Michael M. Santiago/Getty Images News

This week’s U.S. consumer price inflation report due for July represents another big hurdle for the market, which is still fresh from a sharp drop spurred by recession worries, and a disappointing report will fuel further losses, according to Bank of America Global Research.

The Labor Department’s Consumer Price Index report is due Wednesday. Wall Street’s major stock benchmarks (SP500)(COMP:IND) have been throttled down since the July U.S. jobs report stoked recession fears. Bank of America expects headline and core CPI inflation to rise by 0.25% m/m and 0.22% m/m, respectively, or 3.0% Y/Y and 3.3% Y/Y.

“A soft CPI could provide a relief rally, but a hot CPI would be a major downside event, potentially bringing stagflation fears back to the market. A hotter print would be a bigger surprise to the market than a softer print,” BofA Analyst Ohsung Kwon said in a Sunday note. He said to watch the Y/Y number, as +0.278% m/m (unrounded) would result in reacceleration, +3.1% YoY vs. +3.0% last month.

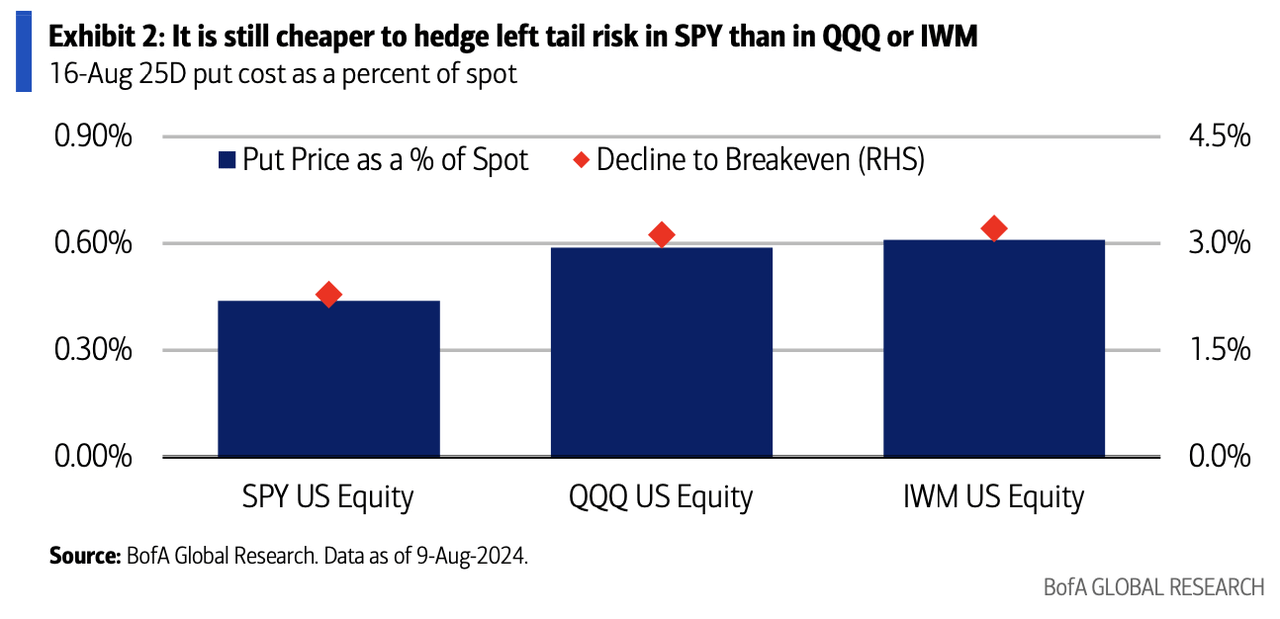

Investors who expect a hot CPI print to trigger an equity selloff could purchase S&P 500 puts, which are “still cheaper” than buying downside Russell 2000 (RTY) or Nasdaq-100 (NDX) protection, he said, publishing this chart:

“On the other hand, if an investor wants to prepare for renewed upside on the back of a softer CPI print, options give an opportunity to buy the recent dip with limited risk,” BofA said. It recommended a QQQ Sep 480/500 call spread (price: $2.69), calling it an “attractive structure” heading into CPI and Nvidia’s (NVDA) Q2 report on Aug. 28.

Hard-landing concerns are overstated and there is a low likelihood the Federal Reserve needs to make large or inter-meeting interest rate cuts, Kwon said. Still, “equities need the Fed at least until the next strong macro data (or blowout NVDA earnings),” he said. “What’s missing is the Fed’s nod, restoring confidence that growth is ultimately going to be supported.”

BofA projects Fed rate cuts of 25bp at its September and December meetings.