Summary:

- Roku’s Q2 results showed improved growth profitability, but the company’s operating environment remains difficult.

- Ad pricing will likely be pressured going forward, and Roku’s high margin Media and Entertainment revenue stream could weaken in the second half.

- Roku’s stock appears attractively priced, if US success can be repeated internationally, but investors should be prepared for near-term volatility.

Vanit Janthra/iStock via Getty Images

Roku’s (NASDAQ:ROKU) second quarter earnings showed an improvement in growth and operating profitability. The stock price reaction to what were fairly mediocre results demonstrates how negative sentiment towards the stock has been. Investors shouldn’t just expect smooth sailing from here on out though. Ad pricing is likely to remain under pressure, as is Roku’s high margin Media and Entertainment revenue stream, potentially delaying a return to consistent growth and profitability.

Market

While there are signs that some of the headwinds that have plagued Roku in recent quarters are beginning to ease, soft ad demand coupled with an increasing supply of inventory is an ongoing issue. In addition, consumer spending could be pressured in the second half of the year, and the writer’s strike is likely to impact Media and Entertainment revenue.

Roku has suggested that its operating environment did not change in the second quarter, with strong demand for Roku TV models and industry wide soft TV advertising demand. Smart TV unit sales in the US were resilient in Q2, despite slight increases in TV panel and freight costs. Consumers are reportedly focusing on value, which is a tailwind for Roku.

The total US advertising market was flat YoY in the second quarter. Ad spend on traditional TV declined 9.4% YoY, with the shift to streaming appearing to accelerate. Consistent with Q2 industry trends, brand advertising on the Roku platform remained pressured in verticals like technology and media and entertainment, which was offset by increased spend in categories like CPG and health and wellness.

VIZIO (VZIO) suggested that its advertising business started the year quite slow, but growth accelerated as the second quarter went on. As a result, VIZIO is optimistic about the second half of the year, although the writer’s strike is expected to create headwinds for its media and entertainment segment.

PubMatic (PUBM) delivered over 30% growth in CTV in the second quarter, although CTV revenue is expected to decline YoY in the third quarter. PubMatic’s video CPMs were down 10% in July relative to June. Given the progression of CPMs over the last 12 months, PubMatic expects video CPMS to be roughly 20% lower YoY in the third quarter.

Magnite’s (MGNI) CTV contribution ex-TAC increased 8% YoY in the second quarter. June was softer than expected though, with slower order flow and paused campaigns. This may be something of an SSP specific issue though, as larger players are taking share from smaller CTV publishers and moving spend towards programmatic advertising.

Netflix’s (NFLX) revenue growth was only around 3% in the second quarter, although is expected to accelerate to 7% in the third quarter. Revenue growth is also expected to increase further in the fourth quarter, as Netflix continues to monetize account sharing between households and grow its advertising business.

Roku

Roku continues to be the number one TV OS in the US by a wide margin and has been gaining share across the full range of TV screen sizes, particularly in the larger-screen segment which increased more than 70% YoY. While Roku has established a strong position in the US, this success still needs to be replicated internationally. In the second quarter, the Roku OS was the number 1 selling smart TV OS in Mexico for the third quarter in a row. Roku has expanded its TV licensing program to Central America with the launch of RCA Roku TV models in Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua.

Roku also launched Roku-branded TVs in March through Best Buy. These have generally been receiving strong customer and industry reviews, but the success of the initiative remains to be seen. Roku branded TVs could reasonably be considered a competitive threat to Roku’s OEM partners, but the company has stated that it is trying to increase its market share in mid to high range TVs where it has previously had less exposure. This also allows Roku to showcase features which OEMs may have rejected for cost reasons. This should help to scale Roku’s business, which management continues to believe will contribute to consolidation within the TV OS market. How important Roku’s cost advantage is and whether the market transitions towards 1-2 operating systems remains to be seen though. Roku’s cost advantage comes from the fact that its OS is designed to run on less powerful chips with limited memory requirements. In comparison, many other systems are based on Android, which is a mobile first operating system.

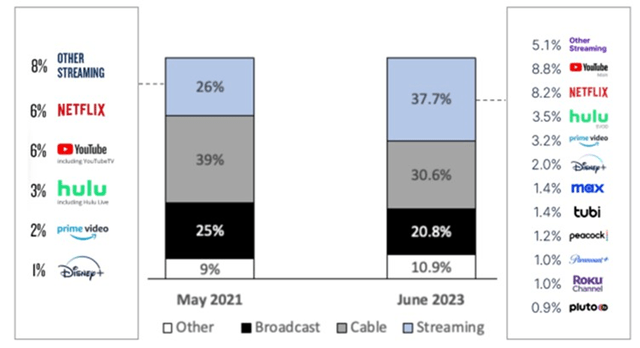

The Roku Channel continues to be an area of strength for Roku, increasing the value of its platform to consumers and providing another monetization surface. The Roku Channel was responsible for an estimated 1.1% of total US TV viewing in May.

Figure 1: Share of US TV Screen Time, Total Day, Persons 2+ (source: Netflix)

While the Roku Channel provides additional ad inventory, the benefits of this are somewhat limited at the moment as Roku is currently demand constrained rather than supply constrained. Even prior to recent ad market weakness, Roku’s platform was demand constrained in its core video advertising.

To try and help combat this, Roku is opening up to third-party DSPs, but this process is occurring slowly as Roku wants to protect its existing revenue streams. Opening up to programmatic advertising in a demand constrained environment could place immense pressure on prices as Roku has so far been able to support prices through its direct sales force.

Roku is leveraging relationships with top-tier advertisers to open up certain inventory to incremental demand through DSPs. Ultimately pricing should be dependent on ad performance and Roku is comfortable in this regard, believing that the ROI supports premium CPMs.

Roku is not alone in this regard though, with AVOD in general moving towards programmatic advertising. For example, Magnite has suggested that its partners (Disney, Roku, Warner Brothers, Vizio, etc.) are moving more inventory toward programmatic transactions and away from traditional direct sold executions.

Financial Analysis

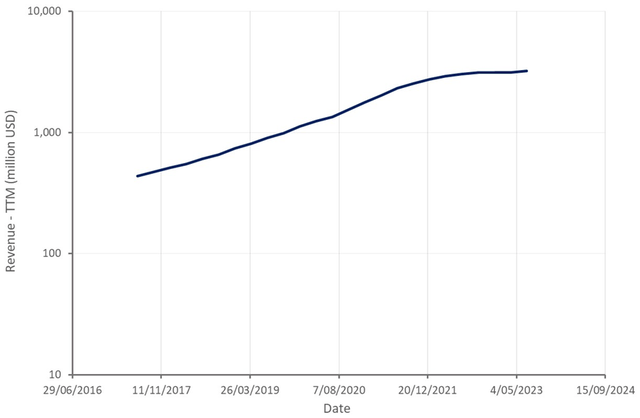

Total revenue increased around 11% YoY in the second quarter, with solid results from both the Player and Platform segments. Player revenue increased roughly 13% YoY in the second quarter. Player unit sales remain above pre-COVID levels, although pricing pressure remains, with the average selling price down 9% YoY in Q2. Platform revenue grew approximately 10% YoY in the second quarter, which is a solid result given ongoing ad inventory pricing pressures.

Roku expects total net revenue in the third quarter to be 815 million USD, a 7% YoY increase. It is not clear how much cushion Roku has built into this guidance though. Consumer spending could be pressured in the second half of the year, particularly with student loan payments recommencing. The writer’s strike also places media and entertainment spend at risk.

Video advertising is the largest source of revenue within Roku’s platform segment. Media and entertainment spend is also an import source of high margin revenue, and Roku receives a revenue share from users subscribing to streaming services. If there is a dearth of content later in the year, promotional spending for new content is likely to drop. Streaming services could also see less subscriber growth and elevated churn, pressuring some of Roku’s high margin revenue streams.

Figure 2: Roku Revenue (source: Created by author using data from Roku)

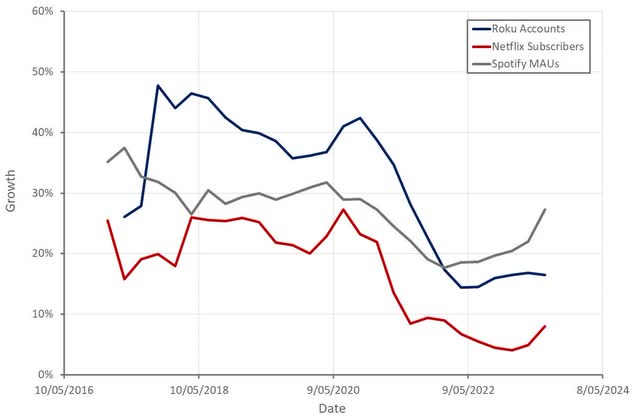

Roku’s user base continues to grow, albeit at a somewhat muted pace. In contrast to streaming services like Netflix and Spotify (SPOT), Roku hasn’t seen a recent uptick in account growth though. While this could be due to Roku specific issues, it should be noted that Roku is generally dependent on an upfront hardware sale to grow accounts. As a result, Roku is probably dealing with a post-pandemic hangover and the impact of inflation and interest rates on consumer spending.

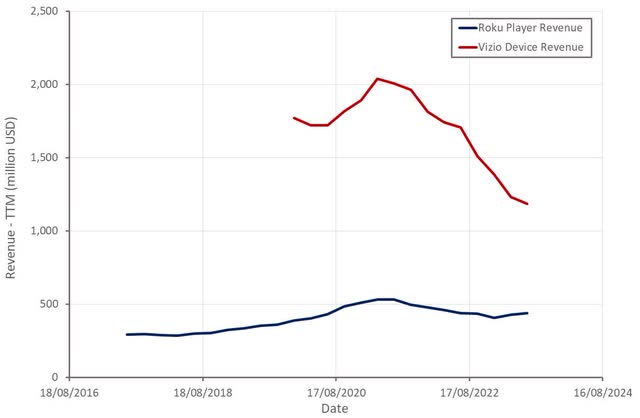

Figure 3: Roku Account Growth (source: Created by author using data from company reports) Figure 4: Roku Player Revenue (source: Created by author using data from company reports)

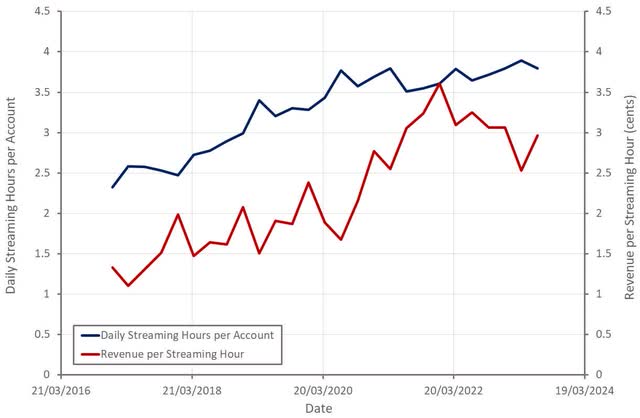

Roku’s streaming hours increased 21% YoY in the second quarter, while viewing hours on traditional TV in the US fell 13%. Streaming Hours on The Roku Channel grew more than 50% YoY. Strength in streaming hours is helping to offset the impact of advertising weakness.

Figure 5: Roku Streaming Hours (source: Created by author using data from Roku)

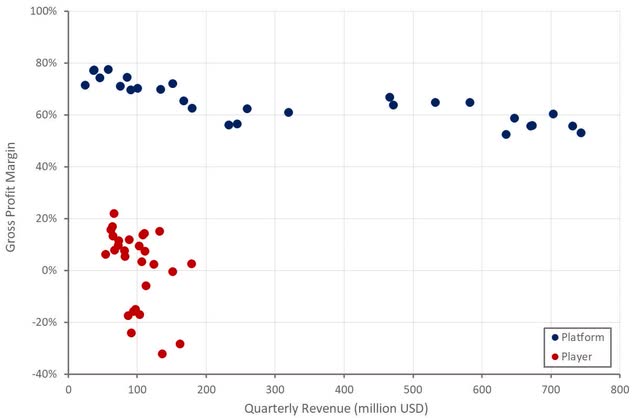

Roku’s player gross profit margins continue to be extremely poor, although the company has stated that some of the inflated component and supply chain costs are starting to normalize. Even with lower input costs, Player margins may not improve significantly as Roku needs Player sales to drive account growth.

Platform gross profit margins also continue to be fairly soft. Roku has attributed this to weak ad pricing in general along with a mix shift away from media and entertainment. While ad supported streaming should be supportive of media and entertainment spend long-term, a limited fall release schedule will likely negatively impact gross profit margins in the second half of the year.

Figure 6: Roku Gross Profit Margins (source: Created by author using data from Roku)

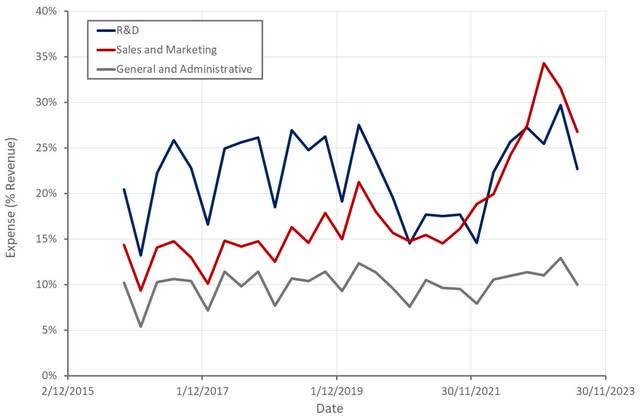

Roku’s operating expenses remain elevated on the back of investments in the business coupled with weak growth. While Roku’s operating profitability improved significantly in the second quarter, this is an area that the company still needs to improve.

Figure 7: Roku Operating Expenses (source: Created by author using data from Roku)

Valuation

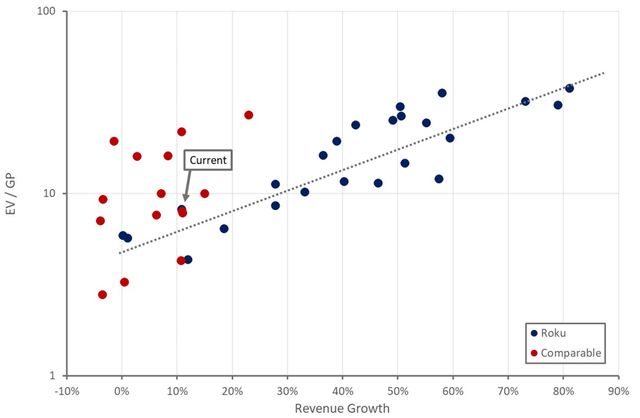

Based on its current growth and profitability profile, Roku’s stock appears to be valued broadly in line with its own price history, although at a slight discount to comparable companies. While Roku could perform well in the long run if it can replicate its US success internationally, a discount may be warranted due to near term headwinds.

Many companies (beyond just streaming) have responded to recent economic pressures by introducing advertising or increasing ad loads. This increase in supply has come at a time when demand is weak, resulting in downward pressure on pricing. Roku is likely to find itself with ongoing margin and growth headwinds while this situation persists. This could also be exacerbated by the resumption of student loan payments pressuring consumer spending and a potential recession, which would further mute advertising demand.

Figure 8: Roku Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.