Summary:

- Nvidia Corporation’s near-term prospects have been called into question, due to the recent mixed earnings reports by Super Micro Computer, its key server assembly supplier, and Taiwan Semiconductor, its foundry supplier.

- Despite the robust generative AI demand, it appears that Nvidia sales has been gated by supply, with Taiwan Semiconductor preferring to err on the side of caution for its capex/ revenue guidance.

- Based on the conventional replacement cycle of every four years, Nvidia has been presented with a generational AI opportunity, building upon CEO Jensen Huang’s strategic supercomputer gift to OpenAI in 2016.

- The GH200 Grace Hopper superchip slated for delivery by Q2’24 may also challenge AMD’s current sampling of MI300 Accelerators, allowing Nvidia to retain its market-leading GPU share.

- However, with much of the Nvidia upside potential already pulled forward, it may not be wise to add shares here, since we may see more near-term volatility, depending on how the upcoming earnings call on August 23rd plays out.

MicroStockHub

Nvidia’s Key Partners Are Painting Mixed Signals – The Investment Thesis Appears Inflated Here

We previously covered Nvidia Corporation (NASDAQ:NVDA) in June 2023, discussing its fiscal Q1 2024 double beats and stellar forward guidance, thanks to the robust generative artificial intelligence (“AI”) demand.

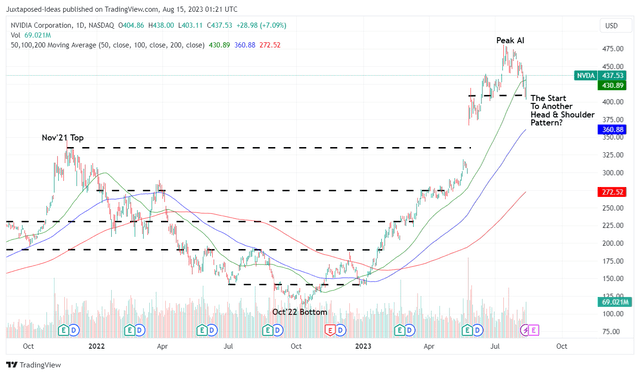

The high-growth cadence had also directly contributed to the subsequent rally and elevated valuations, with the stock charting new heights way above the previous November 2021 top at that time.

NVDA 2Y Stock Price

For now, NVDA’s near and intermediate term prospects have been called into question, due to the mixed earnings call by Super Micro Computer, Inc. (SMCI), its key server assembly supplier, and Taiwan Semiconductor Manufacturing Company Limited (TSM), its key foundry in the recent quarter.

With the durability of the generative AI demand over the next few years hanging in balance, it is unsurprising that the NVDA stock has had a drastic pullback of over -13% at its worst.

On the one hand, SCMI has reported “record-high backorders and new design wins/ customers” in the recent earnings call, thanks to the growing consumer demand for “large language model-optimized NVIDIA HGX-based Delta Next solution.”

On the other hand, with SCMI’s FY2024 revenue guidance of $10B at the midpoint (+40.4% YoY), it appears that demand has been gated by supply for now, due to “temporal key components supply shortages” and likely, insufficient manufacturing capacity.

While SCMI has also committed to expanded manufacturing footprint and tripled output from its plants in North America, Taiwan, and Malaysia over the next fifteen months, it appears that market exuberance has been momentarily tempered for now, with NVDA’s FQ3’23 guidance potentially being underwhelming.

The same mixed signal has been given by TSM, with the foundry reporting that generative AI has a long runway for growth and adoption, with Advanced Micro Devices, Inc. (AMD) projecting an AI chips total addressable market, or TAM, of $150B by 2028.

Despite so, based on TSM’s H1’23 performance and FQ3’23 guidance (with the assumption of another flattish FQ4’23), we may see the foundry report underwhelming FY2023 revenues of NT$2.04T (-9.7% YoY) with its EPADR also declining to approximately NT$29 (-26% YoY). This is “from the lower capacity utilization due to semiconductor cyclicality.”

This is on top of TSM’s narrowed FY2023 capex “towards the lower end of our range of between $32B and $36B,” compared to FY2022 levels of $36.3B (+21% YoY), worsened by the delayed Arizona production from 2024 to 2025 due to “insufficient skilled workers.”

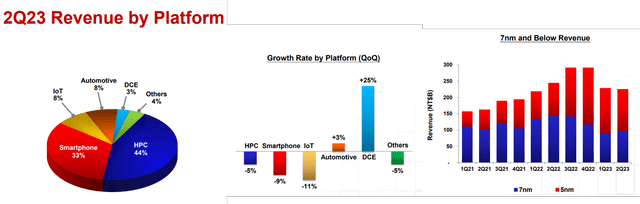

TSM FQ2’23 Revenues By Platform

TSM also reported minimal growth rate in the HPC end-segment in FQ2’23, with market analysts predicting that much of NVDA’s FQ2’24 sales potentially derived from the existing inventory of $4.61B (-10.4% QoQ/ +45.8% YoY) in FQ1’24.

While TSM may have reported a +13.5% MoM jump in July 2023 revenues, it appears that the foundry prefers to err on the side of caution for its capex and revenue guidance, despite the increased likelihood of a soft landing in H2’23.

As a result of the mixed signals, we maintain our thesis that NVDA may have pulled forward too much of its upside potential, with the market exuberance surrounding AI seemingly over inflated, nearing the dangerous hyper-pandemic levels in November 2021.

So, Is NVDA Stock A Buy, Sell, or Hold?

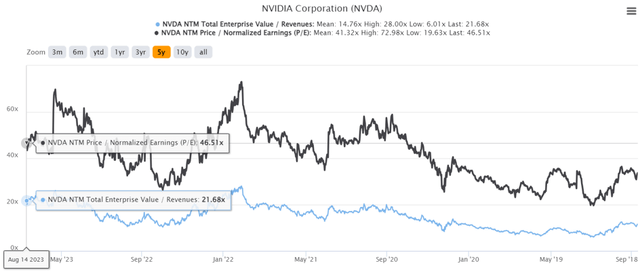

NVDA 5Y EV/Revenue and P/E Valuations

For now, NVDA trades at NTM EV/ Revenues of 21.68x and NTM P/E of 46.51x, somewhat elevated compared to its 1Y mean of 17.93x/ 47.91x and 3Y pre-pandemic mean of 9.58x/ 33.56x.

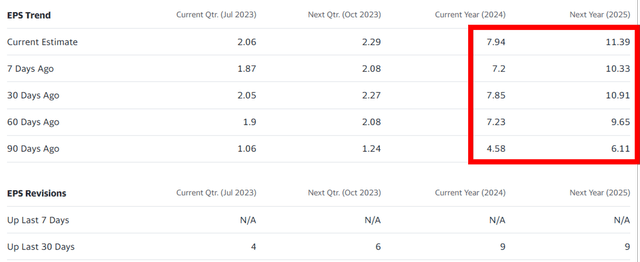

Market Analysts’ Estimates For NVDA

Thanks to the NVDA management’s forward guidance, the semi company’s projected profitability has also been raised dramatically by nearly double for both FY2024 and FY2025.

This may have contributed to the eye-watering projected top and bottom line expansion, at a CAGR of +40.2% and +63.6% through FY2026, respectively. This is against the previous estimates of +22.2%/ +35.2% and the hyper-pandemic levels of +35.2%/ +32.1%, respectively.

For now, there is no denying the explosive demand for generative AI, with multiple Chinese tech companies reportedly placing $5B worth of orders to be delivered over the next few quarters, with the Saudi Arabia/ the United Arab Emirates similarly jumping into the large language model band wagon.

Based on the conventional replacement cycle of every four years, it appears that NVDA has been presented with “a generational opportunity for AI-first hardware to gain ground,” building upon CEO Jensen Huang’s strategic gift of a DGX-1 supercomputer to OpenAI back in 2016.

NVDA has already opportunistically launched the GH200 Grace-Hopper superchip by early August 2023, with 3.5x in expanded memory capacity and 3x in bandwidth, slated for delivery by Q2’24.

This may further challenge AMD’s current sampling of MI300 Accelerators and production ramp in Q4’23, potentially allowing NVDA to maintain its leading share in the GPU market at 84% (-2 points QoQ/ +9 YoY) in Q1’23.

Therefore, while recent Chinese/ Saudi Arabian orders may have directly contributed to NVDA’s raised guidance for FQ2’24 and FY2024, its long-term prospects remain bright, thanks to the data center capital investment cycle of every four years.

However, while NVDA may deserve the premium valuations, thanks to its well-diversified tech/ AI offerings in multiple growth sectors, we are uncertain if it is wise to add here.

This is due to the minimal Nvidia Corporation upside potential of +18.4% to our long-term price target of $518.12, based on its current P/E valuations and market analysts’ FY2025 EPS projection of $11.14.

Depending on how the upcoming earning call post-market on August 23, 2023, plays out, we may see more volatility occur in the near term as well. Combined with our full position from the previous load-up point in September 2022/ January 2023, we prefer to rate the NVDA stock as a Hold here, while observing from the sidelines.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.