating the retail segment of Amazon

There are many business operations included in the retail operations that offer plenty of reasons for investor excitement. This includes the company’s incredible e-commerce strength in combination with the industry’s impressive growth outlook, Amazon’s incredible worldwide brand strength, growth in subscription revenue through the company’s diverse offerings, and incredible growth in advertising revenues. In fact, based on all these aspects and operations, the growth outlook for these segments is not even that far away from the outlook for its cloud segment despite the much larger size of these operations.

Yet, the most important factor to monitor over the next several quarters, or even years, is profitability improvements in Amazon’s retail segments, as the potential impact on the company if it is able to improve margins by only a few more percentage points is massive due to the sheer size of its retail operations. As of the latest quarter, operations apart from AWS accounted for around 84% of net sales and saw the operating margin come in at 2%, leaving much room for improvement, and commentary by management indicates that this is what investors can expect over the next several years.

It looks well underway to drive further cost efficiencies and boost margins. Its retail segments can become incredible net income drivers for the company if executed correctly. This should be the bull case for investors instead of basing their investment thesis on a deteriorating and challenged cloud segment (Of course, not disregarding this as a result).

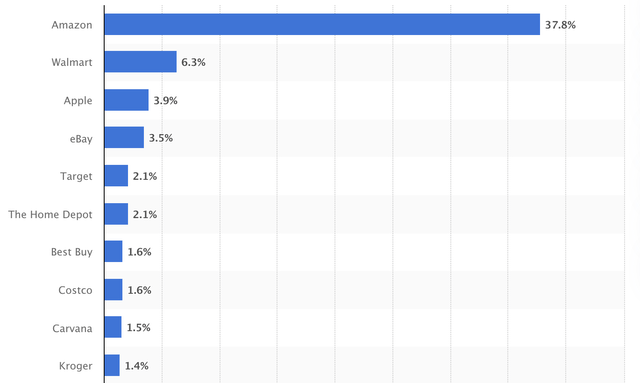

Furthermore, the retail segments have been unprofitable for good reasons as Amazon has sacrificed a lot of its retail profitability over recent years to increase its global presence and improve the customer experience through aspects like fast delivery. This strategy has made it the number one choice for consumers in e-commerce worldwide and has allowed the company to become the industry’s unchallenged leader.

US e-commerce market share (Statista)

Its sublime focus on the customer experience and the incredible quality and discounts it offers make it easy to see why customers choose Amazon for their online orders. During its recent Prime days, the company delivered $2.5 billion in discounts to its customers in a single day and increased discounts to customers by 144% YoY in terms of the number of coupons over the quarter. Also, tens of millions of items in the Amazon store are now available for Prime free same-day delivery, highlighting impressive progress in the company’s logistics over recent years and massively improving the customer experience. This is what CEO Andy Jassy said regarding this during the earnings call:

It’s also true that when customers know they can get their items really quickly, it changes their consideration of using us for future purchases too.

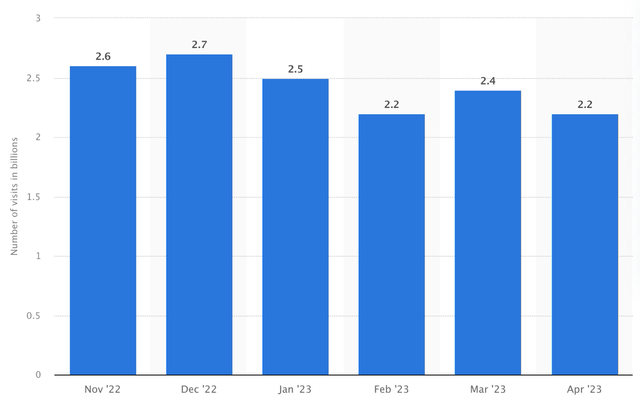

These customer benefits and the excellent customer experience have led to Amazon recording an average of 2.5 billion visitors to its websites and apps on a monthly basis and 220 million Prime subscribers as of the end of 2022. This incredible size should give the company several advantages and abilities to drive efficiencies and lower costs.

Monthly visitors of the Amazon webpage and app (Statista)

So, while investors have not always appreciated this strategy, there is no denying that the company has executed it to perfection and is now perfectly positioned to benefit from growth in e-commerce demand and has a massive user base that it can leverage to grow its subscription services and advertising efforts, among others.

Improving retail margins are key to the Amazon investment thesis

Yet, as indicated before, today’s most important development is the company increasing its retail profitability to drive much more meaningful operating cash flow. Recent quarters have already shown that Amazon is very capable of driving solid profitability in its retail segments as margins have been improving rapidly after hitting their lows last year.

I believe management already tried to convince investors that profitability was coming once the company decreased its rate of investments and started prioritizing profitability over growth, but this was often thrown into the wind by investors and analysts alike in my view.

Management has indeed been very capable of decreasing its cost growth, which led to improved margins. An important factor contributing to this was to move the stores’ fulfillment and transportation network from one national network in the US to a series of eight separate regions serving smaller geographic areas. Through this, the company could lower prices and increase delivery speed. In fact, it brought very significant improvements as highlighted by these numbers provided by management:

Regionalization is working and has delivered a 20% reduction in number of touches for our delivered package, a 19% reduction in miles traveled to deliver packages to customers and more than 1,000 basis point increase in deliveries fulfilled within region, which is now at 76%.

This shows significant operational and logistical improvements, leading to lower costs. Whereas the increasing number of one-day or same-day deliveries is positive for customer satisfaction, as mentioned before, this also boosts Amazon’s cost savings on shipments. This is due to the simple fact that the closer the fulfillment center is to the customer, the lower the shipping costs are. This makes the lower shipping times a double positive for the company and highlights the strength of its delivery network, which has been building over many years, making it hard to match this for competitors, at least not on this scale. From this standpoint, Amazon is unchallenged as well.

Furthermore, management remains optimistic and committed to further improving productivity as highlighted by the quote from the earnings call below:

While we’re seeing strong early results from this regionalization effort, we still see several ways in which we can be more efficient in this structure and we believe will improve productivity further.

This should lead to further cost efficiencies and higher operating margins. As management has shown its ability to improve margins over recent quarters, they have given investors no reason to doubt this commitment either. These margin improvements are what investors should be focusing on as this will drive significant cash flows and earnings to shareholders.

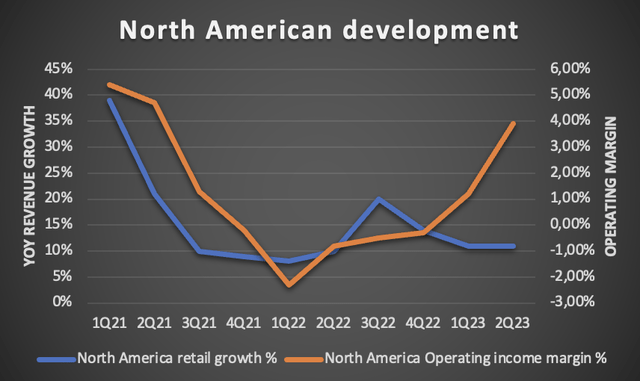

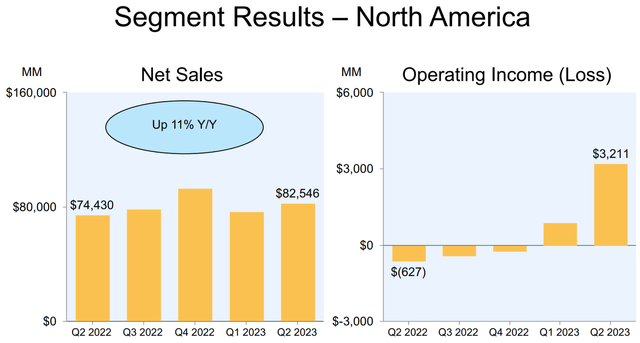

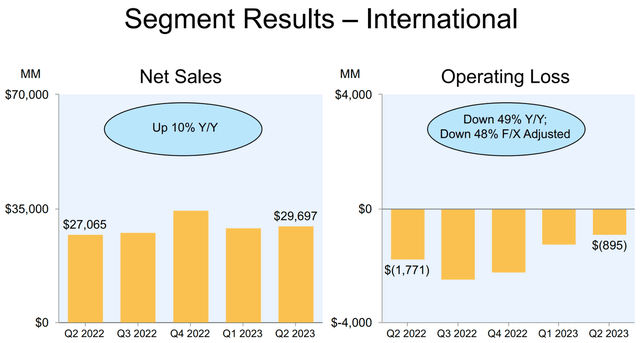

Since bottoming in the first quarter of 2022, Amazon has recorded five consecutive quarters of operating margin improvement for its North American business, hitting 3.9% in Q2, the highest level in two years. Operating income was $3.2 billion, compared with an operating loss of $0.6 billion in 2Q22.

Key to the margin expansion has been the slowing growth in operating costs through improved shipping and fulfillment costs efficiencies. Revenue growth is now outpacing operating costs, resulting in improved margins. So, no, Amazon is not cutting costs, but it is simply slowing the growth of these costs through improved efficiencies.

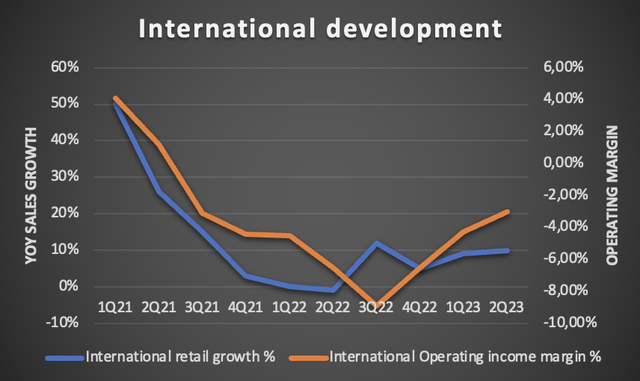

Meanwhile, the International retail segment operating margin bottomed in Q3 of 2022 and has seen three consecutive quarters of improvement, though it still came in at a negative 3% in Q2. Of course, most of the company’s international operations are much younger and are still rapidly developing toward profitability. Investors need to be a little more patient with this segment. The operating loss was $0.9 billion, compared with an operating loss of $1.8 billion in 2Q22

To further illustrate the significance of Amazon improving retail margins, as of the latest quarter, operations apart from AWS accounted for around 84% of net sales and saw the operating margin come in at 2%. Even when assuming a very conservative growth rate of 11% over the next 2.5 years for the retail segment and the operating margin improving to 5%, which should be absolutely no problem for Amazon when looking at the massive improvement over the last year or so and headwinds in the International segment easing, this would result in a very significant $29.7 billion in operating income in FY25 generated by the North American and International segment alone. I believe growth should probably come in even higher, but this conservative estimate clearly shows the segment’s potential.

Still the leader in a fast-growing industry, and no, I am not talking about cloud

As illustrated before, Amazon is by far the largest e-commerce platform worldwide. It is still expanding into new regions, starting operations in 6 new countries over the last five years. This significant market share has also provided the company with some resilience, as highlighted by the continued solid growth rates. Last quarter, Amazon reported growth in its North American segment of 11% YoY to $82.5 billion, which means growth in North America remains in the double digits despite headwinds like inflation and decreasing consumer spending power, a testimony to the company’s strength. Furthermore, as e-commerce volumes are stabilizing, as highlighted by the recent quarterly results from Deutsche Post (OTCPK:DHLGY), we could see growth accelerate slightly in the second half of the year and increase its pace going into FY24.

Amazon quarterly data (Amazon)

The overall e-commerce outlook remains incredibly strong, which investors often seem to forget. According to Grand View Research, the global e-commerce industry is poised to grow at a CAGR of 14.7% through 2030, fueled by the continued digitalization worldwide. With Amazon being the number one player in this industry by a large margin, it should be well-positioned to benefit.

As for International revenues, these increased by 10% YoY to $29.7 billion in Q2. As these operations tend to be much younger and have a weaker moat than US operations, growth slowed more significantly over recent years, even turning negative in the year-ago quarter. Yet, growth has been more meaningfully accelerating over recent quarters as headwinds are easing and Amazon continues gaining share. The growth runway for Amazon in countries outside of North America is massive and should be a growth driver for the company, although competition also tends to be higher in these countries, which might lead to the segment continually reporting lower margins.

Amazon quarterly data (Amazon)

Advertising and subscriptions are the most significant growth drivers for Amazon

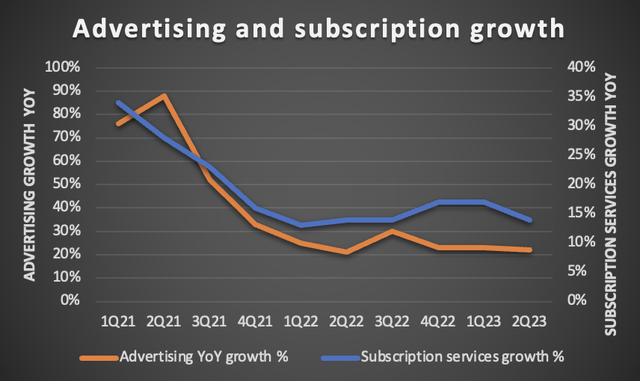

Earlier, I said that Amazon has a massive user base that it can leverage to grow its subscription services and advertising efforts. How well the company is indeed able to leverage this user base is nicely illustrated by the graph below.

Amazon is rapidly growing both of these services and although these have seen slowing growth rates, these remain at impressive levels of above 20% and mid-double digits. These service revenues are incredibly important as they carry meaningfully higher margins and are more recurring in nature, especially the subscription revenues.

As a result of these growing rapidly over recent years, service revenues now make up 56% of Amazon’s total revenue (also includes AWS), up from just 43% in 2019. As this continues to grow more quickly, as is the expectation, this creates a more reliable and resilient revenue stream for Amazon and should improve its overall margin profile.

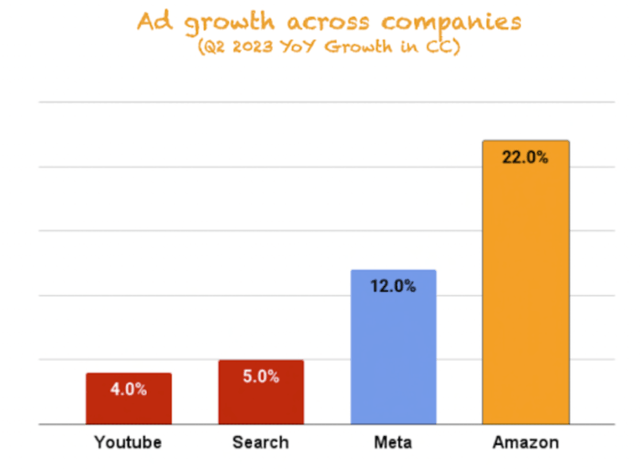

Zooming in on advertising, this remains a massive opportunity for the company. Advertising revenue increased by 22% YoY to $10.7 billion, now making advertising alone a $40 billion run-rate business for Amazon, sitting at half that of AWS but growing almost twice as fast.

Growth in advertising revenues has been slowing over the last year as a result of the overall downturn in the digital advertising industry, but growth rates have been stabilizing in recent quarters and still remain above 20% YoY, far above all its advertising peers. As beautifully illustrated by the graph below from fellow SA analyst Best Anchor Stocks, Amazon is delivering much faster growth in advertising compared to its industry-leading peers in the advertising industry.

Seeking Alpha analyst Best Anchor Stocks

Amazon has shown its ability to grow advertising revenue at a rapid clip, also through a down cycle in the advertising industry. The secret to this success is the massive number of eyeballs that are attracted to the Amazon platform and apps every single day and the fact that these people come to Amazon with clear intent. They literally type what they want in the search bar, making it easy for Amazon to precisely target the advertisements, which leads to better results for advertisers, which is why they likely prefer Amazon as an advertising platform over alternatives like Meta’s (META) social media apps.

I expect growth in advertising revenues to start accelerating again from the fourth quarter onward as growth in the overall advertising industry accelerates again. I believe advertisers will keep preferring the Amazon platform over alternatives, which should ensure that Amazon keeps outgrowing its peers and taking market share.

With the digital advertising industry projected to grow at a CAGR of close to 14% through 2030, I believe Amazon should be able to keep growing its advertising revenues at a growth rate of above 20%, making it one of the most important growth drivers for the company.

In closing of the retail subject, I used a very conservative growth rate of 11% for the next 2.5 years in my earlier calculations. Yet, based on my research, I believe a FY24 and FY25 growth rate of 13% to 14% is more likely, driven by my bullish stance on the company’s advertising efforts and e-commerce outlook.

AWS will continue to be a growth driver for Amazon but don’t overestimate its competitive strength

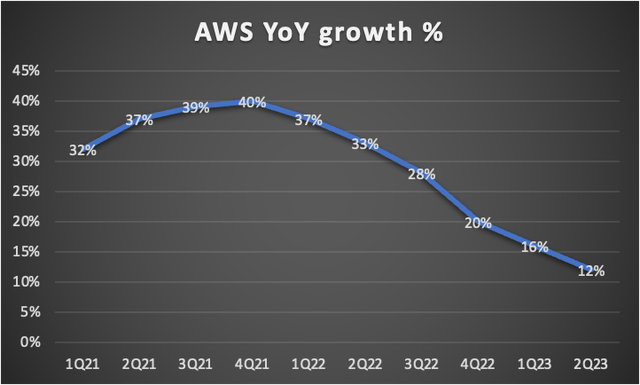

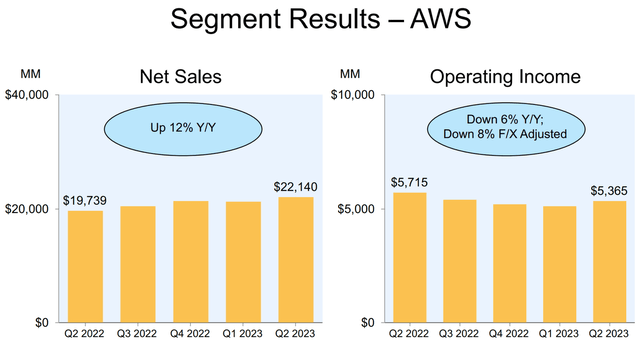

Q2 revenue derived from the company’s cloud operations, AWS, came in at $22.1 billion, up 12% YoY, slowing down further from 16% in Q1 and 33% one year ago. After a rapid growth rate deceleration over the last year, growth now finally seems to be stabilizing and even came in around one percentage point above the analyst consensus after reporting disappointing growth for several quarters. Still, the growth deceleration is worrying.

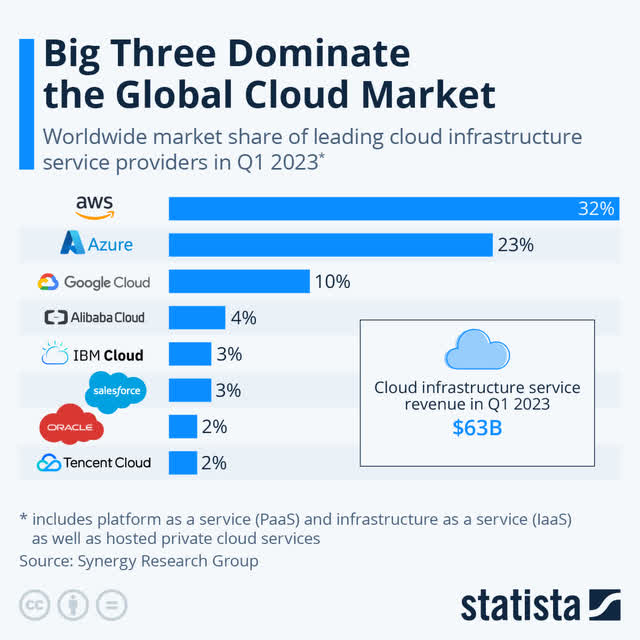

Yes, the AWS segment is massive and of great importance to Amazon. The outlook for the cloud industry remains strong and profitability remains solid. Also, AWS remains the global cloud leader, although it has been losing market share to the likes of Microsoft, Google (GOOGL) (GOOG), and Oracle over the last year or so. This is highlighted by the latest quarter where Microsoft’s and Google’s cloud segments continued to report incredible growth of above 25%, while growth for AWS fell to the lower teens. As a result, AWS has been losing market share. Back at the end of 3Q22, the cloud platform still held a market share of 34%, which has now fallen to 32%, while Microsoft went from 21% to 22%. While this might not seem overly meaningful, a 2% loss in market share is quite impactful long term.

Amazon quarterly data (Amazon)

Furthermore, Amazon looks to be on the back foot compared to some of its peers like at least Microsoft and Oracle, regarding its cloud offering and the very promising integration of AI in particular.

The likes of Microsoft and Oracle seem to have taken the lead, with Microsoft being the largest threat to AWS as its cloud platform is superior today, according to some customers. Yes, being the largest with thousands of large customers gets you so far but it does not make you untouchable if your offering isn’t superior.

Furthermore, regarding AI, which is expected to be a crucial driver in the cloud industry over the next decade, Oracle seems to have the strongest and most specialized platform. So, while AWS will definitely benefit from AI, the popularity and importance of the technology will not be working in its favor in terms of holding on to its market share.

Yet, not all is negative. AWS will continue to be a meaningful growth driver for Amazon and one of the leaders in the cloud industry. In the short term, AWS growth is stabilizing as customers focus more on innovation from optimization, creating a higher demand for cloud expansion, benefitting AWS. This is what primarily drove the fact that AWS growth came in 1 percentage point above the Wall Street consensus, and I expect growth to have reached a bottom. We will likely see growth accelerate over the next couple of quarters with a similar growth rate in Q3 to Q2.

AWS segment operating income still was $5.4 billion, compared with an operating income of $5.7 billion in 2Q22. According to CEO Andy Jassy, AWS is still in its early adoption curve. Furthermore, he believes short-term headwinds will impact the segment’s profitability, but continued investments should make sure it keeps customers on board. In the long run, keeping customers on board should be the most important aspect as it is safe to assume that customers will spend more on their cloud environment over time, which should drive growth for Amazon.

Notably, CEO Andy Jassy stated this in his annual shareholder letter back in April, so the decreasing profitability of AWS in Q2 does not come as a surprise. I even believe it is positive in some aspects as explained above. Amazon is not overly focused on driving profits but wants to keep its customer number as steady as possible to fuel long-term growth. Amazon has shown in the past that it is capable of focusing on the long-term at the cost of short-term profitability, only to grow its market share and drive long-term growth at above industry growth rates. For that reason, I am quite bullish on these developments and the lower operating margins are simply the result of continued investments and slowing growth due to a challenging macroeconomic environment.

On the note of AI, reportedly, loads of AWS customers are already using Amazon’s new AI tools. Bedrock, an AI tool that allows customers to use foundational models with their own data without having to invest in servers, is already being leveraged by customers like Sony (SONY) and Ryanair (RYAAY). Amazon is focused on creating a platform where other developers can build AI models, which Amazon customers can then use. This is what was said regarding AI during the latest earnings call:

Inside Amazon, every one of our teams is working on building generative AI applications that reinvent and enhance their customers’ experience. But while we will build a number of these applications ourselves, most will be built by other companies, and we’re optimistic that the largest number of these will be built on AWS.

AWS not only has the broadest array of storage, database, analytics and data management services for customers, it also has more customers and data store than anybody else.

While I might often sound negative on AWS, I am not. I am very bullish on the business but believe its strength and growth potential is often overestimated. Yes, it already has an $80 billion revenue run rate and is the largest cloud platform available, but Microsoft seems better positioned today. As a result, AWS will most likely lose market share, but its massive size will still allow it to benefit from the expected 14% growth CAGR for the cloud industry. I believe the business should be able to report growth rates of around this level, between 12% and 15% through 2030. I do not expect it to start reporting growth that sits structurally above 20% again. Nevertheless, if AWS grows by 14% per year over the next three fiscal years (including this year), this will result in the segment reporting sales of $117.3 billion by FY25. If the operating margin would return to 28% for this segment, which still sits below its 1H22 operating margin, this should lead to $32.8 billion in operating income.

If it is able to report these growth rates, which I believe is highly likely, investors still have little to complain about. Its incredible profitability will continue to drive impressive earnings growth for Amazon.

Outlook & AMZN valuation

For Q3, Amazon guides for revenue between $138 billion and $143 billion, or to grow between 9% and 13% YoY, roughly in line with the previous two quarters. Operating income is expected to be between $5.5 billion and $8.5 billion, up significantly from the $2.5 billion reported in 3Q22.

As for my long-term expectations, based on my earlier-mentioned growth expectations and margin developments, I expect FY25 operating income from the retail segments to be $30.5 billion and AWS operating income to sit around $32.8 billion, which together leads to a FY25 operating income of $63.3 billion, based on an overall operating margin of 8.7%.

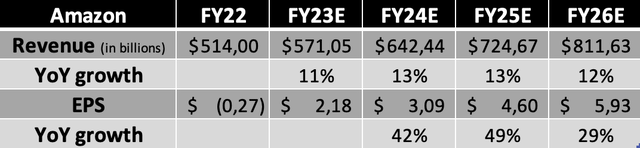

If net income as a percentage of operating income drops to 80%, from 87% last quarter, leading to slightly less net income margin expansion, this should lead to an FY25 net income of $50.6 billion or a net income margin of 7%, up from 5% last quarter. This should bring EPS in the range of $4.60 by FY25. I believe the estimates used in these calculations are still quite conservative and leave plenty of room for upside.

Furthermore, based on the company’s recent financial performance, outlook, and my in-depth analysis and calculations, I expect the following financial results through FY26.

Financial estimates (By Author)

(This includes Q3 revenue of $142.5 billion and EPS of $0.61)

Shortly explaining these estimates, I expect Q3 to be another strong quarter with improved profitability for Amazon and expect revenue and operating income on the top end of management’s guidance. This includes the expectation of solid continued growth in advertising and retail, and AWS to report another quarter of 12% to 13% growth YoY.

For the years after, I expect substantial top-line growth from Amazon as growth in the AWS segment should accelerate slightly to the 14/15% range, and the other segments to report growth slightly below that level. EPS should continue to increase more rapidly as laid out in my earlier calculation.

As for the valuation, this is always a tough one for Amazon. Yet, now that we have a more straightforward profitability trajectory, we can start valuing the company on its earnings. Going with a 37x P/E multiple would lead to an FY25 target price of $170 per share.

I am using a 37x multiple, which is rather high, as Amazon should be able to grow revenue at low to mid-double digits for the remainder of the decade and EPS even faster, driven by significant margin improvements. Furthermore, my current estimates are still rather conservative and leave plenty of further upside potential, which is why I am comfortable with paying a higher multiple. Furthermore, looking at its P/S, EV/EBITDA, and Price/Cash Flow ratios, it is valued around 20% below its 5-year average, which should also create a sufficient margin of safety.

Going with a 10% annual return, this would lead to a fair share price of $134 today. Yet, this is solely based on its P/E ratio and very conservative long-term estimates. Therefore, I recommend taking this valuation with a pinch of salt.

For comparison, 55 Wall Street analysts currently maintain a target price of $167 per share combined with a strong buy rating.

Conclusion

Amazon’s Q2 results demonstrate a promising outlook. Management’s focus on cost efficiencies has turned the retail segment into a solid profit driver, while the AWS segment, despite facing challenges, remains a significant growth contributor.

Overall, I am turning more bullish on Amazon as there are significant cash flow and margin improvements visible, improving the company’s financial health and earnings growth potential. I believe investors should focus their investment case on the opportunities in the retail segments, including growth in e-commerce, advertising, and subscriptions. Meanwhile, AWS should remain a significant growth and profitability driver as well, although it will most likely continue to lose market share to competitors which are better positioned within the cloud computing and AI market.

With an estimated fair value of $134 based on conservative estimates and a current share price of $138, I rate Amazon shares a hesitant buy. I am comfortable starting a small position at these levels and will likely do so in the next few days. However, I urge investors to trade carefully and recommend adding more aggressively if the share price drops below $134 again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.