Summary:

- We’re downgrading PayPal Holdings, Inc. to a hold as we think current macro dynamics won’t work in the stock’s favor.

- We expect PayPal will struggle to increase active accounts and expand transaction margins under macro uncertainty and see Y/Y revenue growth slowing as a result.

- While we’re constructive on PayPal’s cost-cutting initiatives and position in the e-commerce industry, we don’t share management’s expectation of discretionary spending improving materially in 2H23.

- We now think the macro weakness is priced into the stock for the most part.

- Still, we believe there are better names to invest in for the near term as we don’t see the stock working through 2H23.

TadejZupancic

We’re downgrading PayPal Holdings, Inc. (NASDAQ:PYPL) to a hold this quarter; while we think macro weakness has been priced into the stock for the most part, we don’t see PayPal outperforming in the near-term due to current macro dynamics. We think the two metrics that’ll drive the stock’s outperformance would be an increase in active accounts and expanding transaction margins; we believe PayPal will struggle to do both in the back half of the year. Management noted on the call the “need to deliver growth in our transaction margin dollars to ensure we sustainably grow our earnings.” While historically, PayPal has been regarded as a growth stock; we’re seeing the growth story continue to slow in 2H23.

This quarter, the company reported revenue of $7.3B, up 7.4% Y/Y and 3.5% sequentially; while we’re seeing positive signs of management’s shift to profitability and cost-cutting efforts, we continue to expect the weaker spending environment to limit growth in 2H23. We’re already seeing revenue growth as a percentage slow this quarter to a 7.4% Y/Y increase versus an 8.3% Y/Y increase last quarter; management noted on the call that, “We expect revenue growth in the back half of the year to be in line with this performance.” We think there are better names to invest in for the near-term, as we don’t see consumer discretionary spending improving materially to incite growth amid macro uncertainty.

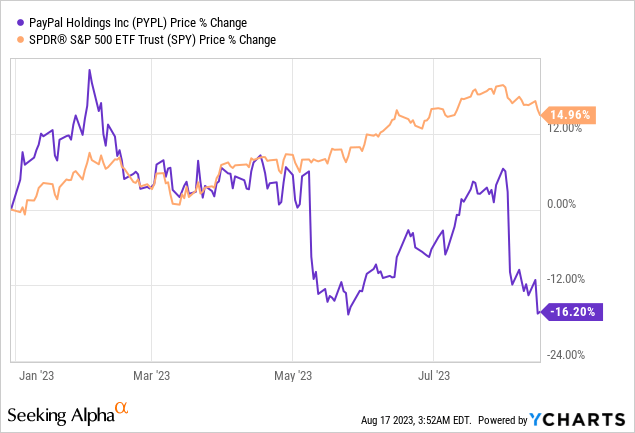

The stock is down 16% YTD, underperforming the S&P 500 (SP500) by roughly 31%. We don’t see outperformance in the second half of the year, primarily due to macro headwinds but also due to competition with Apple (AAPL). We recommend investors to stay on the sidelines for the near term.

The following graph outlines PayPal’s YTD performance against the S&P 500.

SeekingAlpha

Transaction revenue increased 5% Y/Y to $6.6B this quarter, versus an increase of 6% Y/Y to $6.4B in 1Q23; transaction margin also declined in the quarter at 45.9% compared to 47.1% last quarter. We’re constructive on PayPal’s transaction margins’ decline moderating Y/Y but don’t expect margins to improve substantially in 2H23 due to lackluster growth in active accounts. The company reported active accounts of 431M, up only slightly from 429M in the year-ago quarter and down from 433M last quarter.

While management is trying to increase user engagement and expand its customer base, we think the current macro environment won’t work in the company’s favor as discretionary spending tightens due to macro uncertainty. This quarter, U.S. revenue grew 9% Y/Y versus a 13% growth in 1Q23. We don’t see PayPal outperforming under the current macro situation.

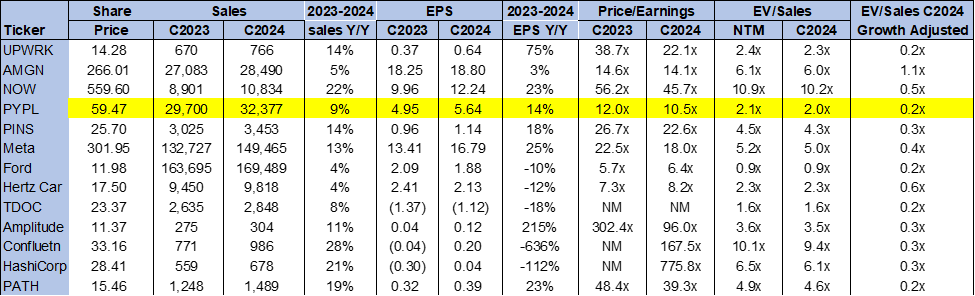

Valuation

PayPal is relatively cheap, trading at 10.5x C2024 on a P/E basis EPS $5.64. The stock is trading at 2.0x EV/C2024 Sales, versus the peer group average of 4.4x. We don’t recommend investors buy the stock on weakness, as we don’t see PayPal outperforming in the second half of the year.

The following chart outlines PayPal’s valuation against the peer group.

TSP

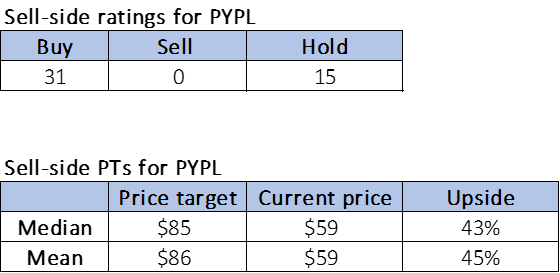

Word on Wall Street

Wall Street doesn’t share our bearish sentiment on the stock. Of the 46 analysts covering the stock, 31 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $59 per share. The median sell-side price target is $85, while the mean is $86, with a potential 43-45% upside.

The following charts outline PayPal’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re downgrading PayPal Holdings, Inc. to a hold, as we don’t see a favorable risk-reward profile for the stock in the near-term and think there are better-positioned names to outperform in 2H23. We don’t believe e-commerce growth stock like PayPal is the best way to weather the current macro environment. We think management is on the right track to improve profitability and expand transaction margins, but we don’t see this happening in 2H23 due to the worsening macro uncertainty. We expect the company to continue to struggle to boost active accounts in the second half of the year, and don’t believe PayPal Holdings, Inc. stock has hit its infliction point yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.