William_Potter/iStock via Getty Images

Mortgage REIT AGNC Investment (NASDAQ:AGNC) finished in green for the eighth consecutive trading session in the wake of a reported fall in mortgage rates.

The stock rose 0.10% to close at $9.90 today.

AGNC had gained ~4% during the course of the last seven trading sessions. The stock especially closed 1.15% higher on May 9, the day after the dividend was declared. Mortgage rates were reported to have fallen that day, after five consecutive weeks of gain in the wake of a weak jobs report.

Another notable gain was logged on the day a softer-than-expected retail inflation report was said to have made way for the mortgage rates to dip further. AGNC rose 1.13% on May 15.

The company’s Q1 non-GAAP earnings had extended their downward trend in a higher-for-longer interest rate environment.

“In April, interest rates and interest rate volatility increased meaningfully as the timing and magnitude of rate cuts in 2024 became increasingly more uncertain and as the conflict in the Middle East escalated,” President and CEO Peter Federico had said.

AGNC has been on an upward trajectory ever since declaring $0.12/share monthly dividend, with a forward yield of approximately 15%.

The overall cash balance minus the dividend seems in balance, i.e. the business is generating the cash needed to pay it, said Seeking Alpha analyst Patient Tech Investor, who believes that the company’s Q1 earnings model suggests a safe dividend going forward.

Mortgage payments continue to flow in steadily, allowing dividends to flow out regularly. AGNC Investment is ramping up their portfolio size, meaning that their income stream is also ramping up, according to SA contributor Rida Morwa.

SA analysts grade the stock as Hold, while the Wall Street analysts rate AGNC as Buy.

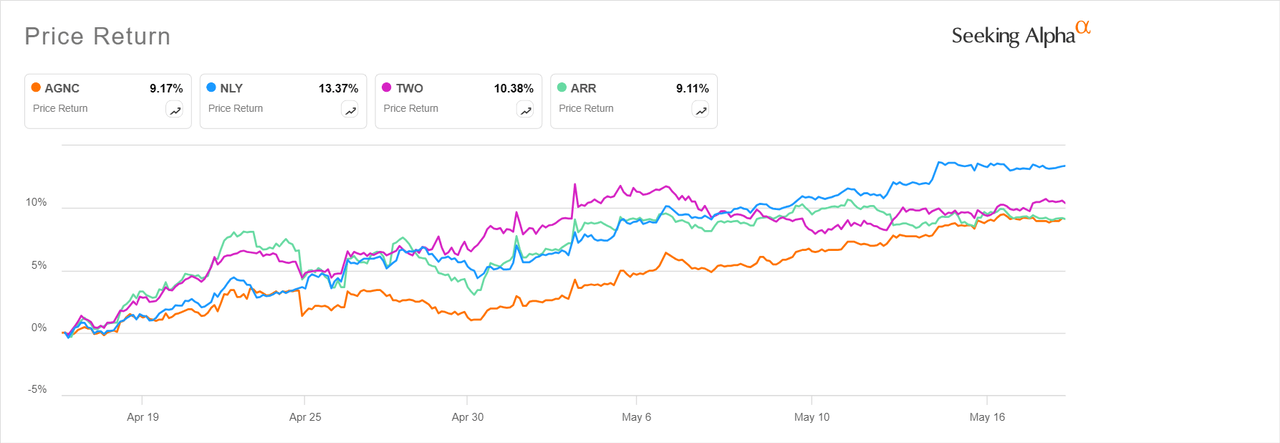

For stock price movements, other mortgage REITs, such as Annaly Capital Management, Two Harbors Investment and ARMOUR Residential REIT, have more or less followed a similar pattern. Here is a look at their stock price movements in the last one month: