jetcityimage/iStock Editorial via Getty Images

3M’s (NYSE:MMM) shares touched a two-year high on Tuesday before falling as much as 3% after reporting quarterly results. U.S. stock indices were little changed, declining less than 1%.

The maker of Post-it Notes, Scotch tape and Command strips swung to a third-quarter profit of $1.37 billion, or $2.48 a share, from a loss of $2.08 billion, or $3.74 a share, a year earlier.

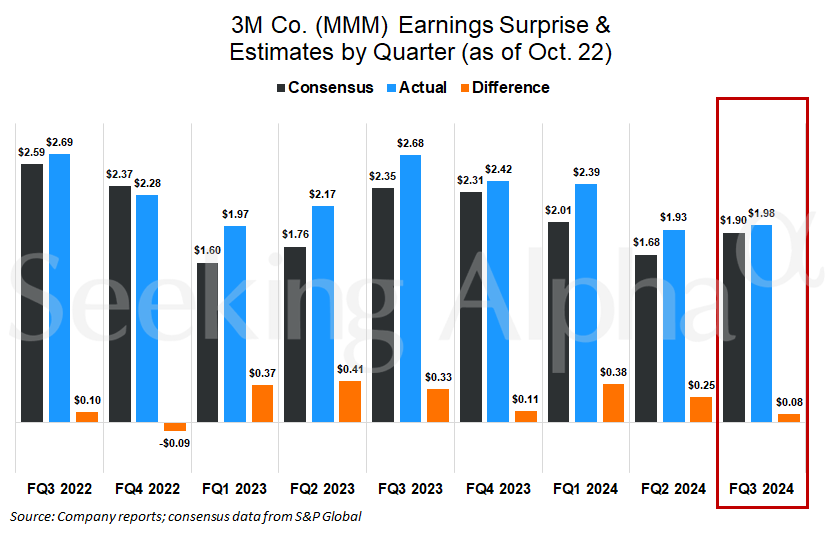

Adjusted earnings that exclude one-time items such as a lower value for its ownership interest in Solventrum, were $1.98 a share. Wall Street analysts on average had expected $1.90 a share.

The company is targeting adjusted earnings of $7.20 to $7.30 a share for the full year, narrower than its prior target of $7.00 to $7.30 a share.

Revenue edged up by 0.4% from the prior year to $6.29 billion. Adjusted sales of $6.1 billion beat the consensus estimate of $6.06 billion for the three-month period.

Among 3M’s (MMM) various businesses, the safety and industrial segment reported organic growth of 0.9% from a year before amid strength in roofing and industrial adhesives.

Organic growth for the transportation and electronics business was up 2% on an adjusted basis. Electronics, advanced materials and commercial branding drive enough demand to more than offset declines in autos and aerospace.

3M’s (MMM) consumer segment experienced a 0.7% drop in organic growth, as the home-improvement business expanded. However, the packaging and expression and consumer safety and well-being segments saw sales declines.

Adjusted free cash flow in the latest quarter was $1.5 billion, up from $1.2 billion in the second quarter but down from $1.93 billion a year ago.

“The 3M team delivered another quarter of strong operational execution, resulting in a double-digit increase in adjusted earnings along with solid adjusted free cash flow generation,” William Brown, chief executive of 3M (MMM), said in a statement. “Our ongoing execution positions us well to deliver a strong finish to the year.”

Brown joined 3M (MMM) in May after working as the chief executive of defense contractor L3Harris Technologies (LHX). He has worked to restore production innovation while making operations more efficient.

3M (MMM) had been dogged by litigation related to forever chemicals and earplugs for the U.S. military. Settlement efforts have helped to remove much of the financial overhang from those suits.