Summary:

- JPMorgan Chase is the largest and most profitable bank in the U.S., offering a 2.6% forward dividend yield and over 20% upside potential.

- The bank demonstrates solid financial performance and efficiency, with higher net income margins and strong dividend history.

- JPMorgan’s massive scale and strong brand position it as a trusted one-stop shop for customers, with vast potential for cross-selling and cost-efficiency.

Michael M. Santiago/Getty Images News

Investment thesis

JPMorgan Chase (NYSE:JPM) is successful in utilizing all benefits from its massive scale. The bank has massive cross-selling potential, driving down the cost of new client acquisition. I see the management is very efficient in exercising JPM’s superpower in unmatched profitability. The bank demonstrates solid financial performance during this high-rates phase of the cycle and is entering the remainder of 2023 in a strong position. The stock currently offers a 2.6% forward dividend yield and above 20% upside potential. I think that when the largest and most profitable bank in the U.S. share offers these perks, investors should buy. That said, I assign JPM stock a “Strong Buy” rating.

Company information

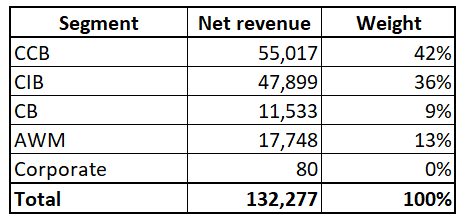

JPMorgan Chase & Co. is the biggest financial services firm [bank] in the U.S., with operations worldwide. JPM’s business is organized into four segments: Consumer & Community Banking [CCB], the bank’s wholesale business segments called the Corporate & Investment Bank [CIB], Commercial Banking [CB], and Asset & Wealth Management [AWM]. CCB and CIB combined accounted for 78% of the total net revenue in FY 2022. The bank’s fiscal year ends on December 31.

Compiled by the author based on the latest 10-K report

Financials

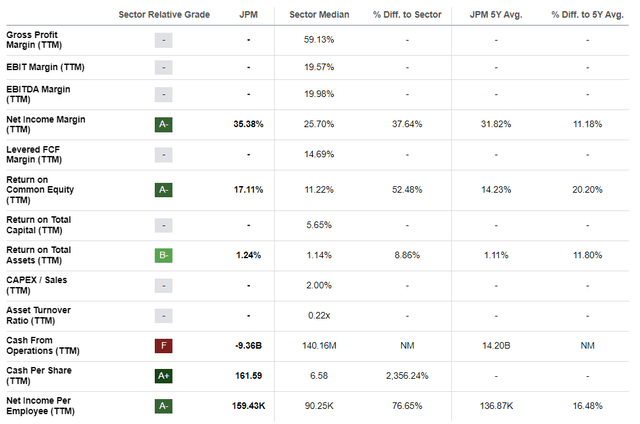

JPMorgan demonstrates stellar profitability compared to the sector median and expanded margins compared to past five-year averages. The net income margin is about ten percentage points higher than the sector median, which is impressive. A massive TTM negative cash from operations should not frighten potential investors since this was due to one-off items. When assessing the efficiency of the business, I like to look at per-employee metrics. As you see, JPM’s net income per employee is about 80% higher than the sector median, which is a massive gap given JPM’s scale.

The bank’s stellar profitability allows it to offer attractive returns to shareholders. JPM has a solid dividend history and the current forward dividend yield looks very attractive to me at almost 2.6%. The last five-year CAGR for the dividend was impressive at above 12%. Apart from paying out dividends, JPM consistently conducts multi-billion stock buybacks yearly.

JPM’s balance sheet is solid, with a Basel III Tier I standardized capital ratio at 13.8% as of the last reporting date, an increase from 12.2% a year earlier. The total capital ratio was 17.3%, up from 15.7%.

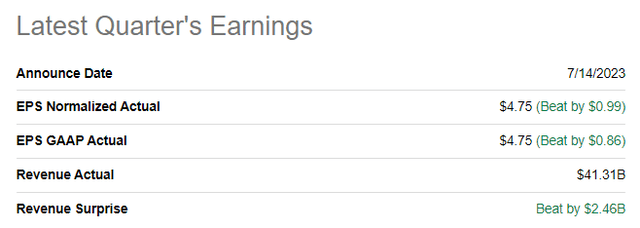

The latest quarterly earnings were released on July 14, when the bank smashed consensus estimates by a notable margin. Revenue demonstrated a massive 34.5% YoY growth, with non-GAAP EPS almost doubling. The strength was shown by all segments with double-digit revenue growth in all segments except for CIB.

The bank enters the second part of 2023 well-positioned. During the latest earnings call, the management raised its full-year NII guidance from $84 to $87 billion, while expense guidance remained unchanged. The upcoming quarter’s earnings are scheduled to be announced on October 13, with eleven upward revisions in the last 90 days. Quarterly revenue is expected at $39.46 billion, meaning a strong 21% YoY growth. The bottom line is expected to follow with a non-GAAP EPS YoY expansion from $3.12 to $3.82.

We leave in an era when financial services are commoditized and the bank’s scale is the most important factor to compete. JPM’s unmatched scale gives it massive competitive advantages. Operating four different business segments means JPM is able to provide a very broad spectrum of financial services. That said, the bank has vast room to cross-sell its services to customers. When banks cross-sell frequently, their customer acquisition costs go down notably. That is the biggest source of efficiency in the banking industry at the moment. Being able to provide a broad range of services also means that switching costs become higher for customers since it is more efficient for them to use a one-stop shop for financial services. JPM’s massive scale and strong brand give it a strong positioning to be a trusted one-stop shop for customers. What I like the most is that JPM’s management does not plan to stop there. They are building an ecosystem and its acquisitions of a booking system, a restaurant review company, and a luxury travel agent which means the bank wants to control the entire travel experience of customers. It will also help generate more customers in the future, and I think that “connecting” the travel industry to JPM’s ecosystem is just the beginning.

Valuation

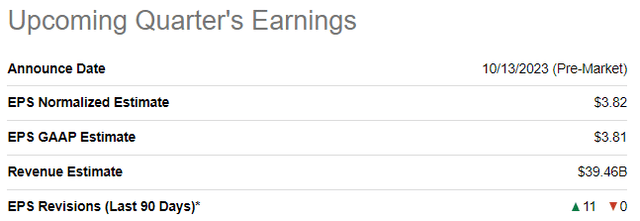

The stock rallied 11.6% year-to-date, lower than the broader market’s performance. On the other hand, JPM significantly outperforms the Financial sector (XLF) this year. Seeking Alpha Quant assigns the stock a low “D+” valuation grade. Indeed, the valuation ratios of JPM are mostly higher than the sector median. On the other hand, JPM is by far leading in the U.S. banking industry, meaning that premium to peers is fair. It is also crucial to emphasize that current multiples look fair and even lower than historical averages. That said, JPM looks attractively valued from the valuation ratios perspective.

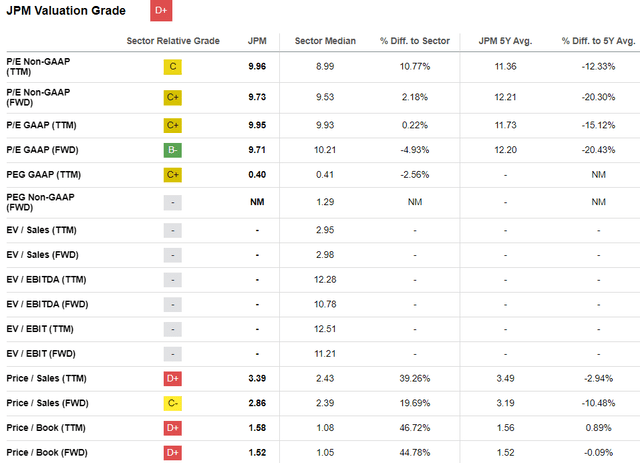

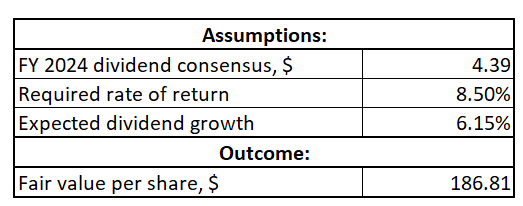

Now let me simulate the dividend discount model [DDM] to get more conviction regarding the fairness of JPM’s valuation. I use an 8.5% WACC as a required rate of return, as I did when I covered Bank of America (BAC). Dividend consensus estimates forecast FY 2024 payout at $4.39. Dividend growth is always difficult to project, but I prefer to be conservative. Therefore, I use half of the five-year CAGR, which would be 6.15%.

Author’s calculation

As you see, the DDM suggests that the stock’s fair price is almost $187, indicating about 24% upside potential. To me, both approaches suggest that the stock is undervalued.

Risks to consider

The banks’ earnings are closely tied to the broader economy and interest-rate cycles. Economic downturns can increase loan default rates, adversely impacting JPM’s profitability. Changes in Federal Funds rates also affect the banks’ net interest margin. As the management has almost no control over these external factors, the stock price of JPM tends to be very sensitive to economic cycles.

JPM is also exposed to significant regulatory risks. The banking industry is heavily regulated and as the biggest bank in the U.S., JPM is subject to very thorough scrutiny. Changes in regulations can impact the bank’s ability to engage in certain segments or expand into new opportunities.

The rise of the fintech industry also poses substantial risks to legacy banks like JPM. Fintech companies disrupt various segments if the financial industry and the bank face the risk of failing to keep up with new secular shifts. On the other hand, JPM has a vast scale and invests heavily in innovation with a $12 billion annual tech budget. It is good that the bank’s management recognized the need to invest in innovation, but the transformation and innovation execution risks are substantial, given the bank’s hyperscale.

Bottom line

JPM is a “Strong Buy” to me. The stock currently offers a very attractive upside potential and a decent dividend yield. When the largest and the most efficient bank in the U.S. is traded at a double-digit discount, it is apparently a gift for long-term investors. The bank’s massive scale is its superpower which unlocks unmatched cost-efficiency and cross-selling opportunities. The rise of fintech is a real threat, but I think that the management’s strong track record of success together with its $12 billion annual tech budget, makes JPM well-positioned to be successful during this technological revolution in the banking sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JPM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.