Summary:

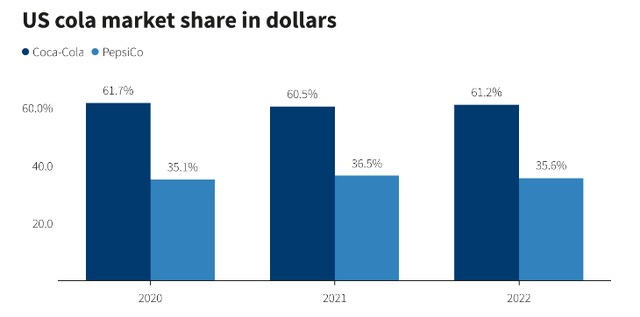

- PepsiCo only captures 35.6% of the total market share, so there is ample room for improvement.

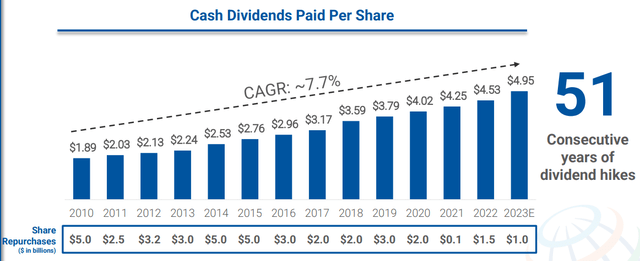

- Pepsi has consecutively raised their dividend payments for 51 years!

- PepsiCo’s upgraded revenue and EPS projections indicate a promising future.

Jonathan Knowles

There has always been something appealing about owning shares of an internationally known brand. Going to the groceries and seeing people with PepsiCo (NASDAQ:PEP) products in their basket felt awesome and seeing how my investments related in the real world always felt like a cool aspect of investing. What’s even cooler, is knowing that I could get paid my share of the profits through dividends.

Pepsi has a strong portfolio of snacks, great management, a strong dividend increase history, and is an internationally known brand. These are the reasons I think PepsiCo deserves a spot in any dividend growth investor’s portfolio.

Overview

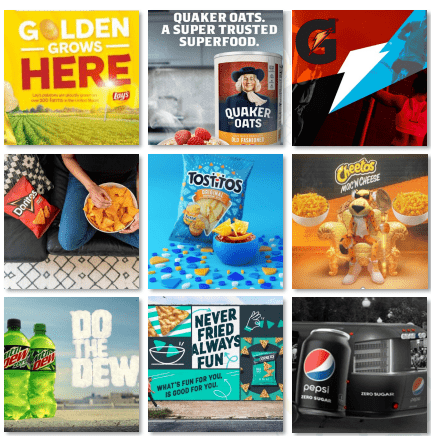

PepsiCo has a great collection of well-known drink and food brands like Pepsi, Mountain Dew, Quaker Oats, Doritos, Gatorade, Aquafina water, and Cheetos. The affordability and comfort factor makes PepsiCo the number one company in snacks worldwide. Data from this year shows that people are generally snacking much more. PEP comes second in the drink category as studies have proven that Coca-Cola (KO) is more internationally known. The snack segment of the business has always managed to capture sales during rough economic times.

PepsiCo Investor Presentation

Product Diversity

PepsiCo’s Investor Presentation

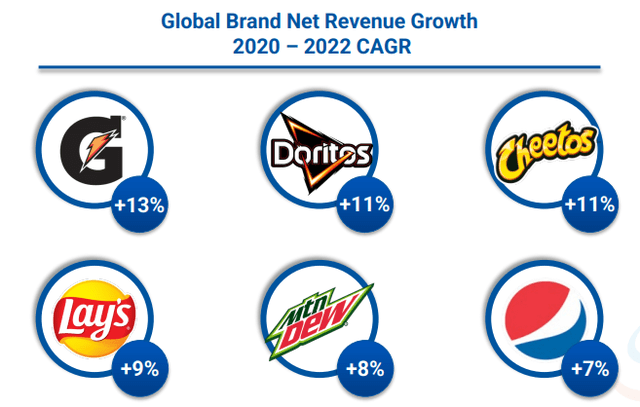

PEP’s popular brands saw consistent net revenue growth during the pandemic and I fully expect this trend to continue based on the previously mentioned studies, which determined more people prefer snacking than large meals.

The brands CAGR from 2020 to 2022 (Compound Annual Growth Rate) are as follows

- Gatorade: 13%

- Doritos: 11%

- Cheetos: 11%

- Lay’s: 9%

- Mountain Dew: 8%

- Pepsi: 7%

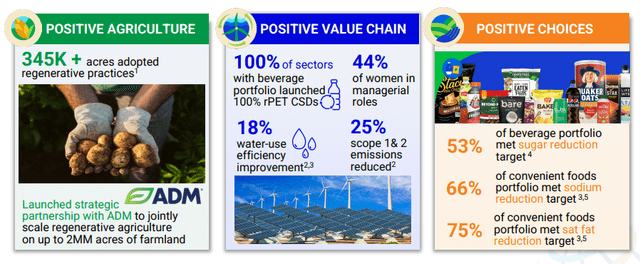

Another impressive thing about PepsiCo’s portfolio mix of products are the diversity initiatives they are trying to tackle. Historical data shows us that people are trying to reduce the amount of sugary drinks they consume. PEP’s leadership sees the trend and is trying to adapt by building their portfolio of drinks that contain less sugar.

PepsiCo’s Investor Presentation

We can see PEP trying to adjust to these habits by having reduced sugar, sodium, and saturated fat target for drinks. These specific health metrics in combination with their positive agriculture and value chain mission targets sets PEP apart and shows they are making an effort to adapt to the changing consumer value landscape. I think they will succeed in this area consumers are starting to value health and environmental factors more in their purchasing decisions.

Market Share – Room For Growth

PepsiCo only captures 35.6% of the total market share, so there is ample room for improvement to tighten the spread to Coca-Cola.

Even during tough times, PepsiCo has been introducing new products and ideas to capture more market share and it seems to be working out well. Over the pandemic, PEP launched Mountain Dew Rise Energy, a type of energy drink for morning consumers, which is doing better than expected. Sales within the energy drink category are projected to double to $19.2 billion in 2024.

They’ve also come up with Soulboost sparkling water. The drink diversity goes on and on as PEP is trying to collect as many “healthier alternatives” as possible.

In short, if people in other countries don’t like the PepsiCo brands, the company still finds ways to grow by buying other companies. For example, in 2020, they bought a big snack company in China called Be&Cheery. This company makes all sorts of snacks like dried fruits, nuts, and meat snacks. Then, as recent as 2022, PEP invested $40M in a company in Ethiopia called Senselet Food Processing, which is the company is known for its Sun Chips brand. PepsiCo also got into the market for energy drinks, by buying Rockstar Energy for $3.5B and investing in Celsius Holdings. They also bought some other companies as part of their plan.

Cash Flow Supports Dividend Growth

PepsiCo’s Investor Presentation

With a solid starting yield of 3%, you can accumulate a decent income stream from PEP. Pepsi has consecutively raised their dividend payments for 51 years! This crosses the major milestone of being a dividend king! Dividend kings are a very small list of high quality companies that have managed to steadily raise their dividend for over 5 years.

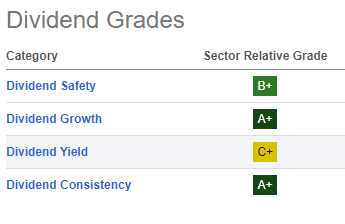

Seeking Alpha

We can see that Seeking Alpha grades their dividend safety as a B+. This is fair considering their payout ratio is slight over 65%. More impressively though, we see a dividend growth grade of A+. This is because in addition to the 51 consecutive raises, PEP also averages a 5 year growth rate of 7.12%. PEP’s most recent dividend raise was a large increase of 10% which is another indicator of strong cash flow!

Seeking Alpha

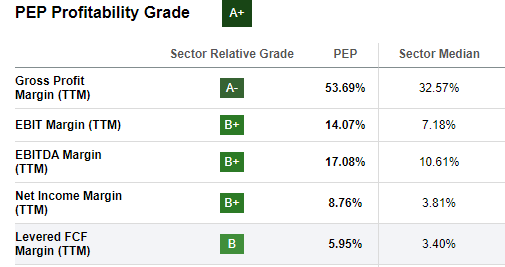

A quick glance at their profitability grades helps us understand why they receive a profitability grade of A+. They are outperforming the sector median in total gross profit margin, FCF margin, and net income margin.

Valuation – Slightly Expensive

In the second quarter, organic sales rose 13%. This increase was driven by a 19% rise in Latin America and an 18% increase in the Africa, Middle East, and South Asia area. In North America, the sales of PepsiCo drinks went up by 10%, while the sales of Frito-Lay snacks went up by 14%.

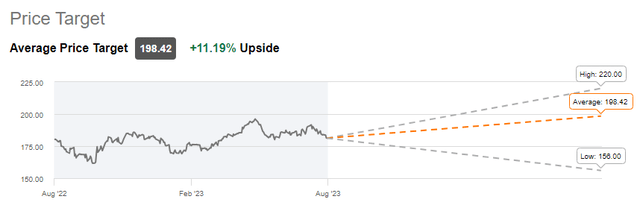

The current average price target is $198/share. This represents a potential upside of 11%. I expect PEP to continue trading at the higher end of this range due to the company’s expected revenue growth of 10%, which is higher than their previous expectation of 8%.

Based on their most recent earnings, EPS will grow by 12%, up from their earlier expectation of 9%. This would make the profit per share $7.47, which represents a slight 2.75% increase to their prior outlook. Since PEP did better than expected and they have a more positive outlook, I feel reassured that the upside is yet to be captured.

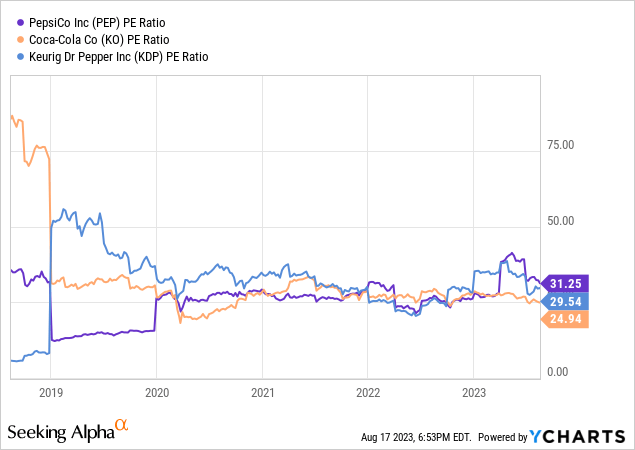

From a PE perspective, PEP is on the higher end with a PE of 31 compared to Coca-Cola’s 25. The stock may be in the expensive territory right now, so I can expect it to trade flat for the near future. This is especially likely when you consider that over the last 5 years, PEP’s PE was usually on par or below that of KO’s.

Conclusion

In conclusion, PepsiCo boasts a strong portfolio of recognizable food and beverage brands, propelling it to the top position in global snacks due to its affordability and comfort appeal. Despite already capturing a significant portion of the soft drink market, there’s still room for growth, with the company consistently introducing new products and ideas.

While the current stock price is relatively high, it reflects the stable growth outlook and premium quality of the company. PepsiCo’s strong cash flow supports consistent dividend growth, contributing to its status as a dividend king. Looking ahead, PepsiCo’s upgraded revenue and EPS projections indicate a promising future. While the stock’s valuation is relatively high compared to historical levels, the company’s positive growth trajectory suggests further potential upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.