martin-dm

Bank of America said Q3 is shaping up to be “great environment” for stock pickers, with earnings from S&P 500 (SP500) companies set to drive a large portion of benchmark’s returns.

The investment bank’s equity and quant strategists see the derivatives market pricing in the biggest post-earnings implied move at the single stock level in its data history since 2021. That comes as corporate earnings are driving 45% of the S&P 500’s (SP500)(SPY)(IVV) 12-mo month returns as of September, after multiples were predominantly behind returns in a “macro-dominant market” in 2022-2023.

“This earnings season could be a stock picker’s paradise,” BofA Equity Strategist Ohsung Kwon said in a Sunday note. “With an easing cycle having started, we expect earnings to contribute a bigger portion of returns going forward,” Kwon said, referring to the Federal Reserve’s large 50bp rate cut last month, to 4.75%-5%.

S&P 500 (SP500) companies slated to report earnings this week include Domino’s Pizza (DPZ) and investment banks J.P. Morgan Chase (JPM), Wells Fargo (WFC) and BlackRock (BLK).

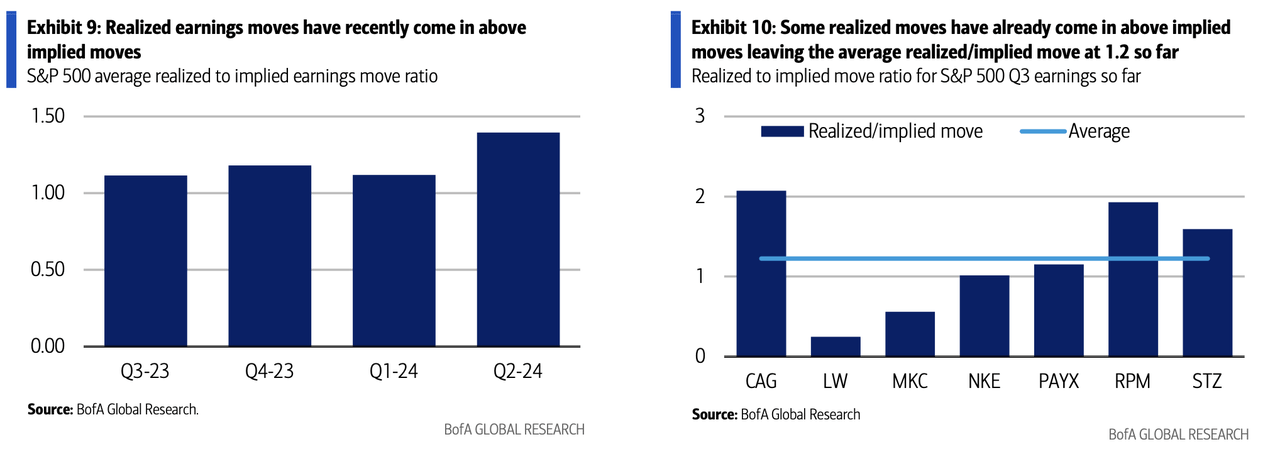

BofA said options around Q3 earnings may be more expensive than it has seen in the recent past, with an elevated average single-stock implied move. However, realized earnings moves have recently come in above implied moves, so far leaving the average realized/implied move at 1.2, with BofA publishing this chart:

“Last quarter’s underpricing of risk may explain the move higher in implied moves this quarter, but if results again lead to higher moves than what the options market implies, earnings straddles may expire in the money,” Kwon said.