Summary:

- Kenvue Inc. is the largest OTC drug company on earth, with the most trusted brands and impressive free cash flow margins that are expected to keep improving over time.

- It’s likely to become a dividend king next year when Kenvue confirms it will keep raising the dividend each year.

- Kenvue is an A-rated company whose leverage ratio is expected to decline and potentially achieve an A+ rating by 2027.

- Kenvue is about 18% undervalued, offering about 11% return potential through 2028, about 2X that of Johnson & Johnson.

- One is the better dividend growth stock, but the one you should own depends on whether you’re seeking maximum safe income over time, or the 2nd best risk-free stock returns in America.

RyanJLane

One of the most popular requests from Dividend Kings members is to compare Johnson & Johnson (NYSE:JNJ) and Kenvue Inc. (NYSE:KVUE).

Here is what you need to know about both companies and which is likely to make the better choice for your portfolio.

Meet Kenvue: The Next Potential Dividend King

Per the S&P’s rules (they run the official dividend aristocrat index), any spinoff that keeps dividend investors whole does not count as a dividend cut.

Furthermore, as seen with AbbVie (ABBV), if a company continues raising dividends each year and management intends to do so in the future, the spun-off company inherits the dividend streak of the parent company.

This is why AbbVie, spun-off in 2013, is an official aristocrat.

So, is Kenvue a brand-new dividend king with a 60-year dividend growth streak and an even more impressive streak of at least 107 years without a dividend cut?

Not quite yet, because Kenvue management has only declared the first dividend and has not said whether KVUE will grow the dividend each year.

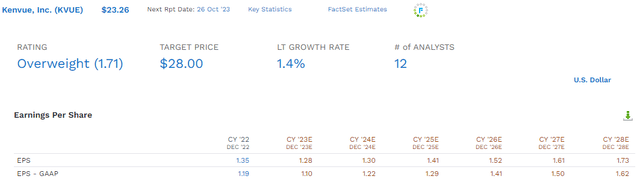

What about dividend safety? It’s very early, with Kenvue just now starting to get analyst coverage (12 and counting), and we now have enough data for a preliminary dividend safety estimate.

- preliminary dividend safety score: 70%, safe, 1% dividend cut risk in average recession, and 3% risk in severe Pandemic level lockdown recession

- preliminary quality score: 60%, 10/13 blue-chip quality potential dividend king

- Preliminary risk cap recommendation: 7.5% or less

- Preliminary S&P Long-term Risk Management (same as JNJ until S&P has time to analyze KVUE standalone): 77th (low risk).

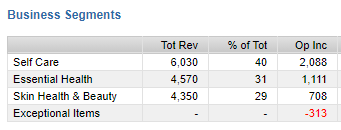

What does Kenvue do? It’s the world’s largest consumer healthcare company, with $16 billion in sales from brands like Tylenol, Nicorette, Listerine, and Zyrtec.

FactSet Research Terminal

Macro factors such as an aging population, premiumization of consumer health care products, and growing emerging markets should provide tailwinds for Kenvue’s wide array of brands.” – Morningstar.

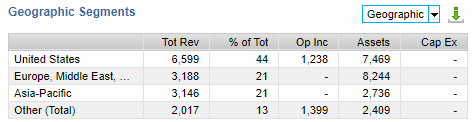

The company is focused on global markets such as China and India,

FactSet Research Terminal

Kenvue is a highly diversified company both in terms of segments and geography. It’s also an A-rated company by S&P, implying a 0.66% 30-year default risk.

It has $7.7 billion in debt, $1.2 billion in cash, and $9.2 billion in liquidity courtesy of two $4 billion credit revolvers.

Its leverage ratios are solid, though not exceptional. That’s normal, since spinoff companies tend to be loaded up with debt to help the parent company.

- debt/EBITDA 2023 consensus: 2.0

- debt/EBITDA 2025 consensus: 1.85.

Rating agencies say 3.0X or less is safe for healthcare companies like this. If KVUE keeps deleveraging steadily, it will likely get upgraded to AA and possibly even AAA.

We forecast this figure to drop below 1.5 by 2027 from a mix of lowered debt balance and a higher EBITDA from a growing top line and improving margins.” – Morningstar.

| Credit Rating | Safe Net Debt/EBITDA For Most Companies | 30-Year Default/Bankruptcy Risk |

| BBB | 3.0 or less | 7.50% |

| A- | 2.5 or less | 2.50% |

| A | 2.0 or less | 0.66% |

| A+ | 1.8 or less | 0.60% |

| AA (Morningstar 2027 Forecast) | 1.5 or less | 0.51% |

| AAA | 1.1 or less | 0.07% |

(Source: S&P, Fitch, Moody’s.)

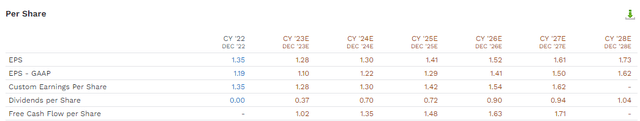

What about the dividend? The first dividend has been declared at $0.20 for an $0.8 annual dividend and a 3.4% yield.

That’s slightly higher than JNJ, though that should be expected as Kenvue is expected to be a slower-growing company.

Reuters reports a 1.5% long-term growth consensus, which at first glance is rather disastrous.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Schwab US Dividend Equity ETF | 3.6% | 9.70% | 13.3% | 9.3% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| Vanguard Dividend Appreciation ETF | 1.9% | 9.7% | 11.6% | 8.1% |

| REITs | 3.9% | 7.0% | 10.9% | 7.6% |

| Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.4% | 8.5% | 9.9% | 6.9% |

| Johnson & Johnson | 2.8% | 4.60% | 7.4% | 5.2% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

| Kenvue | 3.4% | 1.40% | 4.8% | 3.4% |

(Sources: Morningstar, FactSet.)

Adjusting for inflation, Kenvue’s 1.1% expected risk-adjusted real return is rather bond-like.

JNJ’s 2.9% risk and inflation-adjusted expected return isn’t much more impressive, but it comes from one of just two AAA stable-rated companies in America.

- a stronger balance sheet than the US Treasury.

Rating agencies believe the U.S. government would default on its debt before JNJ goes bankrupt.

If that ever happened, the world has likely ended, the living envy the dead, and money is the least of our problems;)

In fact, according to S&P and Fitch, the odds of JNJ going bankrupt in the next 30 years is 0.07% or 36X lower than the risk of nuclear war with Russia (2.5%, according to Goldman).

Is an approximately 3% real, risk-adjusted return worth it for what is effectively a risk-free investment? A lot of people would say yes.

After all, the real yield on US Treasuries is 1.6% for the 10-year yield (US10Y), and for the 30-year yield (US30Y), it’s 2.0%.

So, JNJ offers a risk-free 3% risk and inflation-adjusted return of 1% more than the U.S. government, which rating agencies now consider riskier than JNJ.

But for long-term growth investors, the answer might not be so simple.

Which Is The Better Long-Term Dividend Investment? The Answer Might Surprise You

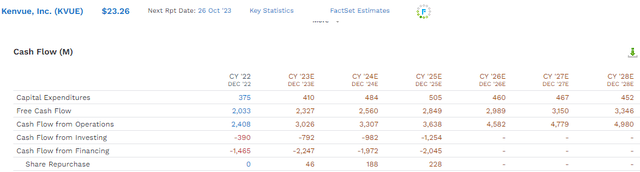

First, let’s be clear: Kenvue is a great company expected to generate steadily rising free cash flow margins.

- 2022: 14%

- 2023: 15%

- 2024: 16%

- 2025: 17%

- 2026: 17%

- 2027: 17%

- 2028: 18%.

While KVUE’s 18% long-term free cash flow margins are not close to JNJ’s 28%, given that it has no patent cliffs to worry about, it might be an appealing OTC company.

Listerine first became commercially available in 1914, Band-Aid in 1921, and Tylenol in 1955, so Kenvue’s brands’ reputation, which is underpinned by their long-standing history, is difficult to replicate. We also believe a number of Kenvue’s brands (Tylenol, Motrin, Zyrtec, Band-Aid, and Benadryl) are sought out in times of poor health, so the importance of brand familiarity and trust is heightened.” – Morningstar.

I’m not sure I quit believe the “moatiness” of Kenvue’s brands as much as Morningstar. However, if its industry percentile rank climbs high enough over time, I will switch my rating from narrow to wide moat.

Almost 20% free cash flow margins, that analysts think are coming would support a wide moat rating for something without patents, if it’s actually attainable.

But what about KVUE’s terrible growth outlook?

Consider the current medium-term consensus. If we measure from 2022 and use the consensus EPS out to 2028, then we have 5.1% annual growth. If we start in 2023, the first year KVUE is a standalone company it’s a 6.2% growth rate.

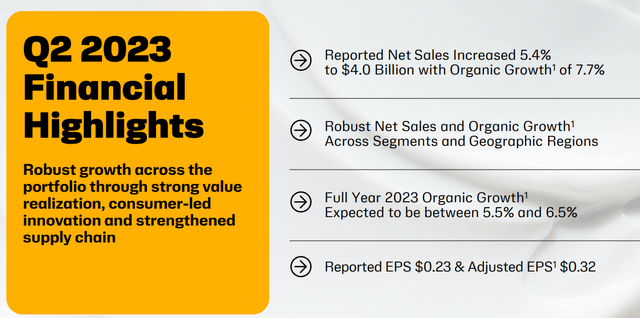

In its first quarter reporting, KVUE saw sales grow 5.4% due to price increases of 7.7% while volumes fell 2.3%.

Management expects sales growth of 6% for the year which is largely due to strong pricing power during this period of elevated inflation.

The ability to deliver around 6% sales growth, much better than the rate of inflation (by 2% to 3%) indicates a narrow moat, and possibly a wide one if KVUE can actually keep growing at these rates.

- consensus sales growth through 2028: 4.7%

- consensus EPS growth: 5.1%

- dividend growth: 10.4%.

Starting from 2024 a 10.4% annual dividend growth rate resulting in a 4.5% yield on cost in 2028.

KVUE’s free cash flow per share is expected to grow at a much more impressive rate of 13.8% through 2027, resulting in a payout ratio of 55% in 2027 compared to 60% safe for this industry.

- 2024 FCF payout ratio consensus: 51%

- 2027 consensus: 55%.

It appears that management is expected to payout 50% to 55% of free cash flow as dividends with a modest $100 to $200 million in buybacks. Most likely that’s to offset stock based compensation.

So it appear that KVUE might actually be a faster-growing company than JNJ, though of course, a lot lower quality.

- it is expected to become a dividend king next year when the first dividend hike is confirmed.

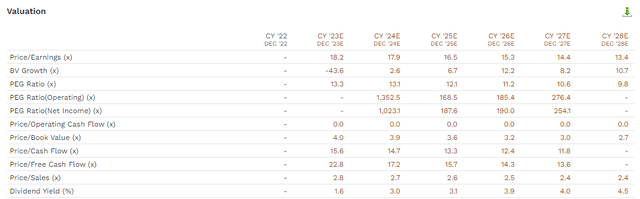

Valuation: Winner

How do we value Kenvue when it is a brand new company?

On a forward P/E basis, 18X earnings is potentially a bit much, but not necessarily.

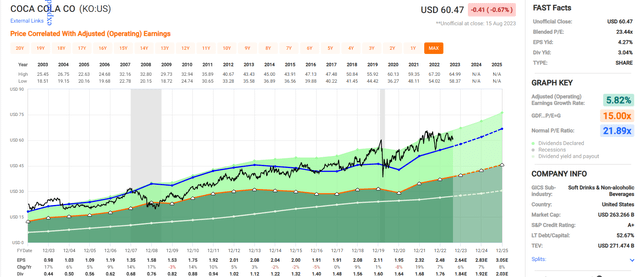

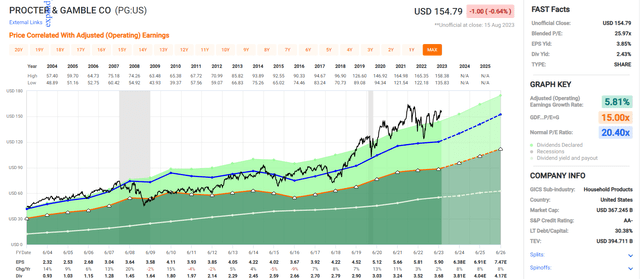

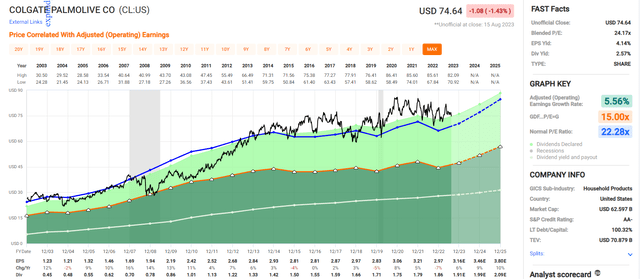

That’s because consumer staples giants like Procter & Gamble (PG) and Coca-Cola (KO) trade around 20X, and on a cash-adjusted (EV/EBITDA) basis KVUE is trading at 12.8X.

Cash-adjusted earnings is private equity’s favorite valuation metric, the true value of a company factoring in cash, debt, and cash flow.

Private equity is paying 11.5X cash-adjusted earnings for private companies, and Sharks like Mark Cuban are paying 7X for billionaire sweetheart deals.

I would say that until

We are maintaining the fair value estimate of Kenvue at $27.50 per share with a wide moat rating thanks to its strong brand reputation (intangible assets) and an entrenched standing with retailers and low consumer acquisition costs (cost advantage). Our forecast is underpinned by a 5-year compound annual growth rate of sales of 4.2% and an annual margin expansion with operating margin reaching slightly over 20% by 2027.” – Morningstar.

Morningstar’ discounted cash flow model estimates KVUE’s fair value at 21.3X forward earnings.

How reasonable is that?

Coke is worth about 22X earnings

Procter is worth about 20X earnings

Colgate-Palmolive is worth about 22X earnings

Morningstar’s valuation model is based on a 5% to 6% long-term growth rate and corresponds to a 21X forward P/E.

Does that seem reasonable? At least through 2028 analysts do think KVUE is growing at 5% to 6% and given that its peers trade around 21X earnings, I would say yes, a $27.5 fair value estimate is reasonable and prudent and evidence based.

Mind you, over time the market will tell us what KVUE’s fair value truly is.

Kenvue Fair Value

- fair value estimate: $27.5

- current price: $23.26

- discount: 18%

- quality: 60% low risk 10/13 blue-chip potential dividend king

- DK rating: potential reasonable buy

- good buy price: $22.00 (20% margin of safety).

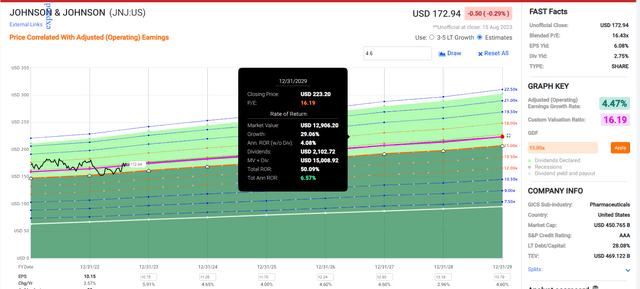

What kind of return potential is KVUE capable of? FAST Graphs doesn’t yet have it but here’s how we can determine the 2028 total return potential.

- 21.3X preliminary fair value P/E X 2028 EPS of $36.85 share price

- $4.67 cumulative consensus dividends

- $41.52 consensus total return price at the end of 2028

- 5-year consensus total return potential: 11.1% CAGR vs. 5% S&P 500.

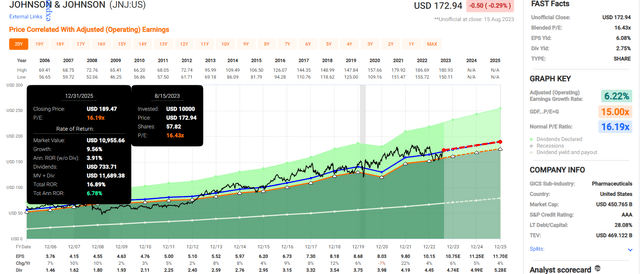

And how about JNJ?

JNJ Fair Value

- fair value estimate: $184.32

- current price: $172.94

- discount: 6%

- quality: 99% low risk 13/13 Ultra SWAN dividend king

- DK rating: potential good buy

- good buy price: $175.11 (5% margin of safety).

Johnson & Johnson 2025 Total Return Potential

Johnson & Johnson 2029 Total Return Potential

JNJ has about 7% long-term return potential and that includes the next 2 years and the next six years.

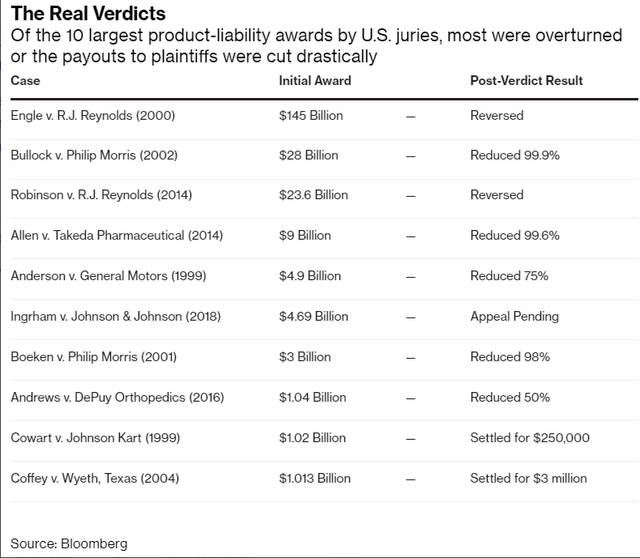

What About The Talcum Powder Lawsuits?

The litigation, which first started in 2013, has involved nearly 70,000 plaintiffs and J&J reached a final deal in April 2023 when it agreed to pay $8.9 billion to people who filed claims with the settlement to be paid out over 25 years ($356 million per year).

Johnson & Johnson plans to appeal the bankruptcy court’s rejection of the proposed $8.9 billion settlement regarding the talc cancer claims. While the pathway forward with close to 100,000 talc claimants is now less clear, we believe the total cost of resolving these claims is likely close to the $8.9 billion established in the proposed settlement and already factored into our valuation. As a result, we don’t expect any major changes to the firm’s fair value estimate or wide moat rating.” – Morningstar (emphasis added).

JNJ should be able to afford the talcum powder settlements easily.

That’s why it has two AAA stable credit ratings.

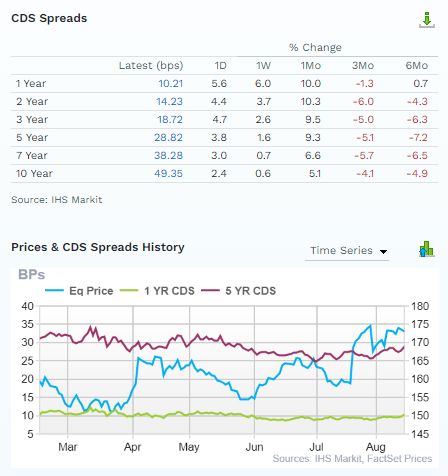

FactSet Research Terminal

It’s why the bond market isn’t overly concerned about JNJ’s default risk.

$356 million per year doesn’t threaten JNJ’s growth prospects, dividend safety, or overall investment thesis.

Bottom Line: Kenvue Is The Slightly Better Dividend Stock, But JNJ Is The Ultimate Low Volatility Risk-Free Investment

Long term, JNJ can’t lose money, at least according to rating agencies.

As long as it remains in business, and you don’t panic sell for emotional or financial reasons, it’s as close to a risk-free stock as exists.

At a 3% risk-free inflation-adjusted expected return JNJ is a solid alternative to U.S. treasuries…assuming you understand that its volatility is 15% per year, about 5X more than bonds.

And of course, it’s hard to beat a 61-year dividend growth streak and at least 107 years without a dividend cut.

However, KVUE is a very impressive company. It’s 3.4% yield is secure, its business boasts already impressive margins, and its FCF margin is expected to rise to 18% by the end of 2028.

Throw in an A stable credit rating that is likely to be A+ by 2028, and you have a very attractive potentially 18% undervalued high-yield blue-chip.

One that might become the newest dividend king next year.

Would I have taken the 7% discounted exchange offer from JNJ? Probably not, but that’s because JNJ is all about that 3% expected inflation-adjusted risk free return.

KVUE offers a potentially solid 8% to 10% long-term return that’s likely better than JNJ, and its dividends are expected to grow about twice as fast for the next five years.

But if you bought JNJ, it’s for that AAA virtually risk-free long-term return potential, and there is only one company that offers a stronger inflation and risk-adjusted return with virtually zero fundamental risk than JNJ.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own JNJ through VIG.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

- Access to our 13 model portfolios (all of which are beating the market in this correction)

- my correction watchlist

- my family’s $2.5 million family hedge fund

- 50% discount to iREIT (our REIT-focused sister service)

- real-time chatroom support

- real-time email notifications of all my retirement portfolio buys

- numerous valuable investing tools

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.