Summary:

- Iconic companies like Procter & Gamble, General Electric, and Ford have not consistently outperformed the S&P 500 in the last decade.

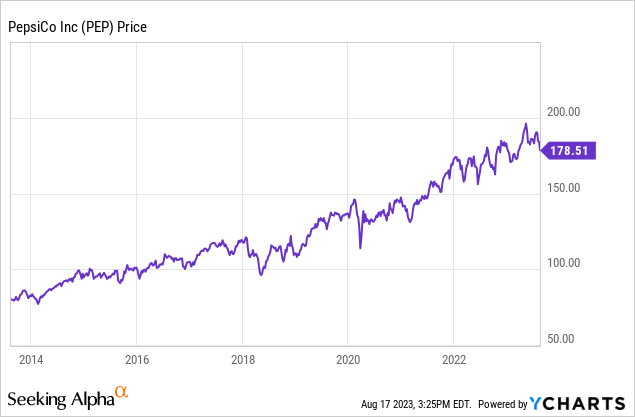

- PepsiCo has underperformed the S&P 500 but has given investors a total return of 202% over the last 10 years.

- PepsiCo’s recent earnings report shows slowing volume declines and improved net margins, leading to a more reasonable valuation.

Fernando Leon/Getty Images Entertainment

Iconic companies don’t always make great investments. While corporations such as Procter & Gamble (PG), General Electric (GE), and Ford (F), are well-known brands, none of these companies consistently been able to outperform the S&P 500 and most of the broader indexes over the last decade. Allocating capital is about finding value, and investors often have to unjustified premium for the most popular investments.

One of the most well-known brands in the United State is PepsiCo, Inc (NASDAQ:PEP).

The leading beverage and food company has given investors total returns of 202% over the last 10 years. Still, PepsiCo has underperformed the S&P 500 during this same, this index rose offered investors total returns of 219.16% over the last decade.

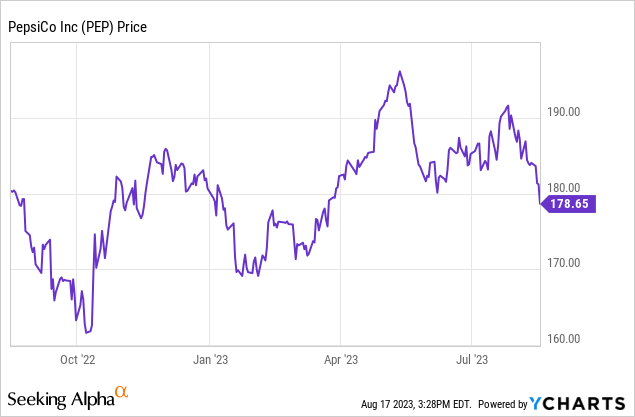

PepsiCo has also gone nowhere over the last year.

The stock has offered investors just a 3.2% total return over the last year.

I wrote in April of this year that PepsiCo was a sell because of the company’s over reliance on price increases, forex headwinds, and the inability to show organic growth in the core food and beverage segments. I am changing my rating of the company from sell to hold. The dollar is continuing to weaken against the Euro and other major currencies, and the Fed is likely to slow interest rate raises moving forward. PepsiCo’s recent earnings report also shows slowing volume declines in key segments. The stock’s valuation looks more reasonable now, since the company faces fewer headwinds.

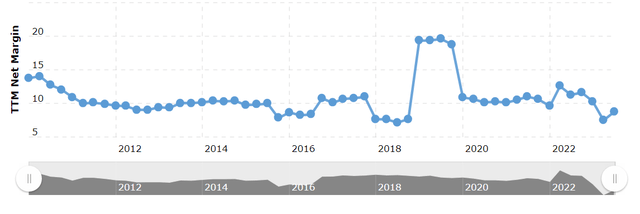

PepsiCo recently reported second quarter normalized actual earnings per share of $2.09 and revenue of $22.32 billion. Analyst expectations were for earnings of EPS of $1.96 and revenues of $21.79 billion. The company reported second quarter earnings growth of 13%, and year-to-date earnings growth of 13.6%. In constant currency second quarter earnings growth was 15%, and year-to-date earnings growth was 16%. While management did report a 1% drop in volumes in the food division, and a 3% drop in demand for beverages, the company’s core Frito-Lays brand saw 1% volume growth. PepsiCo also reported a strong improvement in net margins from 7.48% in the first quarter, 8.6% in the second quarter. The company raised guidance for organic revenue growth this year to 10% from 8%.

A chart of Pepsi’s net margins (Macrotrends)

PepsiCo’s 1% drop in sales volume in the food segment was also a noticeably improvement from the 3% drop in sales volume in the segment that management reported in the first quarter. The drops in sales volume in the beverage division was also offset by price increases, with PepsiCo North America reporting a nearly 7% in revenues year-over-year. The only region where the company saw decline of any note in revenues on a year-over-year basis was in Africa, the Middle East, and Southeast Asia, and that drop was 5%.

PepsiCo’s core food division performed notably better in this quarter than the first quarter, and management’s decision to raise guidance obviously reflects a bullish outlook for the rest of the year as well. There is also reason to believe that the company’s forex challenges will subside significantly over the next year. While predicting currency moves is always perilous, the Fed appears to be close to the end of the current rate cycle, and China, Europe’s biggest trade partner, has now fully reopened their economy. Economic growth in China for the first quarter exceeded expectations, and second quarter growth accelerated to 6.3%. Even though the world’s second biggest economy missed growth expectations for the second quarter, China has fully reopened their economy. The dollar has also continued to slowly fall against most major currencies such as the Euro over the last year.

A chart of the Euro’s moves against the dollar over the last 2 years (Yahoo Finance)

This is why PepsiCo also looks more reasonably valued now as well. The company currently trades at 25x likely forward GAAP earnings, 3.11x expected forward sales, and 17.33x predicted forward EBITDA. The company’s average 5-year valuation is 24.35 forecasted forward GAAP earnings, 3.17x likely forward sales, and 16.77x predicted forward EBITDA. There have also been 15 analysts who have recently revised their earnings expectations up for the company, and management’s bullish second quarter guidance suggests that estimates will likely continue to rise.

Investors almost always have to pay a premium for iconic brands such as PepsiCo, but the company’s recession resistant business model and bullish recent guidance suggest that valuation levels are still reasonable. Predicting currency moves is always difficult, but the dollar’s significant rise against the Euro and most major currencies also appears to have reversed as well. While PepsiCo doesn’t look undervalued at current levels, the stock looks reasonably priced right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.