HJBC/iStock Editorial via Getty Images

TD Cowen on Monday upgraded Accenture (NYSE:ACN) to ‘buy’ with PT of $400, stating that the IT major has reinforced the demand stabilization theme and initial FY25 guide is appropriately positioned for positive revisions.

Accenture’s managed services bookings momentum exiting FY24 supports visibility and reflects leading scale, TD Cowen said, adding, prior headwinds are fading.

The investment bank also sees ACN “as a vehicle for exposure to an IT Services recovery” and a clearer catalyst path ahead. It doesn’t expect shares to pullback meaningfully from current levels and think the bias will be to the upside as the coming quarters unfold.

Furthermore, TD Cowen argues that Accenture’s organic growth trajectory is set to accelerate, and while it’s leaned on mergers and acquisitions over the last year, the combination of its robust bookings and expectation of a “steadily improving backdrop through 2025 into 2026 will support positive estimate revisions and grinding performance of the stock.”

Accenture’s (ACN) fourth-quarter results and guidance topped estimates, leading Morgan Stanley to highlight the “better visibility” into the growth due to longer duration public service deals.

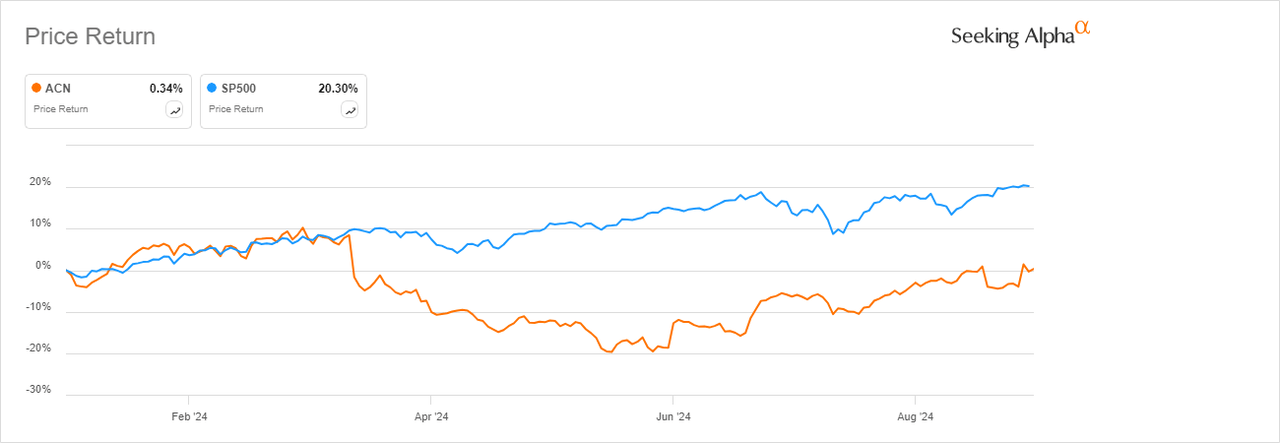

Year-to-date, however, ACN is up only marginally, compared to a more than 20% rise in the S&P 500.