Summary:

- On August 2, PayPal, one of the leaders in the digital payments market, released its Q2 2023 financial report, which showed mixed results.

- At the end of September 2023, Alex Chriss will become President and CEO of PayPal.

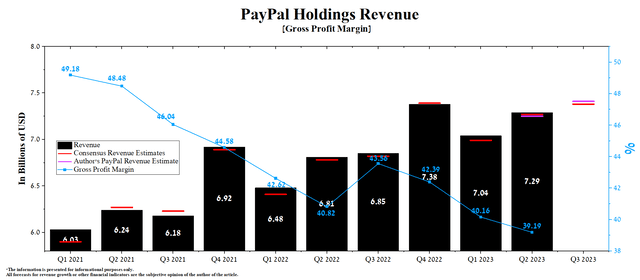

- PayPal’s revenue for the second quarter of 2023 amounted to $7.29 billion, 3.6% more than the previous quarter and 7% more than the second quarter of 2022.

- However, the main negative point in the financial report for the second quarter of 2023 was the decrease in the number of active accounts for the second quarter in a row.

- We continue our analytics coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

Denis_Vermenko

Less than a week after the publication of PayPal Holdings’ (NASDAQ:PYPL) financial report for the second quarter of 2023, which beat our expectations as well as analysts, it announced the launch of a stablecoin called PayPal USD. This initiative relates to the growing need for a reliable instrument to transition to digital currencies that can easily interact with the US dollar.

PayPal USD will be fully backed by deposits in US dollars, short-term US Treasurys, and other cash equivalents. This will ensure that this stablecoin can be exchanged for US dollars at a 1:1 ratio. It is important to note that Paxos Trust Company, responsible for issuing PayPal USD, plans to publish regular reports on the amount and composition of its reserves to ensure transparency and trust from users and regulators.

However, the company will need to invest significant effort to gain the favor of customers and politicians regarding the need to use this stablecoin for transactions. Currently, the regulatory framework for cryptocurrencies continues to evolve rapidly. But simultaneously, a unified global approach to their regulation and organizations interacting with them has not yet been developed. Ultimately, continued regulatory differences between agencies in the US will slow down the mass adoption of PayPal USD as a medium of exchange.

In addition, the company did not stop at the positive news and confirmed on August 14 that Alex Chriss will become its President and CEO at the end of September 2023. Before joining PayPal, he held senior management positions at Intuit (INTU) and was responsible for over half its revenue. Under his leadership, Intuit’s Small Business segment flourished, and its average annual revenue growth rate was 23%. This is a testament to his professional skills and effective business strategies, which have enabled the company to successfully cope in an environment where high inflation persists in the world, and China’s economic recovery after the end of the COVID-19 pandemic is slow.

The persistence of the tense macroeconomic and geopolitical situation in the world has a negative impact on the investment attractiveness of PayPal. Over the past few months, the company’s share price has continued to move sideways in the $60 to $76 per share range. We believe that the pessimism toward PayPal’s prospects is only short-term due to its continued growth in revenue and active use of its share repurchase program.

We continue our analytics coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

PayPal Holdings’ Q2 2023 financial results and outlook for the second half of 2023

PayPal’s revenue for the second quarter of 2023 amounted to $7.29 billion, 3.6% more than the previous quarter and 7% more than the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

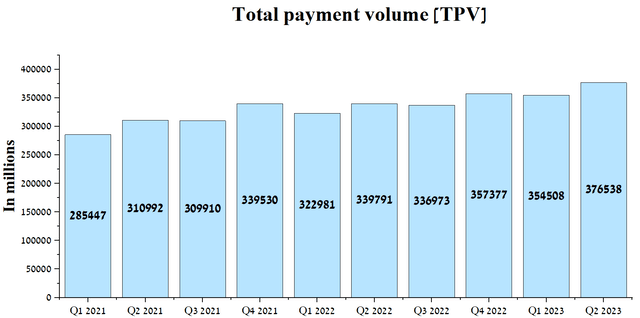

PayPal’s revenue growth was mainly due to increased total payment volume (TPV), which reached its highest levels in recent years. TPV was about $376.54 billion in the three months ended June 30, up 6.2% quarter-on-quarter.

Author’s elaboration, based on quarterly securities reports

The persistence of high-interest rates is dampening the growth of digital payments, which is reflected in slower growth in PayPal’s transaction revenues. Thus, transaction revenues amounted to about $6.56 billion, an increase of 4.5% compared to the previous year, but the number of payment transactions and TPV over the same period rose by 10.2% and 10.8%, respectively. Apart from the ongoing strengthening of the US dollar against the euro, Japanese yen, and pounds sterling, another factor for the divergence between these indicators is the decrease in contractual compensation from sellers that violate the terms of the partnership with the company.

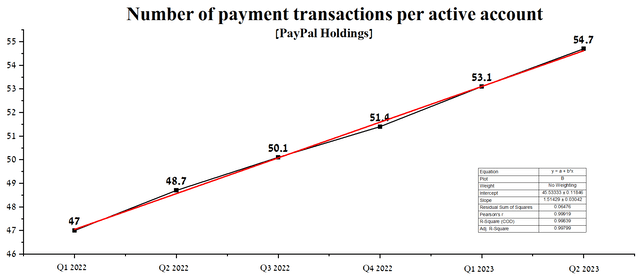

However, the main negative point in the financial report for the second quarter of 2023 was the decrease in the number of active accounts for the second quarter in a row. At the end of June, there were 431 million active accounts, down two million QoQ and five million below our expectations. On the other hand, such an equally important indicator as the number of payment transactions per active account continues to set new records. According to the results of the second quarter of this year, this indicator continued its steady linear growth reaching 54.7, which represents an increase of 12.3% compared to the previous year.

Author’s elaboration, based on quarterly securities reports

According to Seeking Alpha, PayPal’s Q3 2023 revenue is expected to be $7.25-$7.45 billion, up 1.5% from analysts’ expectations for Q2 2023. At the same time, under our model, the company’s total revenue will be slightly higher than the median value of this range and will amount to $7.41 billion. Daniel Schulman delighted investors at the earnings call by noting that total payment volume continued to rise year-on-year.

We expect Q3 revenues to grow approximately 8% on a currency-neutral basis. I would highlight that July was a very strong start to the quarter with currency-neutral revenue growth of 9% and TPV growth accelerating into the low teens. And for the year, we anticipate our revenue growth to be between 9% and 10% on a currency-neutral basis.

This positive trend confirms customers’ continued trust in the numerous payment services of PayPal. In addition, it demonstrates the effectiveness of the company’s management business strategies aimed at increasing its share in the highly competitive digital payments market.

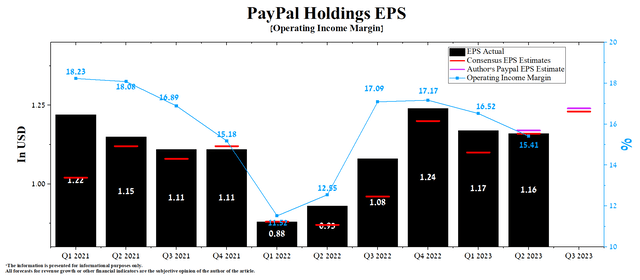

PayPal’s Q2 Non-GAAP EPS was $1.16, up 22.1% year-over-year, mainly due to its revenue growth. Despite the negative impact of increased transaction costs on the company’s margins, its management has maintained guidance for 2023. Non-GAAP earnings per diluted share are expected to be $4.95, up 19.9% year-over-year.

According to Seeking Alpha, PayPal’s Q3 EPS is expected to be $1.23, up 6% from the consensus estimate for Q2 2023. At the same time, according to our model, PayPal’s EPS will be $1.24, up 14.8% from the previous year.

Author’s elaboration, based on Seeking Alpha

Furthermore, the company’s management put forth an optimistic outlook for improving its margins in the second half of 2023. However, this was met with skepticism by a significant portion of the market participants, resulting in continued downward pressure on PayPal’s share price. From the earnings call:

When we think about the back half in Q3, we’ll still see some pressure on transaction margin performance. In Q4, we expect to see an improvement. And then over the longer term, our TM profile in the future will certainly be benefited by the acceleration in branded checkout by e-commerce acceleration by the improved cross-border trends that Dan referred to as well as from the value-added services that we’re adding on the PSP side.

Conclusion

On August 2, PayPal, one of the leaders in the digital payments market, released its Q2 2023 financial report, which showed mixed results. On the one hand, the company’s revenue and net income continue to grow year-on-year, on the other hand, the number of active accounts declined for the second quarter in a row. We believe this negative trend is temporary, and as early as the fourth quarter of this year, active accounts of the company’s payment services will begin to grow.

On August 7, 2023, the company announced the launch of a stablecoin called PayPal USD. This initiative relates to the growing need for a reliable instrument to transition to digital currencies that can easily interact with the US dollar. At the same time, the price of PayPal stock barely reacted to this news, mainly due to the doubts that market participants have about the speed of the introduction of this stablecoin as a medium of exchange and its potential impact on the company’s financial position in the short term.

In addition, this Monday, the company finally announced that Alex Chriss will become its President and CEO at the end of September 2023. Before joining PayPal, he held senior positions at Intuit, and under his leadership, the Small Business segment prospered despite the COVID-19 pandemic, high inflation, and the slow recovery of the Chinese economy.

We believe Mr. Market’s reaction to the company’s financial results for the three months ended June 30, 2023, is overly pessimistic. At the same time, negative sentiment among financial market participants regarding PayPal’s prospects will not last long due to the growth of its revenue and net income yearly and a decrease in total debt. Moreover, at the end of June 2023, PayPal’s remaining share repurchase authorization was $12.9 billion, a significant amount to keep its share price above the strong support level of around $59.

We continue our analytics coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.