Summary:

- Ambarella is a supplier of System on Chip (SoC) for high-tech cameras, but its position in the market is more fragile than desired.

- The company operates in the security cameras, automotive, and other markets, with a focus on computer vision solutions.

- Recent weakness in demand and uncertainty in the automotive market pose risks to Ambarella’s growth and valuation.

djgunner/E+ via Getty Images

Thesis

Ambarella (NASDAQ:AMBA) is a cutting-edge supplier of System on Chip (SoC) for high-tech cameras. Even though this is a compelling market with strong structural growth drivers, Ambarella’s position is more fragile than I’d like. Additionally, it competes against players with deep pockets that can apply pricing pressure when capacity is ample. My model looks through the forthcoming weakness, driven by weak demand, but I still can’t see a major upside from current levels. I remain cautious.

Overview of the business

Ambarella was founded in 2004 by five members of the current management team that worked together before at Afara Websystems. The company quickly became known for its System on a Chip product that helped in entering the TV broadcasting market. In the following years, Samsung and GoPro adopted Ambarella’s SoC. After going public in 2012, management decided to invest heavily in developing computer vision solutions and acquired VisLab thereafter. By the end of the decade, Ambarella launched its computer vision SoCs which leapfrogged the company into the automotive industry.

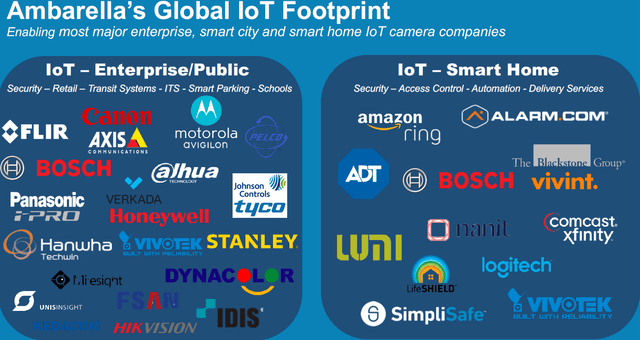

Ambarella derives sales from the following three categories: Security cameras, Automotive and other. The company’s security vision cameras are equipped with the components necessary to carry out facial recognition, object, and motion detection. As you can imagine, they sell these security cameras to households, enterprises, and government entities. According to the company’s data, most of the camera installed base today is what they call “human viewing”, which requires active human supervision to spot irregularities for security purposes. Ambarella’s management is convinced that the transition to Artificial Intelligence based perception cameras is just beginning and will gradually become the dominant force in security cameras and beyond.

The IoT footprint (Company Presentation)

On the automotive side, Ambarella sells small video cameras that mount on a car’s dashboard and smart e-mirrors (poised to replace rear-view mirrors), ADAS Cameras, Driver Monitoring Systems and cameras that constitute a fully autonomous package. Although this segment is smaller in size than the security cameras business, it’s strongly aligned with structurally growing trends of higher electronic components in cars. Customers include Mercedes-Benz, Momenta, Toyota, Honda, Gentex and more. Ambarella operates a fabless model and outsources production to third-party foundries, test, and assembly centres. The company is partnered with two large distributors, Wintech and Chicony Electronics.

In the “other” category, AMBA includes emerging yet important new markets that include wearables, AR/VR devices, aerial drones and action cameras. Also, new AI sensing technologies such as access control, sensing cameras, fixed robotics and mobile robots are part of this category.

Recent developments

In the latest quarter, Q1 2024, excess inventory drove Ambarella’s expectations miss. After facing an extremely tight supply chain in the automotive market, now the inverse is happening where the channel partners are oversupplied with inventory. The weakness extended to the IoT market, down roughly 35% compared to last quarter, and the company cited a lack of visibility over the rest of the year. In part, there were some bright spots in the most recent report. Product development is robust and is well aligned with long-term secular tailwinds in their active markets. Moreover, the gross margin remained solid at around ~63% even during tough demand conditions. Finally, the company is net cash which leads to an asset-light model while much of its operational expense is invested in R&D.

Long-term growth drivers

Smart vision computing is a structural trend that will fuel growth for the industry over the next decade. The roots lay in the rise of image sensors in smartphones when they were launched, and today, they evolved to enable smart vision in AI applications. The mechanisms fending off competition in the market are high performance is power efficiency. Let’s dive deeper into the core applications and their growth.

ADAS systems

Advanced driver Assistance Systems, also known as ADAS, are being enabled by the application of cameras and the analysis of content captured. There are 5 ADAS levels that begin from the lowest level of driving automation, level 1, and fully autonomous cars, level 5. Camera advancement is driving the progression towards level 5 autonomy, and this will continue fuelling growth for the camera industry. According to industry sources, cameras are most likely going to constitute the primary sensor for most autonomous cars. Management estimates Ambarella’s Serviceable Addressable Market to be ~$2.5bn today and to grow to $7.5bn in 2028. That implies 23% annual growth, which is reasonable through the cycle.

IoT Security Cameras

As discussed above, the security camera market is undergoing a transition from human viewing to AI perception, driven by advancements in computer vision technology. The so-called “1G” and “2G” cameras make up ~95% of the market currently, and the rollout of “3G” is still nascent. Ambarella’s management emphasizes that they sell these “3G” units at roughly double the prices of the current “2G” technology cameras. These advanced cameras enhance efficiency as they don’t require human viewing and are capable of being bundled with customized software to be fit for purpose. Longer term, applications for smart cameras are multifaceted and include smart cities, manufacturing automation, smart retail, real estate management and industrial applications. Management expects this market to grow from the current $2 billion SAM to $3.5 billion by 2028, implying an annual growth rate of 12%.

Valuation

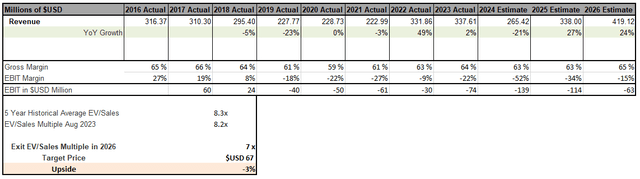

The two key variables in my model are growth and profitability. I will explain my assumptions for both and the main reasons behind them.

Growth

Ambarella is heavily reinvesting in growing and developing its product portfolio. Although this has dipped the company into losses, it maintains its competitiveness against players with deeper pockets and broader expertise. As per management’s comments, the goal here is to develop an “algorithm first, software first” approach tailored to deliver improved power efficiency. However, it’s also worth noting that Ambarella competes against NVDA, MLBY, and QCOM in the SoC space. Considering the long-term growth trends discussed above and the competitive landscape, I expect the company to retain a cyclicality while growing 20% annually for the next five years.

Profitability

Margins are the real wild card here. I will only ever justify very depressed profitability if the company is investing in expanding its economic moat and will, at some point, have the potential to either scale enough that unit economics boost profitability or tone down investments without taking a massive hit on competitiveness. Although gross margins have been somewhat resilient even in the downturn, this is also a function of being fabless and outsourcing production. The competitive pressures Ambarella is under are evident in the average 25% R&D spend as a percentage of revenue. The company is working rigorously to improve its product offering and launch In new markets, but I believe that will continue to be the case in the long run because of the type of competitors it has. They have ample cash to invest and look for growing markets. Consequently, I model EBIT margins turning positive by 2025 but not scaling up to sufficient levels to justify a long-term investment.

Valuation Model (Refinitiv and Author)

On average, there is a 4% increase in shares outstanding from significant R&D-related stock-based compensation, which is factored in for each of the modelled five years. I used an EV/Sales exit multiple of 7x to reflect the fact that the company will prove to be more cyclical than the market implied over the past two years. The target price yields an unattractive -3% return by the end of 2026.

Risks

Currently, management is citing a lot of uncertainty in the automotive market, and this is expected to fade in the following year. If the weakness persists, then this could materially influence the valuation as the company is currently in a heavy investment phase. If a weak auto market persists and growth fails to exceed 15% next year, the downside will be significant.

Although this business is asset-light, it relies on a few key customers (Wintech and Chicony) that make up a significant portion of revenue. If they decide to pull their strings on pricing, the impact could affect AMBA’s growth materially.

China currently constitutes a large end market for AMBA’s products, and in case they decide to pursue local suppliers and manufacturers, this could have a destructive impact on the estimated addressable market.

Conclusion

I believe Ambarella’s strong market position has been forged during a period of tough supply conditions and the “easy money” era. To retain its leading position in the long run, it will have to continue investing because the “moat” is not deep enough to allow for a slowdown. In short, their position is too fragile for my liking, and the current valuation overestimates their prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.