Summary:

- Alphabet’s margins are beginning to rebound and have now returned to the percentage they were at in Q1 2022.

- Meanwhile 1) Resilience in Search, 2) stabilization in YouTube Ads, 3) Market share and profitability gains in Cloud and 4) Growth in Other Google (i.e. YouTube subscription) make us optimistic.

- For all the hoopla surrounding ChatGPT and the belief that it will provide MSFT an opportunity to take share from Alphabet’s core search business, it has yet to happen according.

- Looking for more solid entries into tech stocks? Join my Investor Community, including an automated hedging signal and trade alerts.

Alex Wong

Given the macro headwinds, not many investors expected the magnitude of the Nasdaq-100’s rally through the first six months of 2023. Going into this year, we were positioned for bottom-line focused investment themes that we felt would be able to deliver earnings growth due to secular demand for its products, and in some cases, be able to reduce costs to maintain profitability.

Big Tech versus Tech Sector earnings

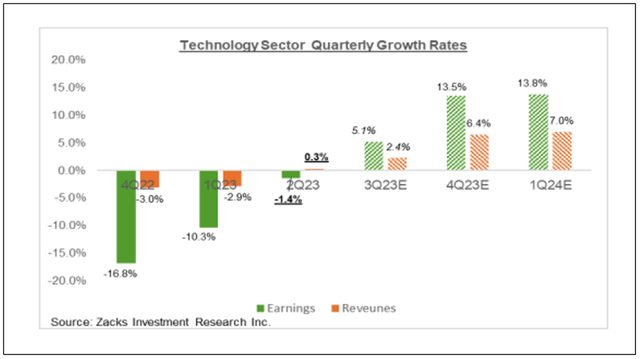

Below is an analysis of consensus earnings estimates from Zack’s on Q2 Technology Sector earnings trends through July 26 plus expectations for the next three calendar quarters.

For the past three quarters, sales and earnings have declined on a year-over-year basis. However, there appears to be stabilization as year-over-year comps get easier and the market is estimating a modest resumption of growth in Q3 and an acceleration in Q4 to Q124.

Zacks Investment Research Inc.

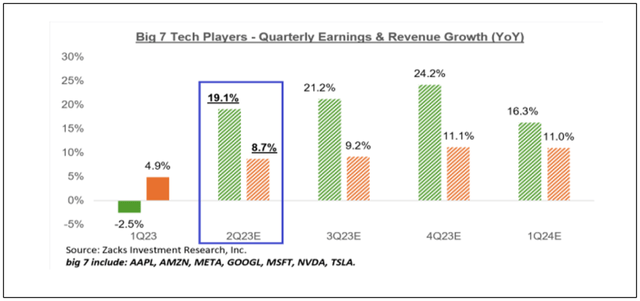

Meanwhile, Zack’s looked at the earnings picture for the “Big 7 Tech Players” – Microsoft, Alphabet, Meta, Nvidia, Apple, Tesla and Amazon. The earnings profile for the Big 7 is estimated to be more robust compared to the overall technology sector.

Zacks Investment Research Inc.

In addition to a better earnings profile, Big Tech prices and valuations have benefited from other factors that investors are seeking

-

Focus on their AI capability and having the financial resources to make the required investments so that they make a positive contribution to future earnings.

-

Company size (i.e. large cap) and the ability to manage margins in the face of macro headwinds by meaningfully reducing costs but not at the expense of critical high ROI investments.

-

Credit quality – following Fitch Ratings’ downgrade of U.S. government debt to AA+. Big Tech Credit worthiness is on par if not greater than US debt. For example, Alphabet has the same AA+ rating.

Amongst the Big 7, we believe Alphabet stands out for several reasons:

Year of Execution – Alphabet

Beginning in mid-2022, Tech Insider Network began to transition allocation toward larger cap tech stocks because they felt they are in a better position to navigate a macro downturn. Big Tech has levers at its disposal to manage its margins by rightsizing its cost base. Importantly, at the same time they have the financial strength to make the investments required to capitalize on the AI opportunity and take market share from its weaker competitors. The medium-term bull case is that once revenue begins to meaningfully reaccelerate helped by its AI offerings, the combination of optimizing its cost structure and efficiencies garnered from technology investments leads to expanding margins. This is similar to Meta and its “Year of Efficiency”.

At the moment we prefer Alphabet (NASDAQ:GOOGL) over Meta (META). We see a similar story playing out for Alphabet and its “Year of Execution”. We believe it’s in an earlier stage than Meta in its self-help process and its core business areas are just now showing signs of stabilization. Alphabet’s margins are beginning to rebound and have now returned to the percentage they were at in Q1 2022. Meanwhile 1) Resilience in Search, 2) stabilization in YouTube Ads, 3) Market share and profitability gains in Cloud and 4) Growth in Other Google (i.e. YouTube subscription) make us optimistic that revenue will accelerate and there is upside to margins for the remainder of the year.

In the recent Q223 earnings call, management commented on the QoQ strength in margins:

A quick comment on the sequential improvement in operating margins in the second quarter. There are two factors to note. First, the benefit from an acceleration in search advertising revenue growth in the second quarter. Second, the vast majority of the charges related to our workforce reduction and optimization of our global office space were taken in Q1.”

Search moat is strong

For all the hoopla surrounding ChatGPT and the belief that it will provide MSFT an opportunity to take share from Alphabet’s core search business, it has yet to happen according to Search Engine. According to their analysis, Microsoft is losing market share. It peaked at 9.92% in October 2022 and is now at 7.14%. With its market position firmly entrenched, Alphabet has the audience to roll out its Search Generative Experience (SGE). On its own, the Search business has proved resilient because it provides advertisers an attractive ROI on their ad spend. Looking ahead, SGE will improve advertisers’ ROI and will likely provide Alphabet additional pricing power. This will also improve their retail vertical. Meanwhile, consumer interest will further strengthen Alphabet’s dominant market position in Search.

However, let’s not forget about anti-trust trial

One of the reason we’re very positive on the AI potential for Google’s businesses is that it is sitting on the world’s very best consumer data, which is not an exaggeration in the least bit. Its ability to lead in artificial intelligence and large language models should not be underestimated.

Therein lies the issue. Google undisputedly has the world’s best consumer data, but did this grow to become part and parcel with operating a monopoly? The Department of Justice has asserted anti-trust violations against Google with the trial beginning in September 2023.

We anticipate two outcomes. The antitrust outcome will be mild, and Google will be empowered to continue to dominate. Or, the outcome will require the ad properties to be broken up, leading to a weaker stance for Google. This could benefit smaller ad-tech players, which we have identified and are monitoring closely.

The Tech Insider Network Analyst Team contributed to this analysis

Recommended Reading:

- Google Stock: Search Is On The Precipice Of Multi-Decade Disruption

- What Alphabet Won’t Tell You About The GDPR

- Big Tech Earnings: Microsoft And Alphabet Signal Q2 Could Be A Bottom

- Alphabet Stock Shows Underlying Strength Compared To Facebook (Meta Platforms)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, NVDA, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.