Summary:

- Coca-Cola’s shares have seen a modest decline during 2023.

- The company’s financial metrics, including revenue growth and profit margin, showcase its consistent financial resilience.

- A decline in the stock price presents buying opportunities for long-term investors.

Anne Czichos

In the world of blue-chip stocks, The Coca-Cola Company (NYSE:KO) shines as a beacon of enduring value, even amidst shifting market trends. While many significant indices have witnessed noteworthy gains lately, Coca-Cola has seen a slight dip. Spanning multiple generations, this beverage titan continually showcases its intrinsic worth, providing assurance to long-term investors. This piece picks up where the last article left off, offering a technical analysis to determine the stock’s upcoming trajectory. As previously discussed, the stock price is undergoing consolidation within a specific range. It is anticipated that the stock may undergo further fluctuations before moving upward.

The Financial Metrics

Amid the expansive realm of blue-chip stocks, Coca-Cola stands out as a symbol of enduring value, even in the face of recent market turbulence. Although numerous leading indexes have enjoyed robust gains this year, Coca-Cola’s shares have seen a modest decline, decreasing by more than 5%. Nonetheless, it’s crucial to grasp the larger picture. Having satiated global thirst for over a hundred years, this beverage giant consistently showcases its inherent value, reassuring long-term investors.

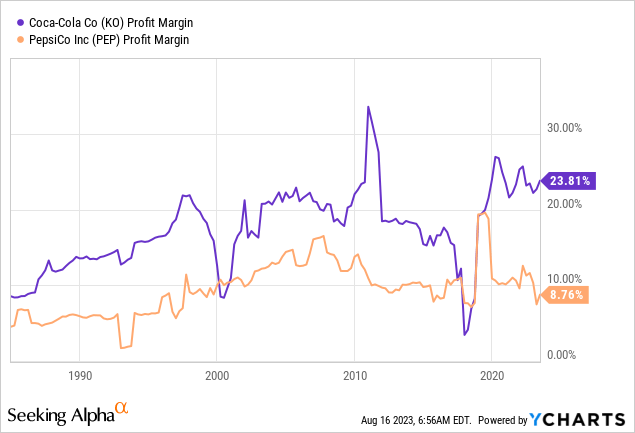

At the heart of Coca-Cola’s sustained allure is its consistent financial resilience. This was evident in the second quarter, with the company raising $11.97 billion in revenue, a 6% rise year-over-year. Even more impressive is its non-GAAP organic revenue growth at 11% year-over-over, adeptly navigating external influences such as acquisitions and foreign exchange rate shifts. However, the shining star in Coca-Cola’s fiscal portfolio is undoubtedly its profit figures. The company boasts a profit margin of 23.81%, notably surpassing PepsiCo, Inc. (PEP) profit margin over the past three decades, as seen in the chart below.

In the competitive beverage world, such margin disparities are far from negligible. The evident bottom line shows that although PepsiCo may outpace Coca-Cola in revenue, Coca-Cola consistently outperforms in turning sales into operational cash.

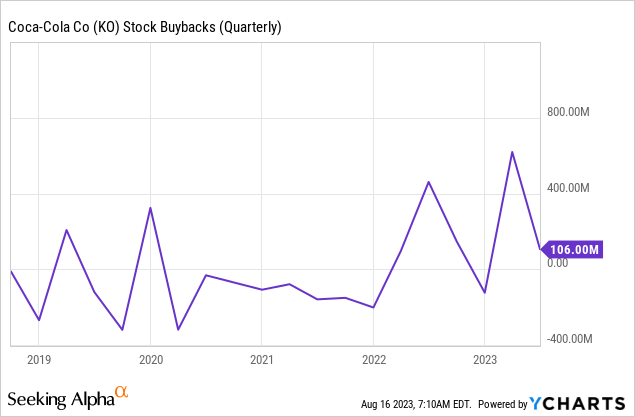

However, financial figures only tell part of the story behind Coca-Cola’s appeal. Digging deeper reveals a company that deeply values its shareholders. A shining testament to this commitment is their dividend yield of more than 3%. Remarkably, the company has maintained an unbroken streak of annual dividend growth for 61 years. Further showcasing its commitment to shareholders, the company actively engages in share buybacks, boosting earnings per share and elevating shareholder value.

Beyond financials and efforts to benefit shareholders, Coca-Cola’s strength resides in its adaptability and vision. While the iconic Coca-Cola drink remains a timeless classic, the company perpetually adapts to changing market demands. Their foray into the alcoholic beverage market, previously considered a no-go zone, exemplifies this dynamic approach. Launches like Lemon-Dou in Japan and various ready-to-drink alcoholic options underline their innovative spirit. Additionally, their acquisition-focused growth strategy showcases this adaptability. Leveraging substantial financial resources, Coca-Cola has seamlessly incorporated brands such as Fairlife, BodyArmor, and Glaceau, cementing its foothold in rising beverage segments.

A Deep Dive into the Next Market Dip

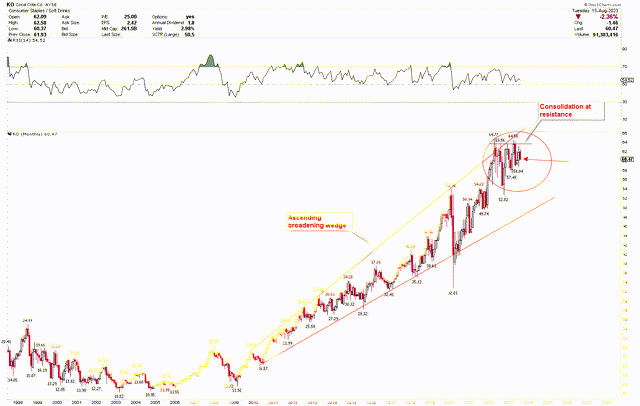

The long-term bullish perspective was explored in a previous article, highlighted through yearly and quarterly charts. These charts signaled a solid bullish trend over an extended timeframe. However, a potential short-term correction was expected from the strong resistance due to emerging price patterns.

The monthly chart below presents an ascending broadening wedge, from lows of $16.57 to highs of $64.70. Despite this, the market continues on a powerful bullish path. A notable resistance appears around the $64 point, with the price experiencing significant fluctuations. While July’s monthly candle showcased remarkable gains, August saw a considerable retreat, negating much of July’s advancements. Such movement suggests the market is in a consolidation phase, where any price reduction could offer a compelling buying opportunity. Notably, the RSI stays above the 50 midpoint, hinting that market downturns could be potential buying signals.

Coca-Cola Monthly Chart (stockcharts.com)

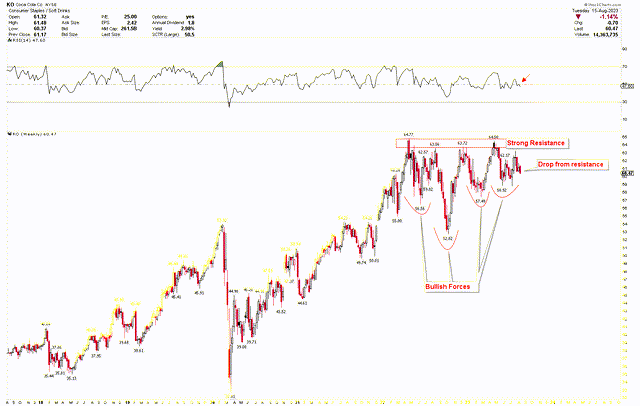

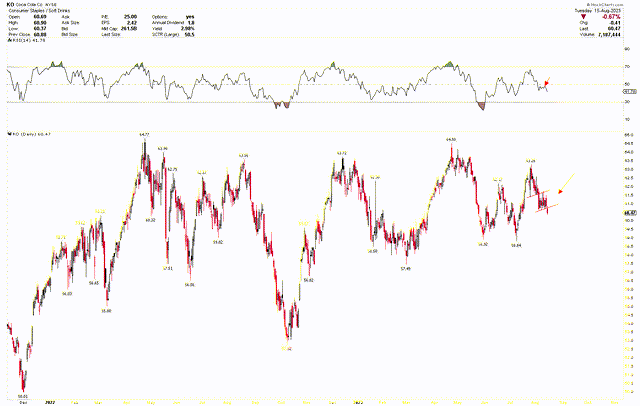

The updated chart from the previous analysis presents the initiation of decline from the identified resistance zone. This drop is marked by bearish tendencies, suggesting the price might keep sliding. The past week’s candle formed an inside bar, and the ongoing week has already exhibited a bearish inclination. This could imply more price reductions before another buying chance emerges, particularly with the active inverted head and shoulders pattern, which remains until the price falls below $52.82.

Coca Cola Weekly Chart (stockcharts.com)

Delving deeper into the bullish view, the short-term daily chart reveals that the RSI hovers below the 50 midpoint. There’s also a steady downward trend in the stock price, emphasized by breaking the bear flag. This trend might signal impending price reductions. However, these reductions might attract fresh buyers to the market.

Coca Cola Daily Chart (stockcharts.com)

Market risk

Despite its dominant position in the blue-chip stock domain, Coca-Cola remains susceptible to broader market fluctuations and sector-specific pressures. Recent modest share declines, juxtaposed against gains in other leading indexes, exemplify this vulnerability. Additionally, as a global enterprise, it faces risks from foreign exchange rate movements which can sway reported revenue. The relentless competition in the beverage industry, highlighted by formidable players like PepsiCo’s robust revenue, demands unwavering attention. Coca-Cola’s commendable profit numbers and consistent dividend growth tradition inspire trust among investors, but any unforeseen challenges or failures to uphold these standards might shake investor confidence. The company’s foray into novel beverage domains, particularly the alcoholic sector, and its tactical acquisitions, hold promise but also introduce possible regulatory and integration challenges. Moreover, the current consolidation phase in the market, coupled with potential volatility indicated by various technical patterns, suggests that the stock might face unpredictable price oscillations in the near term.

Conclusion

Despite recent market fluctuations, Coca-Cola’s illustrious history and consistent financial performance underline its position as a titan in the blue-chip stock arena. The company’s unwavering commitment to shareholders, evidenced by its attractive dividend offerings and buyback initiatives, combined with its adaptability to market trends, ensures it remains an attractive proposition for long-term investors. The technical analysis indicates that the stock price has reached its long-term target, hinting at a potential short-term market dip. For long-term investors, this drop in Coca-Cola’s market value presents opportunities. Coca-Cola’s rich legacy, financial fortitude, and proactive strategies make these temporary setbacks appear more as windows of opportunity than concerns for many. The company’s ability to balance its storied past with forward-thinking innovations solidifies its commendable stance in the ever-evolving stock market. If the price dips below $50, the long-term bullish outlook would be negated. On the other hand, a price breakout above $64.77 could pave the way for further price increases.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.